Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Bitcoin, started August 2025 with a big drop, going down to $115,000 and losing a lot of the gains it had made earlier in the week.

The unexpected decline, which was caused by a huge wave of rich investors, or “whales,” taking profits, sent shockwaves through the crypto market. It caused key cryptocurrencies to fall and led to nearly $600 million in liquidations. Bitcoin is trading at $115,800, and investors are unsure if this is a normal dip or the start of a worse drop.

CoinMarketCap says that Bitcoin dropped from a daily high of $118,800 on July 31 to a low of less than $115,000 on August 1. This was a drop of more than 2% in 24 hours. This correction brought Bitcoin’s market cap down to $2.3 trillion, which is a sign of selling pressure in the digital asset sector as a whole. The global crypto market cap also fell, to $3.78 trillion, as altcoins including Ethereum (ETH), XRP, BNB, and Solana (SOL) lost 2–4%. Meme coins took a bigger knock, with Dogecoin (DOGE) and Shiba Inu (SHIB) losing 5% and 4%, respectively. This shows how easily the market may change its mind.

Whale Activity: The Reason for the Sell-Off

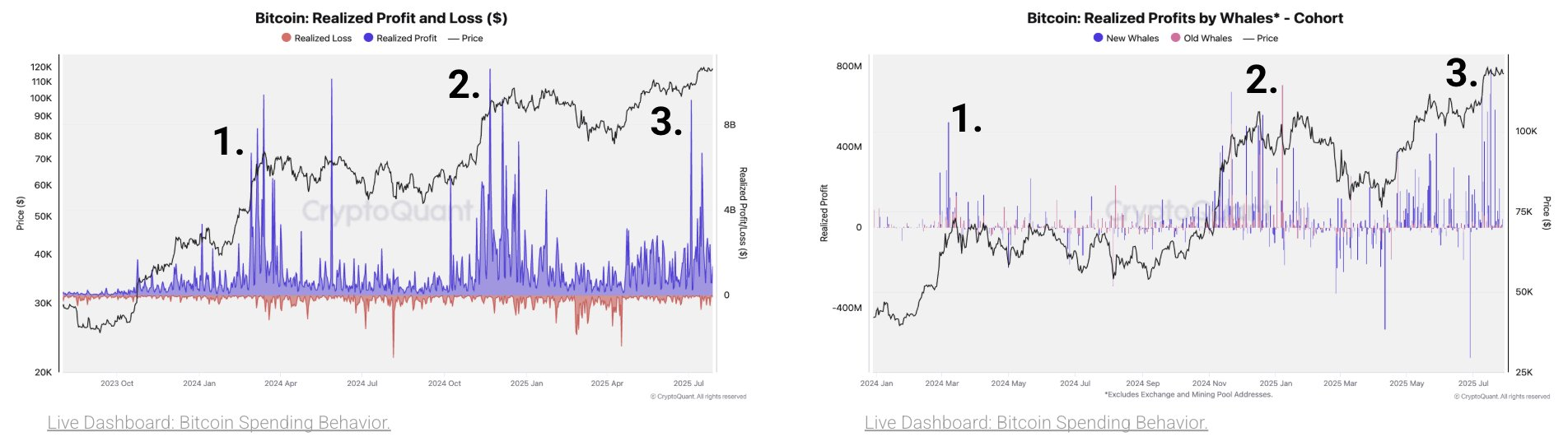

CryptoQuant calls this the third major distribution phase in the 2023–2025 bull cycle, and it is the main reason for this decline. In late July, investors made $6–8 billion in profits. One big deal on July 25 saw a “OG whale” selling 80,000 BTC, which was worth about $9.5 billion at the time. Lookonchain, a company that analyzes blockchain data, pointed out this huge sell-off, which happened at the same time as a huge increase in exchange inflows, hitting 70,000 BTC in a single day. This level showed that people really wanted to get out at the highest prices.

The Spent Output Profit Ratio (SOPR), an important on-chain metric, shot up substantially, especially among short-term holders, showing that a lot of people were making money. Whales that own Ethereum-based assets like Wrapped Bitcoin (WBTC), USDT, and USDC also sold, making up to $40 million a day in gains, which added to the selling pressure. CryptoQuant says that in the past, big profit-taking events like this one have happened before two- to four-month periods of consolidation. This means that Bitcoin may have to trade in a range for a while before it goes up again.

People have different feelings. Some traders, see the decline as a “healthy correction” because Bitcoin is still above important support levels between $112,500 and $115,000. Others, say that selling pressure is going down and buyer offers are piling up, which could mean that bigger players are buying them up.

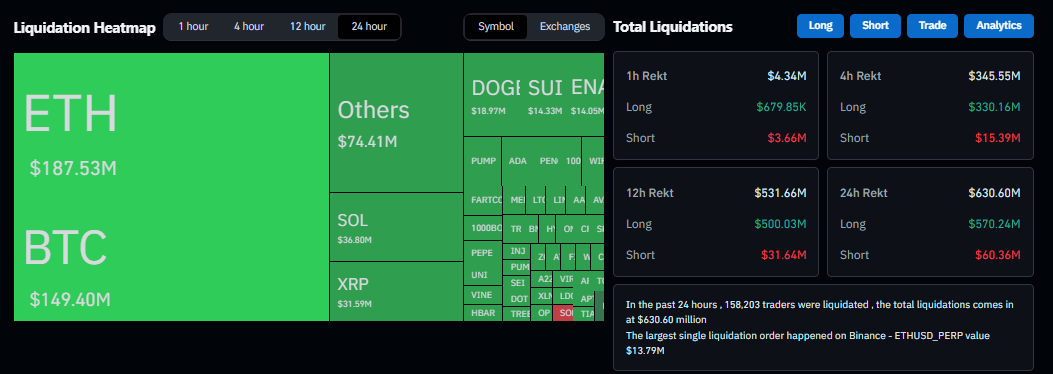

Liquidations Make the Downturn Worse

CoinGlass reported that the price decline caused a chain reaction of liquidations in the derivatives market, with $630 million in total liquidations over 24 hours. Of these, $570 million were long bets relying on price increases. Ethereum had the most long liquidations, with $165 million, and Bitcoin had the second most, with $141 million. This wave of forced selling made the downturn worse since leveraged positions were wiped out, especially for traders who were caught off guard by the quick drop from Bitcoin’s weekly high of almost $123,000.

Even though things are shaky, the Crypto Fear and Greed Index is still at 65, which is solidly in the “Greed” zone. This suggests that a lot of investors still see a chance in the dip. This strength matches on-chain evidence that shows long-term holders are not in a state of widespread panic. The Net Realized Profit/Loss (NRPL) statistic shows that there haven’t been many big exits, and the Adjusted SOPR is still around 1.10, which is a long way from values that are usually seen during market tops. These signs show that people are confident in Bitcoin’s long-term future, even though it is still volatile in the short term.

Big Pressures Add to the mix

In addition to whale activity, Bitcoin and other risky assets are also being hurt by macroeconomic headwinds. The U.S. Federal Reserve’s decision to keep rates at 4.25%–4.50% on July 30 and Chair Jerome Powell’s hardline stance against a September rate decrease made the market less optimistic. New tariff tensions, especially those aimed at Canada, have made people worry about inflation and problems with the supply chain, which has led to a shift toward safer assets. Posts on X talked about Bitcoin’s 3% rise from its low after the Fed, but the general risk-off mood is still keeping prices from going up.

The Coinbase Premium Index, which shows U.S. spot demand, became negative for the first time since May 29. This means that institutional interest is fading. This comes after a record 94 days of positive readings, which shows that the market is changing. But, as analyst Boris Vest points out, Bitcoin’s ability to stay above $115,000 despite this pressure demonstrates that there is still demand from passive purchasers. The futures financing rate is at a neutral 0.01, which means that the leverage is balanced. This means that there is opportunity for a big jump in either direction.

What will happen to Bitcoin next?

Bitcoin’s collapse to $115,000 is the result of a combination of whales taking profits, macroeconomic uncertainty, and technological challenges. The market’s capacity to handle an 80,000 BTC dump without crashing shows how strong it is, even though the sell-off has slowed down short-term momentum.

Based on past patterns, there may be a consolidation phase that lasts until September or October before the next surge. For now, investors should keep an eye on whale activity on exchanges like Binance and Galaxy Digital, as well as big-picture movements, especially U.S. tariffs and signals from the Fed.

Bitcoin’s performance in 2025 is still great, beating the S&P 500 by 15% so far this year. Institutional demand, which is being fueled by spot ETF inflows and corporate treasury allocations, keeps the bull case strong. This dip could be a good time to buy for people who plan to hang on to their investments for a long time. Short-term traders, on the other hand, are at greater danger because of leverage and volatility. One X user, @mikealfred, said, “The market absorbed the sale of 80,000 Bitcoin by an ancient whale, and now we will go higher.” Whether that optimism lasts hinges on whether bulls can protect important supports and keep whales from causing more trouble.

Whale behavior and macro clarity will determine Bitcoin’s short-term path. The market is ready for some ups and downs because $108,000 is a key support level and $140,000 is a possible upside target. For Indonesia’s crypto community, where rules make it hard for new ideas like Grab’s crypto top-up feature in the Philippines to get off the ground, this correction is a reminder that Bitcoin is both a revolutionary asset with the power to change the world and one that is still at the mercy of whales and global economic tides.