Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The cryptocurrency market ignited on Wednesday, August 13, 2025, with altcoins leading a powerful rally that outpaced Bitcoin’s modest gains. Ethereum (ETH) soared to $4,625, up 7% in 24 hours and 27% over the week, while Solana (SOL) stole the spotlight with a 12% jump to $199, according to CoinGecko. Cardano (ADA) and Chainlink (LINK) followed with 8–9% gains, pushing the daily crypto market capitalization up 2% to $4.1 trillion. While Bitcoin (BTC) lingered at $119,500 with less than 1% growth, three key factors—institutional capital inflows, expectations of U.S. Federal Reserve rate cuts, and pro-crypto political sentiment—are fueling this altcoin boom, offering opportunities and risks for Indonesia’s 15.85 million crypto investors.

1. Surge in Institutional Capital Inflows

A tidal wave of institutional money is driving altcoin prices, particularly for major players like Ethereum and Solana. Data from Farside Investors shows U.S.-based Ethereum spot ETFs recorded a record-breaking $1.01 billion in daily inflows on August 11, 2025, when ETH traded at $4,300, followed by $524 million the next day. This marks a potential weekly inflow of $2 billion, a first for Ethereum ETFs and a sign of growing institutional confidence. Unlike past cycles dominated by retail speculation, this rally reflects strategic bets by institutions viewing altcoins as hedges against fiat currency risks.

Solana, too, is gaining traction, with analysts anticipating ETF approvals for SOL, XRP, and even meme coins like Dogecoin. Indonesia’s crypto market, with Rp224.11 trillion in transactions by June 2025, mirrors this global enthusiasm, though local investors are limited to platforms like Indodax and Pintu due to regulatory constraints.

2. Expectations of Federal Reserve Rate Cuts

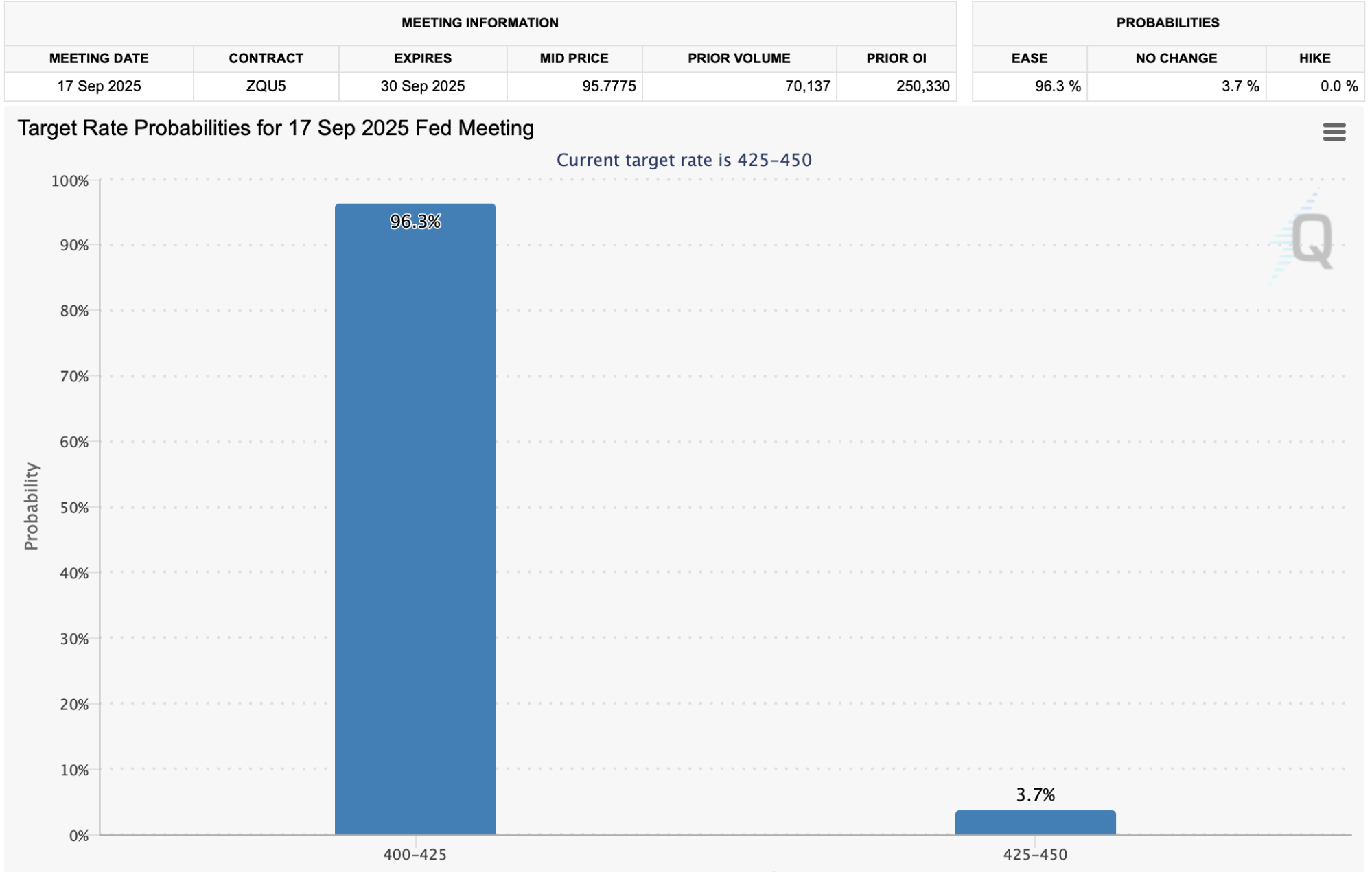

Macroeconomic tailwinds are amplifying altcoin gains. The latest U.S. Consumer Price Index (CPI) data, released August 12, 2025, showed annual inflation at 2.7%, below the expected 2.8%. Revised employment figures, down 258,000 for May–June, further stoked expectations of a Federal Reserve rate cut in September, with markets pricing in an 82.5% probability, per CME FedWatch. U.S. Treasury Secretary Scott Bessent’s push for a 50-basis-point cut has added political momentum, signaling looser monetary policy that favors riskier assets like cryptocurrencies.

Lower interest rates reduce the appeal of fixed-income assets, driving capital toward volatile but high-potential altcoins. Ethereum’s 27% weekly surge and Solana’s climb to $199 reflect this dynamic, as investors chase growth in a low-yield environment. In Indonesia, where the OJK monitors crypto’s volatility risks, this global optimism could spur local interest, though Bank Indonesia’s payment ban limits direct impact. As X user “Rate cut bets are fueling altcoin fire—ETH could hit $5,000 if the Fed delivers.”

3. Pro-Crypto Political Sentiment in the U.S.

President Donald Trump’s August 7 executive order, directing regulators to explore crypto inclusion in 401(k) retirement plans, has ignited market optimism. The move, targeting a $12.5 trillion market, signals unprecedented retail access to digital assets via regulated retirement schemes. While still in early stages, the directive—coupled with the GENIUS Act for stablecoin regulation—has bolstered confidence in altcoins, particularly Ethereum, which dominates over 50% of the stablecoin market.

Also Read: Trump’s Executive Order Opens $12.5 Trillion 401(k) Market to Crypto Investments

This political tailwind aligns with broader U.S. pro-crypto sentiment, including proposals for a Bitcoin reserve. For Indonesia, where Vice President Gibran Rakabuming Raka recently discussed Bitcoin as a reserve asset, the U.S. move could inspire regulatory evolution, though the OJK’s cautious stance tempers immediate adoption. The contrast between U.S. policy momentum and Indonesia’s restrictive framework underscores the global divide in crypto integration.

Opportunities and Risks for Investors

The altcoin rally, led by ETH and SOL, presents opportunities for Indonesia’s crypto community, but volatility remains a concern. Leverage in the market is rising, with open interest in ETH futures up 15% week-on-week, per CoinGlass, signaling potential for sharp corrections if momentum fades. The OJK’s emphasis on risk management, echoed by U.S. fiduciary concerns for 401(k) plans, urges caution. Local investors should leverage regulated platforms and set clear stop-loss strategies to navigate potential pullbacks.

Analysts see Ethereum targeting $5,000–$6,400 if it holds above $4,000, while Solana could breach $200 with ETF approval momentum. However, a failure to sustain key supports—$4,000 for ETH, $180 for SOL—could trigger declines. Altcoin pumps are hot, but leverage is spiking—watch for profit-taking.

A New Altcoin Dawn?

This week’s altcoin surge, driven by institutional inflows, Fed rate cut expectations, and pro-crypto U.S. policies, marks a pivotal moment for the market. Ethereum and Solana’s gains, outpacing Bitcoin’s, reflect a maturing crypto landscape where altcoins are gaining institutional legitimacy. For Indonesia, this global rally fuels optimism, though regulatory hurdles demand a measured approach. As the market eyes a potential $2 billion weekly ETF inflow, the altcoin boom could redefine crypto’s role in global finance—but only for those who tread carefully.