Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The cryptocurrency industry is at another important crossroads. The future of “altseason,” a time when other cryptocurrencies do better than Bitcoin, could depend not on changes in the crypto world, but on global macro policy. Everyone is watching China’s central bank, since what it does next might decide whether altcoins finally hit new all-time highs or stay stuck because of rising fears of a recession.

Stimulus as a Lifeline for Risky Assets

For a long time, central banks have been the unseen force behind market cycles. They provide liquidity in the system by lowering interest rates or making it easier to get loans, which increases demand for risk assets. For cryptocurrencies, which do well in markets with a lot of money and a lot of speculation, this kind of boost has often led to huge price increases.

A research from crypto asset manager 21Shares in March 2025 showed how this works by showing a strong 94% correlation between Bitcoin’s price and worldwide liquidity. That number was higher than those for the S&P 500 and gold, which means that crypto is probably the key asset class that is most vulnerable to liquidity.

Any easing of monetary policy will have a bigger effect on altcoins, which usually follow Bitcoin but are more volatile. Now traders want to know if the People’s Bank of China (PBOC) would give the kind of boost that makes altcoins rise over their previous highs.

Why China Plays Such a Big Role

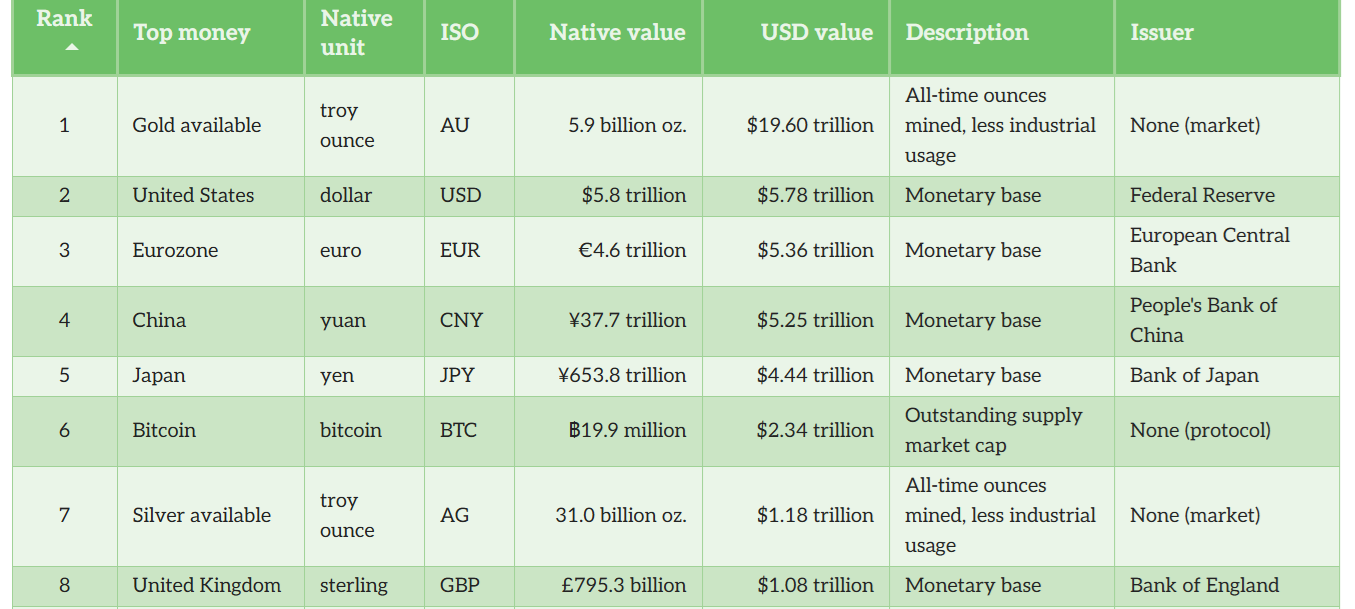

The U.S. still has the biggest pool of money, with $5.8 trillion. Data from Porkopolis Economics shows that the eurozone comes next with $5.4 trillion, China with $5.2 trillion, and Japan with $4.4 trillion.

The Federal Reserve gets a lot of attention, yet China makes up almost 20% of the world’s GDP. That makes it impossible to disregard its policy stance.

The most recent economic data from China paints a grim picture. Retail sales in July were down 0.1% from the month before.

Investment in fixed assets fell by 5.3% year over year, the biggest drop since the epidemic started in March 2020. The unemployment rate in cities went climbed to 5.2%, although industrial production scarcely changed, going up by only 0.4%.

Economists expect stimulus to happen soon because of these trends. Bloomberg Economics analysts predicted the PBOC might move “as soon as September,” and Nomura and Commerzbank stated the same thing, saying that additional support programs were “inevitable.”

If these kinds of actions happen, they might add new money to global markets at a time when people are unsure about how much risk to take.

The Shadow of a Recession

Even if China helps, crypto markets have to deal with another problem: investors are afraid about a recession. In August, the University of Michigan’s survey found that 60% of Americans think unemployment would get worse over the next year. This is the most negative outlook since the 2008–09 financial crisis.

But the paradox is very clear. U.S. stocks keep going up, even if they shouldn’t. The S&P 500 hit record highs, and rates on 5-year Treasurys went up. This shows that investors are still more positive than their surveys show.

When people are afraid of a recession, they usually look for secure investments, which raises demand for government bonds and lowers yields. In fact, the 5-year Treasury yield fell to 3.74% earlier this month, which was the lowest it had been in more than three months.

But the quick rise back to 3.83% shows that people still want to take risks. That strength means that capital can move back into crypto, especially altcoins, if fresh liquidity drivers come along.

Altcoins Waiting for a spark

For now, the market value of altcoins, without including stablecoins, is still below its previous highs. Traders seem to be wary, stuck between hope that China will ease its policies and worry that a worldwide slowdown will lower speculative demand.

The pattern is similar to what has happened before: altcoins tend to rise the most after liquidity injections but fall behind as macro clouds get darker. If the PBOC gives the economy a real boost and overseas investors think the dangers of a recession are bearable, a new wave of altseason might start when all that money comes in.

The opposite situation, on the other hand, is just as likely. If the global economy gets worse, even China’s tough policies may not be enough to make people less afraid of risk. Like stocks, crypto markets are ultimately at the mercy of the bigger economic picture.

What to Look at Next?

In the next few weeks, people will be paying close attention to Beijing’s policy announcements and if they match what people expect to happen in September. Investors will also keep an eye on U.S. economic indicators to see if their fears of a recession grow or fade.

Altcoins are stuck in this delicate equilibrium, waiting for things that are well outside the blockchain. The result could not only change the next chapter for crypto markets, but also how closely digital assets are tied to the rise and fall of global liquidity.

For traders, it’s clear: altseason will keep going, and it’s no longer only about new blockchain technology or investors moving about. It’s a big story that depends on whether the world’s second-largest economy decides to loosen its money supply and how investors around the world choose to react.