Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The worldwide crypto market had notable Bitcoin price swings on May 12, 2025; it peaked at $105,720 (about Rp1.74 billion) and then dropped to $102,000 (about Rp1.68 billion). This drop came about after the United States and China announced a temporary deal to suspend import taxes for ninety days.

Although this deal is viewed as excellent for the stock market, Bitcoin experienced a price decline, raising concerns among investors: why did this commodity, often called “digital gold,” react negatively to seemingly favorable news?

US-China Accord and Market Response

This accord, announced on May 12, 2025, pauses trade tensions between the two global economic powers.

U.S. Treasury Secretary Scott Bessent stated that if productive communication occurs on issues such as currency manipulation, steel price dumping, and semiconductor export limitations, the agreement could be extended.

Also Read: US and China Agree to 90-Day Tariff Rollback in Surprise Trade War Truce

Yahoo Finance reports Technology and manufacturing businesses, which depend on worldwide supply chains, get comfort from the suspension of these import taxes, which helps to drive up stock indices such as the S&P 500 by 7% in the past 30 days.

But Bitcoin, which skyrocketed 24% within the same period, has lost impetus.

With a 30-day correlation between Bitcoin and the stock market reaching 83%, it is clear that traditional market mood is progressively driving BTC’s price fluctuations.

Investors seem to be moving their money to stocks, particularly in industries like technology and autos that directly benefit from tariff cuts. Demand for hedging assets such as gold and Bitcoin has thus dropped; gold prices fell 3.4% on May 12.

Macroeconomic Setting: US Dollar and Economic Recovery

Furthermore, macroeconomic elements are crucial in the dynamics of this market.

The US Dollar Index (DXY) peaked thirty days ago, reflecting growing investor confidence in the US economy.

While the US GDP dropped 0.3% in the first quarter of 2025, a 6.1% increase in house sales in March revealed indicators of economic recovery. Often regarded as a counter against financial uncertainty, Bitcoin loses attractiveness in this state.

The value of the US dollar usually increases in inverse proportion to assets like gold and Bitcoin.

Investors who are more sure about the US economy often lower their exposure to assets regarded as speculative or dangerous. On the other hand, stocks of businesses that gain from reduced tariffs provide more immediate profit possibilities, which causes capital outflows from cryptocurrencies.

The part institutional investors play in the bitcoin market

In the middle of price swings, institutional investors’ influence is growingly important.

Comprising around 1.19 million BTC, or 6% of the total circulating supply, companies including BlackRock and Strategy have amassed.

For instance, Strategy has shown long-term trust in Bitcoin by purchasing 13,390 BTC between May 5 and 11. Some analysts, particularly crypto critic Peter Schiff, caution that the concentration of Bitcoin ownership might reduce market liquidity and increase volatility.

Still, Strategy seemed unconcerned. Reiterating their dedication to Bitcoin investment, this corporation upped the capital increase ceiling to $21 billion in debt and $21 billion in equity. This action indicates that big institutions consider Bitcoin a necessary component of their portfolios despite the temporary risk of market corrections.

Future Prospects for Bitcoin Prices

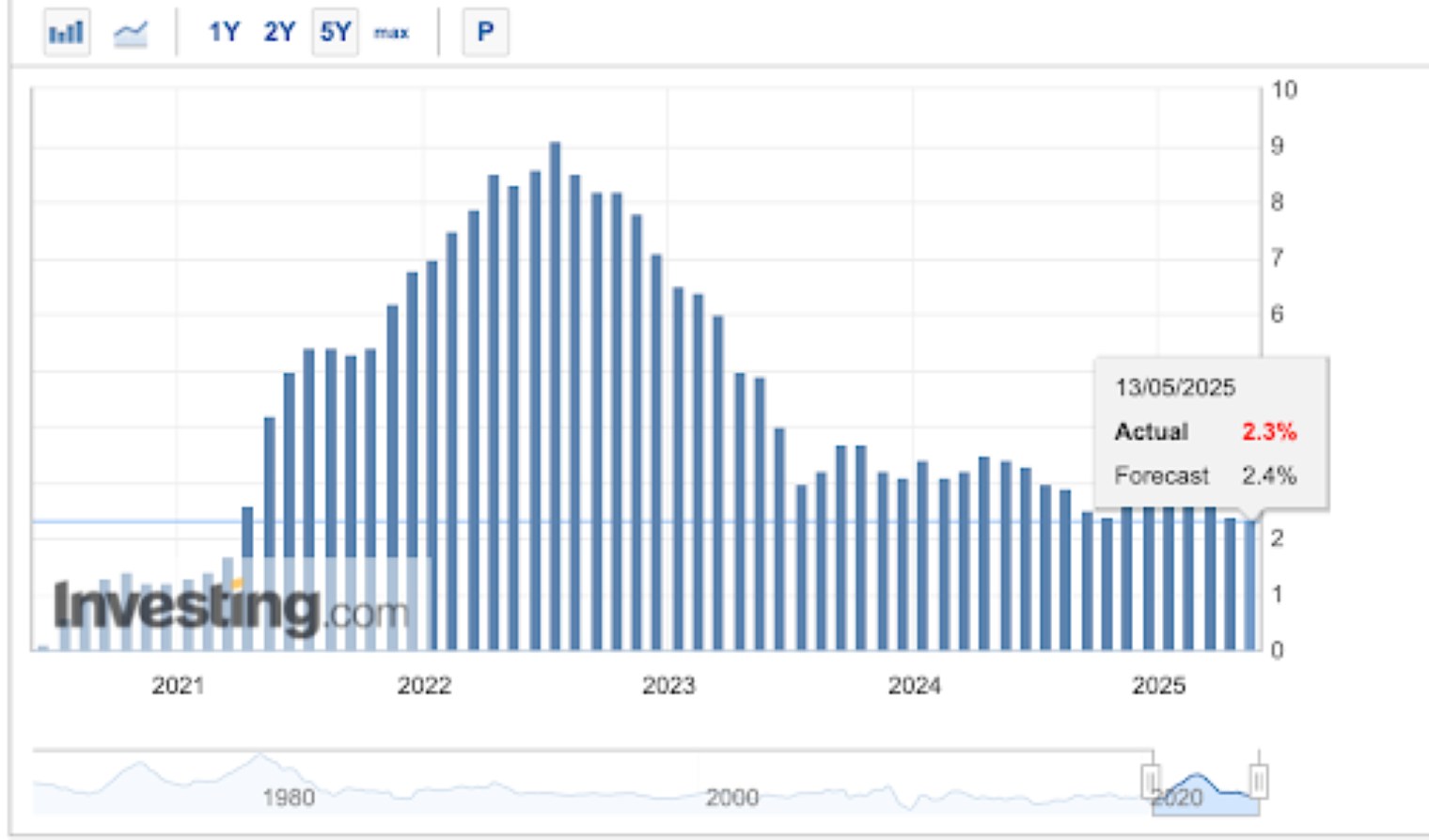

According to the U.S., the U.S. Consumer Price Index (CPI) for April 2025 dropped to 2.3% year-on-year, below the market estimate of 2.4% and the number of 2.4% from last month.

This fall, the Bureau of Labor Statistics suggests more controlled inflation, which raises the possibility of the Federal Reserve contemplating interest rate decreases at forthcoming conferences, maybe beginning in June 2025.

Lower interest rates, which are usually regarded as an alternative store of wealth during periods of weak monetary policy, tend to promote capital flows into risky assets like Bitcoin.

With inflows of $2 billion into spot Bitcoin ETFs in the US between May 1 and 9, 2025, representing adoption driven by big investors, not only retail speculation, institutional interest in Bitcoin remains high.

The medium-term picture is still bright as long as the price of Bitcoin stays above the psychological support level of $100,000. Certain analysts cited in the CoinGape Media article suggest that a surge toward an all-time high (ATH) is likely if the positive attitude continues.

Still, investors have to be alert against outside hazards.

Though the lower CPI supports a positive story, volatility could be triggered by uncertainties about US-China trade policies, including possible tariff-driven inflation in the future.

Several market players also point out that technical movements show a possible temporary drop should Bitcoin fail to overcome the resistance above $105,000.

Given this dynamic, investors should track macroeconomic data and Fed policy signals to project the direction of Bitcoin’s price in the next weeks.

Conclusion

The interim deal between the US and China on May 12, 2025, has generated ripples in the world market, with different consequences for Bitcoin.

While the tariff drop helped the stock market flourish, Bitcoin saw a downturn as people turned to assets that would directly help them.

Additionally, macroeconomic elements, including the appreciation of the US dollar and indicators of economic recovery, are lowering demand for safe-haven assets like Bitcoin. Still, Bitcoin’s medium-term future looks bright, given huge ETF inflows and great backing from institutional investors.

To grasp the market’s next direction, investors are recommended to monitor forthcoming economic statistics, including the CPI. Despite continuous short-term difficulties, Bitcoin is proving its usefulness as a worldwide asset in these dynamic surroundings.