Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

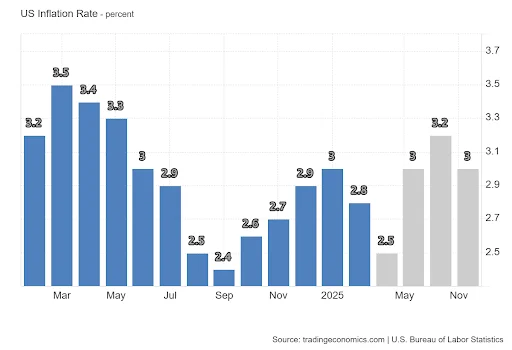

The United States Consumer Price Index (CPI) recorded a decline in annual inflation (YoY) to 2.8% in February, lower than the projected 2.9%. This data sparked optimism in the financial markets, including crypto assets like Bitcoin (BTC).

Not only did it trigger a positive response in the stock market, but the decline in inflation also raised hopes that the Federal Reserve (the Fed) would cut interest rates by the end of the year.

US Inflation Down, Market Sentiment Up

The CPI released by the US Bureau of Labor Statistics shows a significant decline in inflation. This comes as a positive surprise to investors, given that high inflation has been a major concern in recent years.

Although core inflation (Core CPI), which does not include volatile components such as food and energy, remained at 3.1% YoY, this figure was still below market expectations of 3.2%. This is the first time since July 2024 that both inflation indicators have recorded a decline, indicating that price pressures are starting to ease.

“Both overall and core inflation are declining. This clearly raises expectations of interest rate cuts. Interest rates and the dollar/yen exchange rate are responding with declines.

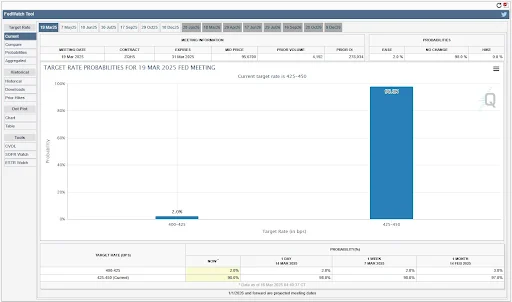

Based on data from CME FedWatch, investor confidence in the possibility of interest rate cuts at the next Fed meeting continues to increase. Lower-than-expected inflation should encourage the Fed to cut interest rates immediately.

Bitcoin Responds Positively

After the release of CPI data, the price of Bitcoin (BTC) recorded a moderate increase, reaching US$83,371.

The decline in inflation reduces the likelihood of tighter monetary policy, thus supporting risk sentiment in the market. In addition to Bitcoin, the main US stock indexes also rose, reflecting investors’ positive response to this news.

Bitcoin is currently in a crucial phase in its cycle. Unlike the post-halving historical pattern that usually triggers a strong rally, BTC’s movement this time is more influenced by macroeconomic factors, including inflation data dynamics and institutional investor involvement.

According to some analysts, a comparison with previous Bitcoin cycles (2012-2016 and 2016-2020) shows a more aggressive price spike than at present. However, since October 2024, BTC has experienced a significant increase, followed by consolidation in January 2025 and a correction at the end of February.

“Unlike the previous cycle, which was more driven by retail speculation, Bitcoin is now seen as a much more mature investment asset. The influence of institutional investors, banks, and governments has changed market dynamics, making BTC price movements more stable compared to the extreme spikes of the past,” they said.

Has Bitcoin Reached Its Peak?

Many are debating whether Bitcoin (BTC) has reached its peak or has room to rise higher to break through US$100,000.

Technically, BTC has just broken through the psychological level of US$80,000 after falling to a low of US$76,555 on November 10.

The latest price movement shows an ascending triangle pattern, which has the potential to push a spike above the US$84,000 resistance. Currently, BTC is correcting after touching the top of this pattern, but the bullish trend persists as long as the price does not fall below US$81,000—if that happens, the uptrend could be canceled.

The next target for BTC is US$86,750, with a stop level below US$84,000. However, to completely reverse the bearish trend, BTC must be able to break through US$91,000 in the next few days.

Currently, trading volume is below average, indicating that this increase could be a short-term recovery.

Political Dynamics and the Future of Bitcoin

In addition to macroeconomic factors, political dynamics also influence Bitcoin prices.

Former President Donald Trump’s pro-crypto stance and the increasing adoption of BTC at the state level add unexpected variables to this cycle.

Although the market did not react too enthusiastically to the White House Crypto Summit, this development is still a big step in the government’s adoption of Bitcoin.

Over time, the Bitcoin rally has weakened. The 2012-2016 and 2016-2020 cycles saw exponential increases, while the 2020-2024 and current cycles are more moderate.

One of the main indicators, the Long-Term Holder (LTH) Market Value to Realized Value (MVRV) ratio, shows that the unrealized profit among long-term holders is declining.

Bitcoin may experience a longer and more stable cycle if this trend continues, not an explosive parabolic rally as before.

Conclusion

The decline in US inflation has sparked optimism in financial markets, including crypto assets such as Bitcoin. With the possibility of the Fed cutting interest rates, risk sentiment in the market is increasing.

However, Bitcoin still faces challenges from complex macroeconomic factors and political dynamics. Although the bullish trend persists, further confirmation is needed to ascertain whether BTC can continue its rally to higher levels.