Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The Federal Reserve (The Fed) declared on Wednesday that it will keep its benchmark interest rate at 4.25–4.50%, marking the third consecutive meeting without a rate change since its last decrease in December 2024.

The decision shows a cautious posture as the central bank deals with more economic uncertainty brought on by President Donald Trump’s broad import tariff plans.

Following a series of forceful rate hikes of 525 basis points from March 2022 to July 2023, the Fed’s action follows a protracted pause at 5.25–5.50% from September 2023 to August 2024.

The Fed lowered rates by 100 basis points across three sessions in September, November, and December of last year, 2024, thereby reducing the current range to its lowest level since early 2023.

However, the central bank now faces a challenging situation because Trump’s tariff announcement on April 2, 2025, poses significant threats to employment and price stability.

Growing Threats of Unemployment and Inflation

In its statement, the Fed recognized mounting challenges to its twin goals of maximum employment and price stability.

Speaking at a press conference after the Federal Open Market Committee (FOMC) meeting, Federal Reserve Chair Jerome Powell underlined the careful balance the central bank has to achieve.

Powell said, “This isn’t a situation where we can act preemptively because we don’t yet know the appropriate response until we see more data.”

Recent figures show a conflicting picture. Down from 2.8% in February, U.S. inflation dropped to 2.4% year-on-year in March 2025, indicating advancement towards the Fed’s 2% target. The unemployment rate for April stayed constant at 4.2%.

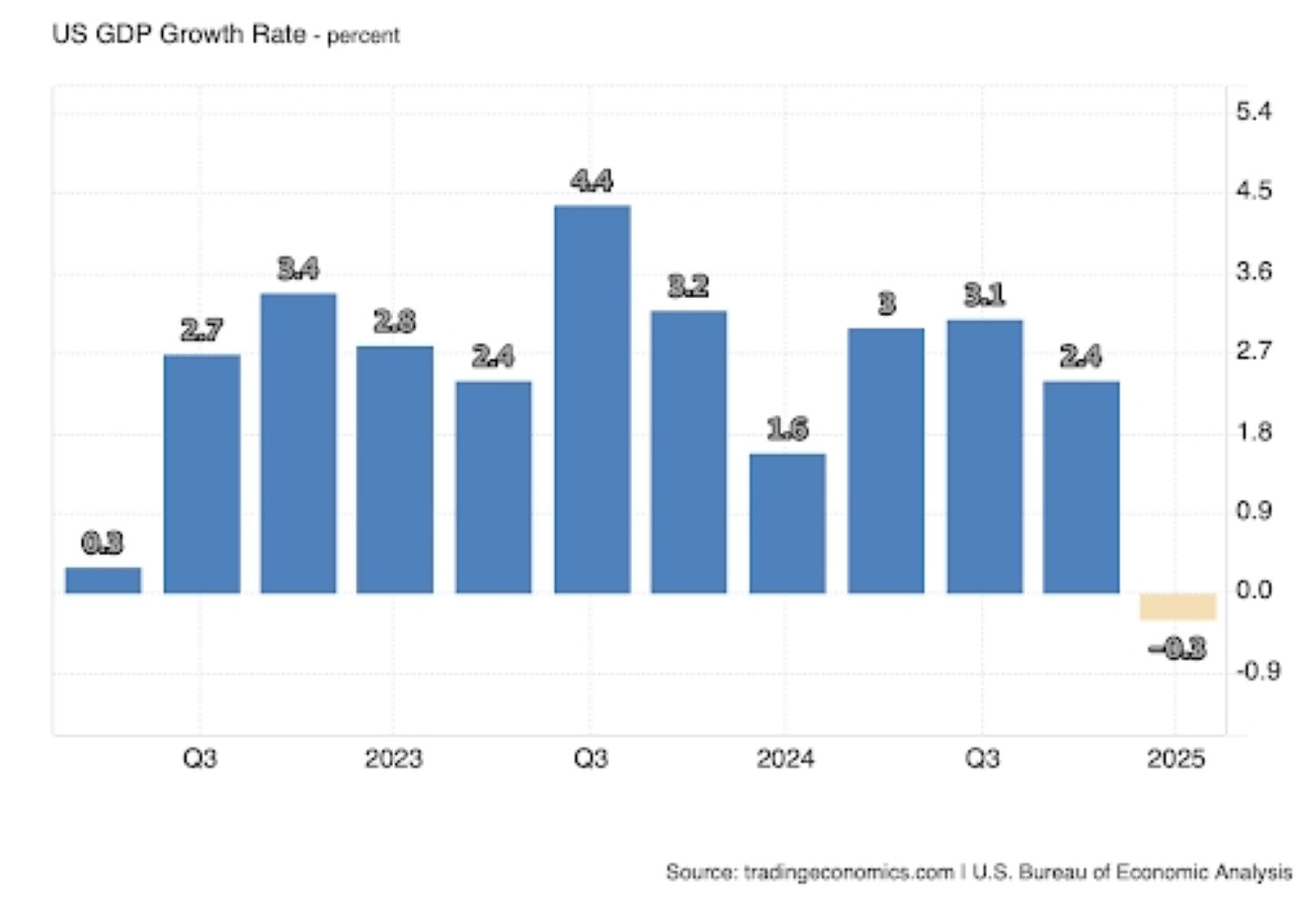

But Trump’s tariffs, which Powell called “far larger than anticipated,” have upset supply chains and contributed to a 0.3% drop in U.S. GDP in the first quarter of 2025—the first drop since Q1 2022.

This slowdown in growth, which fell short of 0.3% expansion, highlights the economic challenges confronting the Fed.

Powell underlined the strength of the labor market and the larger economy but cautioned that continuous uncertainty could slow development towards Fed targets.

“The cost of waiting for more clarity is rather low; the economy is rather resilient and performing well,” he said. “We are in a good posture to wait and observe.”

Economic Indicators point to a slow down

Other metrics, outside GDP, show a slowing down of the American economy. Reflecting mounting public cynicism, the Conference Board’s Consumer Confidence Index sank 7.9 points to 86.0 in April 2025, its lowest level since May 2020.

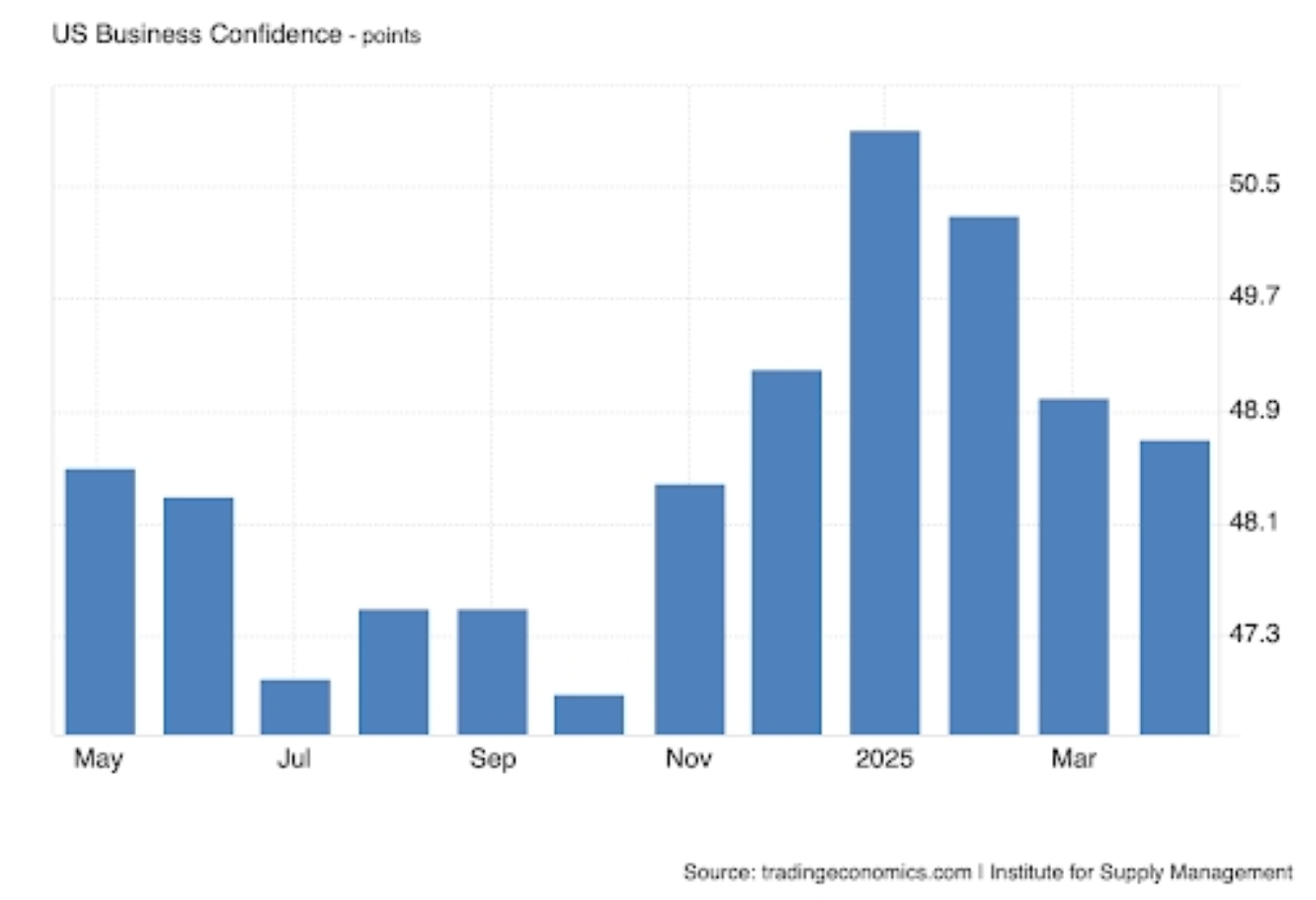

Comparably, the Institute for Supply Management’s manufacturing PMI dropped to 48.7 in April, three straight months of decline from a peak of 50.9 in January. These patterns and continuous trade negotiations with important partners like China complicate the Fed’s policy perspective.

Powell cautioned that attaining pricing and labor market stability could take at least a year if current circumstances continue. “If the tariff scenario fully materialises, we may not see progress towards our goals for the next year,” he warned, implying that rates would stay high longer than formerly predicted. Powell added that the Fed’s future actions will depend on fresh data on inflation, employment, and the wider effects of Trump’s trade policy.

Powell Restates Fed Independence

The choice to keep rates the same arises under growing political pressure.

President Trump, who has regularly criticized Powell, has pushed for a greater rate reduction and even threatened to remove him.

Powell responded by underlining even more the Fed’s independence.

“I have never asked any president for a meeting; I won’t,” he declared. “Always, the initiator is the president. That is not the responsibility of the Fed chair.

Powell’s remarks highlight his dedication to keeping the central bank free from political influence, a posture that has come under criticism as Trump’s public slights get more severe. The heated interplay between the two has spurred conjecture about the Fed’s capacity to negotiate economic obstacles free from outside intervention.

A path forward depending on data

Powell underlined ahead of time that Fed policy will remain flexible and based on data. However, rate cuts in 2025 are not off the table, and their timing and extent depend on how inflation, employment, and global trade dynamics change.

The Fed’s cautious attitude highlights the significant risks associated with misjudging the economic consequences of tariffs, which have already disrupted first-quarter statistics.

Powell’s message is unambiguous for now: the Fed’s strongest weapon in an erratic climate is patience.

“Still a lot we do not know,” he remarked. “We don’t have to hurry; our policy is well-positioned.”

The Fed’s consistent hand marks a deliberate attempt to balance growth, stability, and the unanticipated difficulties of a fast-changing global trade environment while markets await more clarity.