The year 2023 witnessed the L2 “war,” during which liquidity was split and various L2 solutions battled to win over users and dominate the market. So, how will this competition continue in 2025?

- The Beginning of the War and the Consolidation that is Starting to Show

- Strategy Similarities and Differences: Optimism and Arbitrum

- Other Names that Enliven Ethereum’s L2 Competition

- Security and Decentralization: Native Rollup vs Based Rollup

- High Performance at a Cost? Speed-Focused L2

- EVM-based L2s that Prioritize Speed:

- L2 Based on SVM (Solana Virtual Machine):

- Other L2s and a Dynamic Future

[su_box title=”Key Takeaways” box_color=”#000877″ title_color=”#ffffff” radius=”6″]

- 🥇 The Layer 2 wars on Ethereum have led to consolidation. Base and Arbitrum currently dominate, but intense competition continues with many other L2s offering innovations.

- 🛡️ There is a debate between Native Rollup, which prioritizes decentralization and security, and Based Rollup or high-speed L2, which sometimes sacrifices decentralization.

- 🔮 The L2 landscape continues to evolve rapidly. New technologies, such as SVM on Ethereum, the concept of sharding, and various other approaches, will make the competition more complex and interesting in 2025.

[/su_box]

The Beginning of the War and the Consolidation that is Starting to Show

In the beginning, many L2s emerged with a passion for helping scale Ethereum and making transactions cheaper and faster. However, over time, the limited number of users and liquidity became obstacles. A split was inevitable. Entering 2024, the competitive map is becoming increasingly obvious. Even the Arbitrum team, one of the main players in the L2 arena, did not hesitate to declare, “It’s war time!”

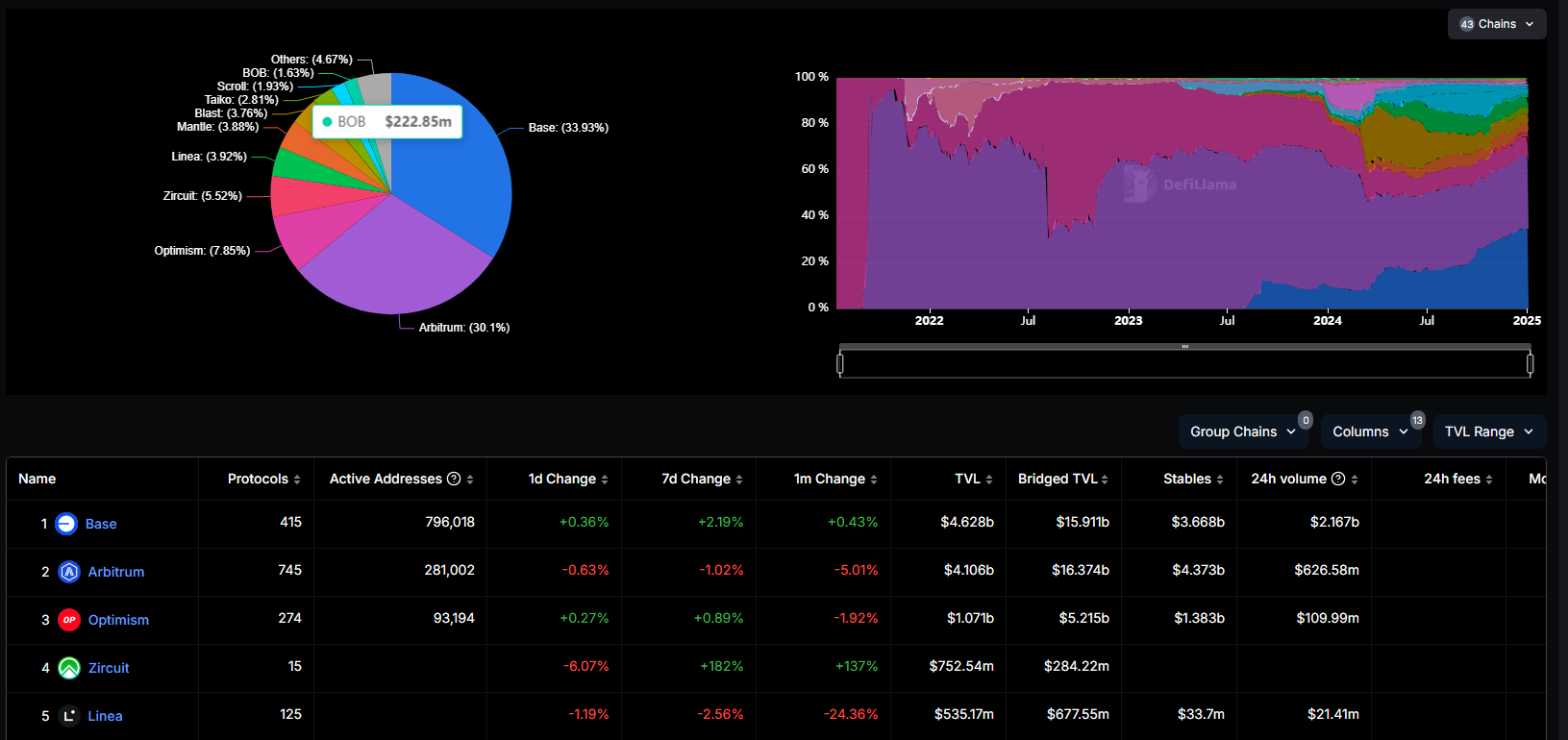

The facts on the ground show that consolidation is starting to happen. Data from DefiLlama shows that some big names are starting to show their fangs. Most activity is now centered on Base and Arbitrum, two L2s that are getting stronger, especially after the implementation of EIP-4844, which brings fresh air to Ethereum’s scalability.

Strategy Similarities and Differences: Optimism and Arbitrum

Although both are at the forefront of EVM (Ethereum Virtual Machine) based L2 solutions, Optimism and Arbitrage have different strategies for navigating the competition.

Optimism chose the adoption path through business relationships with its OP Stack. As a result, many large L2s were built using this technology, including Base, Blast, Worldcoin, Mode, and Zora, as well as upcoming ones such as Ink from Kraken and Unit Chain from Uniswap Labs. Notably, more than 60 L2s have adopted the OP Stack.

Meanwhile, Arbitrum focuses more on targeting specific applications, especially in the gaming and Real-World Assets (RWA) sectors. Some examples are Ape Chain, Xai, Kinto, and other L2s designed to accommodate the specific needs of these industries. However, this strategy makes the adoption of Arbitrum less widespread than that of the more general-purpose Optimism.

Another notable difference is the greater activity on Arbitrum’s L2 compared to OP Mainnet. Activity in OP Mainnet has decreased significantly, especially after Base became the new favorite. This can be seen from the comparison between the Velodrome (in OP Mainnet) and the Aerodrome (a fork of the Velodrome in Base). Despite coming from the same team, Aerodrome has a much higher market cap, reaching billions of dollars, while Velodrome has only hundreds of millions of dollars.

Other Names that Enliven Ethereum’s L2 Competition

Apart from Optimism and Arbitrum, several other names have enlivened the competition in the Ethereum L2 ecosystem:

- Starknet: Starknet had a difficult time in its early days and was even nicknamed “Stucknet” due to slow transactions and technical issues. However, Starknet has now improved. Their UX (User Experience) has improved dramatically, with every account now defaulting to a contract, allowing users to perform various actions such as approve, swap, deposit, and stake in just one transaction. The Argent wallet also contributes to this UX improvement by providing more user-friendly features, such as two-factor authentication (2FA) via email. Not only that, Starknet has also shown ambition to compete in the L2 Bitcoin ecosystem by engaging in in-depth discussions about OP Stack.

- Polygon: Polygon is focused on developing AggLayer (Aggregation Layer), a solution designed to address the issue of fragmented liquidity across multiple L2s. With AggLayer, each L2 can be interconnected under a single standard, thus facilitating interoperability between blockchains.

- zkSync: zkSync offers a solution called Elastic Chain. There was a debate on Twitter regarding the originality of this technology, which added spice to the competition among L2 developers.

- Scroll: As one of the ZK Rollups, Scroll may take longer to reach mass adoption as the technology is relatively new and needs refinement.

Security and Decentralization: Native Rollup vs Based Rollup

In the world of rollups, the security of user funds is paramount. Unlike Ethereum’s proven L1, we must be more cautious in choosing L2. L2Beat provides a risk analysis for each L2, which can be considered.

In addition, Martin Köppelmann, founder of Gnosis, proposed a new concept: Native Rollup. Native Rollup is an L2 built directly on Ethereum and managed directly by the Ethereum protocol, not by a specific L2 company or entity such as Offchain Labs on Arbitrum.

Native Rollup implements a system with as much client software as Ethereum and a rigorously tested codebase. Transaction validation is done at the opcode level, not solidity, and execution is done off-chain using ZK Proof to guarantee full compatibility with EVM. Ethereum’s L1 will directly coordinate this rollup. Martin proposes 128 native rollups that can run in parallel and interconnect to L1 Ethereum.

On the other hand, there are also based rollups, such as Taiko and Spire. While this adds to the transaction cost burden of using L1 resources, Based Rollups are considered more Ethereum-aligned and not “parasitic” in that they take advantage without contributing back to the L1.

Taiko currently has a TVL of 383 million dollars, driven by the popularity of its lending apps, such as Avalon and Takotako. Meanwhile, Spire is an ecosystem-based rollup that secured 7 million dollars in funding and was founded by Mttim, a 17-—to 18-year-old developer. For its sequencer, Spire integrates with ROME, a Solana-based protocol.

It is important to note that both native rollup and based rollup have their own advantages and disadvantages. Based rollup may be better for supporting L1 economy, but native rollup offers a higher degree of decentralization. The balance between the two needs to be continually sought and evaluated.

High Performance at a Cost? Speed-Focused L2

The Solana phenomenon taught us that users like fast transaction experiences, concentrated liquidity, and high application performance. Several L2s have emerged that focus primarily on speed, albeit at the expense of some aspects, including decentralization.

EVM-based L2s that Prioritize Speed:

- Uni Chain: Launched by Uniswap Labs, Uni Chain is different from Uniswap’s DEX products. It is general-purpose but provides a unique feature: applications can pocket their own MEV (Miner Extractable Value).

- Monad: Claiming to be the “fastest EVM”, Monad uses high-spec hardware, is centralized, and relies on the EigenLayer data layer (EigenDA). Its data structure differs from Ethereum, so it is not 100% compatible. Monad is not a direct competitor to Solana, Sui, or Monad (L1), but rather competes with other L2s that also prioritize speed.

- Itheum: This incubation project from Paradigm is led by Paradigm’s CTO and built using the Rust programming language. Itheum is targeting to achieve speeds of 1 GB of gas per second, well above current EVM blockchains.

. - Nil: Nil is similar in concept to Ethereum’s past sharding designs. Nil breaks the validator into multiple subcommittees that run consensus and execution locally, and uses ZK Proof to combine the shards.

L2 Based on SVM (Solana Virtual Machine):

- Eclipse Brings SVM to Ethereum’s L2 ecosystem by using ETH tokens as gas and Celestia for the data layer. However, given the greater access to liquidity in L1 Solana, Eclipse faces challenges in convincing developers to build applications on top of SVM-based L2.

- Atlas: Created by Ellipsis Labs (who also created Phoenix, Solana’s limit order book ), Atlas is an L2 SVM built on Ethereum. Its uses are more specific, such as for order books, high-frequency trading, or margin systems.

- Soon: Developed by former Optimism engineers, Soon is similar to an SVM version of OP Stack. Its mainnet will be launched on top of Ethereum but can also be used on any L1 blockchain.

Other L2s and a Dynamic Future

In addition to the names already mentioned, there are many other L2s worth noting, such as:

- Movement: A move virtual machine-based L2 ecosystem that just launched its token with FDV reaching 8 billion dollars.

- Fuel: Experienced delays due to internal issues, but its mainnet finally went live on October 16, 2023.

- Fluent: Mixes various execution environments (EVM, SVM, Wasm) in one virtual machine.

- Rogue: A project from Lambda Class that carries the zk-rollup concept with a fair launch.

Competition in the Ethereum L2 space is getting more complex and dynamic. Various strategies and technologies are being promoted to attract users and developers. The year 2025 will be a decisive year to see which L2 will dominate and how the blockchain landscape will continue to evolve. Don’t forget to subscribe and keep following the latest updates from RR to get the latest information about the development of blockchain technology