Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

President Donald Trump’s latest wave of tariffs—some of the highest imposed by the U.S. in nearly a century—has sent global financial markets tumbling and triggered an urgent round of diplomacy as dozens of countries race to renegotiate trade terms.

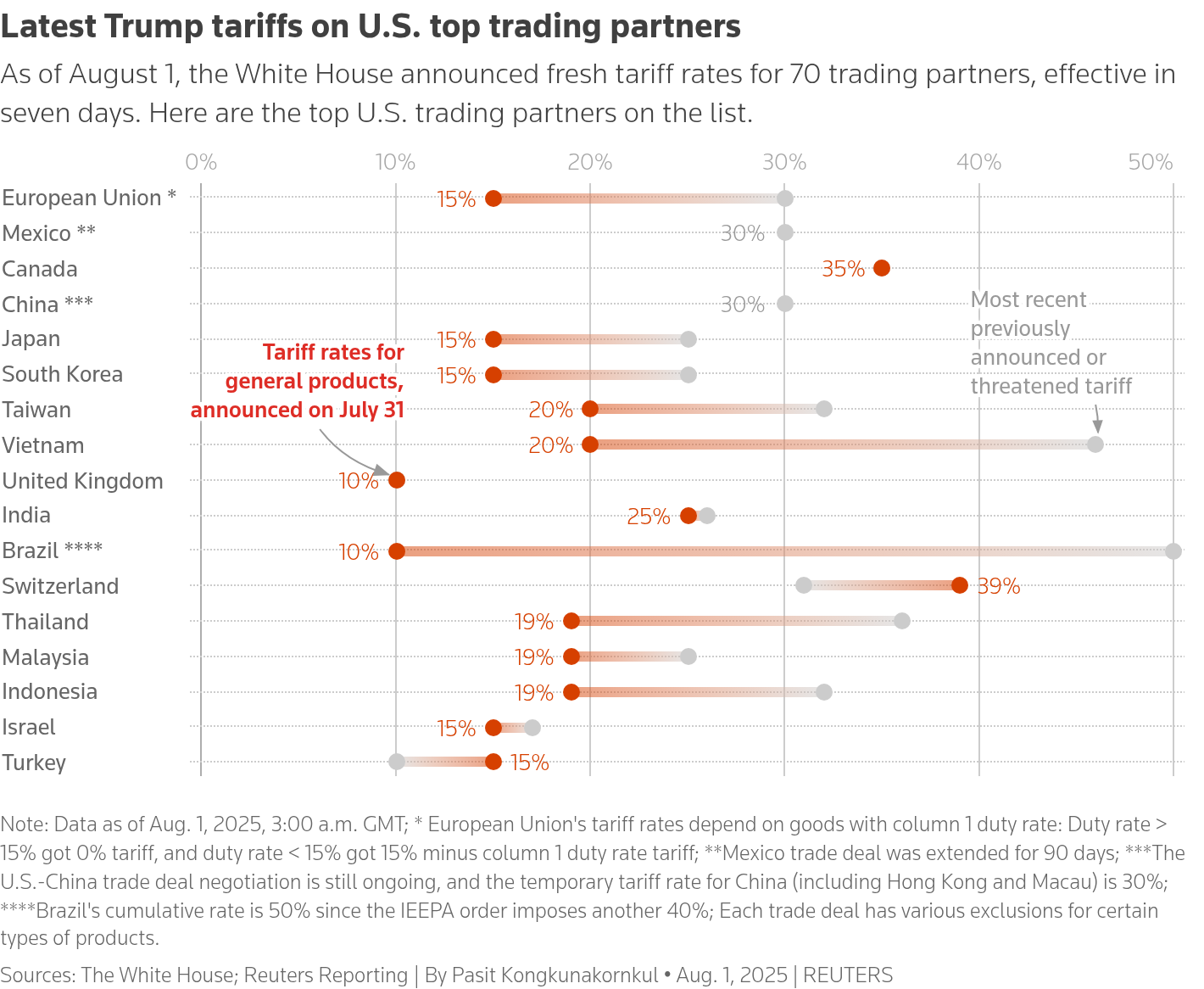

The sweeping order raises U.S. import duties on goods from 69 trading partners, with rates ranging from 10% to 41%, and brings the U.S. average effective tariff rate to nearly 18%, up from just 2.3% a year ago, according to Capital Economics. “Some trading partners…have offered terms that, in my judgment, do not sufficiently address imbalances…or have failed to align sufficiently with the United States on economic and national-security matters,” Trump wrote in the executive order.

Tariff Breakdown: Allies and Rivals Hit Alike

The tariffs hit both allies and rivals, with Switzerland stunned by a 39% rate, India slapped with 25%, and Canada seeing duties on many goods rise from 25% to 35%—linked directly to fentanyl-related enforcement disputes.

Meanwhile, Mexico was granted a 90-day reprieve from pending 30% tariffs, with the White House signaling a willingness to negotiate a broader deal. Brazil faces a 50% tariff, and Taiwan was hit with a 20% rate, which it called “temporary,” pending further talks.

Market Reaction: Red Across the Board

Markets reacted swiftly and negatively.

- Dow Jones Industrial Average fell 1.23%

- S&P 500 dropped 1.6%

- Nasdaq Composite slid 2.24%

- Europe’s STOXX 600 lost 1.89%

The sell-off mirrored the sharp declines seen when Trump first floated the tariff plan back in April. Investors fear the sweeping levies could ignite new trade wars, disrupt supply chains, and stall global economic recovery.

Canada and India Respond

Canadian Prime Minister Mark Carney called the move “disappointing,” and vowed retaliatory steps to protect Canadian jobs and diversify trade away from the U.S. Carney also criticized what he called a lack of consistency in U.S. trade policy.

India, facing potential disruption to $40 billion in exports, has entered fresh talks with U.S. negotiators. A source close to the Indian government said there’s some optimism, citing past White House decisions to revise or scale down tariffs during negotiations.

Still, White House Trade Advisor Rachel Greer said that many of these new rates are “set” and tied to structural metrics, such as trade deficits or surplus levels. “Some of these deals are announced, some are not,” Greer said. “These tariff rates are pretty much set.”

Strategic Logic or Trade Gamble?

Trump’s aggressive trade strategy, rooted in emergency powers, aims to overhaul long-standing global trade norms and push U.S. allies to deepen economic alignment with Washington. But the scale and speed of the latest tariffs have drawn criticism from economists and foreign leaders alike.

Analysts warn that the new duties—especially if met with retaliation—could undermine global trade stability and reduce the effectiveness of prior agreements like the United States-Mexico-Canada Agreement (USMCA).