Calculate Your Loan Repayment Instantly

Loan up to RM100,000, pay it back in 7 Years!

There’s a number of aeon credit personal loans offered by AEON, whether it’s insurance or takaful, AEON has got you covered. But the one we will be talking about today is specifically the AEON iCASH Personal Financing.

Whether it’s to pay for any bills or to come up with any extra money for any means, with this aeon loan; loan up to RM100,000 and to pay it back at your own pace of up to 7 years with AEON iCash!

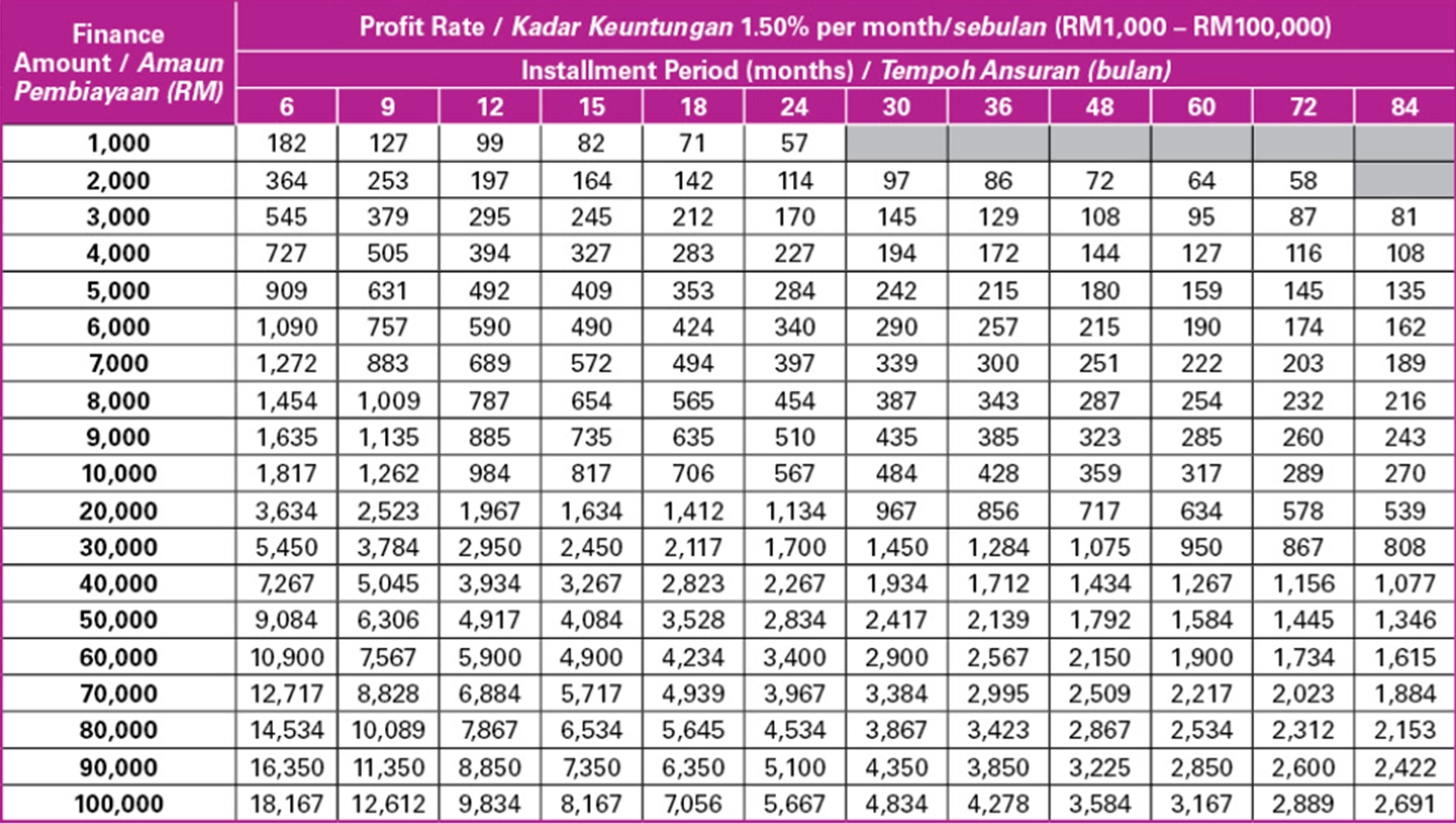

Table of Profit Rates (RM1,000 – RM100,000)

Table 1: Profit Rate 0.66% per month

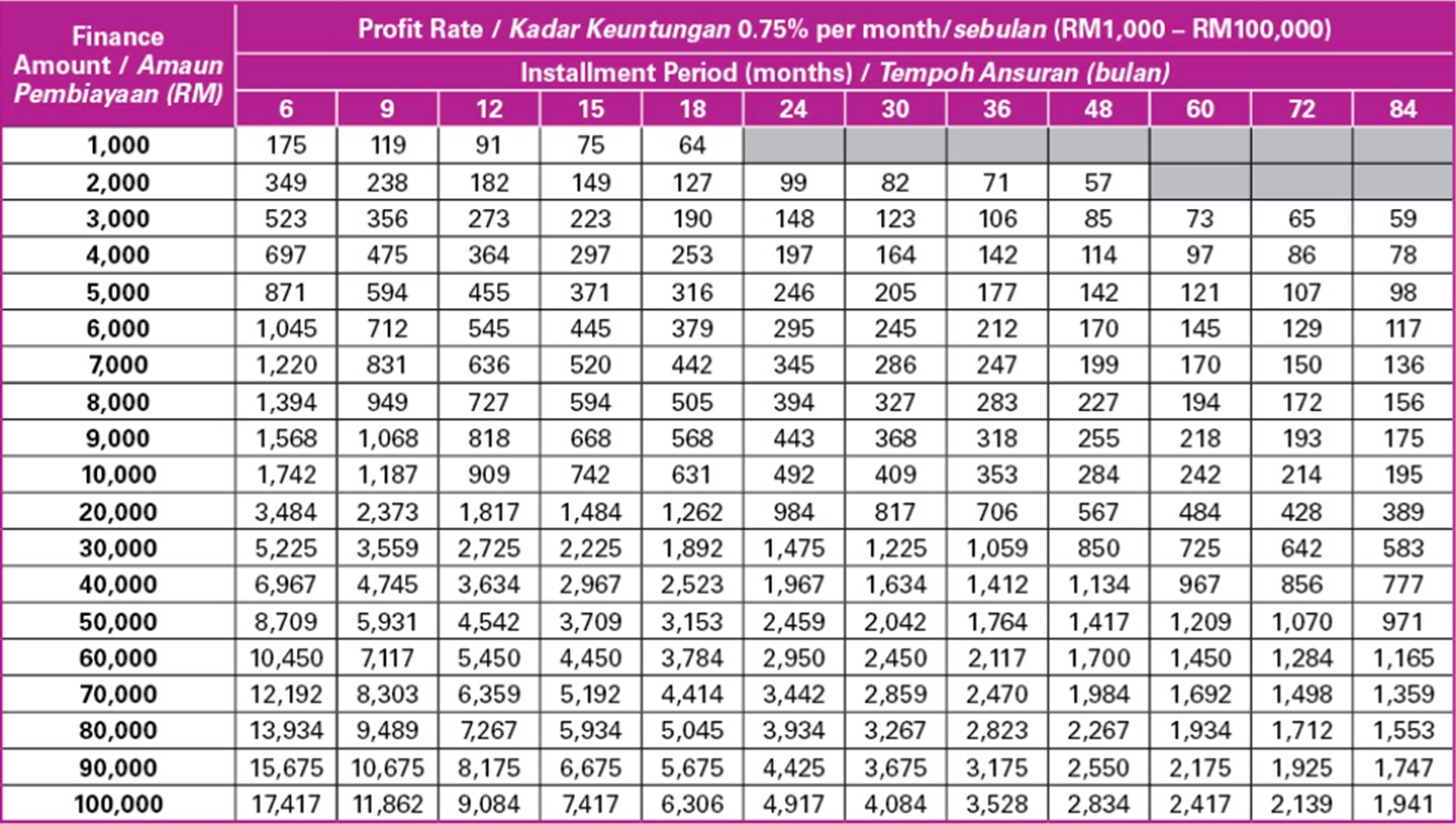

Table 2: Profit Rate 0.75% per month

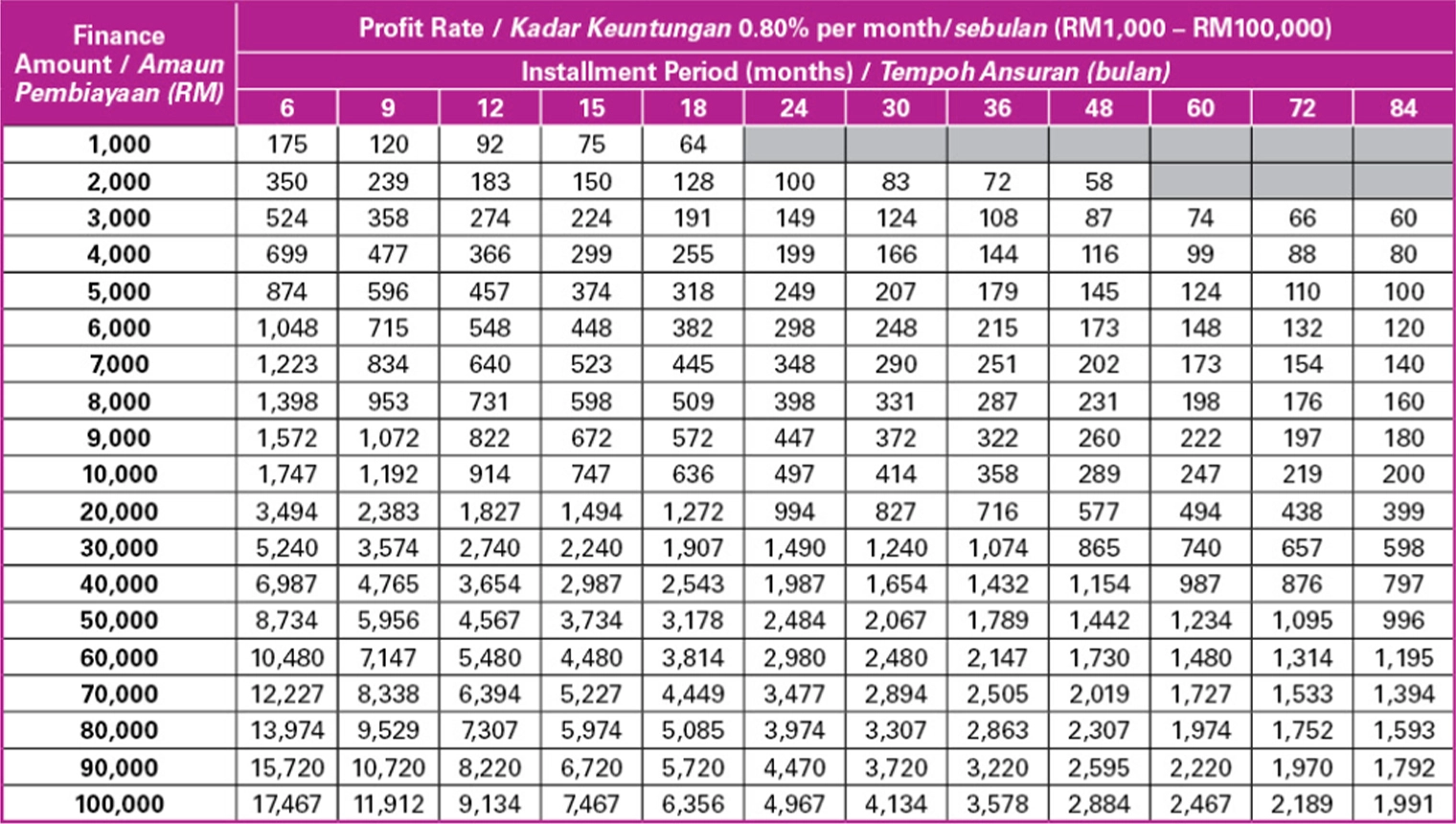

Table 3: Profit Rate 0.80% per month

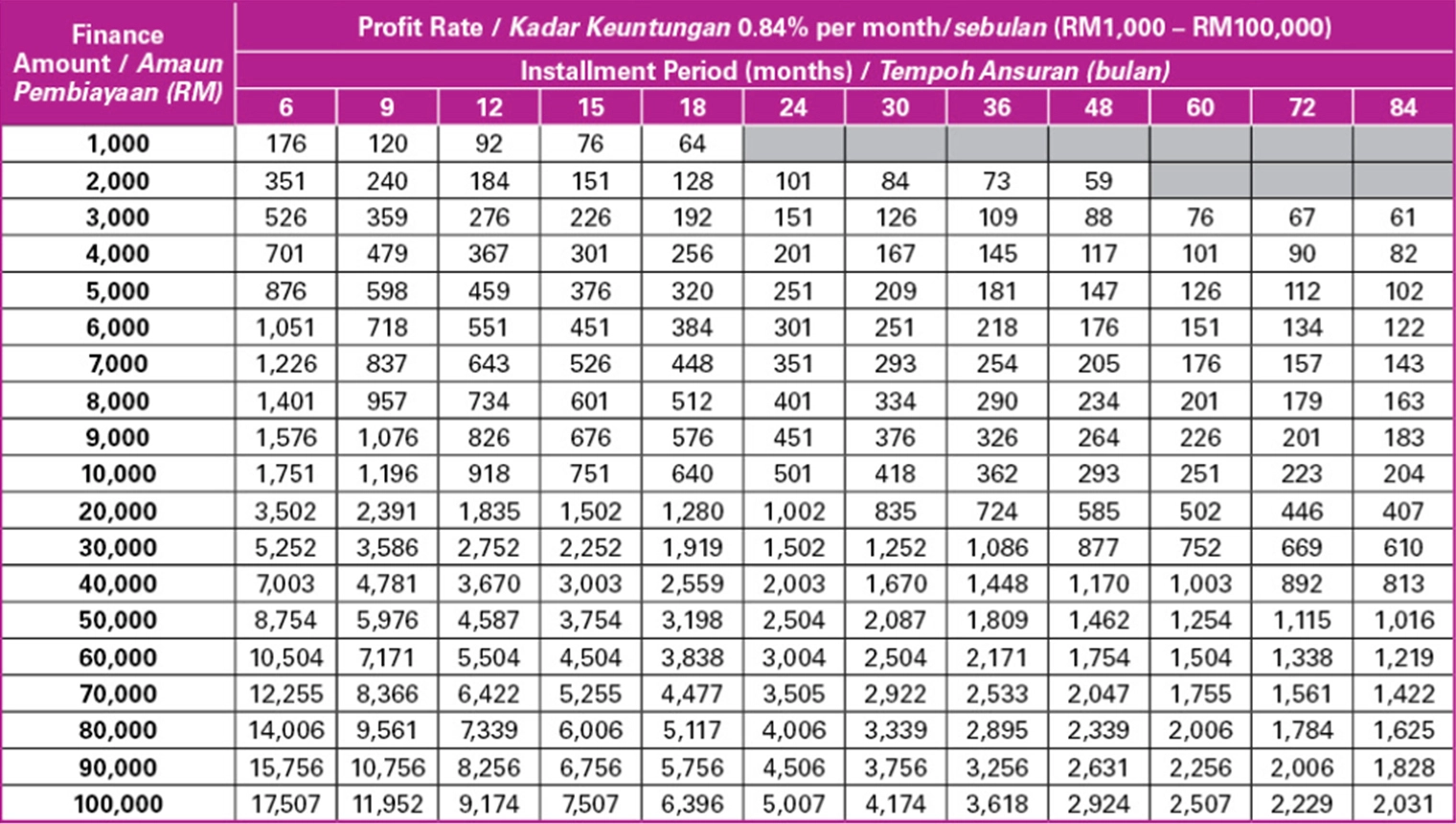

Table 4: Profit Rate 0.84% per month

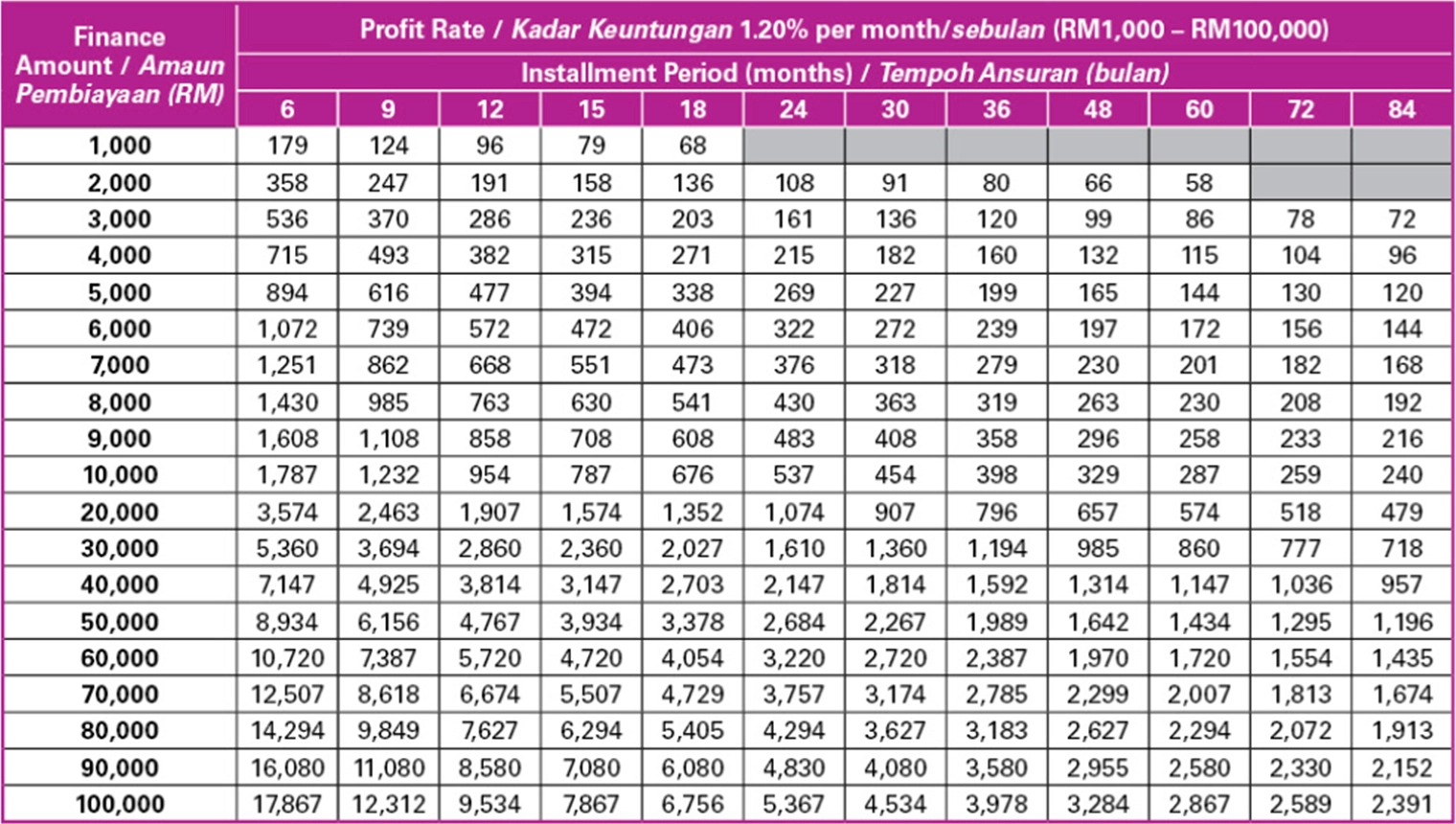

Table 5: Profit Rate 1.20% per month

Table 6: Profit Rate 1.50% per month

Please note that the actual financed amount may differ from the tables provided.

*For the profit rate, the flat rate is 0.66% per month, which is equivalent to 7.92% per year. The effective rate ranges from 13.57% to 14.31% per year.

*Alternatively, for a profit rate of 1.50% per month, the flat rate translates to 18% per year. The effective rate falls between 27.46% and 31.72% per year.

Source from: www.aeoncredit.com.my

Benefits & Features:

So you might just be asking yourself the question; “What will I be getting out of this loan?” or even thinking this loan is too good to be true, look no further than the list below of benefits and what you will exactly be getting from this aeon loan.

- With this personal loan aeon, you can even get your cash on Sundays

- Loans up to RM100,000

- You can select repayment tenure of 6, 9, 12, 15, 18, 24, 30, 36, 48, 60, 72 and 84 months

- Very easy to apply, so long as you have the appropriate documents readied on hand

- Hassle free with no guarantor, no collateral, and no security deposit needed.

Eligibility:

- First and Foremost, this aeon credit personal loan is only for Malaysian citizens

- The starting applicable age is at 18 years old, up to 65 years old can apply.

- Minimum gross income of RM1,500 required

- Minimum loan is RM1,000 up to RM100,000

Documents Required:

1) Salaried Employee

| Source of Income | Required Documents | |

| Salaried Employee | ||

| Fixed Income Earner | – NRIC Copy (Back and Front) | |

| – Latest Salary Slip (1 month) OR | ||

| – Latest EPF Statement | ||

| Variable Income Earner |

Non Commissioned Based |

|

| – NRIC Copy (Back and Front) | ||

| – Latest Salary Slip (3 month) OR | ||

| – Latest EPF Statement | ||

| Commissioned Based | ||

| – NRIC Copy (Back and Front) | ||

| – Latest EPF Statement OR | ||

| – Latest Commission Statement (6 Months) | ||

2) Self-Employed

| Source of Income | Required Documents | |

| Self-Employed | ||

| Self-Employed | – NRIC Copy (Back and Front) | |

| – Company Business Registration Certificate (ROC or ROB) & any of the supporting documents: | ||

| – Latest Company Principle Current Account Statement (6 Months) OR | ||

| – Latest Updated Bank Saving Account Passbook / Bank Statement OR | ||

| – Latest Updated BE/E Form & Tax Payment Receipt | ||

Fees and Charges:

For this aeon loan there are three types of fees that need to be paid:

Processing Fee

- 4% of the financing amount ≤ RM10,000

- 2% of the financing amount > RM10,000

- Maximum fee is capped at RM400

Stamp Duty

- 0.5% of the total amount

Wakalah Fee

- RM10.60 (Inclusive of 6% SST)

Early Termination Fee

- None

Late Penalty Fee

- Subject to restrictions and limitations, prices range from RM18 to RM40.

*The client is responsible for any relevant taxes (if any). Please visit www.aeoncredit.com.my for further information.

*Tips: To learn and know more about what other Best Personal Loans in Malaysia with Low Interest Rates, click here to read at BizTech Community now!