If you’re a business owner, then you’re probably already thinking about ways to reduce your company income tax in Malaysia.

Although the tax system exists to give back to our country, it can feel like a pinch to pay a lot of taxes from your business. Without proper planning, you might also overpay these taxes unnecessarily.

Fret not, there are actually many ways (legal of course!) to maximize your tax savings so that you dont have to pay huge sums of tax.

In this article, we have highlighted several easy and straightforward methods you can use as a business owner, irrespective of the size of your business, to save on your company income tax in Malaysia.

By recognizing these methods, you can take better control of planning your business taxes and significantly maximize tax savings for your company!

Understanding Company Income Tax in Malaysia

Before we jump into the many ways you can reduce company income tax in Malaysia, let’s understand first, what does the company income tax structure for businesses look like in Malaysia.

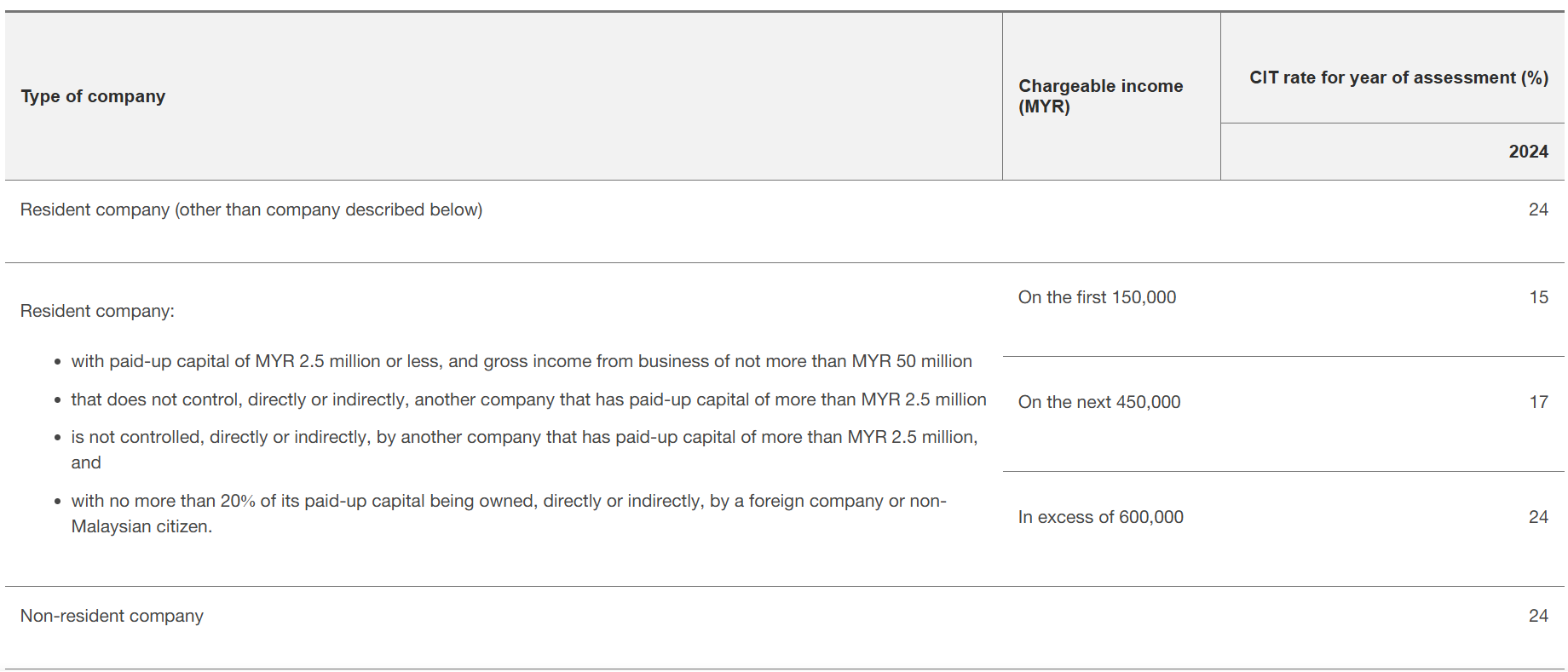

In Malaysia, any income that your company generates is taxed. According to the LHDN, most companies are charged a standard 24% of tax rate. Some SMEs do get a preferential rate of 17% depending if they qualify for it.

Take a look at the table below to determine what is the company income tax in Malaysia that will be charged on your organization :

Now that you can determine how much taxes are chargeable to your company, let’s look at a few ways you can reduce company income tax in Malaysia.

4 Ways to Reduce Company Income Tax in Malaysia

The most important thing to remember when wanting to reduce your company income tax is to make sure that you are using legal means! All of the methods below are totally legal and serve to help businesses in Malaysia reduce their company income tax.

1. Register for the right business entity

Every business entity in Malaysia is subject to different tax brackets. Look at the table below to determine how much tax each business entity pays.

Now that you know exactly how much you need to pay, when registering your business entity, make sure to pick the most appropriate structure to enjoy the tax advantages you might gain.

| Sole Proprietorship | Business income is similar to own income so owner pays individual income tax |

|---|---|

| Partnerships | Since profit and losses are shared between partners, they need to pay individual income tax based on their incomes. If their income exceeds RM2 Million, a maximum of 30% rate is chargeable |

| Companies | Companies will pay up to 24% but certain requirements for SMEs can reduce this rate. |

2. Utilize tax exemptions or deductions for company in Malaysia

The good news is, businesses in Malaysia are also eligible for various company tax relief.

For businesses, you can always claim expenses incurred to run your business to generate income. For example :

- Wages, salaries, benefits & training expenses : This is a key deductible as all payments to employees whether full-time or part-time is tax deductible.

- Operating costs : Office space rental, supplies and other operating costs are also eligible to be tax deductible.

- Marketing or Advertising Expenses: Any costs related to advertising and marketing your products or brand, online or offline, can be considered a business expense and therefore is tax deductible.

- Entertainment expense : Client meetings, team building activities are some of the entertainment expenses that can be claimable.

For a more exhaustive list of expenses that can be claimed, look at LHDN’s information here.

3. Take advantage of available tax incentives

Company tax relieves are not the only way to reduce company income tax in Malaysia. There are many incentives that are provided by the government that can be taken advantage of.

One such example is pioneer status for companies. According to LHDN, pioneer status is granted to companies which are in the manufacturing, agricultural, hotel, tourism, research and development; as well as technical or vocational training. It also includes certain commercial sectors connected to manufacturing.

If your company is eligible for pioneer status, then you can enjoy a total or partial exemption from income tax for a period of five years.

Another incentive that is extended to companies is known as the Investment Tax Allowance (ITA). ITA allows for reduction of tax through deductions on capital expenditures for up to 60%. For example, the purchase of new equipment, machines or investment into new technology will all be eligible for tax claims under this scheme.

4. Charitable work through your company

You may already know that your act of kindness is tax deductible on an individual level. But did you know that businesses can also deduct charitable donations to reduce company income tax in Malaysia?

Yes, you can! You do need to make sure that the charitable organization is registered with the appropriate government bodies. You can also only claim up to 10% of your gross income.

As long as the charitable work is in the form of monetary or gifts in kind, you can use these to reduce your company taxes.

Conclusion

If you have gone through this article, you will quickly realise that reducing your company income tax in Malaysia is not very complicated.

All you have to do is to register for the right business entity, look at the exemptions available to companies in Malaysia and also take advantage of the tax incentives that already exists! You can also make some charitable contributions to further reduce your tax expenses.

But the key takeaway here is to plan and strategize these methods to reduce your tax in advance so that you can prevent paying unnecessary taxes or make the most of company tax relief which are available.

Now that you know what exactly to do from this article, we hope that you can easily implement this in your company. However, if it is complicated, we urge you to seek out licensed tax advisors who can help you through this process.