Have an Easy Life Filing Taxes with LHDN e-Filing!

Everybody in this world will need to rely on the concept of money, that very same premise applies to the government; without money, the country will not be able to develop in many aspects.

- Have an Easy Life Filing Taxes with LHDN e-Filing!

- How do you apply for digital tax filing?

- 1. Login to MyTax

- 2. Start e-filing

- 3. Update your details

- 4. Add more details

- 5. Provide your income details

- 6. Tax Relief

- List of Individual Tax Relief for the Assessment Year 2022 LHDN (e-Filing 2023)

- 7. Check your summary

- 8. Sign the Form and Submit It

- Pay Income Tax for a Better Future of Malaysia

So what do the people being taxed have to do with the government and the country’s development? Simply put, the taxes that are imposed onto the people are one way that the government gets its funding.

But how exactly do you file your taxes? Or if you’re the type to have ever done your taxes but find it cumbersome, then this guide to a much easier life dealing with taxes is right for you!

Here, we will guide you step by step with everything that you need to know about LHDN e-filing with mytax lhdn, for an easier life filing your taxes!

How do you apply for digital tax filing?

Alright, the very first thing you have to do, if you have never filed for your taxes, done it in the form of e filing 2023, or other means, don’t worry, head on over to the MyTax Hasil link https://mytax.hasil.gov.my/, and click on the e-Daftar option in the main webpage.

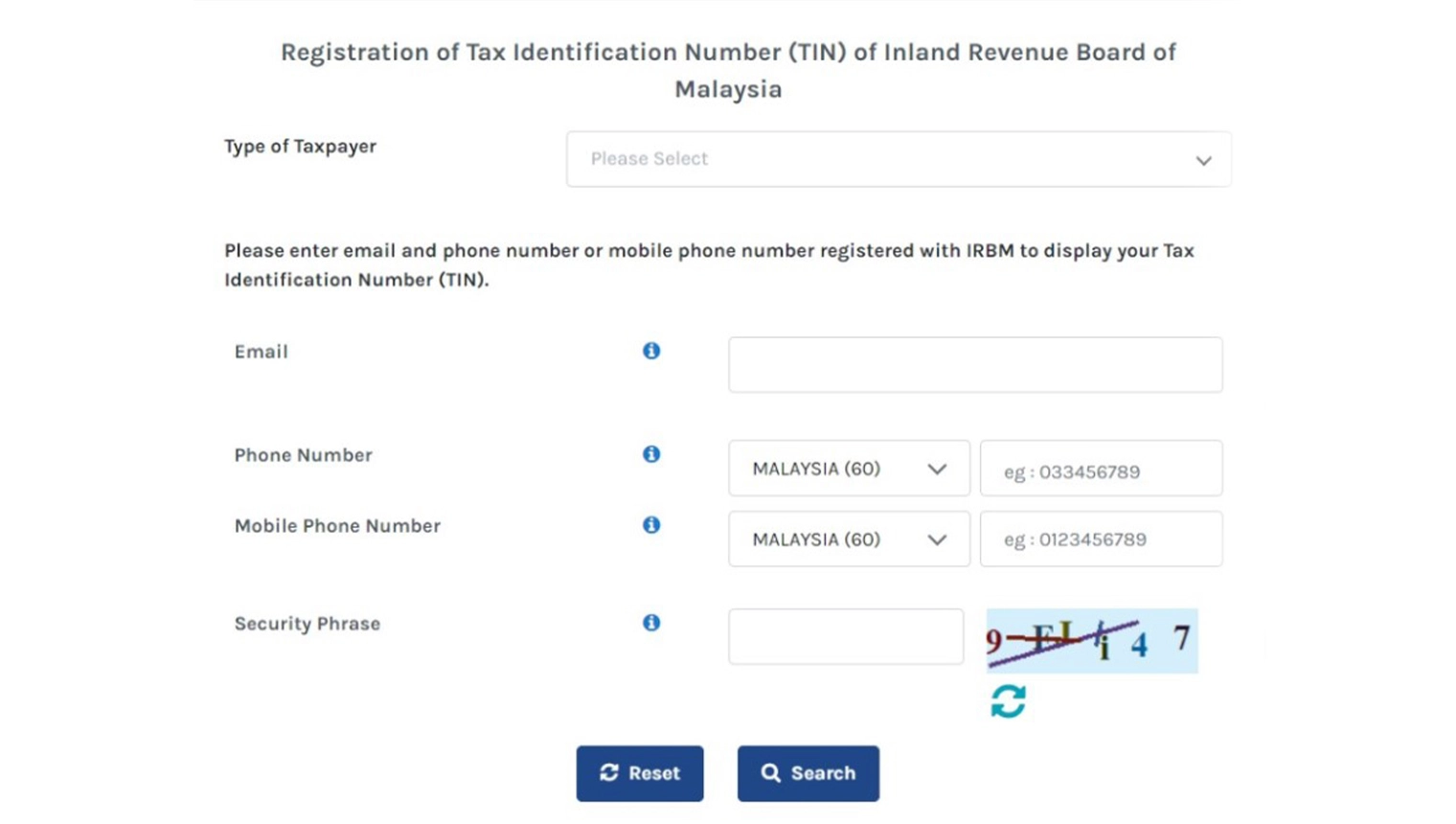

Once you are in, you will need to fill up a type of forum, this first step is important as it registers you to have a Tax ID number.

Once you are in the page above, fill in the appropriate type of tax payer you are registering as, fill in your preferred email and your phone number; and lastly the random security phrase cache.

After you’re done filing in the necessary blanks, you will then need to print out this forum and take it to the closest and most convenient LHDN branch available; in order to acquire your first time login PIN.

This will be about the most physical part you will have to do in regards to registering and doing your online taxes, from here on out it will all solely be digital.

1. Login to MyTax

Alright, so you have just completed the first necessary step to start off your e-filing journey; go to the top right segment of the screen, where you will see two blanks regarding your login, the type of ID Type, and the New Identification No.

Simply fill in the appropriate type of ID on the top section and type in the ID given to you from the LHDN branch.

2. Start e-filing

Now that you’re in, click on through to the ezHasil Services section on the top left segment of screen, then choose the e-filing option to begin the process.

After clicking on it, you will pop into the page where you click on the relevant income tax form for the year. The options may differ depending on what type of income tax you’re filing, but you can rely on the nifty table below to prevent you from losing your way.

For all intent and purposes, the example below is e-filing 2023, so some deadlines may have already passed.

| Type of taxpayer | Form | Deadline |

| Employer |

E (e-E) |

March 31, 2023 |

| Residents |

BE (e-BE) |

April 30, 2023 |

|

Resident Business Owners |

B (e-B) |

June 30, 2023 |

| Partnerships |

P (e-P) |

June 30, 2023 |

|

Resident Individual (Knowledge Worker/ Expert Worker) |

BT (e-BT) |

April 30, 2023 (For those who do not carry on any business) June 30, 2023 (For those who carry on any business) |

| Non-Resident individual |

M (e-M) |

|

|

Non-Resident individual (Knowledge Worker) |

MT (e-MT) |

3. Update your details

Alright, after selecting the type of income tax you are filing, you will then be loaded into the page below, where all your details are displayed, if everything is accurate and appropriate then move on to the next page right away; but if not then proceed to change anything that’s necessary.

4. Add more details

Following the theme of the previous step, there is an additional page for additional information that you may or may not need to fill in. The main focus about this segment is about your personal information, especially in regards to whether or not you have sold any taxable assets, as well as declaring any tax incentives that you have received.

If all is well, you should now be in the page below:

5. Provide your income details

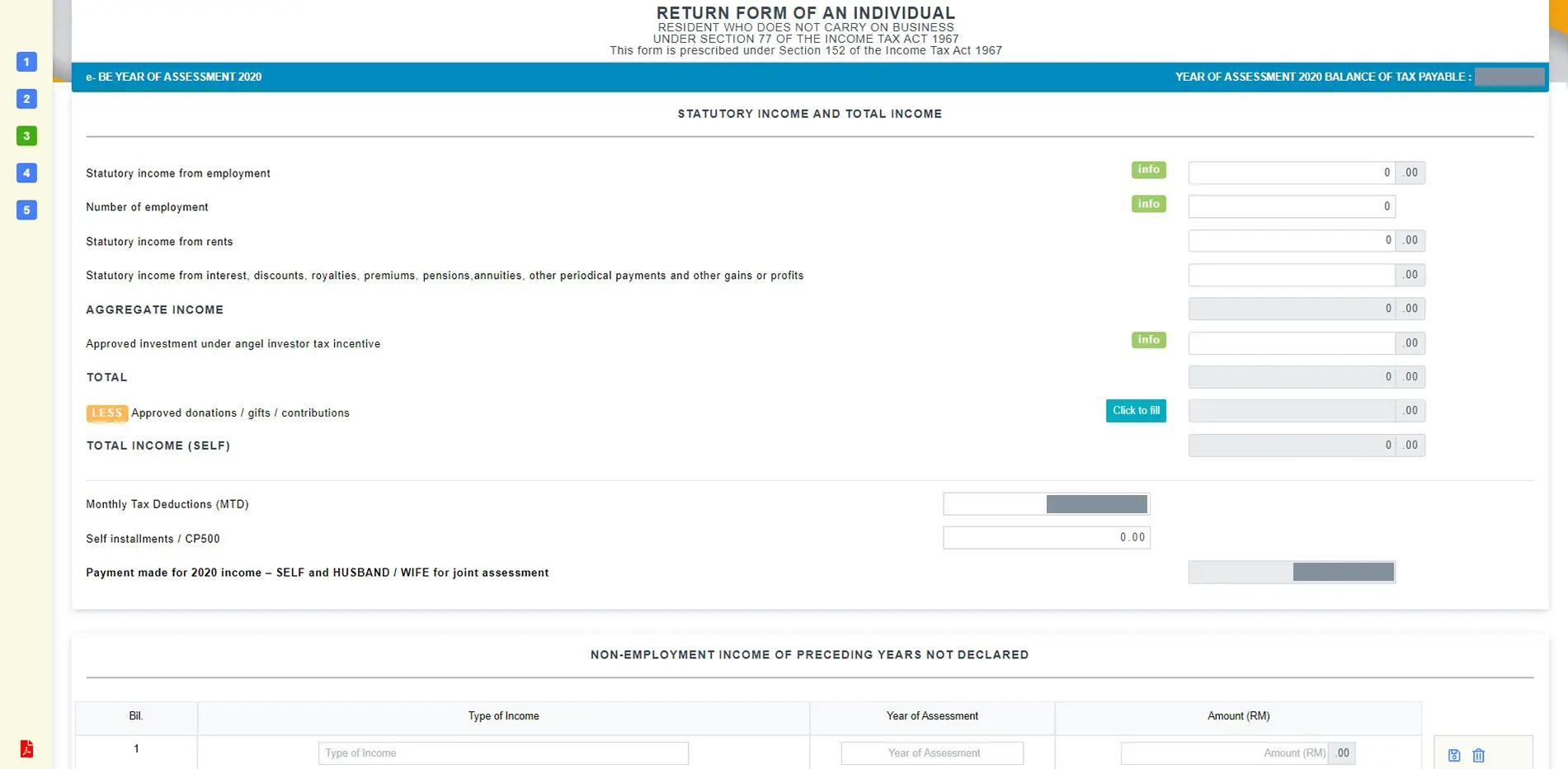

Now we’ve arrived at the income segment of filing for your income tax, below you will find the next page of information you will need to fill in, this one is regarding your work wage.

You are allowed to disclose any contributions or gifts that you have obtained. For more clarity on this deduction, see our section on tax deductions. Keep in mind, the institution you’re donating to must be sanctioned by LHDN. If in doubt, the charitable organisation’s status can be verified on the LHDN website.

Verify that the total monthly tax deductions (MTD/PCB) displayed are accurate. This information can be sourced from the EA Form your employer provides.

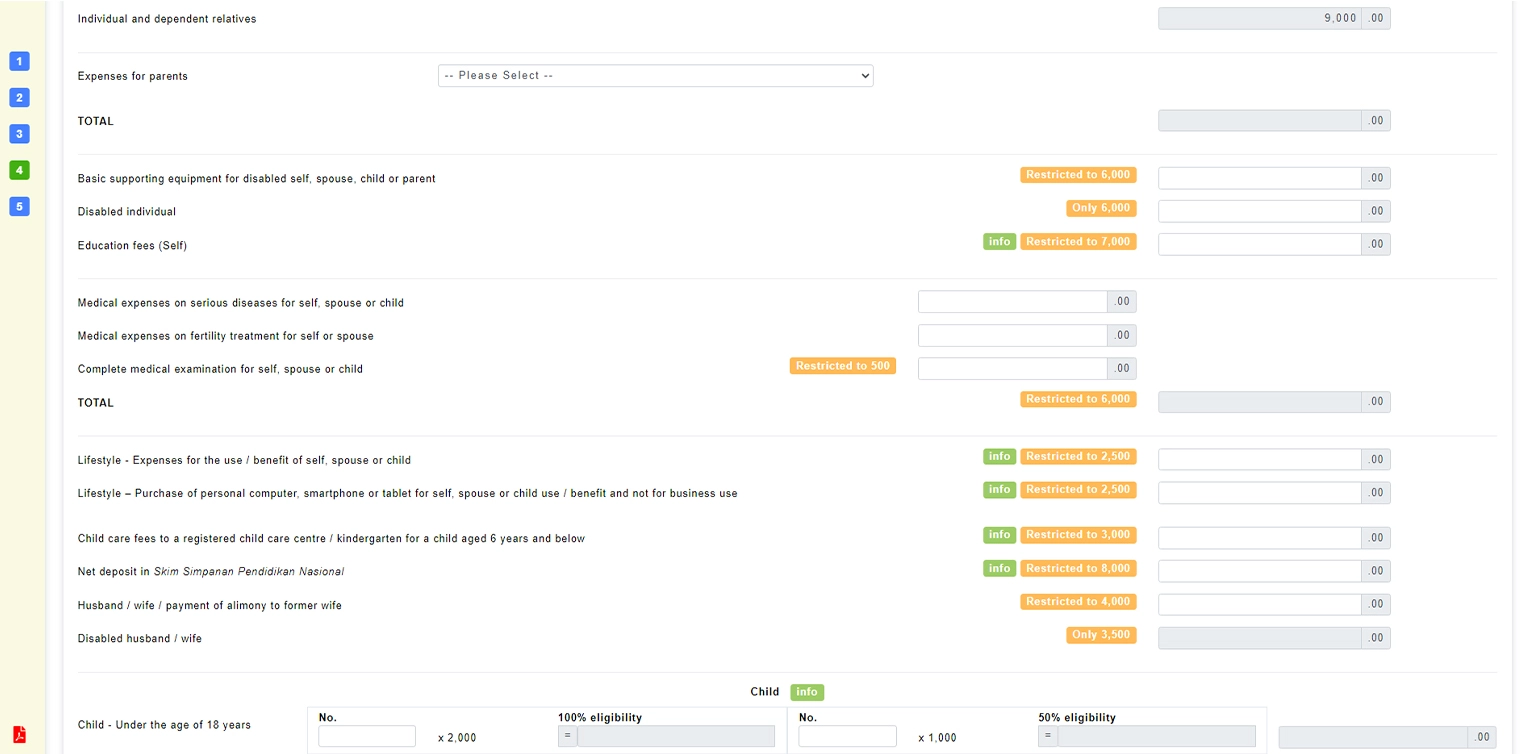

6. Tax Relief

If you’re new to taxing, and are confused about what tax reliefs are, think of it as a way to reduce the accumulated taxes you’ve got when you are in the process of e-filing.

Let’s talk hypotheticals to clear up a bit more of the confusion; you are paying for your student fees, and on top of that, you will need to pay for the taxes that have been incurred along with that expense. But if you are unable to fully pay for it, some of that tax can be relieved, in other words, deducted. Below you will find a table of different tax reliefs that may or not be applicable to you.

List of Individual Tax Relief for the Assessment Year 2022 LHDN (e-Filing 2023)

| No | Individual Relief Types | Amount (RM) |

| 1 | Individual and dependent relatives | 9,000 |

| 2 | Medical treatment, special needs and carer expenses for parents (Medical condition certified by medical practitioner) | 8,000 (Restricted) |

| 3 | Purchase of basic supporting equipment for disabled self, spouse, child or parent | 6,000 (Restricted) |

| 4 | Disabled individual | 6,000 |

| 5 |

Education fees (Self): Other than a degree at masters or doctorate level – Course of study in law, accounting, islamic financing, tehcnical, vocational, industrial, scientific or technology Degree at masters or doctorate level – Any course of study Course of study undertaken for the purpose of upskilling or self-enhancement (Restricted to RM2,000) |

7,000 (Restricted) |

| 6 |

Medical expenses on: Serious diseases for self, spouse or child Fertility treatment for self or spouse Vaccination for self, spouse and child (Restricted to RM1,000) |

8,000 (Restricted) |

| 7 |

Expenses (Restricted to RM1,000) on: Complete medical examination for self, spouse or child COVID-19 detection test including purchase of self-detection test kit for self, spouse or child Mental health examination or consultation for self, spouse or child |

|

| 8 |

Lifestyle – Expenses for the use / benefit of self, spouse or child in respect of: Purchase or subscription of books / journals / magazines / newspapers / other similar publications (Not banned reading materials) Purchase of personal computer, smartphone or tablet (Not for business use) Purchase of sports equipment for sports activity defined under the Sports Development Act 1997 and payment of gym membership Payment of monthly bill for internet subscription (Under own name) |

2,500 (Restricted) |

| 9a |

Lifestyle – Additional relief for the use / benefit of self, spouse or child in respect of: Purchase of sports equipment for any sports activity as defined under the Sports Development Act 1997 Payment of rental or entrance fee to any sports facility Payment of registration fee for any sports competition where the organizer is approved and licensed by the Commissioner of Sports under the Sports Development Act 1997 |

500 (Restricted) |

| 9b | Lifestyle – Purchase of personal computer, smartphone or tablet for own use / benefit or for spouse or child and not for business use | 2,500 (Restricted) |

| 10 | Purchase of breastfeeding equipment for own use for a child aged 2 years and below (Deduction allowed once in every TWO (2) years of assessment) | 1,000 (Restricted) |

| 11 | Child care fees to a registered child care centre / kindergarten for a child aged 6 years and below | 3,000 (Restricted) |

| 12 | Net deposit in Skim Simpanan Pendidikan Nasional (Net deposit is the total deposit in 2022 MINUS total withdrawal in 2022) | 8,000 (Restricted) |

| 13 | Husband / wife / payment of alimony to former wife | 4,000 (Restricted) |

| 14 | Disabled husband / wife | 5,000 |

| 15a | Each unmarried child and under the age of 18 years old | 2,000 |

| 15b | Each unmarried child of 18 years and above who is receiving full-time education (“A-Level”, certificate, matriculation or preparatory courses). | 2,000 |

| 15b |

Each unmarried child of 18 years and above that: receiving further education in Malaysia in respect of an award of diploma or higher (excluding matriculation/ preparatory courses). receiving further education outside Malaysia in respect of an award of degree or its equivalent (including Master or Doctorate). the instruction and educational establishment shall be approved by the relevant government authority. |

8,000 |

| 15c | Disabled child | 6,000 |

| Additional exemption of RM8,000 disable child age 18 years old and above, not married and pursuing diplomas or above qualification in Malaysia @ bachelor degree or above outside Malaysia in program and in Higher Education Institute that is accredited by related Government authorities | 8,000 | |

| 16 |

Life insurance and EPF Pensionable public servant category who do not contribute to EPF or any approved schemeLife insurance premiumOR OTHER than 16(i) categoryLife insurance premium (Restricted to RM3,000) Contribution to EPF / approved scheme (Restricted to RM4,000) |

7,000 (Restricted) |

| 17 | Deferred Annuity and Private Retirement Scheme (PRS) | 3,000 (Restricted) |

| 18 | Education and medical insurance | 3,000 (Restricted) |

| 19 | Contribution to the Social Security Organization (SOCSO) | 350 (Restricted) |

| 20 |

Domestic tourism expenses on: Payment of accommodation at the premises registered (Click here) with the Commissioner of Tourism under the Tourism Industry Act 1992 Payment of entrance fee to a tourist attraction Purchase of domestic tour package through a licensed travel agent registered with the Commissioner of Tourism under the Tourism Industry Act 1992 |

1,000 (Restricted) |

| 21 | Expenses on charging facilities for Electric Vehicle (Not for business use) | 2,500 (Restricted) |

Source: https://www.hasil.gov.my/en/individual/individual-life-cycle/how-to-declare-income/tax-reliefs/

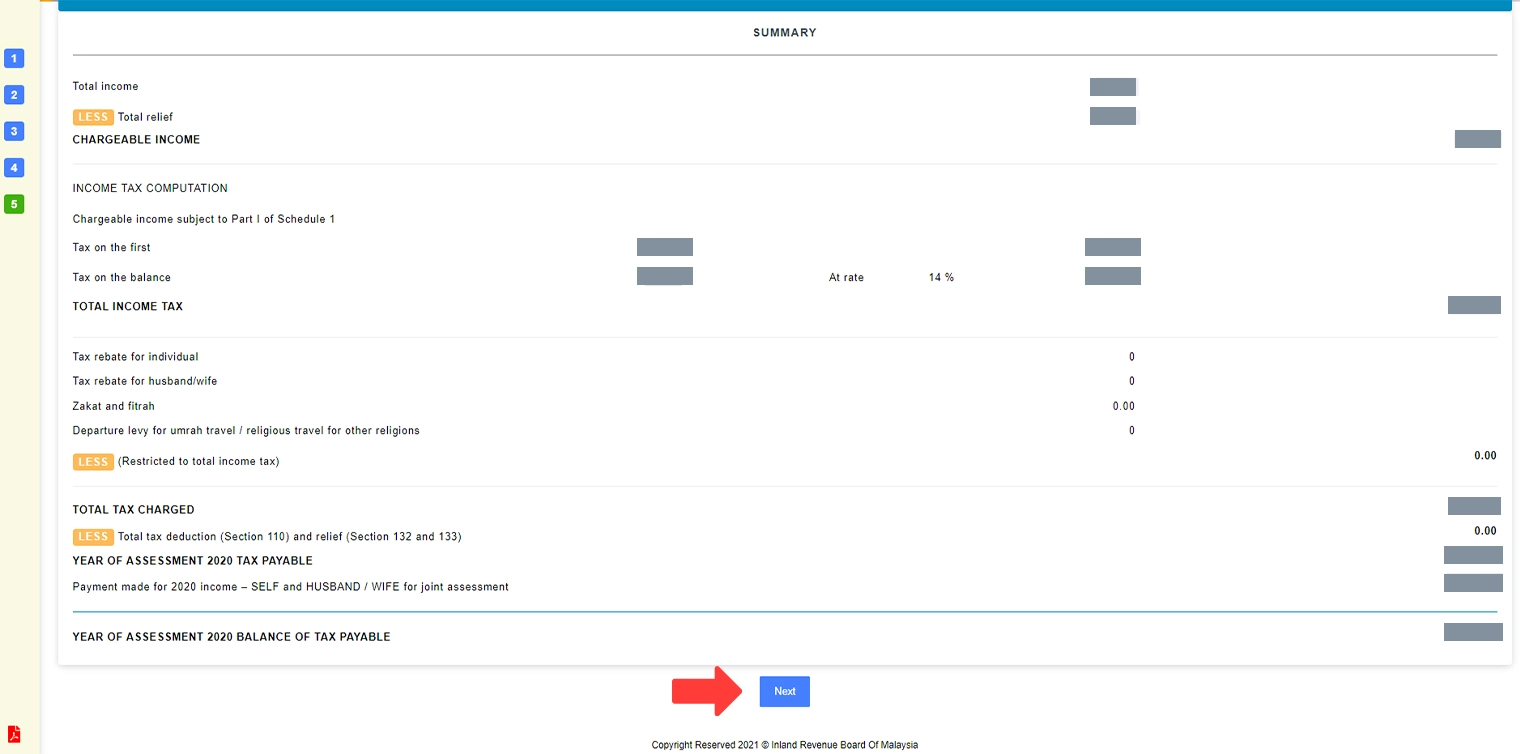

7. Check your summary

Whether you have any tax reliefs or you don’t, by the next page, MyTax LHDN will automatically calculate how much tax you will need to pay for your income tax; and the lowest row of the page will be the finalized amount of taxes that you may or may not need to pay up.

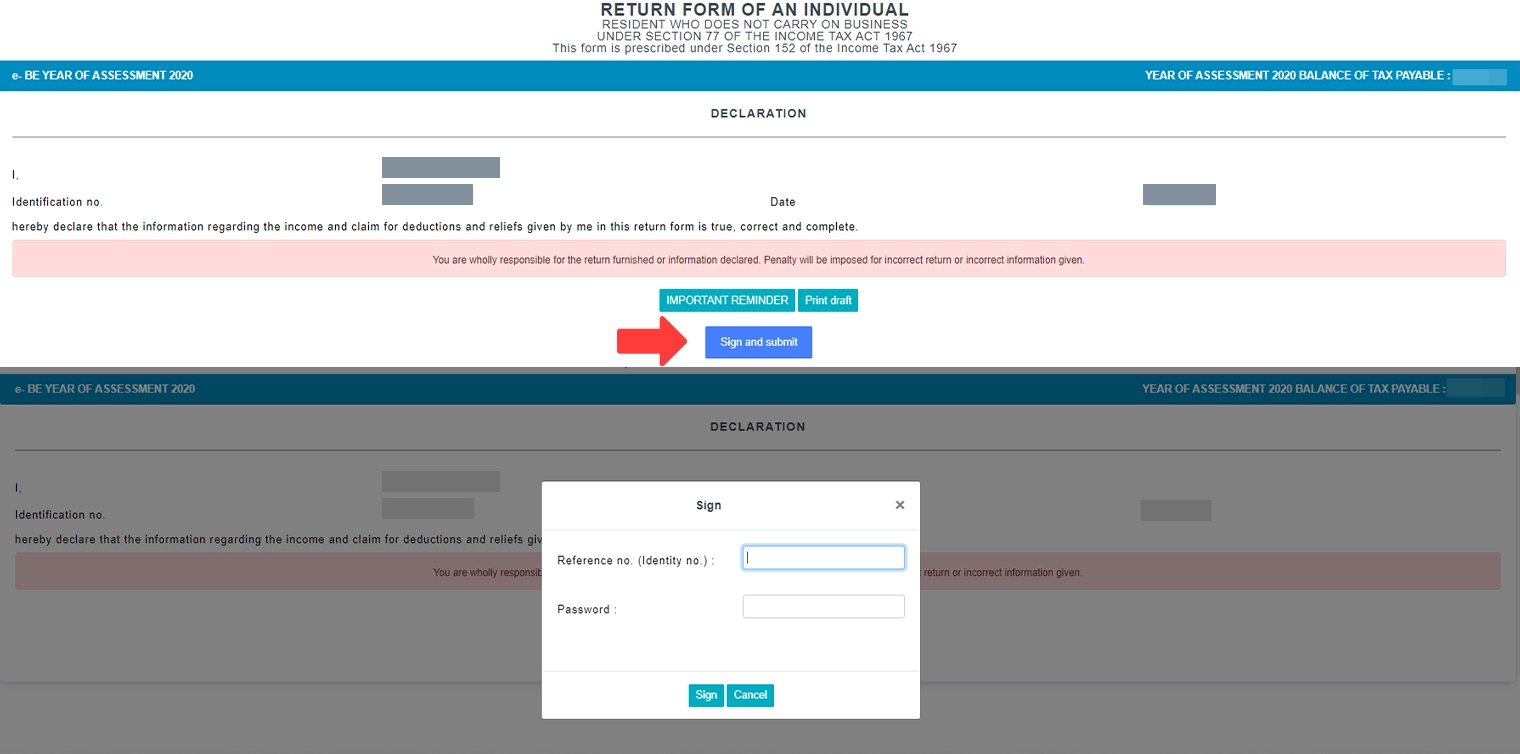

8. Sign the Form and Submit It

That leads us with the very last step, the declaration that everything in this form that you’ve filled in is true. All you have to do now is to click on the sign and submit button, print it out if you’d like a physical copy. Once you click on the sign and submit button, mytax hasil will ask you one more time to provide your ID number, and your password.

Once that’s done, then that’s it!

Pay Income Tax for a Better Future of Malaysia

Congratulations! You have just finished your taxes with e-filing 2023! Whether it is your first time completing your taxes or your first time doing your taxes in general, it’s always a cause for celebration for filing them.

Everyone can admit that filing taxes and even taxes, in general, can be frustrating since it’s taking out your hard-earned money to buy something as simple as RM5 eggs, to have it cost RM5.5 with the extra 10% tax.

But putting past the frustration that a person may have, there is an importance to taxes in any country, that is to put forwards the betterment of the Malaysian lifestyle, developed houses, education, hospital equipment and medicines, safe roads, efficient drainage systems, emergency relief shelters, all of that and more would be impossible for the government to ever create if there were no taxes in countries.

We have to put that bit of suffering from taxes, so we can ensure the safety and security of the future Malaysians that will continue to make us great.