Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Bitcoin (BTCUSD) faces short-term uncertainties mixed with positive signals. Moody’s recent downgrading of the U.S. credit rating has increased long-term hope for Bitcoin, therefore supporting its function as a counterpoint against growing debt and political unrest.

Declining supply of Bitcoin on exchanges shown by on-chain data points to investors choosing to hold rather than sell. BTC is in a short-term consolidation period despite these strong foundations; price action needs fresh momentum to propel more increases.

Moody’s downgrade throws off the US perfect credit rating.

Moody’s reduced the United States’ credit rating from AAA to Aa1 on May 17, 2025, therefore ending the country’s century-long record of flawless score from all three main credit rating agencies.

Driven by growing deficits, rising interest rates, and the lack of realistic fiscal measures, this follows past downgrades by S&P in 2011 and Fitch in 2023.

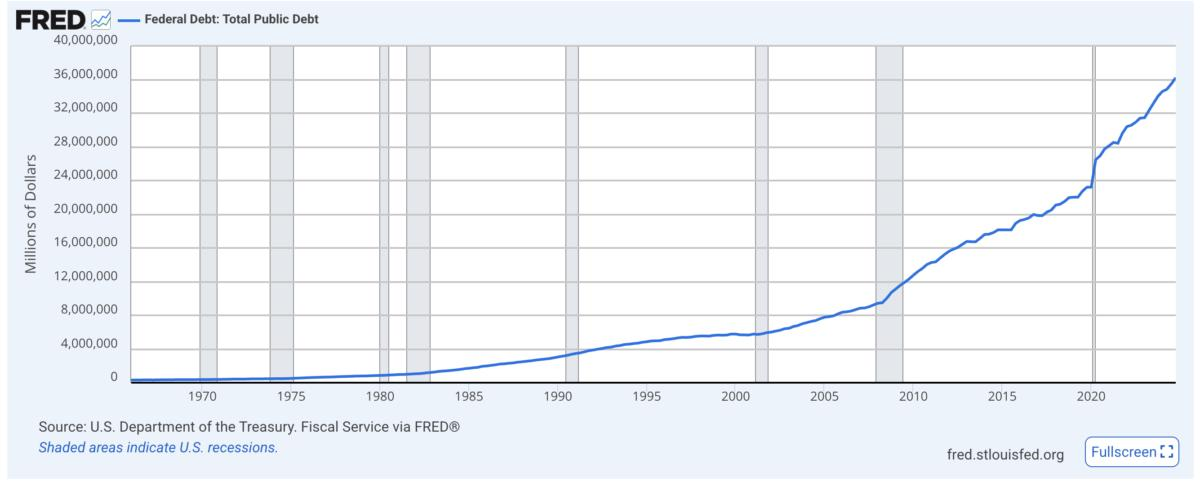

The ruling highlights rising worries about the fiscal situation of the United States since the national debt exceeds $33 trillion and is expected to rise still.

Moody’s underlined that prolonging Trump-era tax cuts could worsen the deficit, maybe bringing the deficit to 9% of GDP by 2035, so aggravating long-term economic uncertainty.

The market responded very away and clearly. While market futures fell to reflect more general worries about economic stability, Treasury rates surged as investors reevaluated the danger of U.S. debt.

Pointing to continuing negotiations over a $3.8 trillion tax and expenditure package, the White House discounted the downgrading as politically driven.

But the downgrading has sparked discussions about the viability of U.S. fiscal policy once more since experts warn of possible inflationary pressures and more borrowing prices.

For distributed assets like Bitcoin, which many see as a hedge against conventional financial system vulnerabilities, this atmosphere of fiscal volatility supports the story.

On-Chain Metrics of Bitcoin Signal Bullish Holder Behavior

On-chain data offers a window into investor mood, and latest patterns point to a rising positive view of Bitcoin.

With presently 1.41 million BTC, the supply of Bitcoin kept on exchanges has been dropping.

After a more noteworthy decline from 1.47 million to 1.42 million between April 17 and May 2, 2025, this follows a slight rise from 1.42 million to 1.43 million between May 2 and May 7.

Usually indicating that investors are shifting their Bitcoin to cold storage, a diminishing exchange supply suggests an intent to hold rather than sell. This action lowers the short-term selling pressure, a positive sign for the price of Bitcoin.

Low exchange balances have historically accompanied notable price swings, as shown by late 2020 and early 2021 when Bitcoin jumped from $10,000 to around $69,000.

The present trend fits this one, implying that holders are more likely to be banking on long-term appreciation than on quick liquidation.

Given the U.S. rating downgrading, this is especially important since investors might start seeing Bitcoin as a safe haven among budgetary uncertainties.

Short-Term Consolidation Still Respected

Technical-wise, the Ichimoku Cloud chart shows that Bitcoin’s price behavior stays in a consolidation period.

The price is hanging at the flat, red line known as the Kijun-sen (red line), suggesting little strong directional movement. The Tenkan-sen (blue line) strongly follows the price, so supporting the sideways trend.

The flat Senkou Span A and B lines forming the cloud also imply a balanced market devoid of obvious trend.

Though typically used as support, the price is positioned close to the top edge of the cloud; the flat form of the cloud suggests that a breakout—either bullish or bearish—is required to clearly identify a direction.

Though the general chart shows uncertainty, the Chikou Span (lagging green line) offers a little positive bias, somewhat above the price candles.

Bitcoin has to break past the resistance level at $105,505 if it is to restart its increasing trend. Ignoring above the $100,694 crucial support level might cause a fall toward $98,002 with more downside danger to $93,422.

With shorter-term averages above longer-term ones, the exponential moving averages (EMAs) remain optimistic; nevertheless, their flattening points to declining momentum in the short run.

Fiscal worries strengthened the long-term bullish case of bitcoin.

The Moody’s downgrading increases the long-term attractiveness of Bitcoin as a distributed asset resistant to the fiscal misbehavior afflicting conventional systems.

Bitcoin’s hard-coded supply cap guarantees scarcity, unlike fiat currencies, which may be issued endlessly, therefore providing an appealing defense against debt-driven crises and inflation.

Particularly since the Congressional Budget Office estimates that national debt interest payments would surpass $1 trillion yearly by 2030, the downgrade raises questions over the U.S.’s capacity to handle her mounting debt load.

Often compared to “digital gold,” this milieu of financial uncertainty fuels interest in Bitcoin as a store of wealth.

Social media debates show how increasingly Bitcoin is seen as a sovereign risk hedge. Analysts cite past events, such the 2011 S&P downgrading, which came before a notable Bitcoin climb.

Although the Moody’s rating may have little immediate effect on prices, long-term consequences are significant.

Particularly as world debt levels climb and central banks under pressure to keep lax monetary policies, investors are growingly dubious of the viability of fiat-based economies.

Outlook Short term: Key Levels to Track and Consolidation

Following its $100,000 mark, Bitcoin’s price stays in a holding pattern in the near term. Though the flattening of these averages points to a need for new catalysts, the optimistic EMA alignment signals possible for more gains.

A breakout over $105,506 would indicate the beginning of a fresh upswing, maybe motivated by macroeconomic events or increased institutional curiosity.

On the other hand, a decline below $100,694 would challenge the resilience of Bitcoin’s optimistic framework since reduced support levels at $98,002 and $93,422 come into effect.

Market mood shows a mix of caution and hope. While some users on X contend the downgrade will hasten the acceptance of distributed assets, others warn macroeconomic headwinds could cause short-term volatility.

Based on the interaction of technical indicators and on-chain data, Bitcoin appears to be at a crossroads with its next action depending on more general market dynamics and investor behavior.

Bitcoin’s part in a changing financial scene

For Bitcoin, the U.S. credit downgrading by Moody’s represents a turning point that supports its story as a counterpoint against fiscal unrest.

Although short-term price behavior is still unknown, diminishing exchange supply and mounting questions regarding conventional banking systems strengthen the long-term argument for Bitcoin.

Bitcoin’s distributed character and set supply make it a more appealing alternative for investors trying to negotiate an uncertain economic future as the U.S. struggles with growing debt and deficits.

Whether Bitcoin can profit on this moment will rely on its capacity to maintain its optimistic momentum by surpassing important technical thresholds.