Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

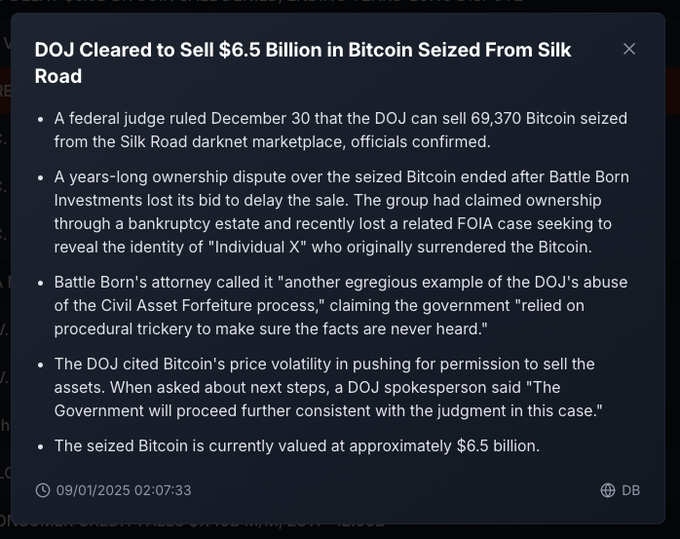

The US government has received official permission to sell approximately 69,370 Bitcoin (BTC) seized from the online black market, Silk Road. The move marks an important chapter in the handling of cryptocurrencies obtained through cybercriminal activity. The value of the confiscated Bitcoin is estimated at US$6.5 billion based on current market prices.

Legal Basis and Rationale Behind the Sale

The federal court issued this landmark decision in late December 2024. Citing information revealed by a trusted source in the crypto world, db, the court granted the Department of Justice (DOJ) ‘s request to auction the digital assets. One of the main considerations was Bitcoin’s high price volatility.

The US government argued that Bitcoin’s highly volatile value has the potential to cause financial losses if not immediately cashed out. Therefore, this sale is seen as a strategic step to optimize the value of confiscated assets.

Interestingly, this sales license was issued shortly after the inauguration of the new US administration. Before taking office, the new administration promised not to sell confiscated Bitcoin. However, the policy changed to maintain the country’s financial stability.

Flashback: Bitcoin Seizure from Silk Road

The Bitcoin to be auctioned was originally confiscated from an individual known as “Individual X” in 2020. The individual managed to scoop up Bitcoin through exploiting security loopholes on Silk Road, an online black market known for dealing illegal goods such as drugs.

Through cooperation with the government, “Individual X” eventually handed over all of his ill-gotten Bitcoin to US authorities.

In March 2023, the US government sold around 9,861 Bitcoins from confiscating the same case. The sale raised more than US$215 million, then allocated to the state treasury. Now, the government plans to sell the remaining confiscated Bitcoin in stages.

Preparation for the Auction: Transfers and Legal Verdicts

In July 2024, the US government transferred 29,800 Bitcoins to an unidentified wallet. This move led to widespread speculation that the government was preparing to sell the assets.

This speculation was reinforced by a Supreme Court decision in October 2024, which rejected an appeal regarding the ownership of these confiscated Bitcoins. The rejection of the appeal allowed the US government to conduct a full sale.

The total value of the assets up for auction reached more than US$4.4 billion, making this one of the largest crypto asset auctions ever recorded. The proceeds from the sale will later be used to fund various national projects and pay off several state obligations.

Impact on Crypto Market: Between Potential Shock and Debate

This massive Bitcoin sale is predicted to impact the global crypto market significantly. The influx of an ample supply of Bitcoin can affect prices, especially if sales are made quickly.

However, some analysts believe the government will gradually regulate sales to minimize market turmoil.

On the other hand, the US government’s move has sparked a heated debate within the crypto community. Some argue that confiscated Bitcoin should be kept as a strategic reserve asset, given its potential value and bright future.

Others, however, support this move as an effective way to utilize assets previously associated with criminal activity.

The US Government’s View on Digital Assets

As the crypto market grows, the US government appears to be taking a more proactive approach to managing digital assets. This sale also reflects the government’s policy of handling crypto assets firmly and transparently.

This move confirms that assets confiscated from illegal activities are stored and utilized to benefit the country.

With Bitcoin’s value continuing to rise, this sale is a historic moment in the government’s management of digital assets. This decision shows the law’s firmness in combating cybercrime and reflects the government’s adaptation to the modern financial world, which increasingly relies on blockchain and crypto technology.