Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

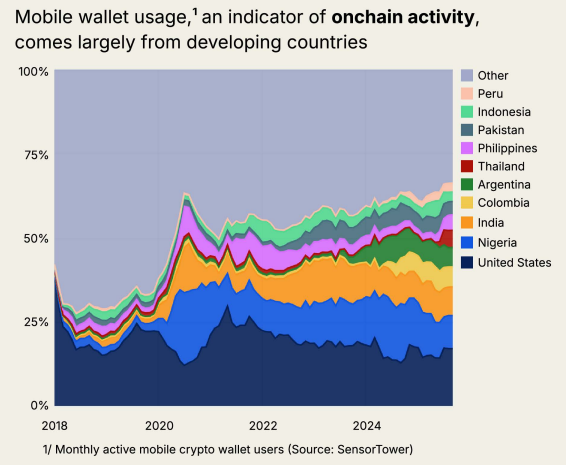

The bitcoin economy is going through a huge change toward emerging economies, where mobile wallets are more than simply tools for speculation; they are also lifelines for financial inclusion. The new “State of Crypto 2025” report from Andreessen Horowitz (a16z) says that several ASEAN countries are leading the way in using mobile crypto wallets. This is part of a larger trend of on-chain activity growing quickly in areas with a lot of smartphones but not a lot of access to traditional banks.

Indonesia, the Philippines, and Thailand are all among the top performers in the world. Indonesia ranks 11th in crypto website traffic (5.63% of the worldwide total) and has seen tremendous rise in wallet adoption since 2020. This “revolution from the developing world,” as a16z calls it, shows how platforms like Binance and local apps are closing the gap between fiat and crypto. They are responsible for $46 trillion in stablecoin volumes and are used for everything from sending money to making everyday payments. These countries show how blockchain is making banking more accessible to everyone, but problems like regulatory fragmentation and gaps in infrastructure might slow down the growth as the global crypto market cap passes $4 trillion for the first time.

ASEAN’s Wallet Wallet Boom in Indonesia The Region’s Leader

a16z’s in-depth study, which used on-chain data, app downloads, and traffic analytics, shows that ASEAN is a hotbed for mobile crypto activity, with more than 70% of transactions happening on smartphones. Indonesia is at the top of the regional charts, with 18 million monthly active wallet users, which is 6.5% of the population and ranks it among the top 15 countries in the world for adoption speed. Since 2023, cross-platform trades have grown three times as fast as before, thanks to platforms like Indodax and Tokocrypto. This is because users are using wallets to send money to each other as the value of the rupiah changes.

The Philippines is next, with 12 million active users (11% penetration). This is because remittances to the country are more than $36 billion a year, and stablecoins like USDT currently manage 15% of the flows, according to Chainalysis. Thailand, with 8.5 million users (12% adoption), benefits from Bitkub’s interface with LINE for easy payments. Vietnam, with 17 million holders (17% penetration), rounds out the group, thanks to the NDAChain trial channeling $100 billion in domestic volume. ASEAN as a whole is responsible for 15% of the world’s increase in mobile wallets. This is more than Latin America’s 12% but less than Sub-Saharan Africa’s 18%. This is because there are a lot of people who don’t have bank accounts (60% in the Philippines) and a lot of people who have (85% in Indonesia).

a16z says this is because of “practical utility over hype”: In Indonesia, 5.63% of all crypto site traffic is 20 visits per billion people. This is much lower than the U.S.’s 120 visits per billion people, but it shows that individuals are more interested in making transactions than doing research. The paper says that “emerging markets like Indonesia treat wallets as daily tools for value transfer, not just speculation.” It also says that $46 trillion in stablecoin volumes are the “backbone of on-chain economies.”

Emerging Markets Drive On-Chain Revolution

The main argument of the research is that there is a “revolution on-chain from the developing world,” where blockchain answers actual problems: Argentina’s 16-fold wallet growth during 200% inflation, Colombia’s efficient remittances, India’s UPI-crypto hybrids, and Nigeria’s 72.9% mobile tx share. ASEAN is a good example of this: Indonesia’s 20% year-over-year wallet growth is due to cross-platform compatibility, which lets consumers switch between Indodax and PancakeSwap for yields. The Philippines’ 11% penetration is similar to Kenya’s BitPesa (5.9 million users for bill payments).

716 million people around the world possess crypto, but only 40 to 70 million use it regularly. This is a 10 million increase from last year, and a16z calls it the “passive to active” gulf. Emerging economies fill it: With 72.9% of mobile transactions, Sub-Saharan Africa is in the forefront. Western Europe is in last place with 41.2% custodial wallets. Stablecoins are the basis for this: Adjusted volumes of $46 trillion (87% YoY growth) are on par with Visa and PayPal, with ASEAN contributing $7.5 trillion through low-fee cross-border transactions.

Different Patterns: New Activity vs. Established Observation

Emerging markets are very active in trade, whereas developed markets watch: The U.S., UK, South Korea, and Germany get the most traffic to crypto sites (CoinGecko/CoinMarketCap), with the U.S. getting 120 visits per billion people. According to a16z’s way of combining app data and on-chain transactions, Indonesia is in 11th place (5.63% share, 20 visits per billion). This is because consumers trade more than they explore.

This difference shows that things are getting more mature: Emerging users use wallets to stay alive (for example, the Philippines sends $36 billion in remittances, 15% of which are in USDT), while developed users utilize ETFs to speculate ($175 billion in BTC/ETH). “Polarization risks silos; interoperability is key,” says a16z.

The Growth of Stablecoins, AI, and Infrastructure in the Global Crypto Market

With a market valuation of $4 trillion, $175 billion in BTC/ETH ETFs, and fintechs like Circle (which is going public) and Stripe developing chains for payments and RWAs, the research calls 2025 “the year of institutional adoption.” Stablecoins have $46 trillion in circulation and $150 billion in Treasuries, which is greater than many countries. AI-blockchain fusion has 420,000 models on-chain, from DeSci to predictive analytics.

Infrastructure is great: The Arbitrum/Hyperliquid mechanism moves billions of dollars across chains at 3,400 TPS, which is close to TradFi speeds. Developer activity is good for Ethereum L2s (+78% on Solana), as 716 million owners look for ways to use it.

What does ASEAN do? Indonesia’s 1,421 legal assets and Vietnam’s NDAChain pilot are examples of regulated growth that might add $1 trillion to the global TVL by 2030.

Conclusion

“State of Crypto 2025” by a16z shows ASEAN’s blockchain leaders: Indonesia (11th in traffic, 18 million wallets), the Philippines (12 million users, a remittance powerhouse), and Thailand and Vietnam as utility hubs are driving $46 trillion in stablecoin tides and $4 trillion in market values. Emerging markets’ +20% growth is different from what developed markets see, which points to a revolution driven by utility, but there are still gaps in interoperability. With $175 billion in ETFs and 420,000 AI models on-chain, 2025 will be a big year for crypto. For ASEAN, it’s a $1 trillion chance if the rules are right. “From passive to active—welcome to the on-chain economy,” says a16z.