Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

JPMorgan Chase & Co. is planning to allow its trading and wealth management clients to use cryptocurrency-linked exchange-traded funds (ETFs) as collateral for loans.

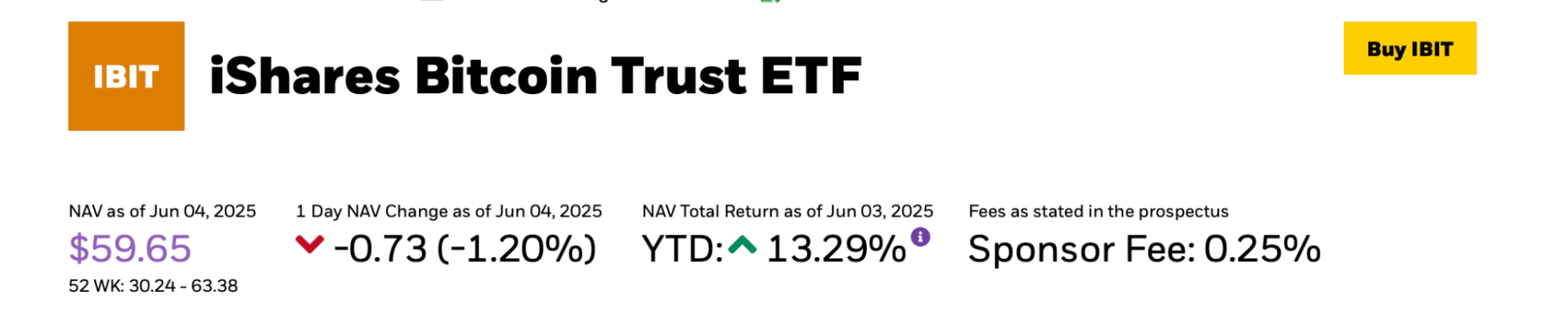

The plan will start with BlackRock’s iShares Bitcoin Trust (IBIT), which is the largest spot Bitcoin ETF in the U.S. and has over $70.1 billion in net assets, according to Sosovalue.com.

The move by JPMorgan goes beyond loan collateral. The bank will also look at clients’ bitcoin holdings when figuring out how much money they can borrow. It will consider digital assets like equities or bonds when doing this. T

This approach shows that more and more people see cryptocurrencies as a real part of a client’s financial portfolio, which is in line with the expanding use of digital assets in the mainstream.

A History of Being Careful with Crypto

JPMorgan’s move into crypto-linked services isn’t completely new. The bank showed an early interest in blockchain technology by releasing JPM Coin in 2020. This stablecoin is tethered to the dollar and is used for institutional transactions. JPMorgan revealed in 2024 that it owned shares in several spot Bitcoin ETFs.

This was another hint that the company is strategically interested in the crypto industry, even though its officials have publicly expressed doubts about it.

Jamie Dimon, the CEO of JPMorgan, has long been sceptical of cryptocurrencies. He famously compared investing in Bitcoin to smoking.

Dimon said in May 2025, “I wouldn’t personally invest in Bitcoin, but I support your right to do so, just as I support your right to smoke.”

Even though he didn’t agree with it, Dimon said that JPMorgan would soon let clients buy Bitcoin. This shows a practical way to accommodate client demand in a market that is changing quickly.

This duality—public caution combined with strategic engagement—illustrates a prevailing tendency among conventional financial firms.

Changes in the rules under the Trump administration

JPMorgan’s decision comes at a time when US laws are becoming more lenient towards cryptocurrencies. The Trump administration has made it easier for banks to deal with digital assets.

The Federal Reserve changed its mind in April 2025 and said banks they could participate in crypto and stablecoin activity. In the next month, the U.S. Office of the Comptroller of the Currency made it clear that banks could hold crypto assets for clients. This gave financial institutions more information and support as they entered the field.

Also, in May 2025, reports came out that big U.S. banks including JPMorgan, Bank of America, Wells Fargo, and Citigroup were looking into making a joint crypto stablecoin on the Ethereum network.

People in the crypto community are excited about this project, but they are also worried about centralisation because banks might have a lot of power over transactions, which could go against the decentralised nature of cryptocurrencies.

The Trump administration has made the crypto industry even stronger by saying it will create a strategic Bitcoin reserve and a stockpile of digital assets. The goal of these projects is to make the U.S. a leader in the global crypto economy.

The administration is also pushing for stablecoin legislation in the Senate. This might make the legal framework for digital currencies clearer and make banks more likely to use them.

Implications for the Industry and the Market

JPMorgan’s acceptance of crypto ETFs as loan collateral shows a bigger change in the financial system, as traditional banks aim to make money off of the surging popularity of digital assets.

For example, BlackRock’s iShares Bitcoin Trust has become a popular way for investors to get into Bitcoin without actually owning the cryptocurrency. The ETF’s performance and the recent rise in Bitcoin’s price, which hit $111,000 in May 2025, have made people more interested in crypto-linked financial products.

Other big institutions are also looking into crypto projects. According to posts on X, banks including Bank of America, Wells Fargo, and Citigroup are thinking about working together to establish a stablecoin.

This shows that they are all working together to make digital assets a part of traditional financial systems.

But these changes have caused a lot of talk in the crypto world. Some people are worried that stablecoins backed by banks could go against the decentralised ideas of blockchain technology.

What Comes Next

As JPMorgan is ready to launch its crypto ETF collateral program, this step is expected to set a standard for other banks.

The bank is bridging the gap between traditional financing and the growing crypto sector by considering digital assets as real collateral and including them in wealth evaluations.

This change, together with positive changes in regulations under the Trump administration, implies that cryptocurrencies are becoming a key part of the world’s financial system.

But there are still problems to solve. Digital assets are quite unstable, and there are worries about centralisation and unclear rules, which could make it harder for them to be used in regular banking.

As the industry deals with these problems, JPMorgan’s newest project shows how important it is for traditional finance and cryptocurrencies to come together, which will have effects on investors, regulators, and the market as a whole.