Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

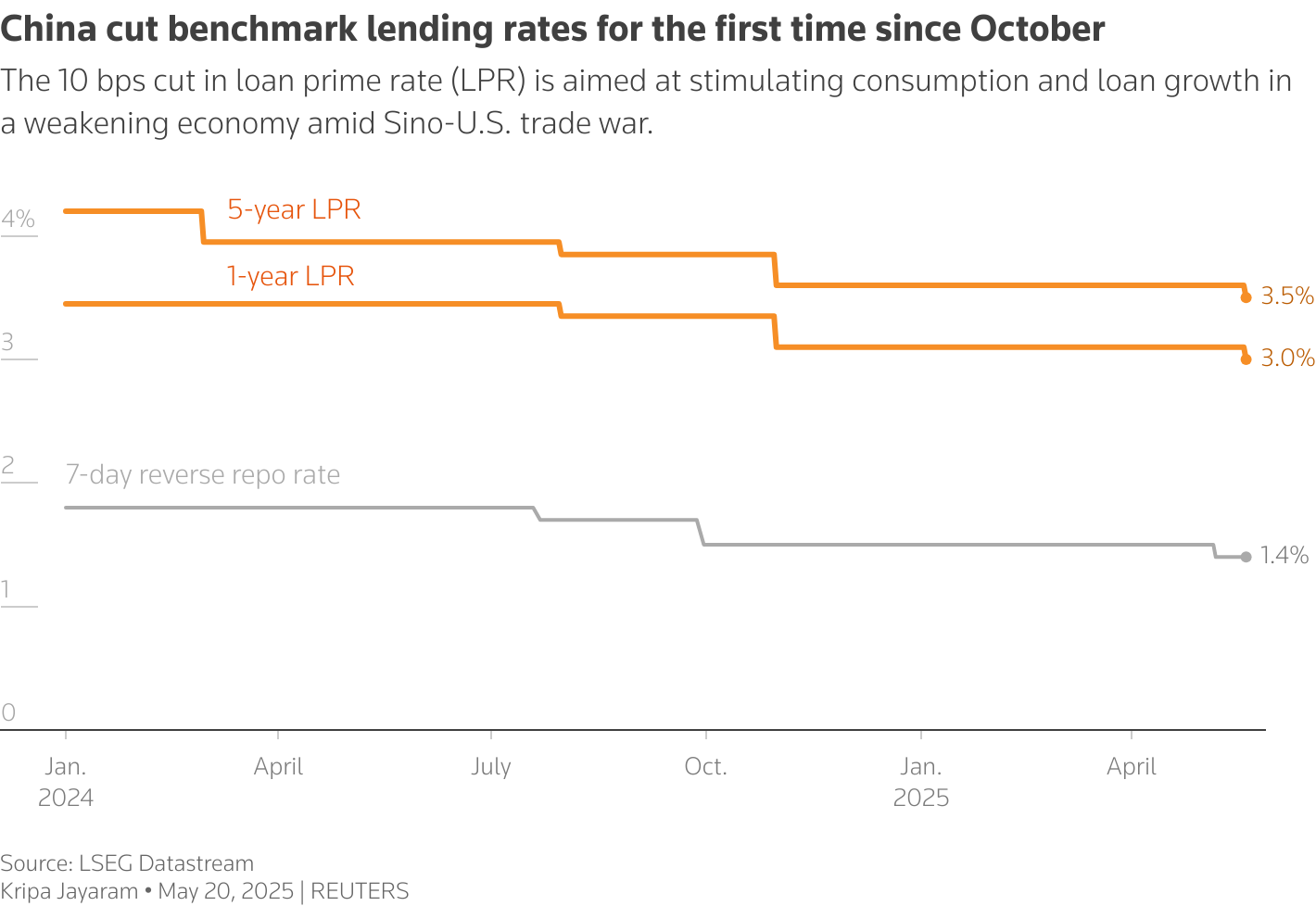

China’s central bank has lowered its benchmark lending rates for the first time since October 2024, signaling a cautious but deliberate move to stimulate economic growth in the face of ongoing deflationary pressure and trade uncertainty. The People’s Bank of China (PBOC) announced Tuesday that the one-year loan prime rate (LPR) was cut by 10 basis points to 3.0%, while the five-year LPR was trimmed to 3.5%. These are now the lowest levels since the LPR mechanism was revamped in 2019.

The reductions come as Chinese authorities seek to support slowing consumption, boost lending, and stabilize the housing market — all while safeguarding the profitability of commercial banks.

State Banks Follow Suit with Deposit Rate Cuts

Ahead of the PBOC’s announcement, five major state-owned banks, including Industrial and Commercial Bank of China and China Construction Bank, cut deposit rates by 5 to 25 basis points. These cuts, intended to protect banks’ net interest margins, set the stage for the LPR reductions and are expected to prompt similar moves by smaller lenders.

The coordinated easing reflects a broader package of stimulus measures introduced by Chinese financial regulators, including earlier reductions to banks’ reserve requirements and mortgage rates offered through government-backed housing funds.

Room for Further Easing, But Caution Remains

Analysts say the cuts were widely expected but modest in scope. Zichun Huang, chief economist at Capital Economics, forecast an additional 40 basis points in cuts by the end of the year, though he noted that monetary policy alone may not be enough to restore momentum. “The burden of supporting demand mostly rests with fiscal policy,” he said.

Trade tensions between the U.S. and China have eased following a surprise agreement in Geneva earlier this month, where both sides agreed to a 90-day rollback of punitive tariffs. This de-escalation has boosted market sentiment and provided Beijing with some space to maneuver on monetary policy.

Economic Outlook Improves, but Risks Remain

Despite ongoing structural issues — including a prolonged housing downturn and persistent deflation — global investment banks have raised their forecasts for China’s economic growth. Nomura now expects Q2 GDP to rise 4.8%, up from 3.7%, and has lifted its full-year outlook to 3.7%. However, it warned that meeting Beijing’s official growth target of “around 5%” will remain “challenging without a sizable stimulus package.”

Consumer prices have fallen for three consecutive months, and wholesale prices dropped at their steepest rate in six months in April, pointing to weak domestic demand. While the yuan has rebounded slightly, strengthening more than 2.8% against the dollar since its record low, economists expect Beijing’s additional stimulus efforts to be rolled out gradually.

With U.S. tariffs still elevated at an estimated 40% and China facing internal headwinds, the PBOC’s cautious rate cuts may only provide limited relief in the near term. Policymakers are signaling a preference for stability over aggressive intervention, especially as trade negotiations with the U.S. remain fluid. Still, these incremental steps underscore China’s efforts to navigate a fragile recovery without overcommitting its fiscal or monetary arsenal.