Are you a recent graduate navigating your way through a new job and feeling uncertain about filing income tax in Singapore or understanding your tax obligations in this unique financial landscape?

In this guide, I will walk you through Singapore’s comprehensive tax systems, covering all the things you need to know about Income Tax in Singapore.

This progressive structure for personal income tax in Singapore boasts one of the world’s lowest rates, ranging from 0% to 22% for incomes above S$320,000.

Stay informed as you navigate the intricacies of Income Tax in Singapore!

Table of Contents

Understanding Singapore’s Personal Income Tax Rates

Singapore Tax Resident Tax Rates from the year 2024 onwards:

| Income Level (S$) | Chargeable Income (S$) | Income Tax Rate (%) | Gross Tax Payable (S$) |

| 0 – 20,000 | First 20,000 | 0 | 0 |

| 20,001 – 30,000 | First 20,000

Next 10,000 |

0

2 |

0

200 |

| 30,001 – 40,000 | First 30,000

Next 10,000 |

–

3.50 |

200

350 |

| 40,001 – 80,000 | First 40,000

Next 40,000 |

–

7 |

550

2,800 |

| 80,001 – 120,000 | First 80,000

Next 40,000 |

–

11.5 |

3,350

4.600 |

| 120,001 – 160,000 | First 120,000

Next 40,000 |

–

15 |

7,950

6,000 |

| 160,001 – 200,000 | First 160,000

Next 40,000 |

–

18 |

13,950

7,200 |

| 200,001 – 240,000 | First 200,000

Next 40,000 |

–

19 |

21,150

7,600 |

| 240,001 – 280,000 | First 240,000

Next 40,000 |

–

19.5 |

28,750

7,800 |

| 280,001 – 320,000 | First 280,000

Next 40,000 |

–

20 |

36,550

8,000 |

| 320,001 – 500,000 | First 320,000

Next 180,000 |

–

22 |

44,550

39.600 |

| 500,001 – 1,000,000 | First 500,000

Next 500,000 |

–

23 |

84,150

115,000 |

| More than 1,000,000 | First 1,000,000

In excess of 1,000,000 |

–

24 |

199,150 |

In summary, as of the Year of Assessment 2024, Singapore’s personal tax rates range from 0% to 24% for residents, while non-residents face a flat rate of 15% to 22%.

Taxable income is determined by its accrual or derivation in Singapore, irrespective of the individual’s residence status. Income sourced outside Singapore is only taxable for resident individuals if received in Singapore through a partnership.

Singapore Income Tax Rate for Residents:

For Singapore residents, the personal tax rates range from 0% to 24%.

What is the Minimum Salary Requirement?

Tax residents earning S$20,000 or more annually must file a personal tax return. However, residents earning less than S$20,000 are exempt from tax obligations.

Furthermore, earned income relief is granted to reduce the payable income tax in Singapore based on age.

How is Income Tax Calculated in Singapore for Residents:

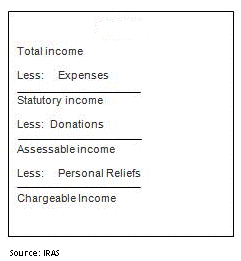

Tax residents must pay taxes based on their chargeable income, following the resident tax rate table outlined above. The computation of chargeable income for tax residents involves the following steps based on IRAS:

To help you identify what falls within those categories, here are additional details for your understanding on how is income tax calculated in Singapore:

- Determine Total Income:

- Gains or profits derived from operating any business, trade, profession, or vocation, either individually or as a partner in a partnership.

- Gains or profits from employment.

- Dividends, interests, and investment income.

- Rents, royalties, and any other income generated from properties

- Any qualified income earned overseas is not included (details provided later in the guide).

- Deduct Expenses:

- Qualified employment-related expenses.

- Qualified rental-related expenses.

- Account for Donations:

- Donations made to qualified charitable organisations.

- Consider Personal Reliefs:

- Special personal reliefs. This spans from eligible course fees, parent relief or earned income relief, etc.

Tax Deductions and Credits for Individuals in Singapore

Nobody enjoys seeing a large chunk of their hard-earned money disappear in taxes. The good news is that the Singapore government provides straightforward and legitimate ways to reduce chargeable income.

Here are some easy steps on how to reduce your income tax in Singapore:

1. Supporting Your Ageing Parents

A recent study found that nine out of ten individuals aged 25 to 34 aim to financially support their ageing parents.

The government’s ‘Parent Relief’ scheme offers tax deductions to Singaporeans caring for elderly parents.

Benefits of the Parent Relief scheme include:

- Tax deductions of $9,000 per year if staying together.

- Tax deductions of $5,500 per year if staying separately.

- Handicapped Parent Relief of $14,000 per year if staying together.

- Handicapped Parent Relief of $10,000 per year if staying separately.

- Total cap for QCR/HCR plus WMCR is $50,000 per child.

2. Grandparent Caregiver Relief (GCR)

Working mothers with a parent/parent-in-law or grandparent/grandparent-in-law caring for children aged 12 and below can claim a GCR of $3,000.

Via the Parenthood Tax Rebate (PTR), eligible individuals can get a direct refund on income tax, which can be claimed only one time for every child in the year following their birth.

3. Maximising Retirement Savings through CPF and SRS:

You can uop-off your retirement accounts for deductions on taxable income.

CPF top-ups on Special Accounts allow deductions of up to S$7,000 per year.

Further deductions of S$7,000 are available by topping up family members’ CPF SA/RA accounts.

Contributions to SRS (Supplementary Retirement Scheme) can lead to deductions on chargeable income.

SRS withdrawals from age 62 onwards will receive a 50% exemption from taxation.

4. Tax Relief for Charitable Donations

Cash donations to approved Institutions of a Public Character (IPC) or the Singapore Government could get you a tax deduction of 2.5 times the donation amount.

For instance, a $1,000 donation reduces your tax-assessable income by $2,500.

5. Plan Early for Maximum Tax Relief

When it comes to tax, it’s always better to plan early. Early planning can lead to significant tax savings.

The maximum tax relief claimable in a year is capped at $80,000.

Therefore, you can plan your investments, savings, and other tax-saving measures accordingly to minimize your taxable income.

6. Learn New Skills, Pay Less Taxes

Thanks to the Course Fees Relief scheme, you can now reimburse the actual course fees you paid, with a maximum of S$5,500 each year.

It is limitless on the number of courses, seminars, or conferences you attend. Just ensure the courses are either related to your current job or are helping you make a career switch.

Remember, you can only claim them after successfully transitioning to your new job.

Time to skill up and reap the benefits!

7. Enjoy Family NSman Relief!

As a gesture of gratitude for citizen’s service in the army, the Singapore government offers a special token.

Depending on your National Service (NS) duties in 2022 and your NS appointment, you can claim tax relief ranging from S$1,500 to S$5,000.

Additionally, wives and parents of NSmen are eligible for tax relief of S$750 each.

(If you want to know more, read our article on 10 legal ways to reduce income tax in Singapore.)

Filing Your Income Tax Return in Singapore

Tax filing can be initiated from the commencement of the year’s first quarter, and the electronic submission through the IRAS website is open annually from 1 March to 18 April.

Remember this deadline, as it has been one of the most common mistakes for many Singaporeans when paying their income tax.

The assessment pertains to income earned in the previous year. For instance, in 2023, you would be filing taxes for the income received or derived in 2022.

Alternatively, if you opt for paper filing, your completed tax form must reach the IRAS headquarters by 15 April.

How to File Income Tax in Singapore?

There are two options for submitting tax returns: electronic and paper. The majority of taxpayers prefer the online filing method due to its convenience.

(For detailed information on the documentation and filing process, read our article on how to file income tax in Singapore.)

Here’s a simplified breakdown of the electronic income tax filing process:

1. Prepare Necessary Resources:

Ensure you have the following ready:

- SingPass / IRAS Unique Account (IUA)

- Form IR8A (if your employer isn’t part of the Auto-Inclusion Scheme)

- Dependent such as children, your parents for new relief claims

- Details of rental income and any additional income

- Business Registration Number / Partnership Tax Reference Number (for self-employed and partners)

2. Log In to myTax Portal:

Access myTax Portal using your SingPass / IRAS Unique Account (IUA).

Navigate to “Individuals” > “File Income Tax Return” and follow the provided instructions.

3. Key In or Verify Details:

Enter income, deductions, and reliefs. If your organisation participates in the Auto-Inclusion Scheme, this data will be pre-filled for verification.

4. Update Existing Tax Reliefs:

Include new or additional tax relief claims, such as relief for a newborn child. Remove any previously claimed reliefs you no longer qualify for (e.g., course fees).

5. Declare Other Sources of Income, If Any:

Declare other income sources, like rental income, if applicable.

6. Receive the Acknowledgement Receipt:

Upon successful e-filing, an acknowledgement page will appear. It is recommended that you save or print a copy.

For individuals unable to file taxes online, IRAS will dispatch the relevant paper tax return between February and March.

How Can You Pay for Income Tax in Singapore?

Settling your Singapore income tax is a straightforward process, even for expats. Here are various payment methods available for your convenience:

- GIRO:

- Common method for most taxpayers.

- Allows for a one-time payment or 12-month interest-free instalments.

- Electronic Modes:

- Payments through AXS, internet banking, phone banking, mobile banking apps (PayLah and PayNow), and SAM.

- Post Office:

- Alternative option for payment using NETS.

You can opt for a longer payment plan if you need additional assistance for your Singapore income tax.

Do Foreigners or Expatriates Have To Pay Income Tax in Singapore?

Many people wonder if foreigners or expatriates need to pay taxes in Singapore. It’s important to know if income tax applies to them, especially if they work or live in the country.

Let’s explore the details of Singapore income tax for foreigners and expatriates:

Criteria of Singapore Income Tax for Foreigners

If you are a foreigner who has either stayed or worked in Singapore for less than 183 days in the tax year, you are classified as a non-resident for tax purposes.

As a non-resident, your taxation is as follows:

- If your stay is short-term, 60 days or less in a year, your employment income is exempt from tax. However, this exemption does not apply if you hold a directorship, are a public entertainer, or engage in a profession in Singapore.

- Professions include roles like foreign experts, foreign speakers, queen’s counsels, consultants, trainers, coaches, and similar positions.

- For stays between 61 and 182 days a year, you will be taxed on all income earned in Singapore. While you can claim expenses and donations for tax savings, personal reliefs are not applicable.

- Employment income is taxed at either 15% or the progressive resident tax rate, whichever results in a higher tax amount.

- Director fees, remuneration, consultant fees, and other incomes are subject to taxation at 15% to 22%.

Tax Rates for Singapore Income Tax for Foreigners

|

Type of Income |

Non-resident individual tax rate / withholding tax rate from YA 2017 to YA 2023 |

Non-resident individual tax rate / withholding tax rate from YA 2024 |

|

Director’s remuneration |

22% |

24% |

|

Income derived from activity as a non-resident professional (consultant, trainer, coach, etc.) |

15% of gross income or 22% of net income |

15% of gross income or 24% of net income |

|

Income derived from activity as a non-resident professional (consultant, trainer, coach, etc.) |

10% concessionary rate up to 31 Mar 2022; 15% concessionary rate from 1 Apr 2022 |

15% concessionary rate |

|

Other income e.g. rental income derived from a Singapore property |

22% |

24% |

|

SRS withdrawal by a non-citizen SRS member |

22% |

24% |

|

Interest, royalty etc. |

Reduced final withholding tax rate (subject to conditions) as follows: Interest: 15% Royalty: 10% OR 22% if reduced final withholding tax rate is not applicable. |

Reduced final withholding tax rate (subject to conditions) as follows: Interest: 15% Royalty: 10% OR 24% if reduced withholding tax rate is not applicable |

|

Pension |

22% |

24% |

Common Mistakes to Avoid When Paying Singapore Income Tax

Singaporean citizens earning more than S$22,000 annually must fulfil personal Singapore income tax obligations. Similarly, foreigners in Singapore with an annual income of S$22,000 or more who have stayed for over 183 days must also pay personal income tax.

Evading taxes is a grave offence in Singapore, even if committed unintentionally.

Here are four common mistakes that you should steer clear of and pay extra attention to:

1. Failure to Declare Overseas Income

Singapore nationals who frequently travel abroad but are based in the country must disclose their overseas income.

This applies to citizens working abroad as part of their contract or job responsibilities with a Singapore company.

Even if employed overseas by the Singapore government, the income remains taxable in Singapore due to tax residency.

2. Overlooking Rental Income Declaration

All sources of income, including rental income, are taxable. Many Singapore tax residents fail to report or misreport rental income, which is a common oversight.

Considerations such as new furniture or fittings installed in a rented property, influencing a higher rent, must be included in tax returns separately.

While these expenses can’t be deducted from the total rent received, they must be declared separately.

3. Confusing Business and Personal Expenses:

Self-employed individuals, taxi drivers, freelancers, and independent business owners often encounter challenges distinguishing between business and personal expenses.

Only business-related expenses are eligible for deduction, not personal or family expenses.

Maintaining a detailed record of all income and business-related expenses is crucial to avoid this mistake.

4. Reporting Taxes Based on Estimates:

Lots of people, including those who work for themselves or in real estate, often make a mistake when filing taxes. Instead of using actual numbers, they estimate their income and expenses.

But here’s the catch – estimates are unreliable, especially when tax authorities ask for proof. It’s better to give precise and provable information to make things smoother during tax assessments.

Comparing Singapore’s Income Tax System to Other Countries

We are going to compare Sinapore’s tax system to that of UK and Australia. We will make the comparison across different aspects.

As a starter, the tax year for the UK lasts from 6 April to 5 April; for Singapore, from 1 January to 31 December; and for Australia, from 1 July to 30 June.

Who is required to file tax return?

UK

Employed individuals typically pay income tax through payroll and may not file a Tax Return.

Tax Returns are necessary for those with

- Earnings exceeding £100,000 in a tax year

- Non-UK sourced income

- Property income

- Taxable savings, investments, and dividends

- Claims for income tax reliefs

- Capital gains tax obligations

- Self-employed or partnership income

- Liability to high-income child benefit charge

- Untaxed taxable income.

Singapore

Tax Returns are required where:

– Individuals who are tax residents and have an annual income of S$20,000 or more

– Non-resident individuals who derived income from Singapore

Australia

All Australian residents and non-residents with any Australian-sourced income (some exclusions apply)

Payroll System

In the UK, taxes are collected through the PAYE system, with employers deducting and remitting them to HMRC.

Singapore has no payroll withholding; individuals file annual tax declarations and pay directly to IRAS.

Taxes are collected through the PAYE system, with employers deducting and remitting them to HMRC.

Tax-Free Allowance

UK residents (and some non-residents) get a tax-free personal allowance set at £12,750 for 2023-24, which can be adjusted based on specific circumstances.

In Singapore, tax residents are not taxed on the first S$20,000 of their income.

On the other hand, a tax-free threshold of $18,200 applies to all Australian resident taxpayers, irrespective of income source, with exclusion for foreign and temporary residents.

Income Tax Rate

Here is a table for each country’s income tax rate:

| UK | The UK income tax rates are progressive, with:

|

| Singapore | Progressive income tax rates in Singapore:

|

| Australia | Australia has progressive income tax rates for residents:

|

Capital Gains Tax

UK Capital Gains Tax allowance: £12,300 per year (2022-23)

- Basic Rate taxpayers:

- 18% on residential property

- 10% on other chargeable assets

- Higher Rate taxpayers:

- 28% on residential property

- 20% on other chargeable assets

On the other hand, Singapore has no capital gains tax.

As for Australia, Australian individuals receive a 50% Capital Gains Tax discount if they own an asset for 12 months or more, resulting in tax on only half of the net capital gain.

Taxable Capital Gains are added to assessable income and taxed at the applicable marginal rate.

Inheritance Tax

In the UK, the standard Inheritance Tax threshold is £325,000 (or £500,000 if the home is passed to children), and estates valued over this threshold face a 40% Inheritance Tax rate.

However, inheritance tax (estate duty) in Singapore was abolished. Similarly, there isn’t any inheritance tax in Australia

Taxation on Worldwide Income

UK residents, for tax purposes, are taxed on their worldwide income.

However, for Singaporeans, income earned abroad and received in Singapore is typically not subject to taxation and does not require a declaration in the Income Tax Return, following the ‘territoriality’ system.

Australian residents are taxed on worldwide income, while ‘foreign’ and ‘temporary’* residents, for tax purposes, declare only income and gains earned in Australia.

National Insurance/ CPF

In the UK, both employees and employers must make monthly national insurance contributions, ranging from 0% to 13.8%.

Singapore follows the Central Provident Fund (CPF) system, requiring contributions from both employees (20%) and employers (17%), with applicable caps.

In Australia, however, individuals are subject to a flat Medicare levy, typically 2% of their taxable income, with an additional levy of up to 1.5% for those without private health insurance.

Analysing Taxation System Between the UK, Singapore, and Australia

When comparing income tax structures among the UK, Singapore, and Australia, Singapore emerges as particularly enticing due to its relatively low personal income tax rates, peaking at 22%.

This makes it a preferred destination for both skilled professionals and investors seeking favourable tax environments.

Singapore’s allure extends further with its business-friendly atmosphere, exemplified by a modest 17% corporate tax rate, robust infrastructure, and streamlined business procedures, which collectively bolster its status as a premier global business hub.

In contrast, while boasting stable economies and sophisticated financial markets, Australia and the UK impose higher personal income tax rates, reaching up to 45%.

Nevertheless, they offset these rates with comprehensive networks of tax treaties that confer advantages to multinational corporations.

Australia’s emphasis on research and development (R&D) deductions and the UK’s inducements for charitable contributions and pension schemes enrich their tax frameworks, catering to diverse investment priorities.

Ultimately, the selection among these nations hinges on individual circumstances, with considerations such as industry focus, corporate objectives, and global engagement influencing the decision-making process for investors and enterprises alike.

Conclusion

To sum it up, delving into the intricacies of income tax in Singapore need not be overwhelming, especially for newcomers.

This comprehensive guide has illuminated key facets, encompassing the progressive Singapore income tax rate, diverse reliefs like Parent Relief and Grandparent Caregiver Relief, and strategic approaches such as maximising retirement savings through CPF and SRS.

Whether you’re a local or a foreigner, grasping the subtleties of Singapore income tax is essential for sound financial planning.

Armed with this understanding, individuals can make informed choices to optimise tax benefits, laying the groundwork for a more secure and prosperous financial future within the vibrant city-state.