Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Amid ongoing global economic turmoil, traditional companies are beginning to look for safe havens outside of conventional assets. Kitabo Co., Ltd., a Japanese textile company with over a century of history, has recently announced a bold move: adding Bitcoin to its reserve assets.

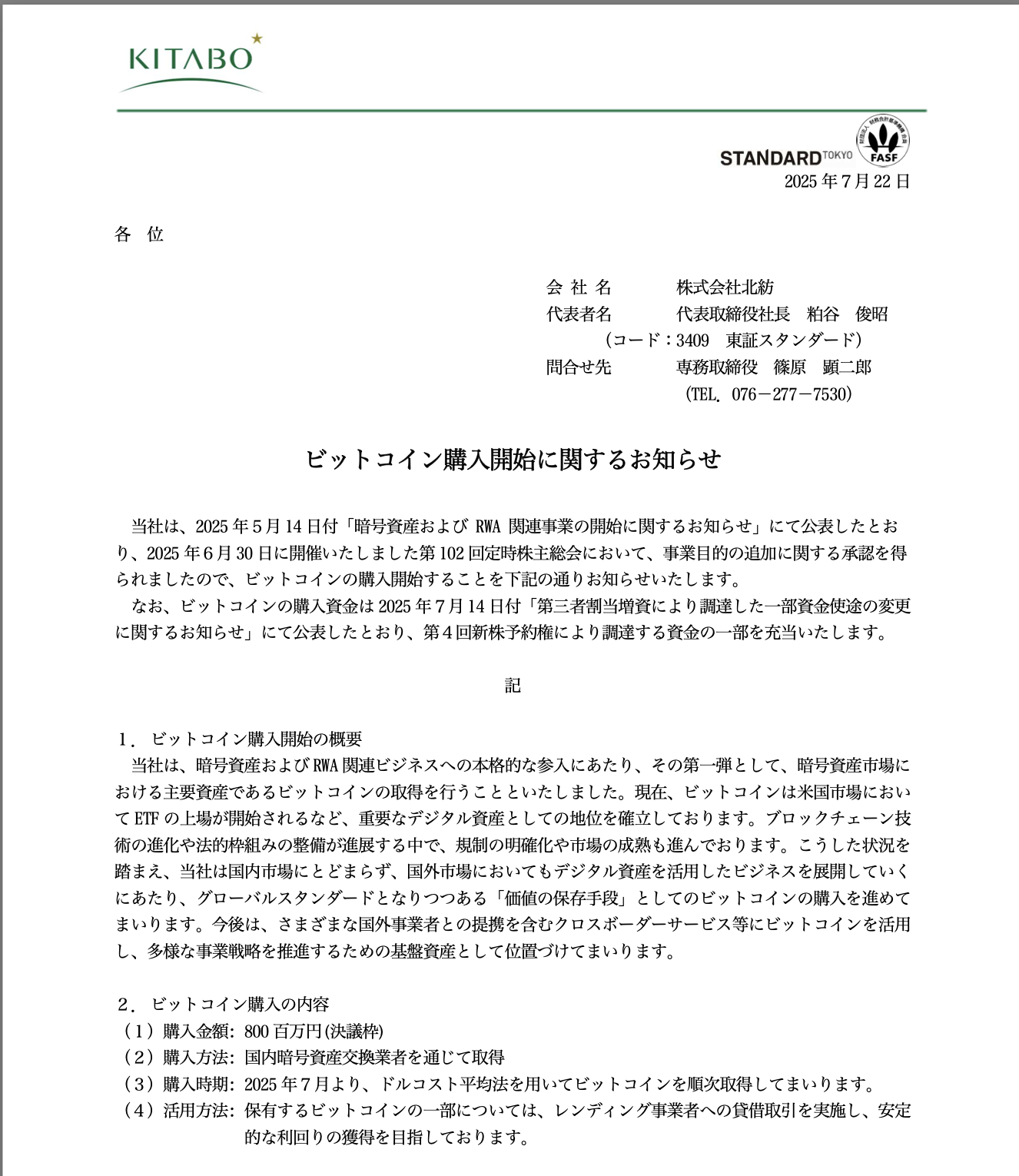

With an allocation of up to ¥800 million (approximately $5.4 million), Kitabo is not only aiming to stabilize its finances after years of cash flow pressures and operational losses but also signaling a strategic shift toward cryptocurrency and Real World Assets (RWA). I’ve been following this trend since the beginning, and it reminds me of how companies like Tesla started—a move that was initially controversial but ultimately proved visionary. According to Kitabo’s official statement on July 22, 2025, the Bitcoin purchases will be made gradually through a Dollar-Cost Averaging (DCA) strategy, starting this month.

This approach minimizes volatility risk by purchasing assets regularly, regardless of price fluctuations. “We view Bitcoin as a reliable store of value amid inflation and yen depreciation,” a Kitabo representative said in their announcement, as reported by CryptoPotato. The company reported a net loss of ¥55.8 million ($379,357) in 2025, despite a 24.7% increase in revenue, highlighting the urgent need for diversification. Beyond serving as a reserve, Kitabo plans to use Bitcoin for cross-border business expansion, including international collaborations where Bitcoin functions as a “fundamental asset.”

They are also preparing a crypto lending scheme, lending out some of their BTC for fixed returns—a tactic that is growing in popularity for generating yield without selling the underlying asset. This move is not entirely surprising. Kitabo, which focuses on textiles and recycling, faces challenges similar to other traditional industries: rising raw material costs, global competition, and weakening fiat currencies.

With Bitcoin rebounding to $118,000 after a major sell-off, the timing seems right. Analysts from Phemex note that “such a rally could fade if not supported by long-term fundamentals,” but for Kitabo, this is a long-term hedge.

Kitabo’s Strategy: From DCA to Crypto Lending

Kitabo isn’t the first company to turn to Bitcoin for financial stabilization, but its approach feels more measured. With DCA, it avoids risky large purchases, as some companies have done in the past. Data from Finway shows purchases began in July 2025 through a local Japanese exchange, ensuring regulatory compliance.

Additionally, plans to lend BTC to verified entities could generate fixed yields, similar to how institutions like Block use crypto assets for passive income.

I see this as a direct response to the yen’s depreciation, which has weakened significantly against the US dollar. Bitcoin, with a market capitalization of $2.34 trillion, offers an alternative not tied to national monetary policy.

However, there are risks: Bitcoin’s volatility could exacerbate losses if the market declines further.

Kitabo reported a loss of ¥115.6 million ($785,000) in fiscal 2024, so this move must be balanced with strict risk management. On X, the crypto community is buzzing about this, with one user calling “Kitabo isn’t hype; it’s enterprise blockchain utility like Boeing.”

Follow in the Footsteps of Metaplanet and Other Asian Companies

Kitabo isn’t the first in Asia. Metaplanet, another Japanese company, has become the largest corporate Bitcoin holder in its country with 16,352 BTC worth $1.93 billion, ranking seventh globally according to BitcoinTreasuries.

They recently purchased 797 BTC in July 2025 at an average price of ¥17.31 million ($117,451), bringing the total to 16,352 BTC. Metaplanet CEO Simon Gerovich said the company aims to reach 30,000 BTC by the end of 2025 and triple that by 2026.

This trend is spreading to other parts of Asia. HK Asia Holdings Limited from Hong Kong purchased Bitcoin in February 2025 as a hedge, with a total of 28.9 BTC by March. They purchased an additional 10 BTC in March, funded from internal cash reserves. DigiAsia Corp, an Indonesian fintech company, launched a Bitcoin treasury strategy in May 2025, with $5 billion flowing into an ETH-related ETF. They secured $3 million in non-recourse debt to begin purchases in Q3 2025, part of a $100 million treasury plan. “DigiAsia is focused on minimizing direct financial risk through non-recourse debt,” said an analyst from AInvest.

On X, discussions are buzzing: “Kitabo is joining the Asian wave using Bitcoin as treasury,” said one user. Quantum Solutions, a Japanese AI company, has launched a $350 million Bitcoin treasury for 3,000 BTC.

Bitcoin Adoption as a Treasury Asset in Asia

Corporate Bitcoin adoption in Asia is growing rapidly, with over 50 Japanese companies—including banks and manufacturers—holding cryptocurrency. In Q2 2025, companies purchased 134,456 BTC, up from the previous quarter. Asia is joining the global trend, where companies like MicroStrategy (now Strategy) hold 582,000 BTC.

| Company | Country | BTC Holdings | Value USD (Million) |

|---|---|---|---|

| Metaplanet Inc | Japan | 16.352 | 1.931 |

| Next Technology Holding Inc. | China | 5.833 | 689 |

| Boyaa Interactive International | Hong Kong | 3.350 | 396 |

| BITFUFU | Singapore | 1.709 | 202 |

| HK Asia Holdings | Hong Kong | 29 | 3 |

Source: BitcoinTreasuries.net

This trend is driven by a weak yen and global uncertainty, with companies like Kitabo seeing Bitcoin as a “hedge against fiat weakness.” However, scam risks are rising, as warned by Brad Garlinghouse of Ripple.

Overall, adoptions like Kitabo’s mark Bitcoin’s maturation as a corporate asset. With ETF inflows and supportive regulations, Asia could become the next hub. But investors should remain cautious: volatility persists, and diversification is key.