Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

This week, reports said that China’s cabinet is thinking of adding yuan-pegged stablecoins. This might be a big change in the country’s policy on cryptocurrencies. The goal of the move is to make the Chinese yuan more widely used around the world and less reliant on the U.S. dollar in commerce. It would also let China into the global stablecoin market for the first time.

China has always been one of the strictest countries when it comes to cryptocurrencies. In September 2021, the country prohibited trade and mining of cryptocurrency. However, it looks like the government is about to change its mind and support a move that would encourage the use of the yuan in the global economy. This concept is gaining traction as demand in stablecoins, especially those backed by the U.S. dollar, grows.

A Change of Plans: Using Stablecoins to Help Globalization

People who know about the situation say that the State Council of China will look at a plan in late August that shows how stablecoins could help the yuan become more widely utilized around the world. The proposal is said to include rules for regulators to follow to reduce the risks that come with introducing these kinds of assets, as well as ways to fight the dominance of stablecoins backed by the U.S. dollar.

The move would be part of China’s larger plan to make the yuan more worldwide. The country has been working toward this aim for years through a number of financial programs. China wants to make the yuan more important around the world, which fits with its long-term goal of making the world less dependent on the U.S. dollar, which is the currency that controls trade and banking around the world.

Cross-Border Trade as a Main Use Case

A yuan-backed stablecoin might be used a lot in cross-border trade and payments. Stablecoins could make transactions between China and other nations go more smoothly, especially in areas that are already using digital currencies. This is because stablecoins promise to be stable and not change too much.

As part of the strategy, China’s government is also said to be working with crucial partners like Hong Kong and Shanghai, two of the region’s most important financial centers, to build infrastructure that will make it easier to use stablecoins for payments.

During the upcoming Shanghai Cooperation Organization (SCO) summit, which will be held in Tianjin from August 31 to September 1, these talks will be widely watched. The meeting will probably be a place to talk about China’s growing plans for the yuan and how stablecoins can fit into the global financial system.

Yuan’s Role in Payments Around the World

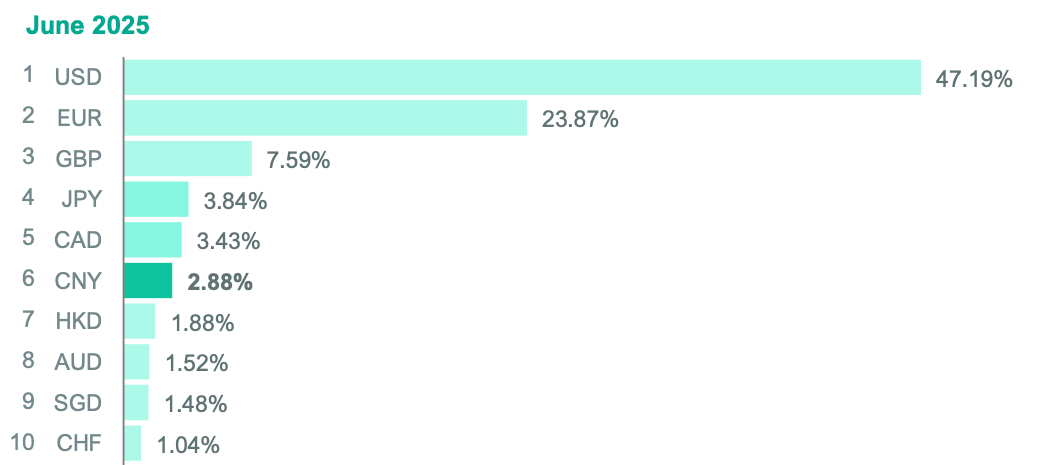

Swift’s RMB Tracker says that the yuan is currently the sixth most used currency for worldwide payments, with a market share of about 2.9% as of June 2025. This puts it well behind the U.S. dollar, which has more than 47% of the world’s payments.

China, on the other hand, wants to make the yuan more important around the world. The usage of yuan-backed stablecoins might speed up its use in international trade, making it more competitive with the U.S. dollar and the euro, which are the most popular reserve currencies.

China may build on these efforts by issuing stablecoins backed by the yuan. This would provide people a digital option that makes it easier to do business across borders and keeps more foreign payments within China’s own financial system. Stablecoins, in particular, offer an attractive alternative due to their ability to maintain a consistent value while harnessing the efficiencies of blockchain technology.

The U.S. dollar is becoming more and more important in stablecoins

Even if China’s plans for a yuan-backed stablecoin are still in the proposal stage, the U.S. dollar is already the most popular stablecoin. U.S. dollar-backed stablecoins represent roughly 98% of the $288 billion total market capitalization of stablecoins, according to CoinMarketCap.

As the global market for digital assets grows, this dominance has strengthened. U.S. dollar-backed tokens are very important for making commerce and investment happen between countries.

China is worried by the power of U.S. stablecoins, even though they are the most powerful. This is especially true since the U.S. government wants to use these digital assets to make the dollar even more important. Pan Gongsheng, the governor of the People’s Bank of China (PBOC), spoke recently about how important it is to not rely on just one currency and how important it is to have a worldwide payment system that works with many different currencies.

More and more people throughout the world are interested in stablecoins

China is becoming more interested in stablecoins at the same time that many other places are trying to figure out how digital currencies could change the way people pay for things throughout the world.

In June 2025, a PBOC official said that stablecoins might change the way the world works in a big way, especially if new technologies like blockchain make digital currencies easier to use and safer.

The Chinese government has been keeping a tight eye on things, especially because nearby areas like Hong Kong have begun to put rules in place for stablecoins. On August 1, Hong Kong, an important part of China’s financial system, started its own set of rules for stablecoins. These rules are anticipated to help the city become a global center for digital assets. As Hong Kong moves forward with regulating stablecoins, it’s probable that China’s ambitions will also fit in with this trend in the region.

The Road Ahead: Risks and Chances

The introduction of yuan-backed stablecoins could make China’s economy stronger, but it also brings up doubts about the hazards. Digital currencies, especially stablecoins, are still rather new and have a lot of problems with rules, technology, and security. As China moves forward with its stablecoin strategy, the government will need to address concerns relating to fraud, money laundering, and volatility—issues that have already damaged the broader cryptocurrency industry.

Furthermore, China’s lengthy history of tough rules around cryptocurrency trade and mining implies that the country’s stablecoin program will certainly be subject to careful inspection. China may need to go ahead with its plan for a yuan-backed stablecoin in order to stay competitive on the world arena, even as stablecoins are becoming more popular in other parts of the world.

As things change, everyone will be watching China’s State Council and the decisions it makes on the future of yuan-backed stablecoins. If this proposal is allowed, it might change the global financial landscape in a big way. It could not only make the yuan more widely used around the world, but it could also challenge the U.S. dollar’s dominance in the realm of stablecoins and beyond.

Conclusion

China’s possible use of yuan-backed stablecoins is a big step in the race to make the yuan more widely used around the world and change the way the global financial system works. As the globe continues to move toward digital currencies, China’s policy adjustment reflects a bigger aim to diversify the global payment system and undermine the dominance of the U.S. dollar. At the Shanghai Cooperation Organization meeting, talks are already happening. The next few months will be very important for figuring out how China will deal with this new area of the digital economy.