Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Cryptocurrency hasn’t taken the role of regular money in the grocery store or coffee shop by the end of 2025, but it has become a big part of some parts of the digital economy.

The idea that crypto is primarily for speculation or holding as “digital gold” is no longer true. Now, it has real-world uses where its benefits—speed, cheap costs, borderless settlement, and programmable ownership—are better than those of traditional systems.

Stablecoins like USDC, USDT, and newer ones like PayPal USD (PYUSD) are the most popular for these uses. They make it easy to pay freelancers, run in-game economies, and make decisions without a central authority.

This year, stablecoin transaction volumes have gone over $46 trillion, and the entire market cap of all cryptocurrencies has stabilized around $3.8 trillion after October’s volatility.

These workflows show that cryptocurrencies have grown from being hype-driven assets to useful infrastructure. This essay looks at the most common real-world uses of crypto in 2025. It combines current patterns, platform data, and ecosystem advancements to show how millions of people use digital assets for more than just trading charts.

Paying Creators and Freelancers

People have started using stablecoins for online employment and content creation, which is one of the most obvious changes in 2025. More and more freelancers, developers, writers, and influencers are getting paid in USDC or USDT instead of traditional platforms like PayPal or bank wires, which can take a long time and cost a lot of money. This trend picked up speed when big content platforms started offering crypto rewards, which made it easier for producers in developing economies to get their hands on global earnings.

YouTube, which has more than 2.5 billion monthly viewers, is a good example of this change. In the middle of 2025, YouTube let creators in the U.S. cash out ad earnings and Super Chat donations through PayPal USD (PYUSD), a stablecoin with a market cap of about $4 billion.

People who make things in nations with capital controls or weak currencies, like Argentina, Nigeria, or Venezuela, get a lot of help since they get money right away without losing 5–10% in conversion fees. Twitch, OnlyFans, and Patreon all have similar integrations where stablecoin tips or subscriptions lower platform fees from 30% to less than 5%.

The freelancing economy, which is worth more than $1 trillion around the world, has also grown. Platforms like Upwork and Fiverr now let you withdraw USDC directly, and decentralized options like Braintrust and LaborX settle completely on-chain. A developer in Indonesia can bill a U.S. client in USDC, get paid in seconds, and exchange it for cash in Indonesia without going via a bank.

This efficiency is very important in places where remittances are more than $600 billion a year. Chainalysis says that 15–20% of these payments now go through stablecoins to save money and time.

These payments can be sent to more than just people. Stablecoins are used for payroll by small enterprises and DAOs. Tools like Sablier make it possible to stream payments, so salaries are paid out every second instead of every month. The appeal is clear: no middlemen, no chargebacks, and always available. However, there are still problems. For example, banks still “debank” accounts linked to cryptocurrencies, which makes it hard for recipients to find on-ramps.

Buying Digital Goods and Services

You can use crypto to buy things and services online, especially when regular payments cause problems. Namecheap and Porkbun are two domain registrars who have accepted Bitcoin and stablecoins for a long time. Namecheap even sold a domain for $2 million in Bitcoin in September 2025.

VPNs that emphasize on privacy, like Mullvad and ExpressVPN, employ crypto to avoid being looked at by payment processors. This makes them popular with people in blocked areas.

E-commerce sites are getting better. With Stripe’s 2025 USDC integration, retailers can accept stablecoins and automatically convert them to fiat money. This cuts cross-border fees from 3–6% to less than 0.5%. Shopify’s pilots let sellers from other countries pay in USDC or PYUSD, which cuts down on cart abandonment in markets with high fees. Digital commodities like software licenses, cloud storage, and streaming subscriptions gain the most since blockchain lets them be delivered right away without any geographical bottlenecks.

This approach is similar to tokenized real-world assets (RWAs), where companies like Centrifuge use stablecoin loans to pay for bills, which earn 8–12%. For customers, it’s easy: You can buy a game key on Keys4Coins with USDT or sign up for a newsletter with Lightning Network micro-payments.

Digitizing Collectibles: From Pokémon Cards to Other Things

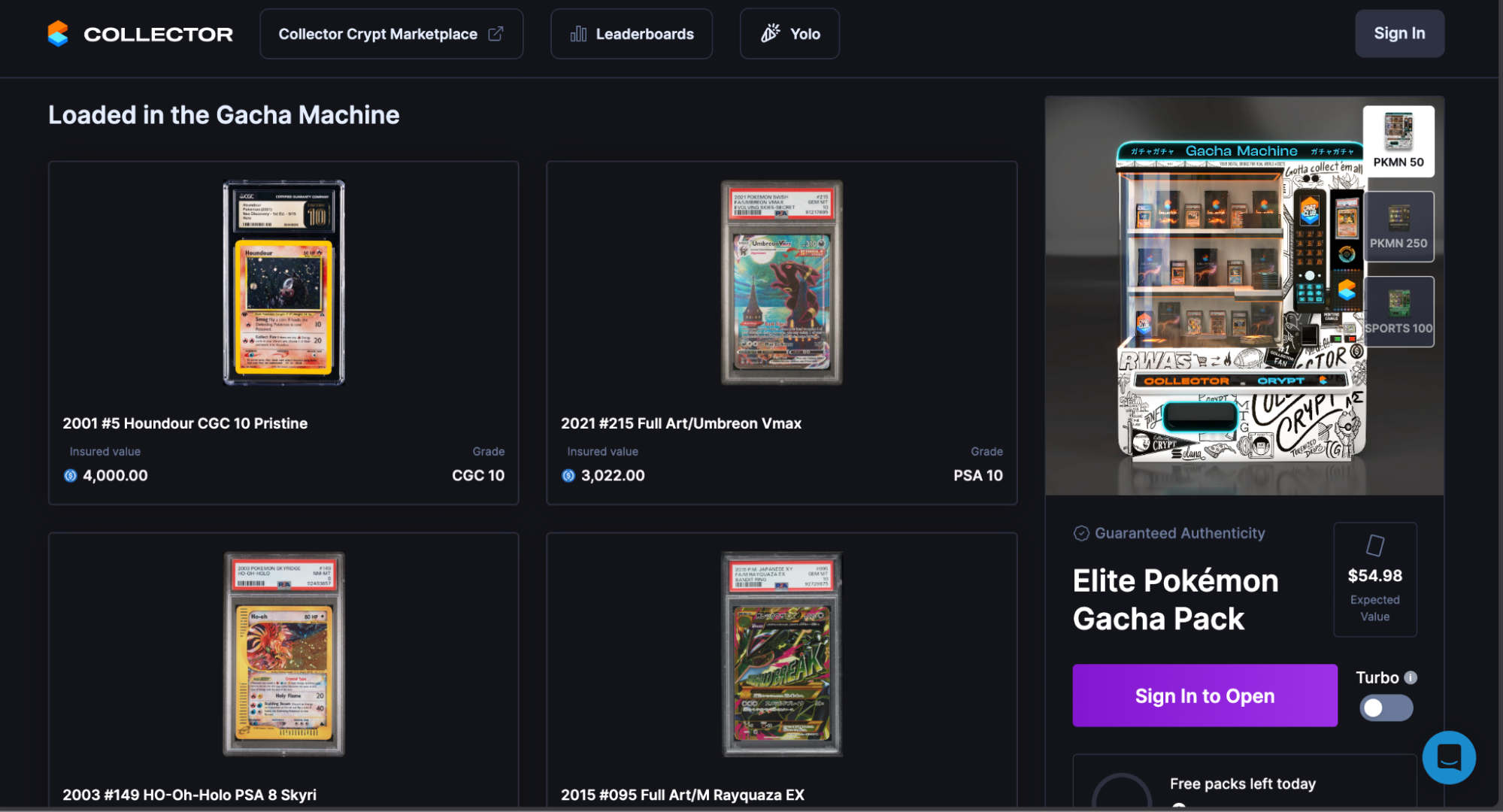

Crypto has brought new life to collector cultures by connecting the actual world with the digital world. The return of Pokémon cards in 2025, driven by nostalgia and scarcity, led to the growth of tokenized markets. Collector Crypt and Blur are two such of platforms that provide NFT “gachas,” where consumers pay $50 to $250 for random digital packs that look like booster openings. Rare holographic cards can sell for thousands of dollars, and their history can be followed on-chain.

This includes toys like Labubu figures: Physical owners mint NFTs to prove their validity, whereas digital collectors trade small amounts. The concept keeps the hobby’s passion alive by letting you scan a card to see its blockchain history. It also adds liquidity and worldwide access. According to CryptoSlam, NFT volumes in collectibles reached $15 billion in 2025 as communities moved from binders to wallets.

What crypto does: it lets people hold things that can’t be changed, trade them in little amounts, and trade them across platforms. For fans, it’s not about replacing things; it’s about evolution. Physical things have nostalgic value, while digital things bring usefulness.

DeFi and GameFi

Decentralized finance (DeFi) is still the most powerful use of crypto, with $150 billion in total value locked up in lending, trading, and yield farming. Users put stablecoins into Aave to earn 4–8% interest, or they give liquidity to Uniswap in exchange for fees. You can use BTC as collateral to borrow money and use leveraged tactics without banks. Flash loans are used for arbitrage.

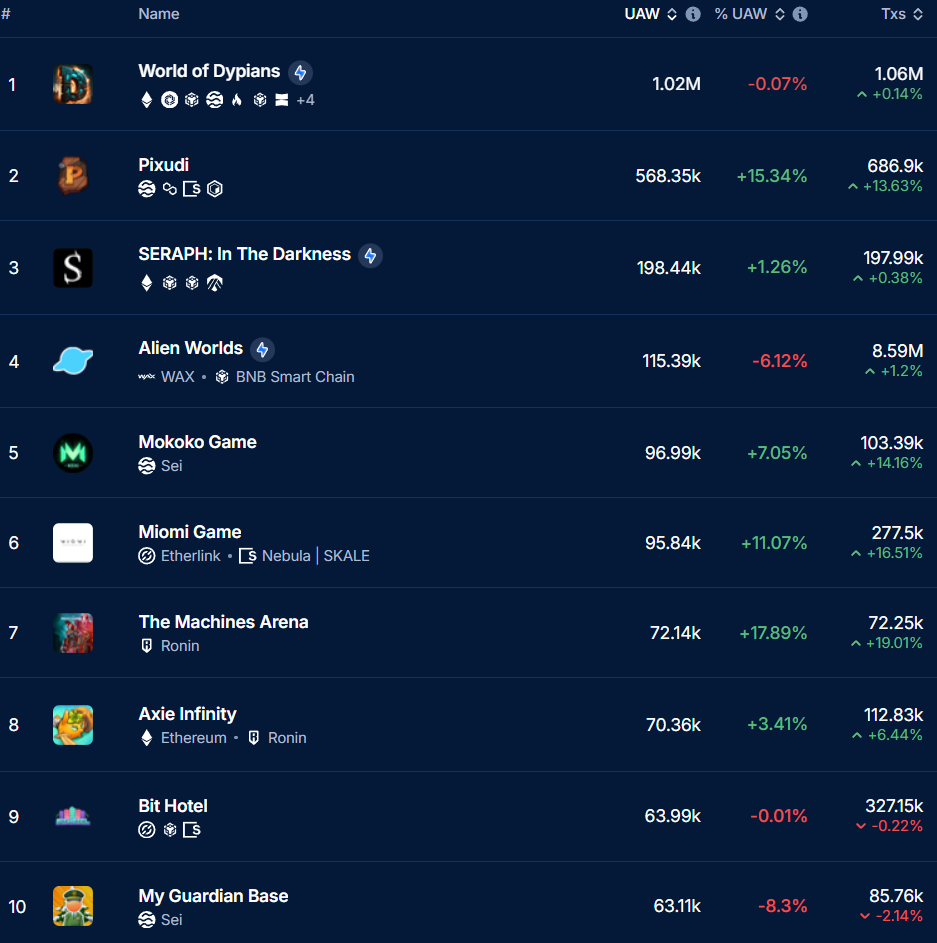

GameFi combines this with play: Players can earn tokens by completing objectives in blockchain games like World of Dypians (1 million unique active wallets, DappRadar) and Pixudi Runs (570,000). Play-to-earn came out of the Axie boom in 2021. Now it’s a way to make extra money, not a way to make a living, with models that encourage talent over grinding. NFTs are genuine digital items that may be traded for real money on different marketplaces.

These economies thrive on crypto’s programmability, which lets you automate yields, make trades right away, and own things that can be moved. They’re easy to get money for emerging markets—Philippine players make $5 to $20 a day.

DAOs and Coordination on the Chain

DAOs, which are part of DeFi’s governance layer, employ crypto to make decisions without a central authority. Token holders vote on proposals, like how to spend the treasury and how to upgrade the protocol. These votes are carried out through smart contracts. MakerDAO is in charge of $8 billion in DAI reserves, and Uniswap DAO decides how to spend them. They have $50 billion in DAO treasuries that they use to pay for projects without VCs.

To take part, you need tokens and wallets, which makes it hard for people who don’t know anything about crypto to do so. Voting turnout is often less than 10%, and whales have most of the power. But DAOs are open about how they manage billions of dollars, from grants to purchases.

The Path Ahead

In 2025, crypto is used for more than just trading. It also be used for tokenized RWAs ($100 billion TVL), wallet-based identity (ENS domains for logins), and Bitcoin lending (5% yields on Ledn). Polymarket and other prediction markets settle $1 billion in USDC bets. These are built on stablecoin rails, which cuts down on middlemen.

There are still problems to solve: scalability (Ethereum’s Fusaka helps), regulation (the GENIUS Act makes things clearer), and acceptance (gaps in education). But crypto’s niches, including creator payments, digital products, collectibles, DeFi/GameFi, and DAOs, show that it works. As on-chain financing gets more popular, 2026 could be the year when big things happen.

In 2025, crypto is employed in the best ways: In the digital world, value can be sent quickly, cheaply, and in a way that can be programmed. From payments on YouTube to Pokémon NFTs, it’s getting deeper. Watch for the next wave.