Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

In the fast-changing world of cryptocurrencies, market cycles have always had a set pattern: Bitcoin is the leader, attracting money and reaching new highs. Then, when liquidity spills over into altcoins, the community calls it “altseason.” This has happened before during bull runs, like the 2017 ICO craze and the 2021 DeFi and NFT bubble. But as we near the end of 2025, something seems wrong.

Bitcoin has taken over the story, rising more than 120% this year to approximately $120,000. On the other hand, altcoins—cryptocurrencies other than BTC and ETH—have mostly done poorly, with several losing double digits every month.

Every trader is asking the same thing: Why does this cycle seem so focused on Bitcoin? Is 2026 finally the year when altcoins will get the attention they deserve?

This “Bitcoin season” isn’t a one-time thing; it’s a structural change brought about by institutional acceptance, clearer regulations, and macroeconomic drivers that put safety and liquidity ahead of risky investments.

This essay looks at why 2025 has gone against the trend, what makes it different from previous cycles, and whether 2026 could see a resurrection of altcoins. It uses information from companies like Chainalysis and a16z and thoughts from BitMEX co-founder Arthur Hayes.

If you know how the ups and downs of crypto work, knowing these things could mean the difference between surfing the wave and getting left behind.

A Quick Look Back: The Parts of Past Cycles

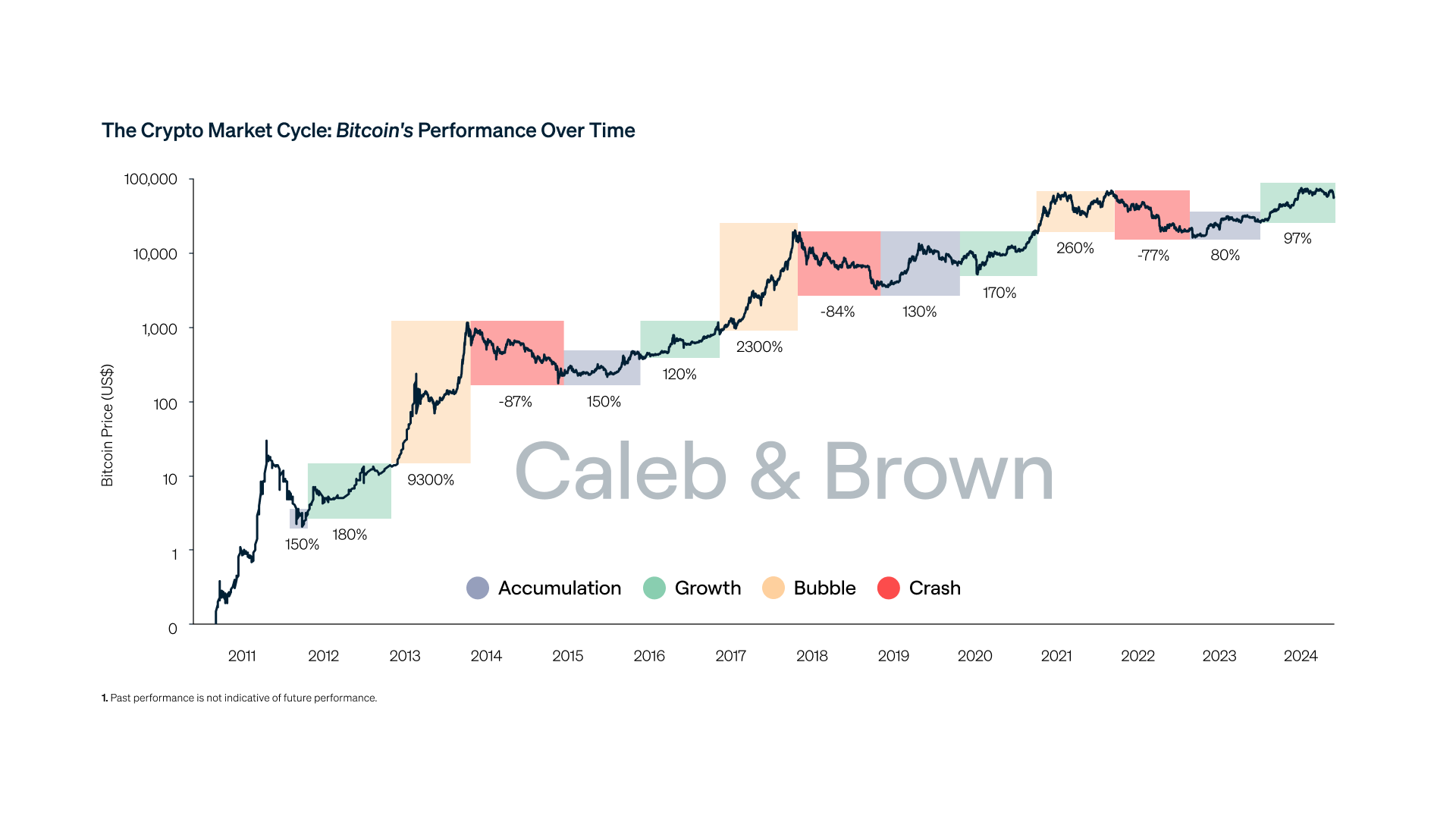

To understand why this cycle is different, we need to look back at history. Crypto markets go through four-year halving cycles because Bitcoin’s supply drops, which has historically led to bull runs.

Cycle from 2013 to 2017: Bitcoin started off with a 5,800% rise in 2013, but altcoins took over in 2017.

Ethereum’s ICO bubble and tokens like Ripple (XRP) made 100 times their original value because regular investors were afraid of missing out. In 2013, BTC was in charge of 95% of the market. By 2018, it had dropped to 35%, starting altseason.

Cycle from 2017 to 2021: BTC led again, rising 20 times from its lows in 2018, but altcoins went crazy in 2021. DeFi on Ethereum (like Uniswap and Aave) and NFTs (like CryptoPunks and Bored Apes) made billionaires, while SOL went up 11,000%. Dominance dropped from 70% to 40% as retail investors flocked to easy-to-use programs like Robinhood.

These times had some things in common: speculation fueled by retail, low obstacles to entry, and lots of cash available because of loose monetary policy. When BTC went up for the first time, altseasons usually came next as profits moved into riskier assets in search of larger multiples.

Why This Cycle Seems to Favor Bitcoin

The story has changed by 2025. According to CoinMarketCap statistics from November 2025, Bitcoin’s dominance has stabilized at 59–60%. This is down from a peak of 61.4%, but it is still much higher than the 40–50% lows of previous altseasons.

The TOTAL2 index (total market cap excluding BTC) shows that altcoins have been lagging behind. Many mid-caps are down 50–70% from their September highs because of $19 billion in liquidations in October.

There are a few reasons for this “Bitcoin season”:

- Institutional Leadership Over Retail Frenzy

In 2025, institutions led the way instead of retail FOMO, which had happened in earlier cycles. BlackRock and Fidelity’s Bitcoin ETFs raised $175 billion in assets under management (AUM), attracting pension funds and companies who see BTC as a store of wealth. According to Galaxy Research, institutions put 90% of their money into BTC and ETH because they see altcoins as risky ventures. Arthur Hayes said in a podcast in December 2025 that “this cycle is different because big money sticks to Bitcoin—altseason happens, but only in certain places.”

- Macro Environment

The Federal Reserve’s quantitative tightening (QT) since 2022 has made it harder to get money, unlike the QE-fueled booms of 2017 and 2021. With rates between 3.75% and 4% and deficits rising to $1.8 trillion, capital is moving away from altcoins and toward safe havens like BTC (up 120% YTD). Shutdown delays in data like NFPs made things even more murky, but BTC’s story about how rare it is grew as fears of debasement grew.

- Regulatory Clarity Favoring BTC

The GENIUS Act (July 2025) made things clearer for stablecoins and ETFs, but altcoins are still under examination because the SEC is calling many of them securities. BTC is “safe” since it is a commodity that the CFTC watches over. Altcoins like SOL, on the other hand, are trying to get ETF authorization. According to TradingView data, BTC.D was at 59.03% in November, which is a little lower than it was before but still strong.

- Too many altcoins But little Added value

With low-barrier solutions like Pump, thousands of tokens have been launched.Fun, the quantity of altcoins has grown a lot, which has made them less valuable. Hayes says, “Altseason never left; you just held the wrong assets.” Hyperliquid (up 2,000% from $3 to $60) and Solana (up from $7 to $300 after the 2022 fall) are examples of selective rallies, but a broad altseason is still to come.

- No new money coming in from stores

Chainalysis says there are 716 million crypto owners around the world, but only 40 to 70 million of them are active users. Retail hasn’t come back yet. Institutions push BTC up to $118,000, while altcoins stay the same because they don’t get any new money. The 2025 research from a16z says that emerging economies like Indonesia (with 18 million wallets) are leading the way in mobile adoption, although speculation favors BTC in times of uncertainty.

These things give off a “Bitcoin season” vibe: Dominance peaks stop alt rotations because money flows into “blue-chip” crypto.

Altseason Is Always On—If You Pick Right

Arthur Hayes, one of the founders of BitMEX, has a different opinion: “Altseason never ended—traders just missed it by holding outdated bags.” In an interview in December 2025, Hayes said that markets reward new ideas, not old ones. He said, “If you’re waiting for 2017 alts to pump, you’re wrong—this cycle’s winners are new, like Hyperliquid or Solana’s revival.”

Hayes says that “altseason” is not a single event, but “always happening somewhere.” His point is that liquidity doesn’t flow to all projects, but only to those that have a strong belief in them.

This is backed up by data that TOTAL2 dropped 8% on October, while specialized alts like ICP (up 50% monthly) and UNI (DeFi rebirth) did better. Hayes says, “Don’t look for things that make you feel nostalgic; look for things that are new.”

Is 2026 the Year for Altcoin Spotlight?

More and more, predictions say that 2026 will be altseason’s year. In the second year of halving cycles (like 2017 and 2021), altcoins tend to go up. Multicoin says that if BTC’s share drops to 50%, it might open the door to $500 billion in alt inflows.

Main drivers:

Change in Fed policy: QT ends in 2025, and QE might start up again by the middle of 2026, flooding the market with money and pushing rates to 3.5%, which would help risk assets. JPMorgan says that by the end of 2025, BTC will be worth $165,000 and then it will start to go down.

- Regulatory Clarity: The Clarity Act could pass in early 2026 and allow alt ETFs (like SOL), just like BTC’s rise in 2024.

- Institutional Rotation: As BTC yields go down (volatility at 30%), investors like BlackRock move to ETH/alt yields (5–10% in DeFi).

- a16z reports on the Emerging Market Boom ASEAN countries like Indonesia (18 million wallets) are pushing growth on-chain, and stablecoins with $46 trillion in volumes could leak over to altcoins.

- Tech Upgrades: Ethereum’s Fusaka (December 2025) raises L2 TPS to 100,000, which lets alt DeFi grow quickly.

Hayes, on the other hand, says, “Cycles don’t repeat exactly—2026 alts will be different from 2021.” Pay attention to AI tokens, RWAs (which will be worth $2 trillion by 2028, according to Standard Chartered), and DeSci.

Conclusion

This cycle’s “Bitcoin season” is different from earlier booms that were driven by retail because of institutional dominance, low liquidity, and regulatory concentration on BTC. Hayes’ thought: Altseason is still going on in some places, and clinging onto the wrong things might lead to missed chances. 2026 looks good with the Fed easing, new rules, and new technology. If dominance declines, there might be $500 billion in altcoin inflows. For traders, change: Look for new ideas, not old ones. As bitcoin grows to $10 trillion by 2030, the attention on 2026 could change the way altcoins earn value.