Wondering how to calculate income tax in Singapore?

Regardless of your occupation in self-employment or freelancing, a local or a foreign employee, you are legally bound to regulations established by the Inland Revenue Authority of Singapore (IRAS) to file for personal income tax in Singapore.

If your earnings in Singapore exceed the individual tax-break threshold of S$22,000 per annum, it’s likely you’re required to pay Singapore income tax.

This guide aims to provide a comprehensive summary of important tax-related matters and how to file income tax in Singapore.

Which Income is Taxable in Singapore?

Income earned within Singapore is generally subject to income tax, while overseas income received in Singapore may not be taxable, depending on specific circumstances.

Taxes on Salaries:

Salaries received as payment for services rendered to an employer are typically taxable.

Taxes on Bonuses:

Both contractual and non-contractual bonuses are taxable.

- Contractual bonuses are paid according to the terms of a contract and are usually taxable in the year specified in the contract.

- Non-contractual bonuses, which the employer can withdraw before payment without legal consequences, are taxed when the employee becomes entitled to the payment.

Taxes on Director’s Fees:

It applies to director’s fees, which are usually sourced from the country where the company is a resident.

Taxable director’s fees in Singapore are treated as income in the year the director becomes entitled to them, typically at the company’s Annual General Meeting or when approved by the board.

Director’s fees approved in arrears are taxable when approved at the AGM.

Also, the director’s fees, which are approved in advance, are taxable when the services are rendered.

However, director’s fees derived from a company without a presence in Singapore may not be liable to Singapore tax, except for fees attributable to attending board meetings in Singapore or other duties carried out within Singapore.

Taxation of Commission:

Commission earned for services rendered is taxable income.

If received from an employer, it’s taxed as employment income; if self-employed, it’s taxed as trade income.

Taxation of Other Employment Income:

Other employment income may include allowances and benefits-in-kind from the employer.

Taxable forms include allowances (e.g., transport, meals) and benefits-in-kind (e.g., club memberships provided instead of cash).

Even after employment ceases, employer contributions to pension/provident funds are taxable, as are salary in place of notice and employer-borne taxes.

Non-taxable Employment Income:

Payments for restrictive covenants are non-taxable, as they’re considered capital receipts.

Compensation for loss of office and certain benefits-in-kind, such as sponsored group outings and outpatient treatment, are also non-taxable.

Taxation of Retirement Benefits:

Retirement benefits from approved pension and provident funds before retirement are taxable on the total amount received.

Taxation of ESOP and ESOW – Gains from Stock Options:

Gains from Employee Share Option Plans (ESOP) and Employee Share Ownership Plans (ESOW) are subject to taxation.

For ESOP, taxation occurs upon exercising share options, regardless of employment status or location.

With ESOW, taxation occurs when shares vest unless there are restrictions on share sales, in which case, taxation occurs when restrictions end.

Moreover, overseas plans and vesting periods also impact taxation, with the “deemed exercise” rule applying to non-Singapore citizens.

In summary, if you have ESOP or ESOW, you will be taxed on gains.

Understanding Your Tax Brackets

One of the most common mistakes when paying for income tax in Singapore is the confusion over tax brackets.

Taxation in Singapore is structured to reflect the residency status of individuals, with tax rates varying accordingly. Here’s a breakdown:

Tax Residency and Rates:

Individuals who qualify as tax residents in Singapore include:

- Singapore citizens

- Singapore permanent residents

- Foreigners who have spent 183 days or more working or residing in Singapore

Are you qualified as a tax resident?

To qualify as a tax resident in Singapore:

- Stay or work in the country for at least 183 days in a calendar year

- Stay or work for at least 183 days for a continuous 2-year period

- Stay or work continuously for 3 consecutive years

This calculation of Singapore employment days includes weekends, public holidays, and temporary absences due to travel.

How is Income Tax Calculated in Singapore?

Before you know how to file your income tax in Singapore, you should first know how your income tax is calculated.

As a tax resident, you are:

- Taxed on annual income earned in Singapore at progressive resident rates

- Taxed on income after tax relief deductions

- Taxed on foreign sourced income brought in before 1st Jan 2007

- Exempted from tax for foreign sourced income received after 1st Jan 2007, except if received through partnerships in Singapore.

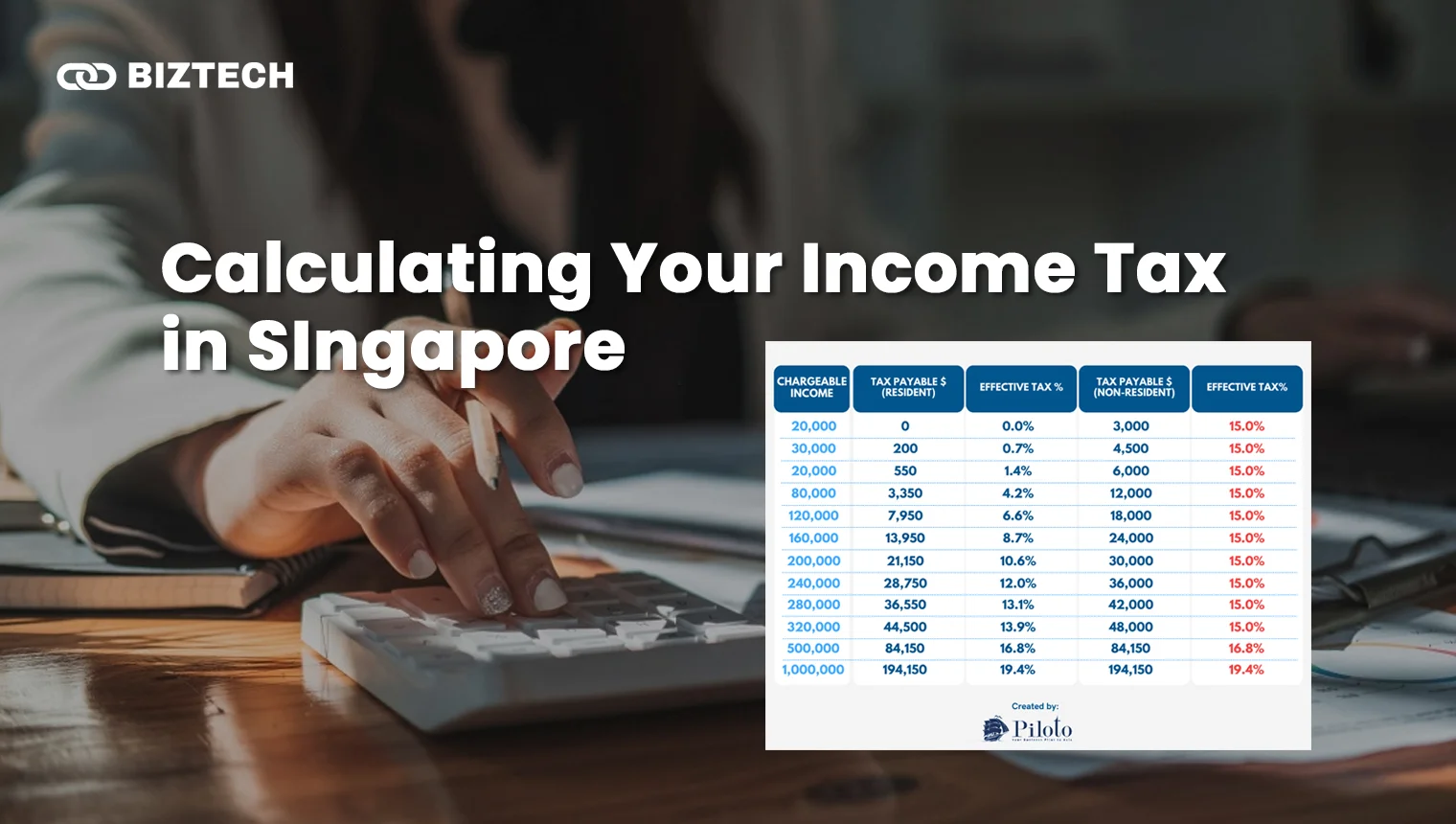

For tax residents, income tax rates are progressive, ranging from 0% to 22%. Below is a summary of the current tax rates applicable to different income brackets:

| Income Level (S$) | Chargeable Income (S$) | Income Tax Rate (%) | Gross Tax Payable (S$) |

| 0 – 20,000 | First 20,000 | 0 | 0 |

| 20,001 – 30,000 | First 20,000 Next 10,000 | 0 2 | 0 200 |

| 30,001 – 40,000 | First 30,000 Next 10,000 | – 3.50 | 200 350 |

| 40,001 – 80,000 | First 40,000 Next 40,000 | – 7 | 550 2,800 |

| 80,001 – 120,000 | First 80,000 Next 40,000 | – 11.5 | 3,350 4.600 |

| 120,001 – 160,000 | First 120,000 Next 40,000 | – 15 | 7,950 6,000 |

| 160,001 – 200,000 | First 160,000 Next 40,000 | – 18 | 13,950 7,200 |

| 200,001 – 240,000 | First 200,000 Next 40,000 | – 19 | 21,150 7,600 |

| 240,001 – 280,000 | First 240,000 Next 40,000 | – 19.5 | 28,750 7,800 |

| 280,001 – 320,000 | First 280,000 Next 40,000 | – 20 | 36,550 8,000 |

| 320,001 – 500,000 | First 320,000 Next 180,000 | – 22 | 44,550 39.600 |

| 500,001 – 1,000,000 | First 500,000 Next 500,000 | – 23 | 84,150 115,000 |

| More than 1,000,000 | First 1,000,000 In excess of 1,000,000 | – 24 | 199,150 |

Note: Starting in 2024, Singaporean tax residents earning over S$500,000 annually face increased top marginal tax rates: 23% for income between S$500,000 and S$1 million and 24% for income exceeding S$1 million.

Calculating Your Income Tax in Singapore (With Examples)

The personal income tax rate in Singapore ranks among the world’s lowest.

To find out how income tax is calculated in Singapore, you first need to calculate your income tax liability.

You must first ascertain your tax residency status and chargeable income, then apply the progressive resident tax rate.

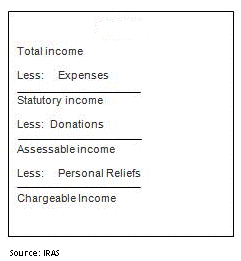

The computation of chargeable income for tax residents involves the following steps based on IRAS:

To help you identify what falls within those categories, here are additional details for your understanding so you know how income tax is calculated in Singapore:

1. Determine Total Income:

- Gains or profits derived from operating any business, trade, profession, or vocation, either individually or as a partner in a partnership.

- Gains or profits from employment.

- Dividends, interests, and investment income.

- Rents, royalties, and any other income generated from properties

- Any qualified income earned overseas are not in cluded (details provided later in the guide).

2. Deduct Expenses:

- Qualified employment-related expenses.

- Qualified rental-related expenses.

3. Account for Donations:

- Donations made to qualified charitable organisations.

4. Consider Personal Reliefs:

- Special personal reliefs. This span from eligible course fees, parent relief or earned income relief, etc.

Step-by-Step Guidelines:

Here’s how income tax is calculated in Singapore for a hypothetical salary of SGD 450,000 after all the deductions.

According to the table of income tax rates based on the income tax bracket, it falls under the bracket of S$320,001 – S$500,000.

So, for the first S$320,000, computed under the progressive tax rate, the taxable income is S$44,500.

For the next S$130,000 (S$450,000 minus S$320,000), the income tax rate imposed is 22%, which amounts to S$28,600.

Thus, the total gross income tax is

S$44,500 + S$28,600 = S$73,100

However, this gross income tax will be further deducted if there is a rebate available. So make sure you know which tax benefits you are eligible for.

(Read more about our 10 legal tips on how to reduce your income tax in Singapore.)

Changes in Singapore Income Tax Rates Overtime

1947:

- Creation of Singapore Income Tax Department to administer the Income Tax Ordinance.

1948:

- Actual tax assessment begins in November.

- 40,000 individual tax returns and 1,000 corporate returns were received in the first year of the assessment. Total tax collected: $33.2 million.

1960:

- Formation of the Inland Revenue Department, consolidating various revenue agencies.

1966:

- Significant changes to the Income Tax Act following Singapore’s independence.

1970s:

- Department’s purview expands to twelve Acts.

- Introduction of microfilming and computerisation of property tax billing.

1980s:

- Economic development prompts policy changes to enhance competitiveness.

- Corporate tax rates lowered from 40% to 33% in 1987.

1990s:

- Shift towards lower direct taxes and focus on indirect taxes.

- Introduction of Goods and Services Tax (GST) in 1994.

- Accelerated trend of lowering corporate and individual tax rates.

2000s to 2016:

- Focus on investment and talent attraction policies.

- Continued lowering of tax rates, capped at 18% for companies and 20% for individuals.

2017 and Beyond:

- Corporate tax rate reduced to 17%.

- Maximum individual tax rate capped at 22%.