Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The blockchain revolution is no longer only for businesses; governments all across the world are seeing how technology can change things to make them more open, safe, and efficient.

Countries like Vietnam, Malaysia, and Indonesia are making big moves to adopt blockchain at the national level in Southeast Asia, a region noted for its fast digital growth.

These projects are meant to change everything, from how the government works to how money is handled, how goods are moved, and more.

As a technology strategist watching these changes, I’ll talk about the most recent progress in Vietnam’s NDAChain, Malaysia’s MBI, and Indonesia’s Project Garuda.

Vietnam’s NDAChain: A Plan for Online Trust

Vietnam made a big step into the world of blockchain when it introduced NDAChain, its national blockchain platform, on July 25, 2025. The National Data Association built NDAChain, and the Ministry of Public Security’s Data Innovation and Exploitation Center runs it.

NDAChain is meant to be a safe, open, and scalable base for Vietnam’s digital economy. It’s not simply a tech project; it’s a way to make Vietnam a leader in digital innovation in the region by 2030.

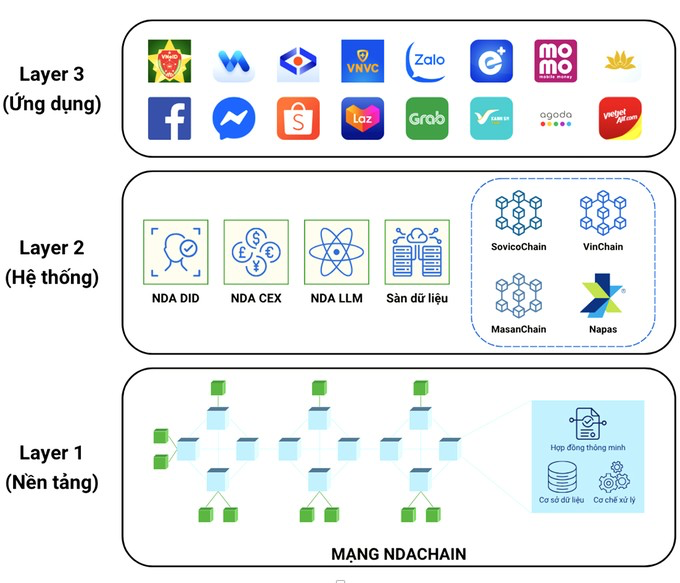

NDAChain is different because it has a hybrid design that combines centralized and decentralized systems to find a balance between security and creativity.

It is a Layer 1 permissioned blockchain that can handle up to 3,600 transactions per second. It uses a Proof-of-Authority (PoA) consensus mechanism that is improved with Zero-Knowledge Proofs (ZKPs).

There are 49 validator nodes on the network, including big names like SunGroup, Zalo, and Masan. This makes sure that the public and private sectors can work together well.

Some important parts of NDAChain are:

- NDA Trace is a real-time tracking system that gives each product a unique code. This makes the supply chain completely clear from production to the end user.

- Decentralized Identity (NDA DID) works with Vietnam’s VNeID system to let people sign documents and verify their identities for transactions and services.

- Broad Sector Integration: Helps e-government, finance, healthcare, logistics, and education by fixing problems with centralized data systems, such as cyberattacks and problems with scaling.

Vietnam’s approach is different since it follows international standards like W3C DID and GDPR, which helps make things work together around the world.

NDAChain wants to be fully integrated into the National Data Center by 2026. After that, it expects to grow to include local governments and colleges.

This could open up chances for businesses to create Layer 2 apps that could help Vietnam’s digital economy grow, such anti-counterfeiting tools or digital notarization services. Posts on X show that people are really excited about NDAChain’s potential to fight fraud and help e-commerce flourish, which shows that the community is quite hopeful.

Malaysia’s MBI: Leading the Way in Regional Blockchain Integration

Malaysia isn’t far behind; it started its National Blockchain Infrastructure (MBI) in April 2025, led by MIMOS Berhad and powered by the Zetrix blockchain.

The MBI is a vital part of Malaysia’s National Blockchain Roadmap. Its goal is to bring together the country’s many digital ecosystems and make Malaysia a major role in ASEAN’s digital future.

MBI is a flexible platform for both public and private sector applications because it works with public blockchains like Ethereum and Solana.

The MBI makes it easier to create blockchain apps by enabling services like:

- MyDigitalID is a solution for managing your digital identity that makes it easy and safe to go to services.

- DeFi and Tokenization: These technologies make decentralized finance and real-world asset (RWA) tokenization possible, which opens up new ways to make money.

- Supply Chain Traceability: Makes industries like halal food more open, making Malaysia a worldwide halal hub even stronger.

Some early adopters, such as Masverse, Cokeeps, and iTrace, are already using MBI in new ways. Dr. Saat Shukri Embong, the Acting President of MIMOS, said that MBI makes it easier for anyone to use blockchain, which helps make the digital world more open to everyone.

TS Wong, one of the founders of Zetrix, termed it a “watershed moment” for ASEAN and talked about how it could help with cross-border transactions. This fits with Malaysia’s bigger goal of increasing trade between ASEAN countries, which is now less than 25% of all trade in the area.

Malaysia is an even better place for blockchain because it has a lot of multilingual talent and rules that are good for investors. There were allegations that Malaysia is one of the top 10 crypto-friendly places in the world at the Malaysia Blockchain Week 2024. This puts Malaysia in a position to not only lead at home but also promote interoperability in the region, which is very important for ASEAN’s digital integration.

Indonesia’s Project Garuda: Laying the Groundwork for Rules

Project Garuda is a Central Bank Digital Currency (CBDC) project led by Bank Indonesia that is helping Indonesia get ready for blockchain adoption, even though it is progressing at a different speed.

Indonesia became the third-largest user of cryptocurrencies in the world in 2024, and the number of registered blockchain enterprises grew by 72%. This rise shows how much potential the country has, but it is still focused on building a strong regulatory framework to promote long-term prosperity.

The Indonesian Payment System Blueprint 2030 (BSPI 2030) and the Blueprint for the Development of Money Market and Foreign Exchange Market 2030 (BPPU 2030) both show Bank Indonesia’s bigger plans for the future. The digital Rupiah is meant to make it easier for people to get access to financial services and make payments across borders, in line with ASEAN’s Payment Connectivity Framework.

The following things guide Indonesia’s regulatory efforts:

- Law No. 4 of 2023 (P2SK Law): Gives the Financial Services Authority (OJK) the power to monitor digital assets and fintech developments, making sure that risks are managed while growth is encouraged.

- Government Regulation No. 28/2025: Recognizes blockchain as a key part of the digital economy and sets up risk-based licensing for blockchain companies.

- Indonesia is behind Vietnam and Malaysia in setting up a national blockchain platform, but its focus on regulation is smart. The OJK’s 2024–2028 Roadmap for Financial Technology Innovation says that to develop trust in digital assets, the government should spend money on public education and infrastructure. Asih Karnengsih from Asosiasi Blockchain Indonesia said that the “crypto degen” community is increasing, with more than half of investors being Millennials and Gen Z. This is boosting demand for DeFi and token projects.

The Future of Blockchain in ASEAN

There are more than 400 million people in the ASEAN region who use the internet, and the market is expected to be worth $1 trillion. This makes it a great place for blockchain-driven growth. The ASEAN Digital Integration Framework Action Plan (DIFAP) intends to increase trade and digital payments within the region. NDAChain, MBI, and Project Garuda are all examples of projects that support this goal.

But there are still problems:

- Regulatory Harmonization: Different rules in different ASEAN countries could make it harder for blockchains to work together across borders.

- Talent Development: Vietnam and Indonesia, in particular, need to invest in education because they don’t have enough people with blockchain skills.

- Trust of the Public: For blockchain to be widely used, people need to know about its benefits and have their security concerns addressed.

Indonesia might get to a national blockchain platform faster by learning from Vietnam and Malaysia.

Indonesia’s economy is very different, therefore a hybrid model like NDAChain, together with MBI’s ability to work with several chains, would work well. At the same time, ASEAN’s joint projects, including Project Dunbar for cross-border CBDC payments, point to a future where national blockchains work together without any problems.