Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The company that makes the USDC stablecoin, Circle Internet Financial, went public on the New York Stock Exchange (NYSE) on June 5, 2025, with the ticker CRCL.

This was a big deal. The initial public offering (IPO) wasn’t only a financial success; it was also a bold declaration that stablecoins, which used to be a small part of the crypto world, are now ready to change the way money works throughout the world.

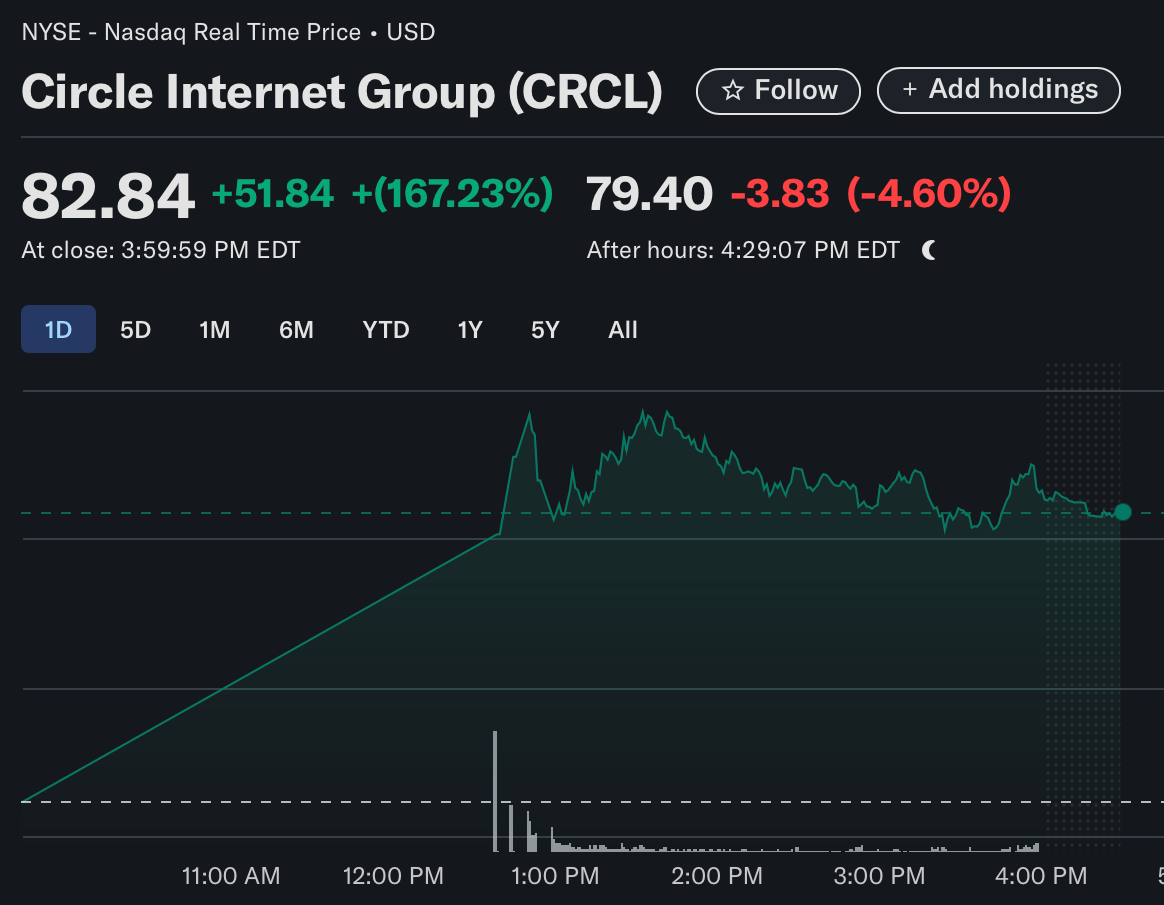

Circle’s arrival into Wall Street has caused a lot of excitement and debate about the future of digital money. Shares soared 167% on their first day, ending at $82 after reaching a high of $103.75.

A Great Start

The IPO for Circle was a show. The corporation sold 34 million shares for $31 each, which brought in $1.1 billion—$200 million more than its original goal of $896 million.

This price was higher than the projected range of $27 to $28, which shows how much investors wanted it.

Bloomberg says that by the end of the first day of trading, Circle’s market value was $18.5 billion and its fully diluted value was $22.1 billion.

The finance card above shows that CRCL is currently worth $115.25 and has a market cap of $18.52 billion. This shows that it is still gaining ground.

The IPO was oversubscribed by 25 times the available shares, which shows that more people are interested in stablecoin enterprises.

A lot of this excitement was caused by big institutions like BlackRock, which bought a 10% interest, and ARK Invest, which bought 4.48 million shares worth $373.4 million.

Their participation indicates that traditional finance (TradFi) is no longer merely experimenting with crypto; it is fully immersing itself.

USDC: The Stablecoin Powerhouse

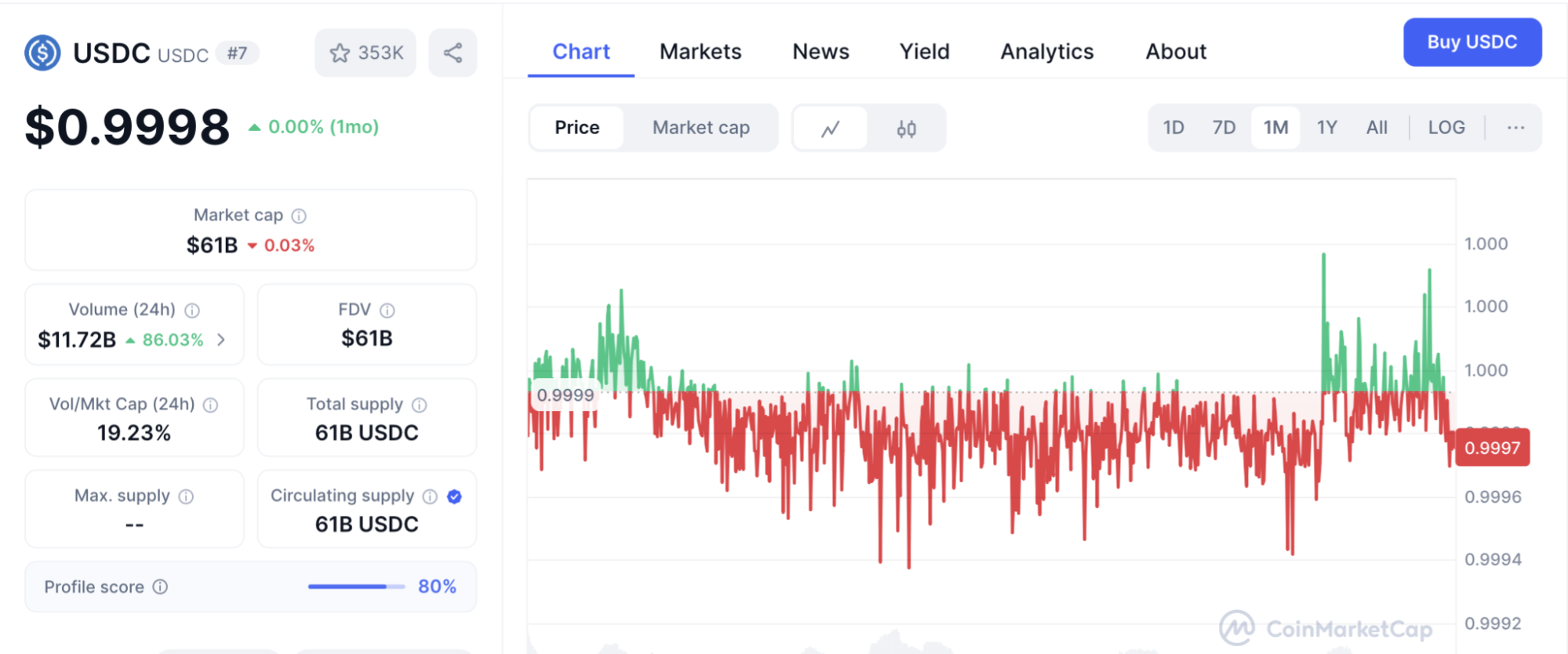

As of June 2025, USDC, Circle’s most valuable coin, is the second-largest stablecoin in the world, with a market worth of $61.5 billion.

Tether is the only coin that is bigger. Since it came out in 2018, USDC has made it possible for more than $25 trillion in on-chain transactions.

This has made it a key part of decentralized finance (DeFi) and blockchain ecosystems. The value of USDC is tied to the U.S. dollar, which makes it more stable than other cryptocurrencies that are based on speculation. This makes it appealing to both retail and institutional users.

Read also : Ripple VS Coinbase: Who Will Win Control Over the USDC Stablecoin

The company’s finances make it more appealing. The company made $578.57 million in revenue and $64.79 million in net profit in Q1 2025.

This was a big jump from Q1 2024, when it made $365.09 million in revenue and $48.64 million in profit. This growth shows that USDC is becoming more popular for payments, remittances, and DeFi apps, making Circle the leader in the $3 trillion stablecoin market.

There is a lot of debate in the crypto community.

Not everyone is happy. There has been a lot of debate around Circle’s IPO, especially among early crypto investors. Jeff Dorman, Chief Investment Officer at Arca, a crypto-native company, publicly chastised Circle for giving his company only $135,000 in shares, even though it had been a long-time supporter.

In a now-deleted X post, Dorman branded the allocation a “joke” and accused Circle of prioritizing Wall Street over its crypto roots, adding, “Most of us stick together and help each other… You have come full circle.

The backlash shows how the crypto community’s belief in decentralization clashes with Wall Street’s profit-driven way of doing business.

Some experts say that Circle missed out on some money. Fortune said that if the IPO had been priced higher, it could have raised an extra $1.72 billion.

This helped Wall Street insiders who liked the first-day pop but made people who felt shortchanged angry. Even still, Circle’s stock has kept going up. Yahoo Finance reported a 22% jump in pre-market trading on June 9, briefly reaching $130.

What is next for Circle and stablecoins?

Circle’s IPO is a big deal, but there are still problems to solve. The stablecoin market is very competitive, with Tether in front and new companies trying to take its place.

Regulators are still working on finding the right balance between innovation and consumer protection, even though they are more supportive.

But Circle’s openness and adherence to U.S. rules provide it an advantage, especially if more people throughout the world start using USDC.

In the future, Circle’s success could change the way money works. Picture a future where you can use USDC to buy coffee, pay for streaming services, or settle foreign paychecks.

These things appeared impossible ten years ago, but they are now possible. One X user said, “If [Circle’s IPO] works, it could lead to other crypto IPOs and USDC being used around the world.” This could be the start of the next bull run.

Circle’s first day on the NYSE is a big deal for the company, but it’s also an indication that stablecoins are no longer just a crypto fad; they’re the basis for a better, more open financial system.