Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

As we get closer to the Federal Open Market Committee (FOMC) meeting on September 16–17, 2025, global markets are getting ready for a lot of data.

Changes in interest rates by the U.S. Federal Reserve, based on new economic data and official remarks, will affect risk assets like Bitcoin and the larger cryptocurrency market.

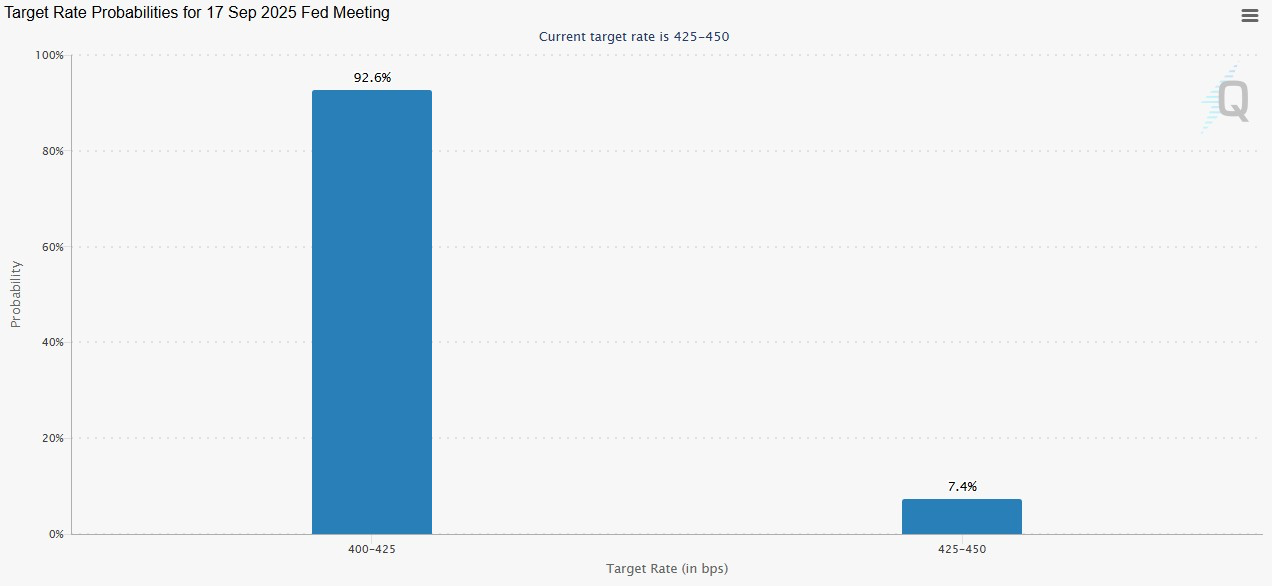

The CME FedWatch Tool gives a 92.6% chance that the market will cut rates by 25 basis points (bps) as of August 15, 2025. Whether crypto markets go up or down will depend on how key economic indicators, Federal Reserve Chair Jerome Powell’s comments, and labor market data interact.

Data Releases Before the FOMC Set the Stage

There are a lot of important economic reports coming out before the FOMC meeting that will affect how people feel about the market.

The University of Michigan’s Consumer Sentiment Index will be the most important thing on August 15, 2025. The figure of 61.7 in July, which was up slightly from 60.7 in June, shows that U.S. consumers are cautiously hopeful.

This index is like an economic barometer: if people feel good about the economy, it could mean that rate cuts are less likely, but if people feel bad about the economy, it could mean that monetary easing is more likely.

A worse rating for crypto might make people more hopeful about a dovish Fed, which would push money toward riskier assets like Ethereum and Solana, which have recently gone up by 27% and 12% in a week, respectively.

The release of the FOMC minutes from the July 2025 meeting in September provide us a look at how the Fed works behind the scenes. These minutes show whether policymakers are hawkish (favoring tighter policy to keep inflation in check) or dovish (favoring growth through rate decreases).

If someone makes a hawkish comment, U.S. Treasury yields could go up, which would make the dollar stronger and put pressure on crypto prices.

On the other hand, dovish signals could start a risk-on rally, like when Bitcoin rose 60% after rate cut announcements in the past. Indonesia’s crypto market will be affected, however local laws prevent direct exposure to changes in U.S. policy.

On August 21, the next day, there will be weekly unemployment claims and S&P Global PMI data. An increase in claims, which might mean a weaker job market, or a PMI below 50, which could mean a shrinking economy, could raise expectations for a rate drop in September.

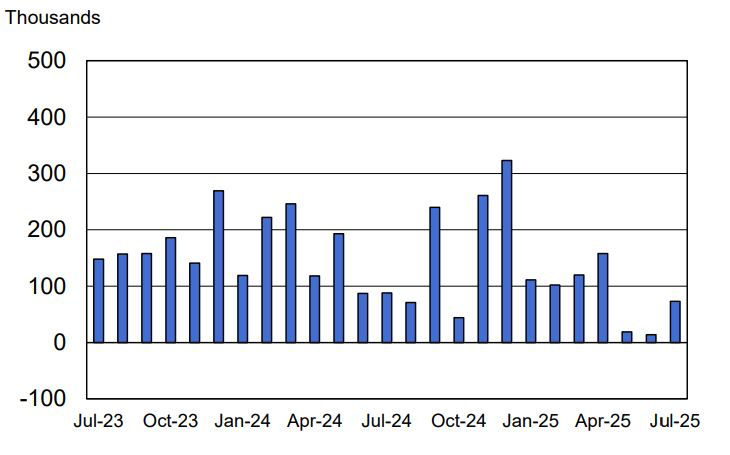

For example, if the non-farm payroll additions in July were the same as they were in July, when they were the lowest in 2025, the Fed might be more likely to ease, which would be good for crypto.

Jackson Hole: Powell’s Tone Moves the Market

The Jackson Hole Economic Policy Symposium on August 22, 2025, will be a very important event. Its theme is “Labor Markets in Transition.” The Kansas City Fed hosts this yearly event, which is a chance for Fed Chair Jerome Powell to give hints about the path of monetary policy.

The Producer Price Index (PPI) for July went up 0.9% from June and 3.3% from July of last year, which was more than what the market expected. This means that the chances of a 50-bps rate drop have gone down, and the market now favors a 25-bps decrease. People will look closely at Powell’s speech to see if he puts more emphasis on controlling inflation or helping the job situation.

A hawkish tone that stresses the risks of prolonged inflation might raise Treasury yields and the U.S. currency, putting pressure on risk assets like Bitcoin, which traded at $119,500 with fewer than 1% daily gains on August 13.

On the other hand, dovish comments that show a commitment to easing could cause a crypto rise because lower rates make fixed-income assets less appealing. Ethereum’s recent 27% weekly rise to $4,625 shows that it is sensitive to these kinds of signals.

The Last Steps: NFP and PCE

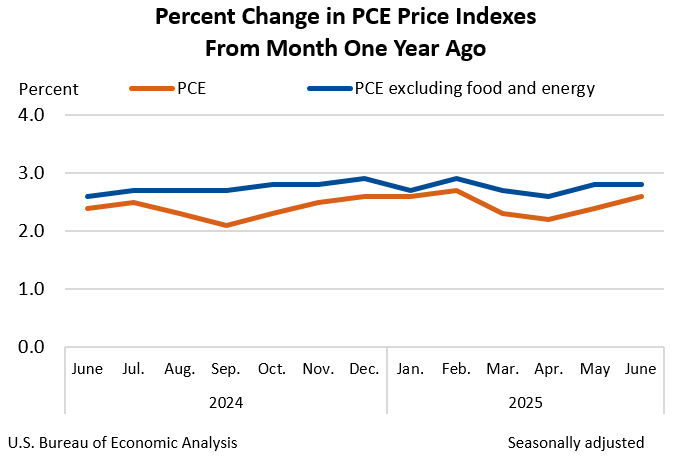

The Personal Consumption Expenditures (PCE) data on August 29, which is the Fed’s favorite way to measure inflation, makes September’s economic calendar even more important. The PCE for June was up 2.6% from the same month last year, and the core PCE was up 2.8%. If the numbers are softer than expected, it might make people more sure that the Fed will lower rates by 25 basis points.

This would create a risk-on atmosphere that is good for crypto. However, a good PCE reading could mean that inflation will stay high, which would make it less likely that rates will go down and put pressure on assets like Solana, which recently hit $199 due to the rise of altcoins.

The Non-farm Payrolls (NFP) report on September 5 will be the last big piece of information before the FOMC meeting. The U.S. Bureau of Labor Statistics said that only 73,000 jobs were added in July, the lowest number since 2025. This shows that the job market is weak.

A similarly weak NFP might make people more sure that rates will go down, which would hurt the currency and push money into cryptocurrencies. Analysts like First1Bitcoin say that if the PCE stays low, this may push Bitcoin beyond $120,000 and Ethereum toward $5,000. But if the data is hotter than expected, it might change this story, raising yields and starting a crypto downturn.

What the crypto market means and how to deal with it

There is a lot of evidence that the crypto market reacts to Fed policy. Data from the past reveals that Bitcoin does worse when rates go up, but it goes up 50–100% once rates go down, like it did following the September 2024 cuts. Altcoins like Ethereum and Solana, which have just gone up 27% and 12%, are even more volatile, which makes both the potential and downside risks bigger.

The market cap is currently $4.1 trillion, which is up 2% per day. This shows that people are hopeful, but leverage is rising—ETH futures open interest rose 15% week-on-week, according to CoinGlass. This might mean that prices could drop sharply.

The FOMC’s decision in September will depend on how these data points interact with each other around the world. The current altcoin boom might continue with a 25-bps decrease, with Ethereum aiming for $5,000 to $6,400 and Solana aiming for $200. A hawkish surprise, on the other hand, might cause rates to rise, with 10-year Treasuries already at 4.1%. This could send Bitcoin below $110,000. The GENIUS Act and Trump’s drive for crypto in 401(k)s make the market more positive in the long term, but there is still a risk of short-term volatility.

A Month with High Stakes Ahead

From mid-August to the September FOMC meeting, the crypto markets are very volatile. The FOMC minutes, PMI, unemployment claims, PCE, and NFP will all affect people’s expectations. Powell’s speech at Jackson Hole could set the tone.

The CME FedWatch Tool says there is a 92.6% chance of a 25-bps decrease, so the market is ready for easing, but surprises could change people’s minds quickly. Traders should be ready for either a dovish decision that boosts altcoin prices or a hawkish approach that causes corrections. Investors may ride the waves of this important time in global markets by being disciplined and setting clear risk levels.