Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Bitcoin is about to hit a new all-time high because people are excited by news that the United States and China are close to reaching a trade deal. On June 11, 2025, US President Donald Trump made an announcement that gave the cryptocurrency market a new boost. Investors are confident that lower global trade tensions could lead to a long-term rise in prices.

After a lot of hard work in London, where representatives from both countries worked out a plan to calm trade issues that have shaken markets all over the world in 2025, the statement was made.

Trump said, “Our deal with China is done, but it still needs to be signed off on by President Xi and me.” We are getting 55% tariffs, and China is getting 10%. “Things are better than ever between us.”

After a lot of hard work in London, where representatives from both countries worked out a plan to calm trade issues that have shaken markets all over the world in 2025, the statement was made.

A big step forward in talks between the US and China about trade

Li Chenggang, China’s Vice Commerce Minister, confirmed the development and said that the talks were “open and constructive.”

He told Chinadaily that the deal is meant to encourage cooperation that benefits both sides, especially on important topics like tariffs and rare earth resource exports.

If the deal goes through, it might put an end to months of back-and-forth trade measures that reached their highest point in April, when US tariffs on Chinese exports exceeded 145%, which led to Beijing’s own limitations.

The trade war has had a big effect on the markets. Bitcoin fell to a low of $74,434 in April, only days after Trump announced his first tariff.

The S&P 500 lost $5 trillion in value, which was the biggest loss in history. Nansen analyst Aurelie Barthere said that the uncertainty also made venture capital less active in the crypto sector.

In May, there were just 62 investment rounds, which is the lowest number this year. She said that the downturn was caused by “market sentiment soured by escalating tariff rhetoric.”

Bitcoin’s Rise and the Mood of the Market

Bitcoin (BTC) is worth about $109,737 as of June 11, 2025. It has gone up 0.27% in the last 24 hours and briefly hit a 24-hour high of over $110,300.

Analysts say that if the US and China reach a final trade deal, BTC could break through the important $110,000 resistance mark, which could set a new record.

Ethereum (ETH) is also gaining ground, with prices nearing $2,800. This is thanks to news that BlackRock bought $600 million in ETH.

Iliya Kalchev, a crypto analyst at Nexo, said that the accord eases concerns over rare earth exports but that “tangible policy changes are still uncertain.”

He said that Wall Street futures fell a little following Trump’s statement, which shows that people are still unsure about how the deal will affect things right away.

Meanwhile, Raoul Pal, the CEO of Global Macro Investor, said that the US’s recent tariff posturing may have been a calculated effort to get this deal with China. He called other conversations “largely symbolic.”

Wider Effects on Crypto

The crypto market is at a very important time right now, and the US-China trade tensions could be resolved soon.

People are getting more and more excited, and even some user are forecasting a “short-term market rally” in the next week, especially because the Federal Open Market Committee (FOMC) meeting is coming up on June 17–18.

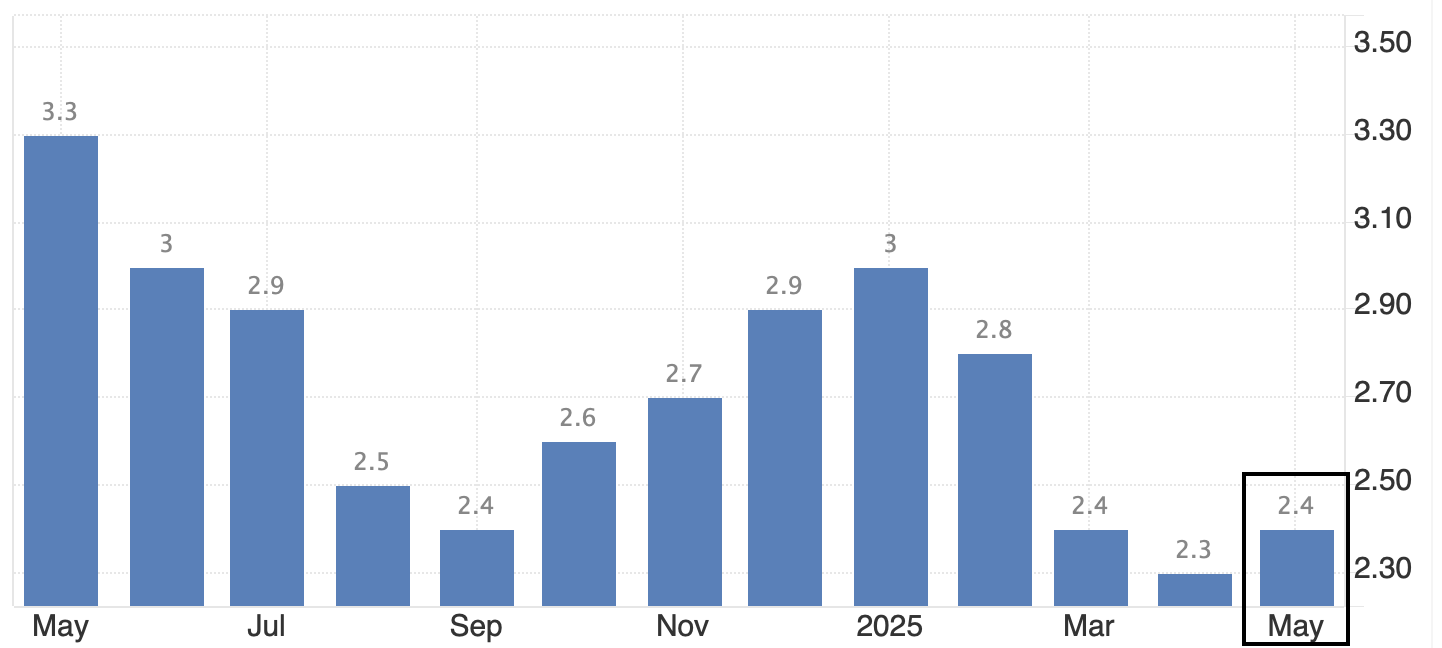

There are still risks, though. The Consumer Price Index (CPI) statistics issued on June 11 indicated a little monthly increase of 0.1% and a yearly increase of 2.4%, which is a little higher than April’s 2.3%.

If inflation goes up more than expected in the next few months, the Federal Reserve may keep interest rates the same or raise them. This might put pressure on risky assets like Bitcoin.

On the other hand, inflation that is lower than projected could lead to even more gains. Some analysts are looking at $120,000 as a short-term goal for BTC.

The US-China trade pact is a key factor in the crypto market’s current state of affairs. Trump’s declaration has made people hopeful, but investors are still waiting for both leaders to give their final assent and for further information on how it would be put into action.

For now, Bitcoin’s ability to stay strong in the face of macroeconomic problems shows that it is becoming more popular as a way to protect against uncertainty.