Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

As Bitcoin [BTC] crosses the $100,000 mark again, it is sparking discussions throughout the crypto space: Is this the beginning of a long-term bull run or just another temporary price increase?

Although influential players express cautious undertones about the longevity of the rise, the market is buzzing with excitement, driven by essential elements such as whale activity, institutional demand, and macroeconomic factors.

Driven by a convergence of internal and external forces, Bitcoin skyrocketed to $103,963 on May 8, 2025.

Under President Trump, a historic U.S.-U.K. trade agreement lowering tariffs on vital goods and opening the U.K. market to American products is the spur. Celebrated as a “game-changer” for world trade, this agreement generated a risk-on attitude that raised equities and cryptocurrencies equally.

Specifically, Bitcoin gained 6.5% in less than 48 hours, recovering six-figure territory for the first time since late 2024.

Macro Boost Meets On-Chain Resilience

One cannot stress the trade deal’s influence. It relaxed fiscal conditions by lowering trade tensions, fostering a rich environment for risk assets.

The market was enthused by social media posts, with several traders stating that, given the macroeconomic tailwinds, the $100K breakout was a logical decision.

While external momentum has been important, Bitcoin’s internal market structure is more intricate. With their cost basis below the present price of $103,264, 99.004% of Bitcoin addresses are currently profitable, claims Glassnode.

Just 0.996% of addresses are underwater, and those purchased above this level. Given that most holders are sitting on gains, this lopsided unrealized profit ratio implies strong market confidence.

For background, a whale paid $94,088 in a 40x leveraged position. They have unrealized gains of around $2.8 million at present rates, which is a significant incentive to hang onto for more upside.

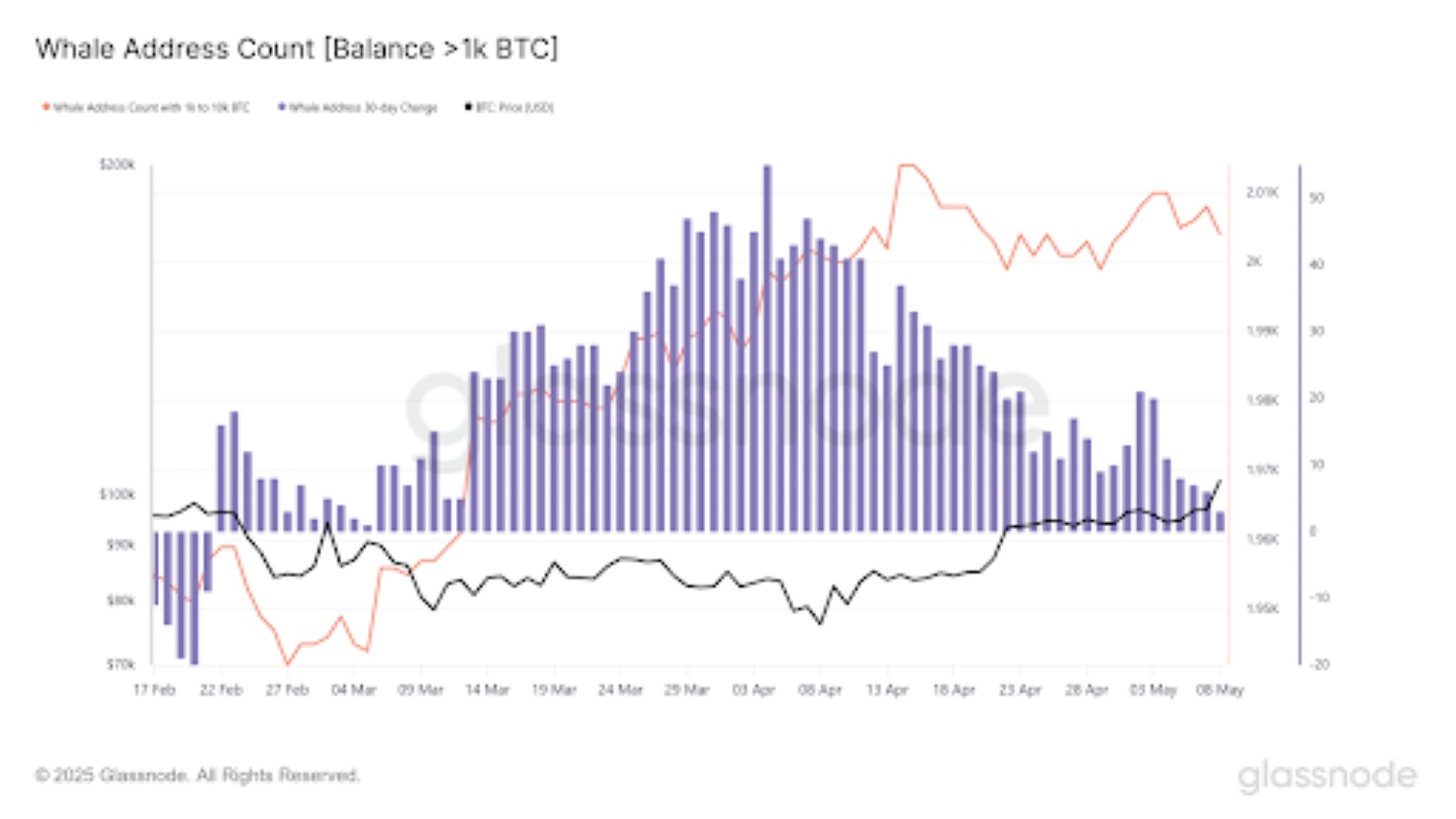

On-chain data, however, raises problems regarding the depth of the surge. Glassnode notes no notable accumulation by whales carrying more than 1,000 BTC as Bitcoin crossed $100,000. This “strategic pause” contrasts with previous stages of the march, when whales aggressively grabbed up coins.

For major holders in April 2025, for example, Glassnode’s Accumulation Trend Score touched 0.7, indicating significant purchasing as Bitcoin rebounded from $75,000 lows. The lack of whale activity indicates liquidity issues or a belief that the rally would encounter temporary opposition.

ETF Inflows and Institutional Demand Ignite Hope

Whales remain wary, but other liquid outlets are driving the surge. With $917 million recorded on May 7 alone, which pushes the three-day total beyond $1.4 billion, CryptoQuant data reveals strong spot buying and notable inflows into U.S. spot Bitcoin ETFs.

Unlike earlier demonstrations, BTC reserves on exchanges are not soaring, suggesting that institutional players and long-term holders drive new demand rather than speculative speculators. This dynamic helps sustain the story of a structurally sound march.

ETF inflows and low exchange reserves, according to some analysts, ” scream institutional conviction.” With a record-high market cap of $889 billion, up 2.1% in the past month, CryptoQuant’s latest analysis further strengthens this perspective.

Unlike the “Extreme Fear” feeling that engulfed markets in early April following Trump’s tariff announcements, this rise demonstrates consistent capital inflows and increasing investor confidence.

Whales: The Card

Despite these encouraging hints, whales remain a volatile asset. Their current prudence suggests a cautious approach, awaiting evidence of consistent movement beyond $100K.

Whale buildup has often followed significant price swings.

For instance, Glassnode’s Weekly Market Pulse in April observed a 61% surge hinted at by a breakout in momentum above the statistical high band. The absence of such certainty today points to whales preparing for a possible profit-taking cycle, which could cause volatility.

A wary whale’s approach does not always mean disaster. Though institutional inflows and spot-driven demand offer a strong basis, a linear climb to new all-time highs looks improbable.

Overhead resistance around $105,000, where sell orders could cap advances soon. Still reasonable is a correction of $95,000–$98,000, particularly if whales are holding back. This kind of retreat helps clear overleveraged positions, facilitating a better ascent.

The Highway Ahead

Though its durability rests on several moving components, Bitcoin’s $100K mark is a psychological and technological triumph. Low exchange reserves and ETF inflows underscore institutional confidence, but the U.S.-U.K. trade agreement significantly strengthens macroeconomic conditions.

But whale hesitancy adds another level of uncertainty. Should big holders start accumulating once more, Bitcoin might aim for $110,000 or more by Q3 2025.

On the other hand, extended whale inactivity runs the danger of a liquidity squeeze, which may cause a strong correction.

Although the bulls are currently in control, the market remains vulnerable.

Whale wallets and ETF movements should be keenly watched by investors since they will determine whether Bitcoin’s six-figure status is here to stay or only a stopgap.

As one X post rightly said, “$100K is the line in the sand—break it with strength, and the next $100K comes fast.”