Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Bitcoin is stirring, and the markets are on edge. After a lackluster Federal Reserve press conference on July 30, 2025, the cryptocurrency’s price took a hit, dropping to around $118,719 as the Coinbase Premium Index turned negative for the first time since late May. This shift, coupled with a hawkish tone from Fed Chair Jerome Powell, has sparked a “big move” in Bitcoin’s price, raising questions about where it’s headed next.

The Coinbase Premium Index, a key gauge of US spot demand, measures the price gap between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair. After a record 94-day streak of positive readings—reflecting robust institutional interest—the index flipped red, hinting at a cooling appetite among US buyers. This marks the end of Bitcoin’s strongest institutional demand period on record, a 62-day run that had fueled optimism. But while the negative premium suggests fading momentum, the broader picture tells a more complex story.

Selling Pressure Meets Underlying Strength

On-chain data paints a nuanced scene. Analyst Boris Vest notes that Bitcoin’s taker buy/sell ratio has dipped to 0.9, signaling increased selling from market makers. Yet, despite this aggression, Bitcoin holds firm above $115,000, suggesting larger passive buyers are absorbing the pressure.

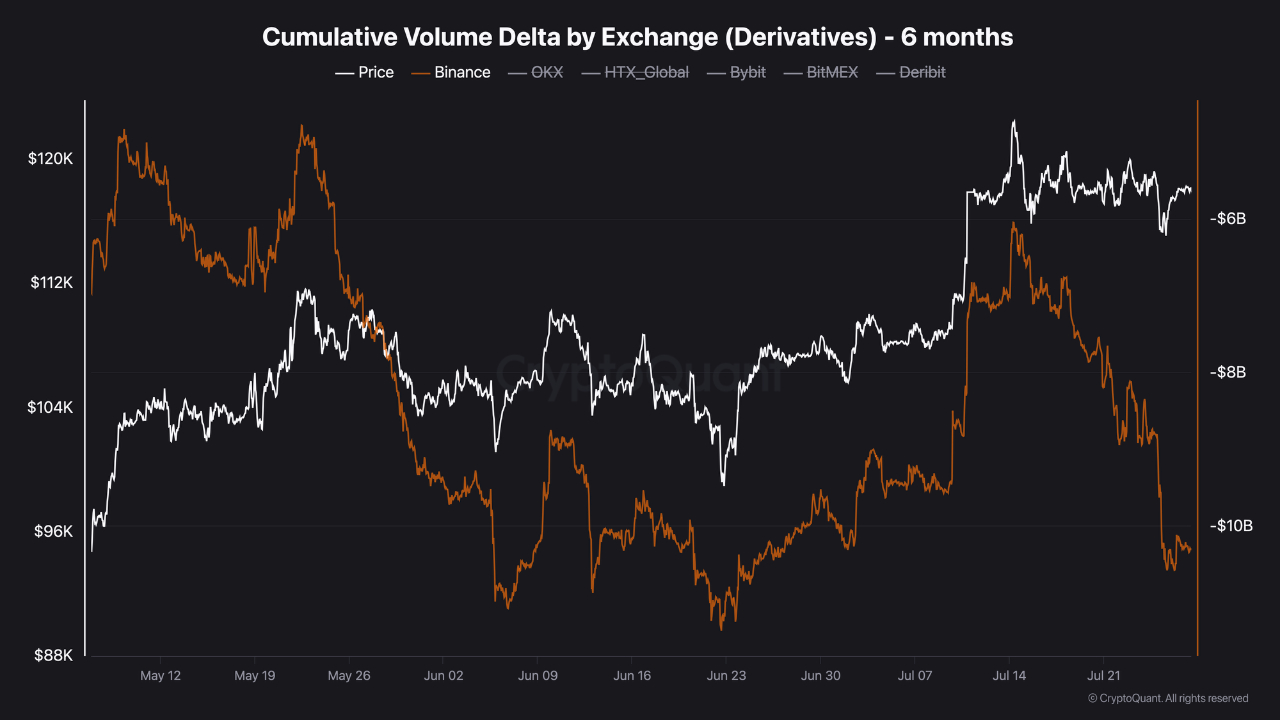

The futures funding rate, hovering at a neutral 0.01, shows no clear bullish or bearish tilt, indicating balanced leverage and room for a bigger move. The futures cumulative volume delta (CVD) also reflects persistent sell pressure, but Bitcoin’s price hasn’t crumbled—a divergence that points to underlying resilience.

This strength is bolstered by investor behavior. The Net Realized Profit/Loss (NRPL) metric shows no signs of mass profit-taking, and the Adjusted SOPR remains below 1.10, far from levels tied to market tops.

These signals suggest holders are confident, not panicked, even as spot demand wanes. “Investors aren’t rushing for the exits,” Vest observed, pointing to a market still braced for opportunity.

Macro Backdrop: A Goldilocks Moment?

Macro conditions add another layer. The US Job Openings and Labor Turnover Survey (JOLTS) released on July 29 came in weaker than expected, hinting at a cooling labor market. Meanwhile, consumer confidence has rebounded after a six-month slide, fostering a “Goldilocks” environment—neither too hot nor too cold—that often favors risk assets like Bitcoin.

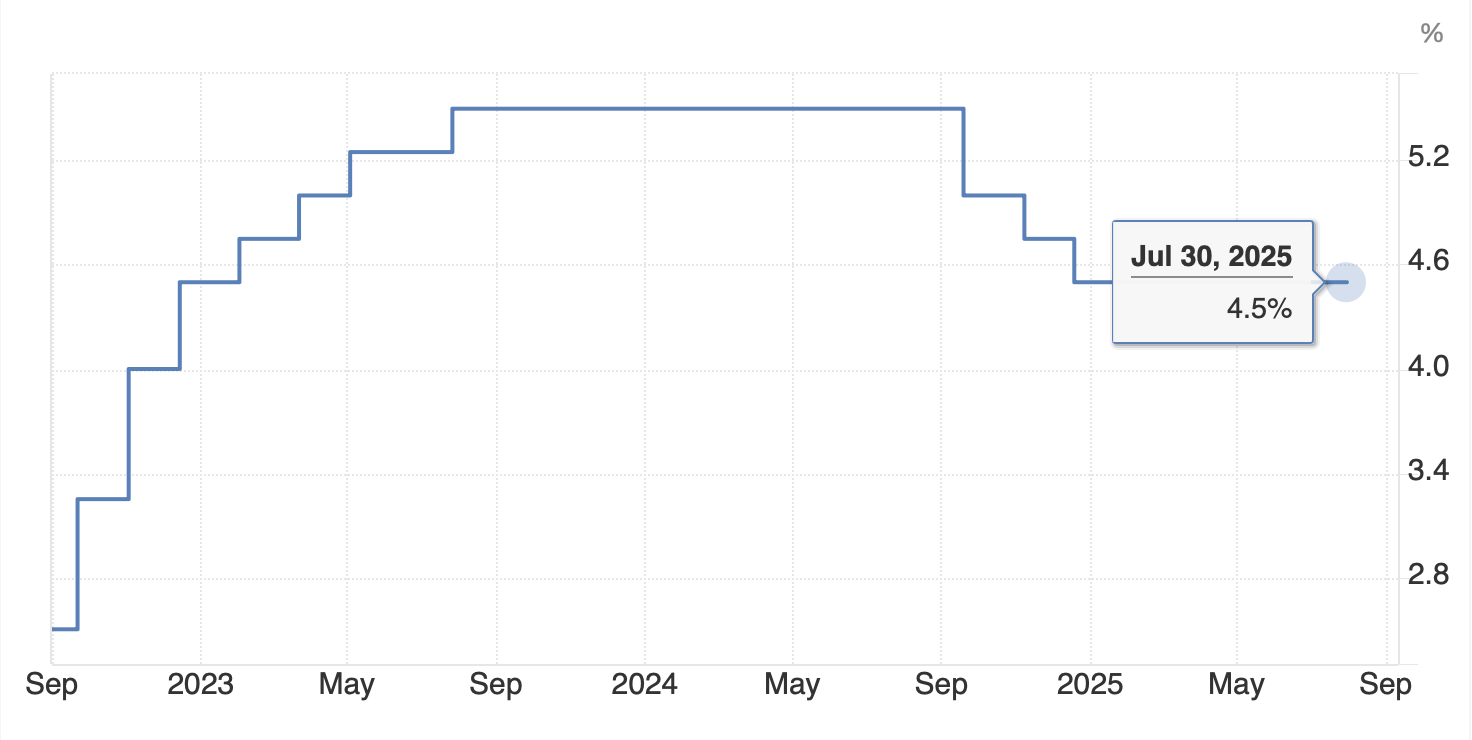

The Federal Open Market Committee (FOMC) meeting on July 30, which left rates unchanged at 4.25%–4.50%, didn’t deliver the dovish surprise some hoped for. Powell’s cautious tone, emphasizing a strong labor market and potential inflation risks, rattled markets, with posts on X noting a brief 3% rebound in Bitcoin from its post-Fed lows as sentiment shifted.

Volatility on the Horizon

Technical indicators are flashing warnings of an imminent breakout. Trader Titan of Crypto highlighted tightening Bollinger Bands on Bitcoin’s daily chart, a sign that volatility is drying up. “Bitcoin’s in a pressure cooker,” the analyst posted on X. “RSI is compressing too. A big move is brewing.” Historically, such squeezes precede sharp price swings, and with Bitcoin consolidating between $115,000 and $120,000, traders are eyeing key levels: $119,000 as resistance and $100,000 as potential support if selling intensifies.

What’s Next for Bitcoin?

Bitcoin stands at a crossroads. The negative Coinbase Premium signals a dip in US demand, but steady on-chain metrics and a supportive macro backdrop suggest this could be a pause, not a plunge. If Powell’s hawkish stance persists or economic data surprises, Bitcoin could test lower supports around $100,000 or even $90,000, as seen in prior pullbacks. Conversely, a dovish shift or renewed institutional buying—evidenced by recent purchases of 28,000 BTC over two days—could push it toward $120,000 or beyond.

For now, the market is holding its breath. With balanced leverage, confident holders, and a volatile setup brewing, Bitcoin’s next move could set the tone for the summer. As one trader on X put it, “This consolidation is healthy, but the breakout’s coming.” Whether it’s a bull run or a deeper correction, the stage is set for something big.