In the crypto market there is a term that is very favored by investors or traders, the term is Altcoin Season. The term is highly anticipated in the crypto world because almost everyone in the market will benefit greatly from it.

Altcoin itself is a term that refers to other cryptos besides Bitcoin with different technology, purpose of use, consensus mechanism, and other characteristics from Bitcoin. To better understand what is meant by Alt Season, the factors that affect it, and how to recognize it, let’s see the full explanation below.

[su_box title=”Key Takeaways” box_color=”#000877″ title_color=”#ffffff” radius=”6″]

- 📊 Alt Season refers to a period when altcoins outperform Bitcoin, offering significant profit opportunities for investors.

- 📉 One major indicator of Alt Season is the decline in Bitcoin dominance, where its market share drops below 50%, signaling that altcoins are gaining momentum.

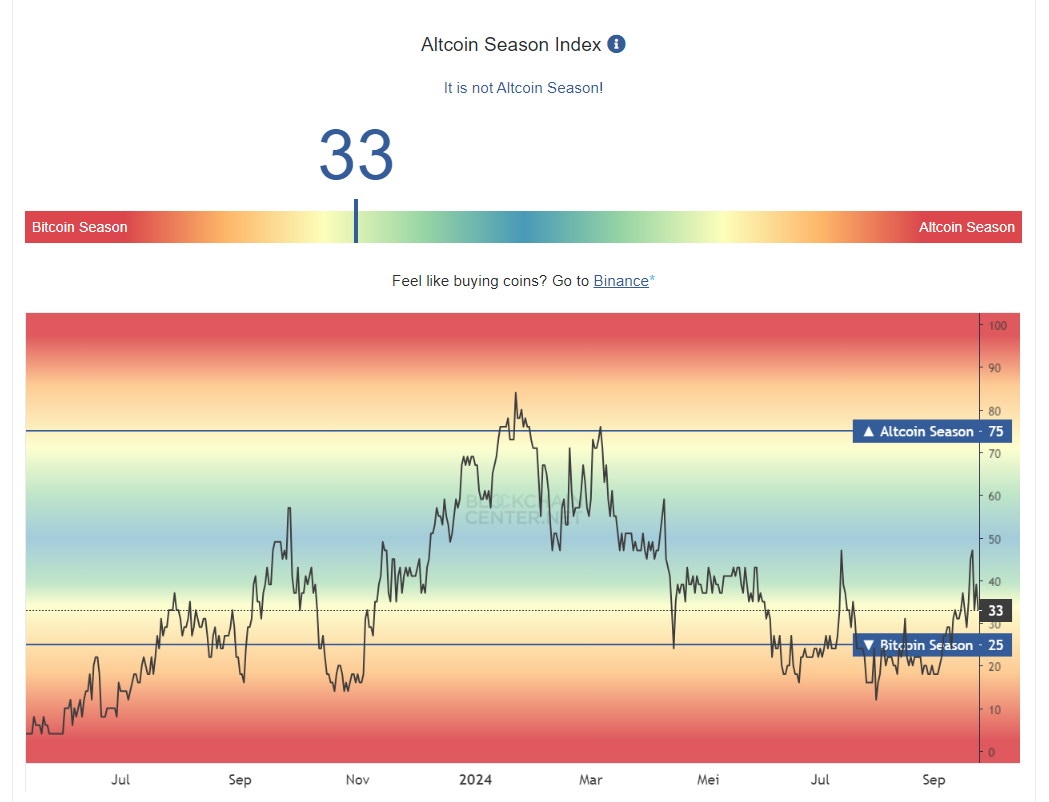

- 📈 The Altcoin Season Index helps track when more than 75% of the top 50 altcoins outperform Bitcoin over a 90-day period, marking the start of Alt Season.

- 🔄 Watching the ETH/BTC pair can also provide clues—when Ethereum outperforms Bitcoin, it often indicates that smaller altcoins are ready to follow.

[/su_box]

What is Alt Season?

The altcoin period or what is often referred to as the “altcoin season” refers to a phase where cryptocurrencies other than Bitcoin experience a substantial surge in value, even surpassing the performance of Bitcoin (BTC) itself. As the pioneer and market leader in terms of capitalization, Bitcoin has long dominated the crypto trading landscape.

A key indicator that analysts often use to gauge market dynamics is the comparison between the value of Bitcoin and alternative coins, known as “Bitcoin dominance”.

In the early stages of the digital currency revolution, Bitcoin practically ruled the entire market with close to 100% dominance. However, over time and as the crypto ecosystem became more diverse, this share of dominance began to erode.

Nowadays, when the total market capitalization of various altcoins begins to approach or even surpass Bitcoin’s, many observers consider this to signal the beginning of a new altcoin season.

Why does this cycle matter?

Knowing the seasonality of the crypto market can open up various profit opportunities for you, even if you are not so good at analyzing so deeply, by understanding the cycle or seasonality of the crypto market you can already get a very decent profit.

In this cycle you can accumulate altcoins at low prices and then sell them after they rise high 1-3 times the initial price.

For example, when Bitcoin season occurs, generally the market will only appreciate Bitcoin if there is positive sentiment that occurs, while other altcoins only follow the movement of Bitcoin itself. If Bitcoin goes up 5% then altcoins can go up that far or even more, conversely if Bitcoin goes down 5% then all altcoins will go down as much as Bitcoin goes down and even more than that.

That’s why there are usually only two options this season, accumulate Bitcoin and wait for the altcoin season to occur so that risk and profit can remain optimal or the second option where to choose an altcoin that may be down and HOLD until the altcoin season occurs later.

How Do We Know When the Altcoin Season is Coming?

The altcoin season was a period when more investment flowed into altcoins than Bitcoin because of that the altcoin season usually occurs when Bitcoin dominance starts to weaken. One example occurs when Bitcoin dominance is around 50%.

During this phase, many investors start selling their Bitcoin holdings, converting them to fiat or stablecoins such as USDT or USDC, to invest in altcoins. This shift led to a significant increase in altcoin market capitalization, marking the start of the altcoin season.

However, it can be difficult to know all of these processes for sure, so there are some indicators that you can use to spot the signs of altcoin season :

1. Altcoin Season Index

In a move to provide investors with deeper insights into cryptocurrency market dynamics, Blockchain Center has introduced the Altcoin Seasons Index. The index’s methodology is straightforward yet powerful. It analyzes the price performance of the top 50 altcoins by market capitalization, comparing them against Bitcoin over a 90-day period. When more than 75% of these altcoins outperform Bitcoin within this timeframe, the index signals the onset of an “alt season.”

At the time of writing this article (24/04/2024), the Index shows 33 which indicates that we have not entered the Altcoin Season. There are only 15 Altcoins that outperform Bitcoin’s performance from the top 50 Altcoins on the market.

2. Bitcoin’s dominance drops

Bitcoin dominance, expressed as a percentage, offers valuable insights into the relative performance of Bitcoin versus altcoins. A decline in this metric typically signals that Bitcoin is underperforming compared to its smaller counterparts. However, experts caution that this decline can stem from two distinct scenarios.

In the first scenario, altcoins experience significant price surges while Bitcoin’s performance remains relatively stable.

The second scenario involves both Bitcoin and altcoins declining in value, but with Bitcoin’s drop being more pronounced, thus reducing its overall market share.

For those anticipating an “alt season” – a period of altcoin outperformance – the first scenario is particularly noteworthy. A decrease in Bitcoin dominance driven by rising altcoin prices is often viewed as a harbinger of an impending alt season.

At the time of writing, BTC Dominance is still at around 57.5%. We hope that it will eventually fall closer to 50% followed by an increase in the Altcoin marketcap.

3. Reversal On Pair ETH/BTC

When Ethereum’s price goes up more than Bitcoin’s, it might mean that altcoins are about to have a good time. This is because Ethereum is the biggest altcoin out there.

Usually, when Ethereum’s price goes up, other smaller coins follow. This often happens when Bitcoin becomes less dominant in the market. You can see this happening by looking at TOTAL3 on TradingView.

Conclusion

Altcoin season is a highly anticipated time for all types of investors in the crypto market; the profits that can be gained can be extraordinary if one can make the most of the momentum. However, looking at various indicators, it seems that we are not yet in the altcoin season. However, this could actually be an opportunity to buy various altcoins with strong fundamentals at low prices.