Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The Singapore-based crypto exchange BingX is reported to have fallen victim to a security incident that resulted in the loss of digital assets worth approximately IDR 651 billion (equivalent to US$43 million).

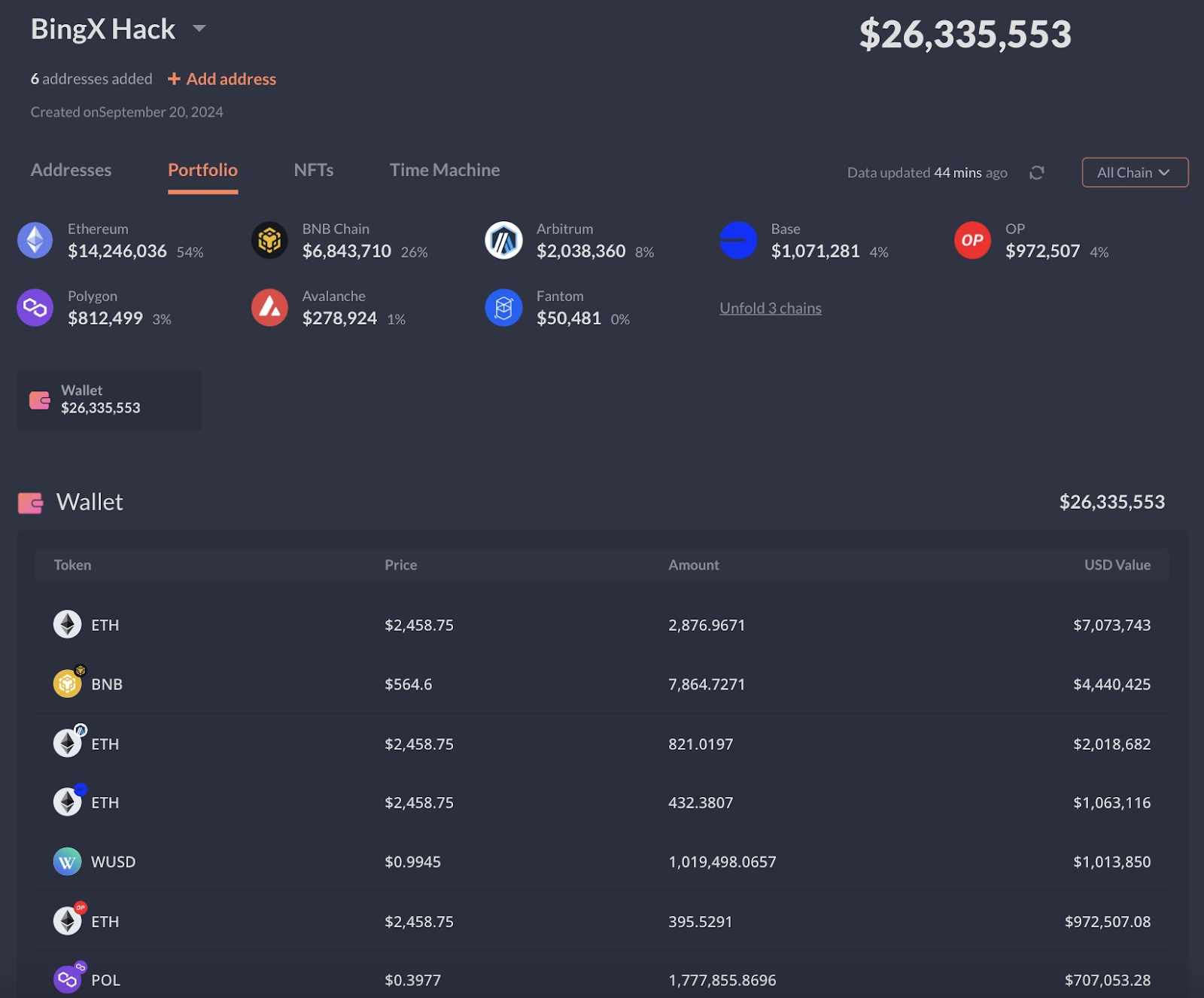

On Friday (September 20, 2024), PeckShield, a blockchain security specialist firm, identified suspicious activity on the BingX platform. They observed a large number of cryptocurrency transfers to several unknown wallet addresses.

Initial estimates indicate a loss of around $26.3 million. However, after a more in-depth analysis, PeckShield revealed an additional fund diversion amounting to $16.5 million. As a result, the total losses experienced by BingX ballooned to US$43 million. Various types of crypto assets have been affected by this incident, including Ether (ETH), Binance Coin (BNB), Polygon (MATIC), Arbitrum (ARB), and Avalanche. (AVAX).

BingX Hot Wallet Becomes a Primary Target for Hackers

In response to the incident, Vivien Lin, Chief Product Officer of BingX, admitted that their technology team discovered the unusual network access on September 20 at around 04:00 Singapore time. Lin emphasized that the financial impact of this incident was minor and did not significantly disrupt BingX’s operations.

“We have a multi-layered asset management system in place to keep user funds safe. Most assets are stored in cold wallets, while only a small portion is placed in hot wallets for withdrawal purposes,” Lin explained.

As a precautionary measure, BingX has suspended withdrawal services and moved remaining assets to a more secure location. System maintenance is currently underway and is expected to be completed in around 24 hours.

Lin also emphasized BingX’s commitment to compensate for losses incurred using the company’s internal funds. He assured that users’ assets will remain safe and secure.

Asia has become target for Hackers in recent times

About a week after one of the largest exchanges in Indonesia, Indodax, was hacked, BingX also felt the same way. Where the losses they experienced reached US $ 22 million. If we look at recent hacks, it seems that hackers are targeting exchanges with high liquidity and volume as well as a lot of user growth.

While regulatory frameworks have been put in place for various digital asset trading platforms, it is undeniable that the security standards set by regulatory bodies often lag behind the development of increasingly sophisticated attack tactics. Even exchanges that operate under strict oversight still face the risk of hacking, especially as operational needs require them to keep some funds in internet-connected hot wallets to maintain liquidity.

Without significant improvements in security protocols, crypto trading platforms will continue to be easy targets for cybercriminals. The implementation of more comprehensive protection strategies, such as wider use of cold wallets and asset protection backed by insurance schemes, is crucial to mitigate this risk.

Also Read: Best Cold Wallet in 2024

In an evolving digital landscape, innovation in security must go hand in hand with innovation in blockchain technology itself. Only with a holistic approach to security, incorporating cutting-edge technology, adaptive regulation, and industry best practices, can crypto trading platforms provide a safer environment for their users.