Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

U.S. President Donald Trump reignited global trade tensions on Friday by threatening a 50% tariff on all goods imported from the European Union starting June 1.

In a simultaneous move, he warned of a 25% levy on imported iPhones — a direct challenge to Apple and other smartphone manufacturers that assemble devices overseas.

Speaking in the Oval Office, Trump said the phone tariff would apply broadly, including to brands like Samsung, and would be implemented “by the end of June.”

These threats mark a sharp turn after weeks of de-escalation, where trade tensions had cooled following temporary agreements with China and the UK.

“I’m not looking for a deal,” Trump said Friday. “We’ve set the deal — it’s at 50%. But again, there’s no tariff if they build their plant here.”

His remarks underscored a push to bring manufacturing back to the U.S., despite the reality that America does not mass-produce smartphones or have the infrastructure to do so at scale.

Markets React Swiftly to Renewed Trade War Fears

Global markets were rattled by the president’s early morning social media announcements. The S&P 500 closed 0.7% lower, the Nasdaq fell 1%, and the Dow Jones Industrial Average lost 256 points.

European stocks were hit harder: Germany’s DAX and France’s CAC 40 dropped by roughly 1.7%, and the Stoxx 600 fell nearly 1%. Shares of European multinationals with significant U.S. exposure — including Deutsche Bank, BMW, Stellantis, and LVMH — posted losses ranging from 2% to 4%.

Safe-haven assets like gold surged, while U.S. Treasury yields dropped, reflecting investor concern that a renewed tariff battle could drag on economic growth. The dollar weakened slightly amid the market turmoil.

Europe Pushes Back, Warns Against ‘Threat Diplomacy’

European Commission Vice President Maros Sefcovic said after a call with U.S. trade officials that the EU remained committed to securing a mutually beneficial deal but stressed that transatlantic trade “must be guided by mutual respect, not threats.”

Trump, however, appeared unmoved by diplomatic niceties, doubling down on accusations that the EU has treated the U.S. unfairly, particularly on car exports and agricultural goods.

Trump’s tariffs would compound those introduced in his “Liberation Day” declaration last month, which slapped a 20% duty on EU goods and triggered new rounds of talks. Unlike more flexible trade partners, the EU has taken a firm stance, indicating it is prepared to retaliate with tariffs on American products if necessary.

Apple Caught in the Crosshairs

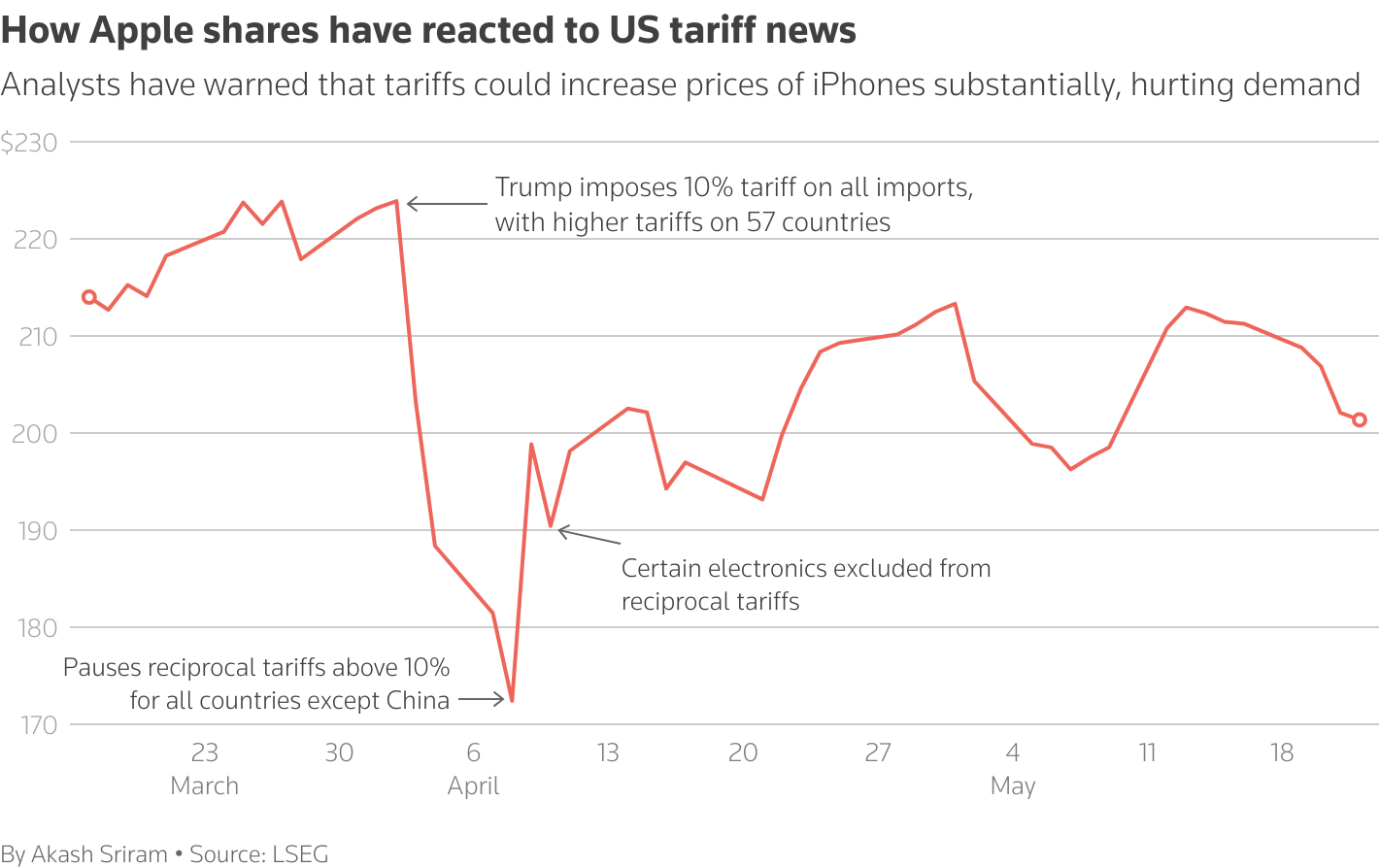

Apple, one of America’s most iconic companies, finds itself in a vulnerable position. The proposed 25% tariff on imported iPhones comes as the company ramps up production in India to hedge against supply chain risks in China.

Still, the bulk of its devices are made abroad, and analysts warn that such a tariff could raise iPhone prices by hundreds of dollars.

Trump’s comment that “there’s no tariff if they build here” reflects a growing pattern of targeting individual corporations to force onshore manufacturing.

Apple has not commented publicly on the proposed tariffs, but industry experts note that building iPhones in the U.S. would require a complete restructuring of its supply chain and would significantly inflate costs.

The EU, the largest U.S. trading partner, exported more than $600 billion in goods to America last year, while the U.S. exported roughly $370 billion to the EU.

Trump blames this imbalance on trade barriers and has frequently criticized the bloc for non-tariff measures, including its value-added tax system and regulatory practices.

As June 1 approaches, the administration’s threats have once again destabilized global markets and left businesses uncertain.

Treasury Secretary Scott Bessent summed up the White House’s posture in a Fox News interview: “We hope this lights a fire under the EU.”