Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

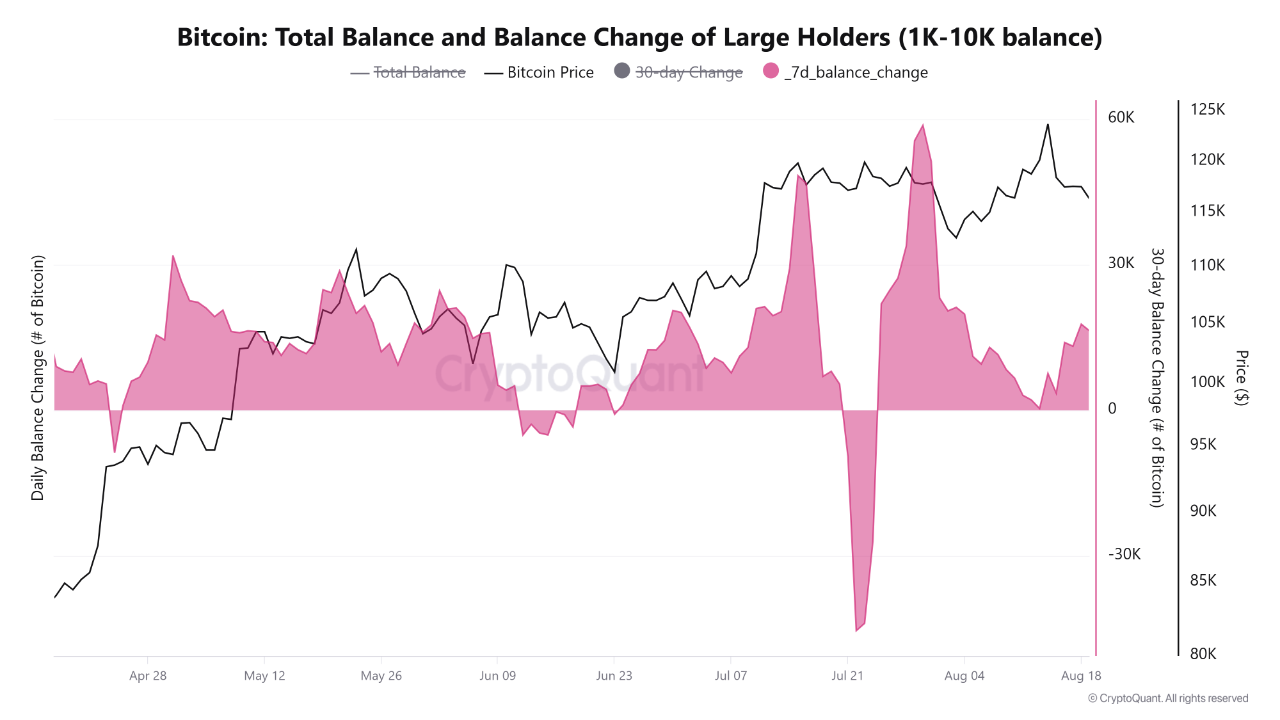

In the last week, big investors, or “whales,” have taken full advantage of Bitcoin’s (BTC) recent price drop by buying a lot of it. According to on-chain data from CryptoQuant’s analyst caueconomy, more than 16,000 BTC have been added to the wallets of big entities. This shows that institutional investors and whales are once again using the “buy the dip” technique.

“This pattern is similar to the first correction in early August, when big players kept buying while small investors were selling at a loss,” stated caueconomy, talking about what happened in the market during the previous dip.

A Long-Term Plan

The movement happened after the price of Bitcoin dropped sharply, which made retail investors sell off since they were under psychological pressure. But the bigger investors reacted very differently. Many of them saw this correction as a chance to buy more of the leading cryptocurrency.

The way these whales act shows how the market as a whole feels: people still see Bitcoin as a long-term investment and a way to protect themselves from macroeconomic volatility. Even if the price of Bitcoin can change a lot in a short amount of time, institutional investors seem to be more interested in the long-term advantages it could provide, especially as existing financial institutions are becoming more and more unstable.

MVRV Shows Bitcoin Still Has Room to Grow

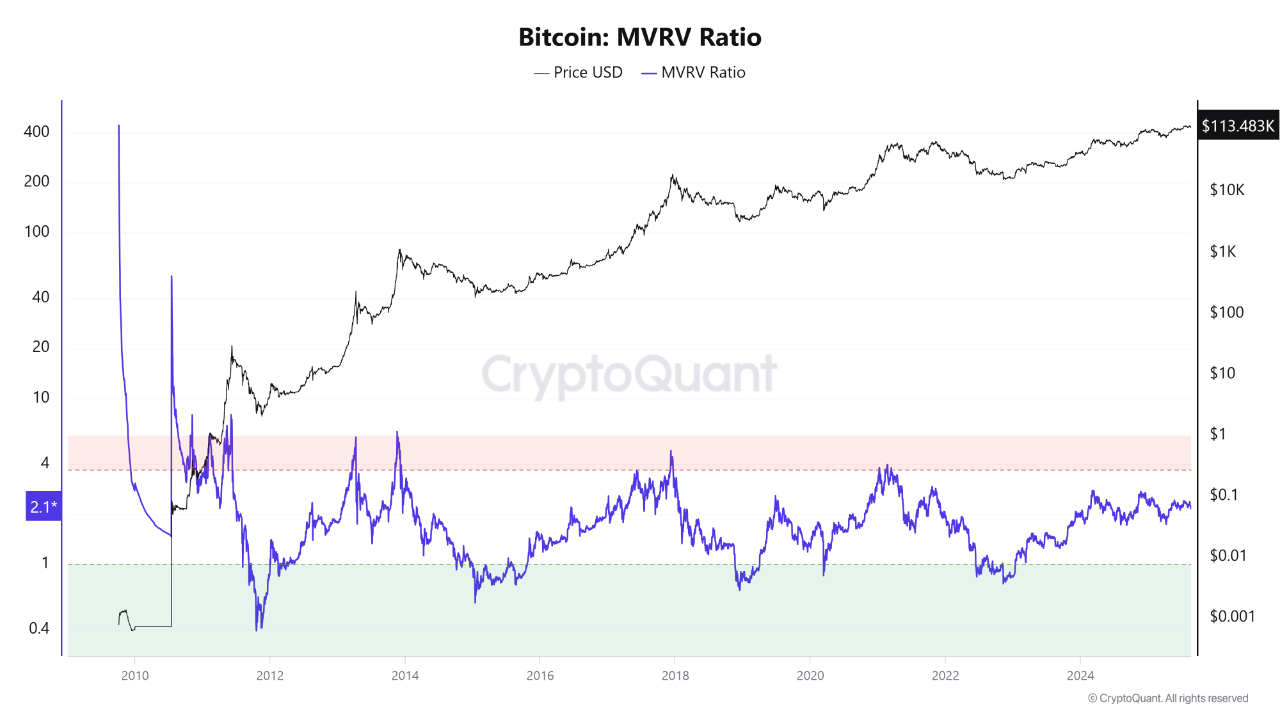

Other on-chain indicators, such the MVRV (Market Value to Realized Value), which is currently at 2.1, also reflect this accumulation pattern. The MVRV ratio is an important sign of market circumstances since it shows how much Bitcoin is worth on the market compared to how much it has actually sold for. CryptoQuant analysts, notably PelinayPA, say that an MVRV between 1 to 3.5 means that the market is neutral to bullish. This means that the market hasn’t reached overvaluation yet, but there is still room for prices to go up.

According to historical cycles, the top of a bull market is when MVRV reaches 3.5 to 4, which means it’s time to take a lot of profits. If the MVRV gets close to these levels again, Bitcoin’s price is likely to surge toward the $140,000 to $180,000 region in the next several months.

The market is no longer thought to be inexpensive, though, because the MVRV is already over 2. Before the price reaches a new high, there will probably still be short- to medium-term declines. This means that ordinary investors should be cautiously optimistic.

Outside Events Make People Hopeful

According to data from CoinMarketCap, Bitcoin’s price has went up by around 1% in the last 24 hours, reaching $113,837. Recent changes in the Bitcoin ecosystem that are getting more attention from institutions are helping this rise.

One good thing that has happened is that CoreDAO and Hex Trust have started offering dual-staking services. This lets institutions earn interest on their Bitcoin without giving up control of it. There are currently more than 7,000 BTC frozen in time in the Core network. This is worth almost $500 million. This new idea could help ease short-term selling pressure and bring in more conservative investors who usually stay away from exchange risk.

Also, this move makes Bitcoin’s position stronger in the yield-generating DeFi (decentralized finance) field, which gives it more uses than just being a store of value. As the yield-bearing strategy increases, Bitcoin’s function in decentralized finance is growing more complex.

Clear Rules Make Institutions More Confident

Another big reason for hope comes from the United States, where Senator Cynthia Lummis has said she will work to have the Digital Asset Market Clarity Act passed before Thanksgiving 2025. This bill wants to make the functions of the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) clearer and set up a legal framework for stablecoins.

People think that this kind of clear regulation is a key step in lowering institutional investors’ uncertainty. A well-organized regulatory environment might let a lot more institutional money flow into the cryptocurrency market, which would strengthen Bitcoin’s place in the global financial system.

The Future of Bitcoin in the Long Term

Whales buying into Bitcoin during the market correction is a strong sign that big investors believe the commodity will do well in the long run. The MVRV measure shows that there is still opportunity for development, and institutional adoption is picking up speed. This means that Bitcoin’s medium- to long-term prognosis is still strong.

However, since the market is no longer in the “cheap” zone, it is still best to be careful, especially for retail investors who may see greater volatility in the short term. The future looks bright, but the price of Bitcoin could still change before it reaches a new all-time high.

These outside influences, such new developments in DeFi and clearer regulations, might have a big impact on the future of Bitcoin as the market matures. Investors will have to find a balance between short-term ups and downs and long-term hope. They should also keep an eye on the bigger economic picture and how Bitcoin’s role in the financial world is changing.

In conclusion, the way the market is acting right now suggests that the next step in Bitcoin’s journey is coming up. This is due to institutional confidence, more people using techniques that make money, and the rules that are always changing. It will depend on how these things play out whether or not Bitcoin can keep this bullish momentum going in the next several months. One thing is clear: Bitcoin’s future as a financial asset is brighter than ever.