Hey there, fellow investors! If you’re looking to jump into the world of stock trading using Cash App, you’ve come to the right place. In this article, I’ll walk you through everything you need to know about Cash App stocks, including the top 10 best Cash App stocks to buy right now. So, let’s dive right in!

Table of Contents

Brief Introduction to Cash App

Are you searching for enhanced convenience, simplified financing for projects or travel plans, and swift, paperless money transfers? If so, an online money transfer app is your solution.

One standout option in this arena is Cash App, which was established in 2013 as a subsidiary of the Square Inc. payment system. Cash App seamlessly connects your bank account, enabling you to transfer funds to friends, family, or other users. As the shift to online platforms gains momentum, Cash App has emerged as a significant player in the market.

It allows users to send and receive money, invest in stocks, and even purchase Bitcoin. The ability to purchase stocks directly through the app was a recent addition in 2019.

Therefore, if you’re a trader considering entering the stock market, Cash App should be your top choice.

10 Best Stocks to Invest in on Cash App

Let’s cut to the chase and take a look at the top 10 best Cash App stocks for 2025. Here’s a handy table summarizing each stock:

| Stock | Ticker | Current Price (USD) | Sector | Market Cap (USD) |

| Apple Inc. | AAPL | $179.32 | Consumer Electronics | $2.9 trillion |

| Amazon.com Inc. | AMZN | $141.23 | E-commerce & Cloud | $1.6 trillion |

| Alphabet Inc. | GOOGL | $138.47 | Digital Advertising | $1.8 trillion |

| Block, Inc. | SQ | $59.02 | Financial Technology | $35 billion |

| Microsoft Corp. | MSFT | $336.42 | Cloud & Enterprise Tech | $2.5 trillion |

| Meta Platforms | META | $303.58 | Social Media & AR | $820 billion |

| Nvidia Corp. | NVDA | $467.52 | Semiconductors | $1.3 trillion |

| Fiserv, Inc. | FISV | $117.84 | Payments & FinTech | $70 billion |

| Shopify | SHOP | $66.92 | E-commerce Platforms | $85 billion |

| Adobe Inc. | ADBE | $565.31 | Creative Software & AI | $280 billion |

1. Apple Inc. (AAPL)

Current Price: $179.32

Sector: Consumer Electronics

Market Cap: $2.9 trillion

Apple’s dominance in the technology space remains unrivaled. With strong revenue growth driven by iPhone sales, services, and wearables, Apple is a staple for any portfolio.

- Key Highlights:

- Expanding services ecosystem with subscription offerings like Apple One.

- Continuous innovation in product lines, including AR/VR devices.

2. Amazon.com Inc. (AMZN)

Current Price: $141.23

Sector: E-commerce & Cloud Computing

Market Cap: $1.6 trillion

Amazon’s leadership in online retail and AWS (Amazon Web Services) ensures consistent revenue growth. Its foray into AI tools also positions it for future gains.

- Key Highlights:

- AWS dominates cloud infrastructure with 32% market share.

- AI advancements integrated into logistics and advertising platforms.

3. Alphabet Inc. (GOOGL)

Current Price: $138.47

Sector: Digital Advertising

Market Cap: $1.8 trillion

Alphabet, parent company of Google, is the backbone of digital advertising. Its investments in AI and cloud computing offer diversified revenue streams.

- Key Highlights:

- YouTube ad revenue rebounding after pandemic slump.

- Expansion into AI-driven products like Google Bard and DeepMind solutions.

4. Block, Inc. (SQ)

Current Price: $59.02

Sector: Financial Technology

Market Cap: $35 billion

Block (formerly Square) has carved a niche in fintech, offering solutions for merchants and digital payments.

- Key Highlights:

- Growth in Cash App user base.

- Bitcoin trading and blockchain innovations driving revenue diversification.

5. Microsoft Corp. (MSFT)

Current Price: $336.42

Sector: Cloud & Enterprise Tech

Market Cap: $2.5 trillion

Microsoft remains a leader in cloud computing, productivity software, and AI. Azure’s growth and AI integrations across products like Office make it a long-term winner.

- Key Highlights:

- Strategic partnerships with OpenAI to enhance AI offerings.

- Expanding presence in enterprise software and cloud solutions.

6. Meta Platforms (META)

Current Price: $303.58

Sector: Social Media & AR

Market Cap: $820 billion

Meta is pivoting toward the metaverse while maintaining robust revenue from its advertising business across Facebook, Instagram, and WhatsApp.

- Key Highlights:

- AR/VR investments through Reality Labs.

- Improving ad monetization on Reels and WhatsApp.

7. Nvidia Corp. (NVDA)

Current Price: $467.52

Sector: Semiconductors

Market Cap: $1.3 trillion

Nvidia’s dominance in AI chip production and gaming GPUs positions it as a key player in the semiconductor industry.

- Key Highlights:

- Strong AI chip demand driving record revenues.

- Expansion into automotive and data center markets.

8. Fiserv, Inc. (FISV)

Current Price: $117.84

Sector: Payments & FinTech

Market Cap: $70 billion

Fiserv powers global payment processing and digital banking solutions. Its consistent growth in financial services makes it a solid pick.

- Key Highlights:

- Increasing adoption of Fiserv’s Clover point-of-sale systems.

- Strategic acquisitions enhancing digital banking capabilities.

9. Shopify (SHOP)

Current Price: $66.92

Sector: E-commerce Platforms

Market Cap: $85 billion

Shopify enables businesses worldwide to establish and grow online stores. Its platform remains a critical tool for small-to-medium enterprises.

- Key Highlights:

- Strong presence in global e-commerce markets.

- Expanding B2B tools for wholesale and enterprise clients.

10. Adobe Inc. (ADBE)

Current Price: $565.31

Sector: Creative Software & AI

Market Cap: $280 billion

Adobe’s diversification into AI with tools like Firefly ensures sustained growth in creative and enterprise markets.

- Key Highlights:

- Expanding subscription revenue through Adobe Creative Cloud.

- New AI-driven features enhancing user experience across products.

What Is Cash App?

Cash App is a financial app that simplifies money management. With Cash App, you can send money to friends, pay bills, and invest in stocks and Bitcoin. It’s like having a bank and a stockbroker in your pocket.

Cash App Investing Features

Cash App offers a range of features for investors, including fractional shares, recurring investments, and a user-friendly interface that’s perfect for beginners.

Here are some interesting features to look into:

- Easily enter the stock market, whether you’re a beginner or an experienced investor, with minimal fuss

- Enjoy discounts through Cash App pay and Cash Card

- A seamless avenue to purchase, sell, send, and receive Bitcoin, the dominant cryptocurrency

- Additionally, the platform enables the transfer of investments between investors and alternative broker-dearlers with minimal effort and set up automatic investments effortlessly

Is It Good to Buy Stocks Through Cash App?

Absolutely! Buying stocks through Cash App is convenient and straightforward, but like any platform, it has its pros and cons.

Pros:

Pros:

Here are some benefits of using Cash App:

- Fractional shares available

- No account minimums

- Sending and receiving money through this app comes at no cost.

- A sleek and straightforward design, making it easy to navigate.

- Small-scale investors will appreciate the availability of fractional shares, making investing accessible to all.

- While most transactions on the platform are fee-free, it’s worth noting that Bitcoin transactions may incur a minor fee.

- Cash App’s unique feature allows users to round up their expenses when using the Cash App debit card, contributing to their investment fund.

- Cash App provides the flexibility to transfer Bitcoin to and from external wallets.

Cons:

Cons:

The app has limitations:

- It offers a limited range of asset choices, account types, and order options.

- It does not support mutual funds or individual bond investments.

- The app lacks support for Options, Futures, or Margin Investing.

- There is no dedicated trading platform.

- It permits investors to trade or invest exclusively in Bitcoin, with no options for other cryptocurrencies.

Cash App Fees and Expenses

When it comes to buying or selling stocks or ETFs through Cash App, you can do so without incurring any charges. However, it’s important to note that the app does impose fees for Bitcoin transactions. These Bitcoin-related fees consist of a service fee and other charges that can fluctuate depending on the price volatility observed across US exchanges.

Should investors encounter any supplementary fees, these are typically imposed by regulatory bodies and government entities. For most ETFs, management fees are paid directly to the fund company, irrespective of where the funds are acquired.

What sets Cash App apart from many other investment brokers is its ability to provide numerous services to users without any associated costs.

How to Trade Stocks on Cash App?

Getting started with Cash App is a breeze. Let me walk you through the steps:

Step 1: Download the Cash App on your device and create your account to sign up

![]()

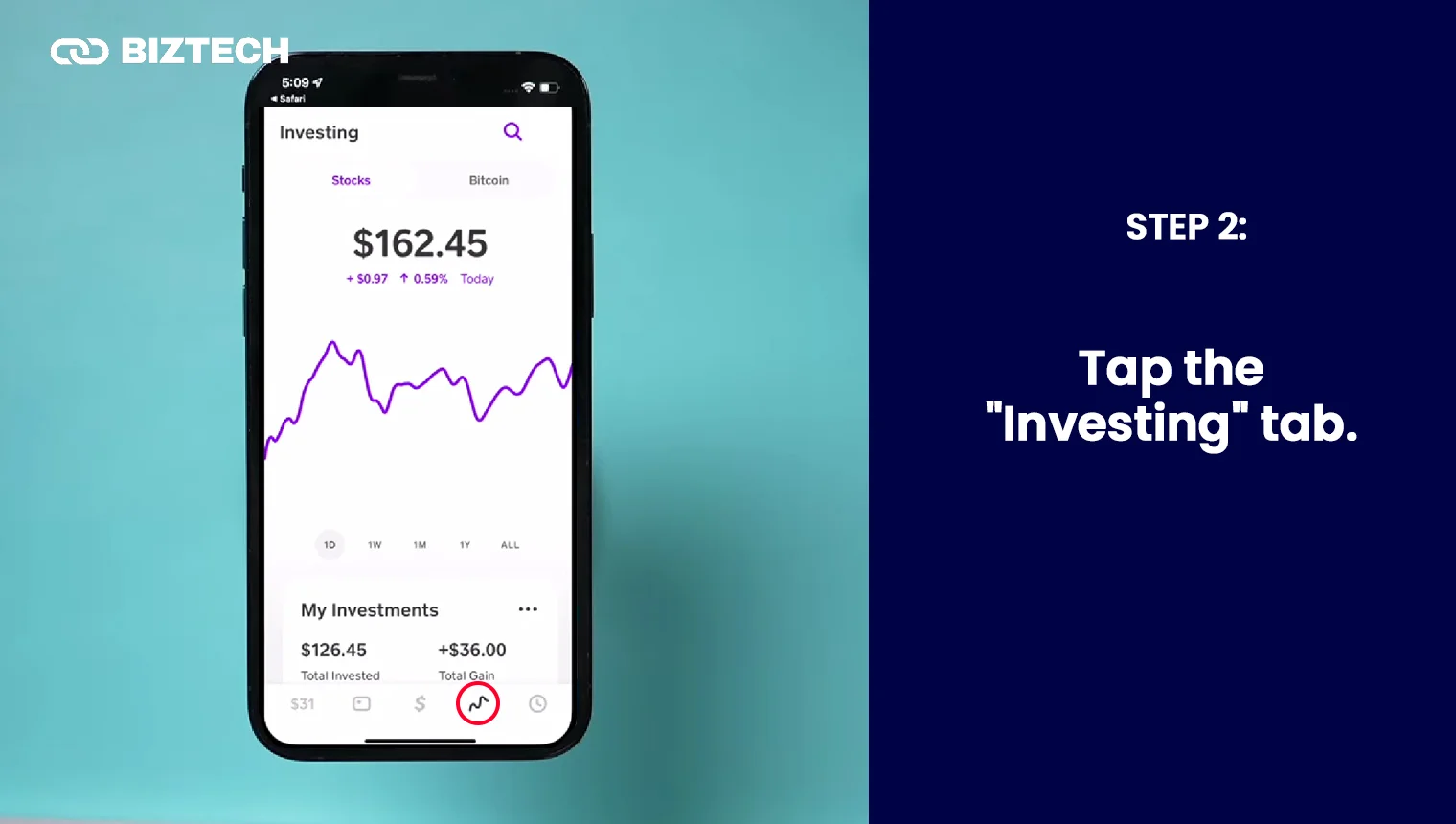

Step 2: Tap the “Investing” tab.

Step 3: Click on the search bar, enter the company’s name, and then tap the ticker symbol to add the stock to your watchlist.

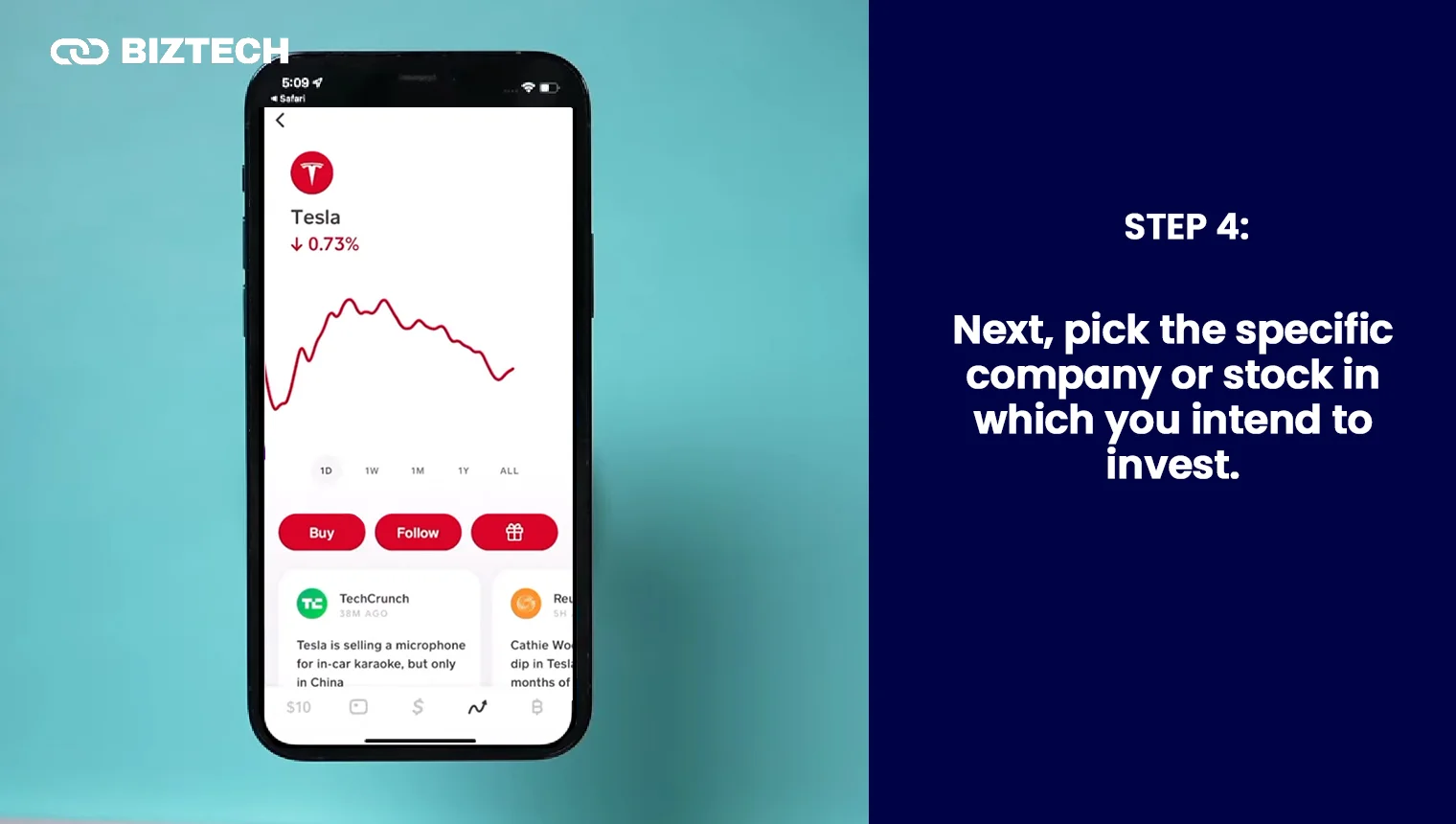

Step 4: Next, pick the specific company or stock in which you intend to invest.

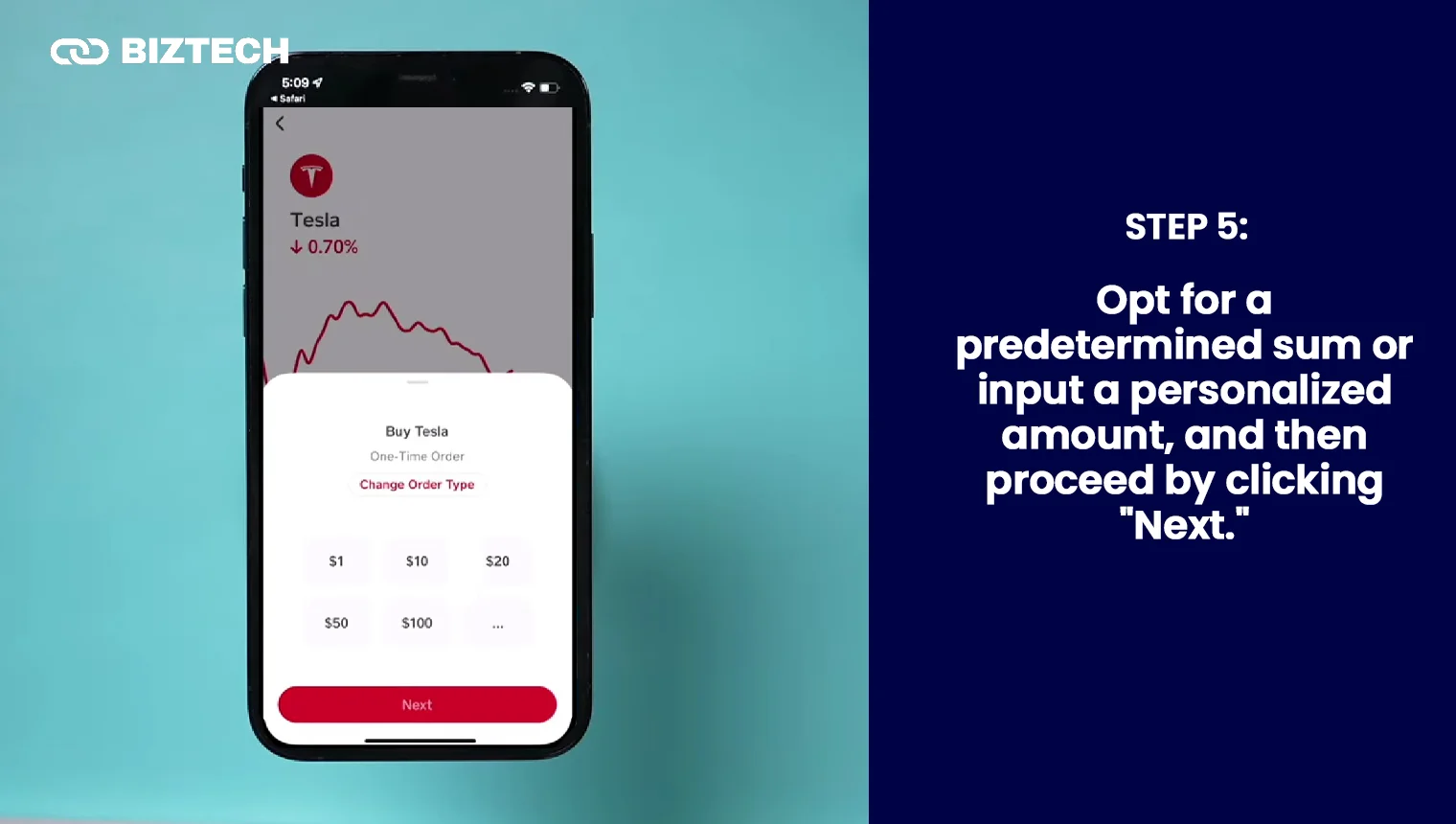

Step 5: Opt for a predetermined sum or input a personalized amount, and then proceed by clicking “Next.”

Step 6: Adhere to the provided instructions for verifying your personal information.

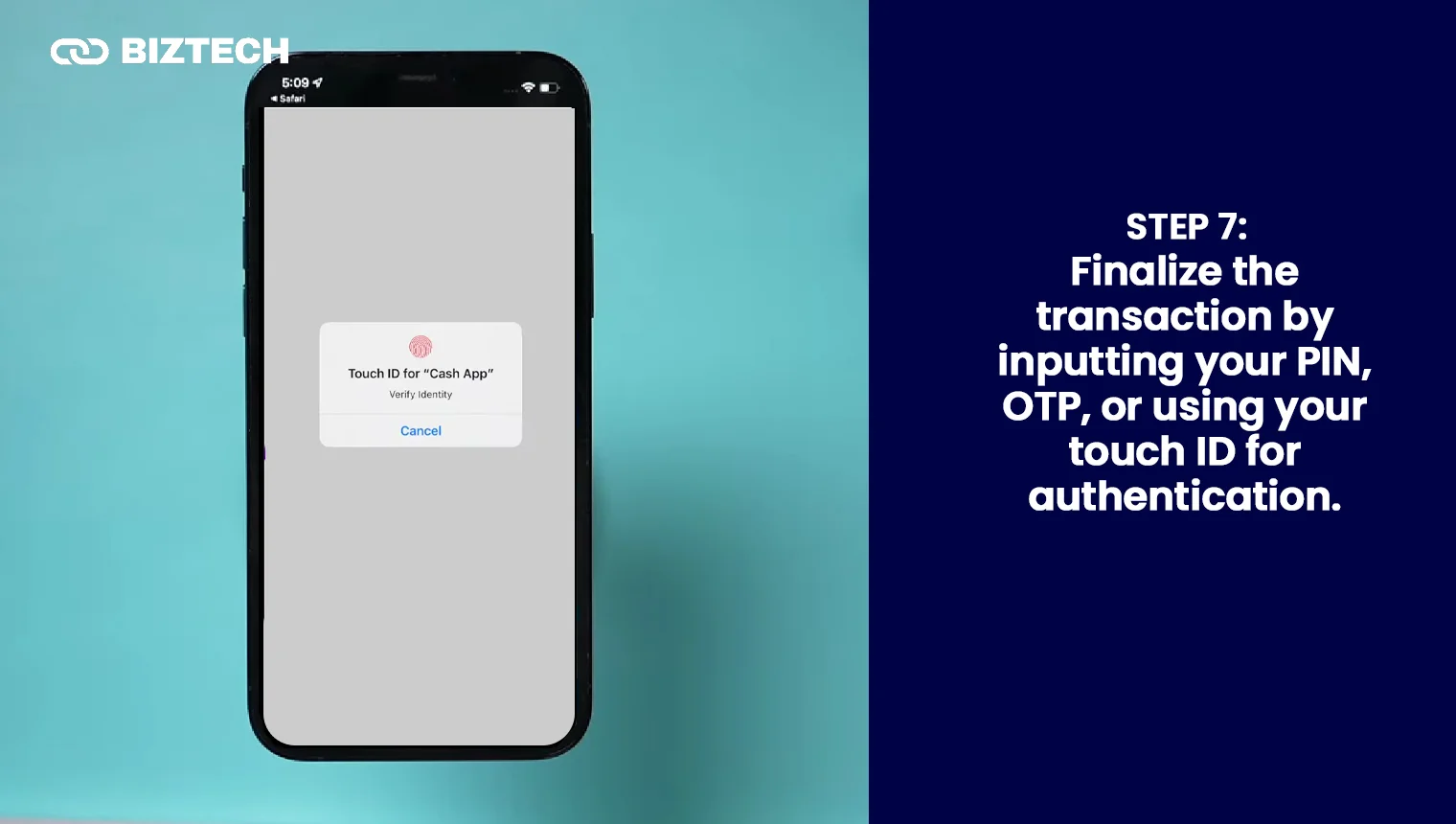

Step 7: Finalize the transaction by inputting your PIN, OTP, or using your touch ID for authentication.

How to Sell Stocks on Cash App?

Selling stocks on Cash App is just as easy as buying them:

Step 1: After launching the Cash App, click on the Investing icon located on the app’s home screen.

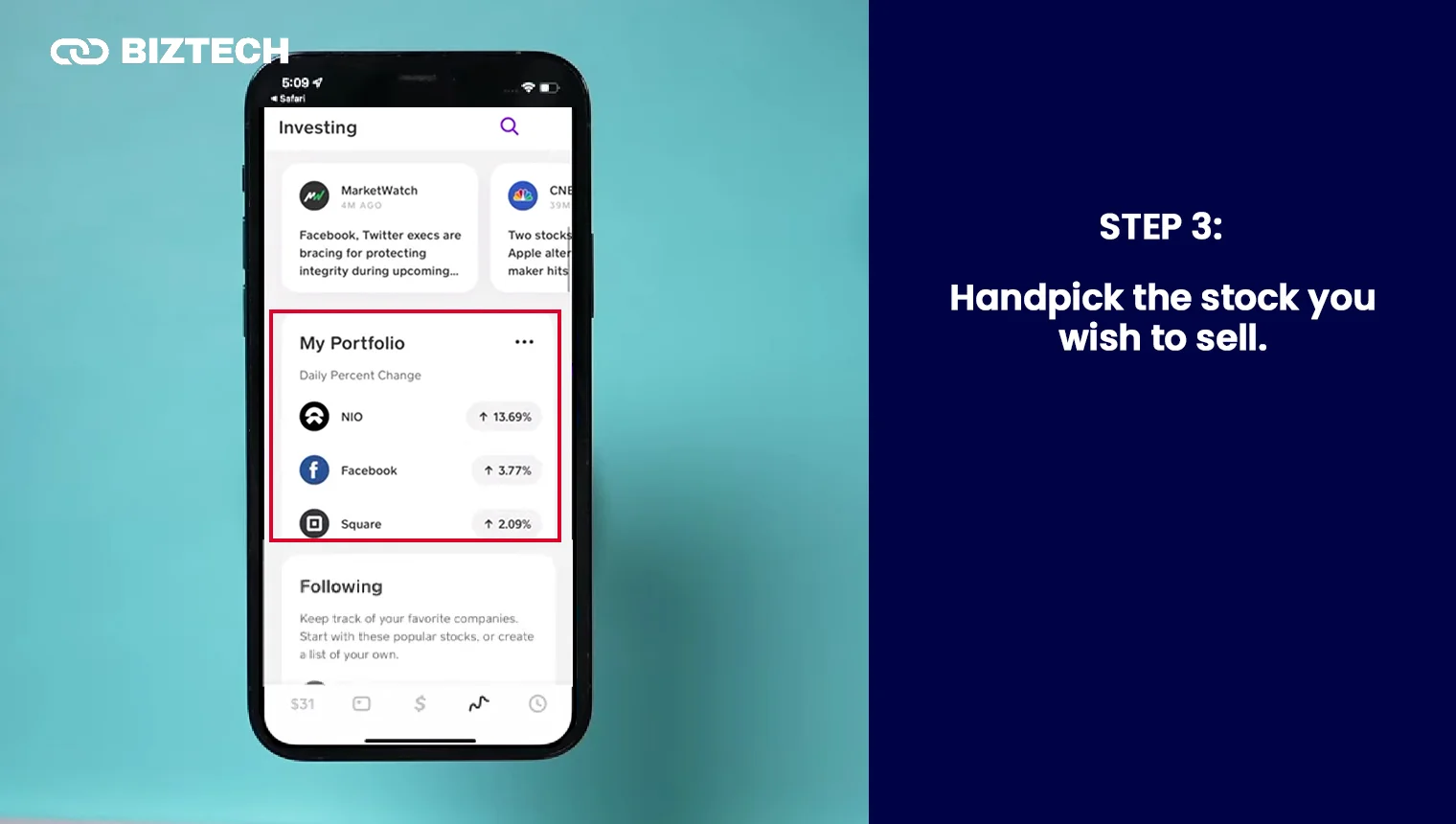

Step 2: Navigate to “My Portfolio.”

Step 3: Handpick the stock you wish to sell.

Step 4: Opt for the “Sell” option.

Step 5: Enter your desired amount using the three dots icon

Similar to the purchasing process, you have two options for selling the stock. You can either choose a preset amount or enter your desired amount using the three dots icon. Then, proceed by clicking “Next.”

Step 6: Conclude the transaction by inputting your PIN or utilizing Touch ID for authentication.

Upon successfully selling your stock, it may take up to 2 business days for the funds to appear in your Cash App account.

Conclusion

So, which are the best Cash App stocks to buy? While I’ve provided a list of top contenders, the best choice for you depends on your investment goals and risk tolerance. It’s essential to do your research and consider your financial objectives before diving into the best stocks on Cash App.

Personally, I’m keeping a close eye on Amazon and Nvidia due to their consistent growth and innovative endeavors. However, remember that the stock market can be unpredictable, and it’s essential to diversify your portfolio for a well-rounded investment strategy.

Read also: Top 5 Hydrogen Stocks for 2023: Investment For The Future

Malaysia

Malaysia

Singapore

Singapore

Philippines

Philippines