Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The Santa Claus Rally Phenomenon in the Crypto World: Will Bitcoin Experience a Price Spike This Year?

Every year-end, the crypto world is often enveloped in a phenomenon known as the Santa Claus Rally, during which the price of Bitcoin (BTC) tends to rise significantly. This phenomenon is a hot topic among investors, especially as the holiday season approaches.

But does this rally happen every year? What factors influence Bitcoin’s price movements during this period? This article will examine the Santa Claus Rally in the context of Bitcoin and discuss what investors can expect this year.

What is the Santa Claus Rally?

A Santa Claus rally refers to the tendency of asset prices—including Bitcoin—to rise at the end of the year, especially between the last week of December and early January. This phenomenon is better known in the traditional stock market, but lately, it has also been seen in the crypto market.

There are several underlying reasons for this phenomenon. First, many investors sell their assets at the end of the year to take advantage of tax deduction strategies. By selling loss-making assets, they can reduce their tax burden. However, high optimism during the holiday season also encourages more people to buy assets, including Bitcoin. This optimism often leads to lower trading volumes, but prices still tend to rise.

Factors Affecting the Santa Claus Rally

1. Window Dressing

One factor contributing to the Santa Claus Rally is the window-dressing strategy implemented by fund managers. At the end of the year, they try to spruce up their portfolios to make them look better in the eyes of investors. This could involve buying strong assets like Bitcoin to show positive results in their annual reports.

2. Lower Trading Volume

Towards the end of the year, many investors and traders take a sabbatical to celebrate the holidays, leading to lower trading volumes. In situations with low trading volumes, price movements tend to be more volatile and easily influenced by large amounts of buying or selling. Therefore, the price of Bitcoin can quickly spike or drop due to just a few transactions.

3. The January Effect

This phenomenon is also related to the January Effect, where prices of stocks and other assets tend to rise at the start of a new year. New investors often put their funds into the market after the new year, pushing the prices of assets like Bitcoin to rise.

Historical Analysis of Bitcoin’s Santa Claus Rally

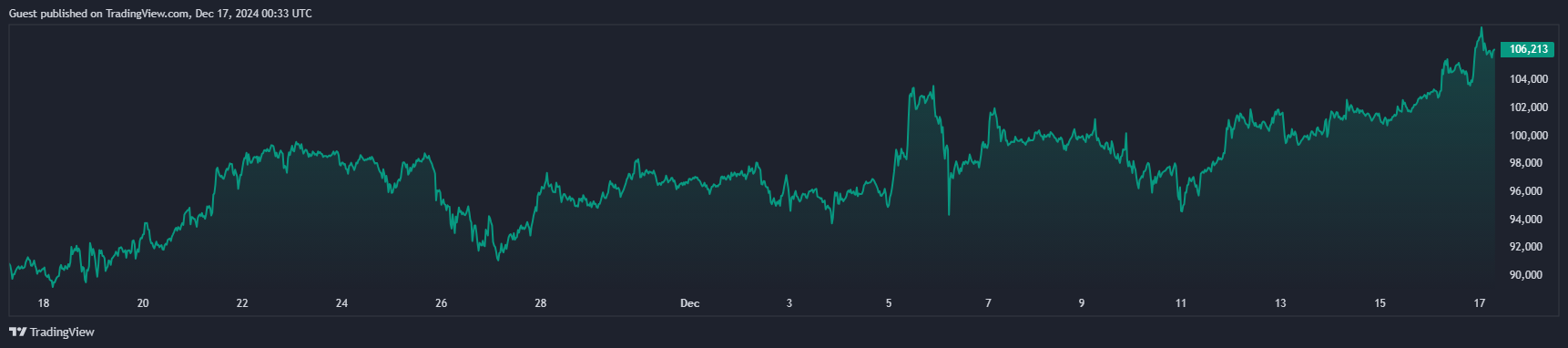

Bitcoin’s price rallied almost 5% on Dec. 15 to a new all-time high above $106,000, sparking speculation that it may become a United States reserve asset.

Looking at historical data, we can see that this phenomenon occurs frequently in the Bitcoin market. Bitcoin’s Santa Claus rally usually starts in the last week of December and continues into early January. However, while the price of Bitcoin often rises during this period, it is not always predictable.

Technical analysis plays an important role in this case. Buy signals appear when indicators show that the Bitcoin price is in an uptrend, while sell signals appear when there are signs that the price will fall. Therefore, investors must monitor the charts closely and conduct market analysis before making investment decisions.

Catalysts Supporting the Santa Claus Rally

In addition to seasonal factors, several catalysts, including government policies and regulations, can amplify Bitcoin’s price movements at year-end. For example, in 2024, Donald Trump, elected US President, hinted that he wanted to make Bitcoin part of the US national strategic reserve, similar to the oil reserve.

In an interview, Trump stated that the United States does not want to be left behind in the crypto sector and will strive to keep the country at the forefront of technology and digital finance. This plan could be the main catalyst that pushes the price of Bitcoin to higher levels.

Not only that, but Jack Mallers, CEO of Strike, also mentioned in a podcast with YouTuber Tim Pool that Trump will most likely issue an executive order early in his administration designating Bitcoin as a national reserve. If this materializes, it will certainly have a positive impact on the price of Bitcoin.

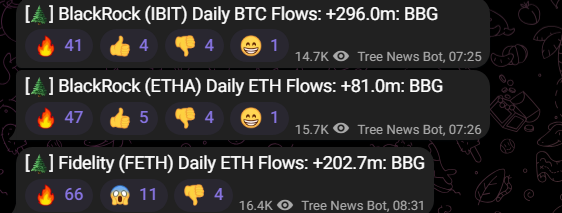

In addition, BlackRock, one of the world’s largest asset management companies, continues to accumulate Bitcoin through ETFs (Exchange-Traded Funds). This suggests that more institutional capital flows into the Bitcoin market, potentially increasing demand and price.

For Bitcoin investors, the Santa Claus Rally phenomenon offers opportunities for short-term gains. However, as with all investments, it’s important to stay aware of high volatility. While there are great opportunities for profits, there are also risks to consider.

Investors must carefully analyze and identify potential catalysts that could affect the market and adapt their investment strategies to changing market conditions.

Conclusion: Will Bitcoin’s Santa Claus Rally Happen This Year?

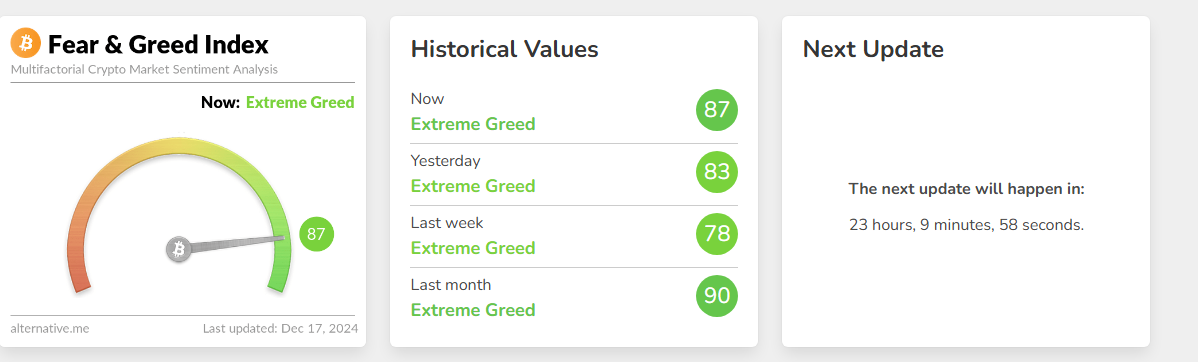

Looking at historical data and the factors affecting the market, it is likely that the Bitcoin Santa Claus Rally phenomenon will happen again by the end of this year. Catalysts such as pro-crypto government policies, increased institutional interest, and seasonal factors such as holiday optimism and low trading volumes could potentially support Bitcoin’s price rise.

However, keep in mind that the crypto market is very dynamic and can be very volatile. Therefore, it is important for investors to remain cautious and conduct thorough research before making investment decisions. If all these factors favoring a rally come to pass, then we could see Bitcoin experience a significant price spike by the end of this year.