Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The cryptocurrency market’s big corrections are often caused by things that happen within the market itself, such exchange hacks, news about regulations, or whale moves. But some of the strongest influences come from traditional finance. In early December 2025, Bitcoin dropped from $92,000 to less than $86,000.

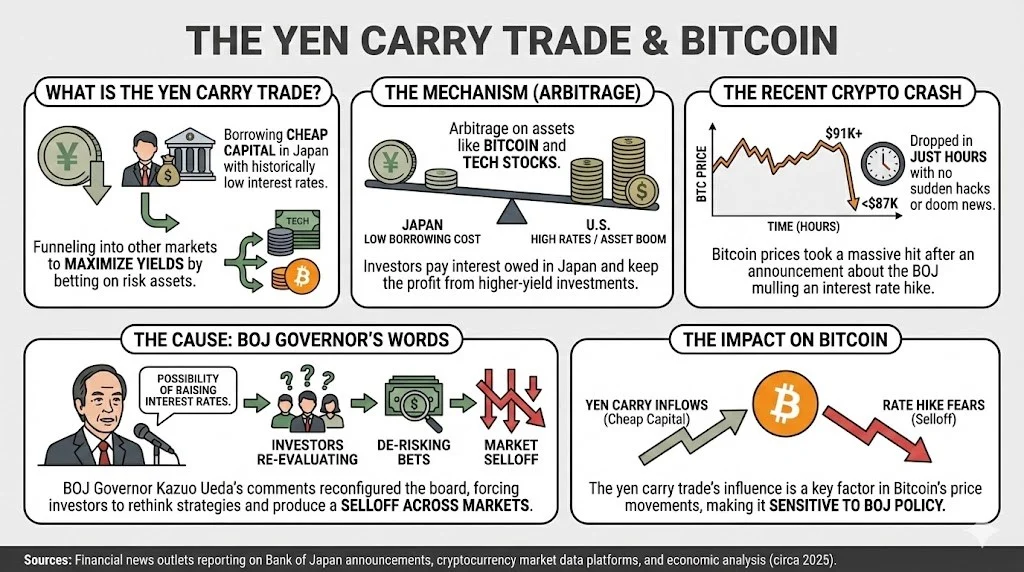

This was not because of anything that happened in the cryptocurrency world, but because the Bank of Japan (BOJ) sent out indications that interest rates will rise again. This pressure comes from the “yen carry trade,” a tactic that has been around for decades and has discreetly boosted global risk assets like Bitcoin.

The BOJ is moving toward normalcy after years of very low rates. This could mean that these transactions will end, which would be bad for crypto. Investors need to understand how this mechanism works in order to deal with the unstable market in 2025, when macro policies have a bigger and bigger effect on short-term price movements.

What is the Yen Carry Trade Anyway?

The yen carry trade takes advantage of differences in interest rates across countries. Investors borrow Japanese yen at very low rates, sometimes even zero or negative, and then change the money into currencies that pay higher interest rates, like the U.S. dollar.

Then they put their money into things that provide them better returns, such U.S. Treasuries, stocks, or, more recently, cryptocurrencies. The profit derives from the difference between the cost of borrowing money and the return on investment, which is made bigger by leverage.

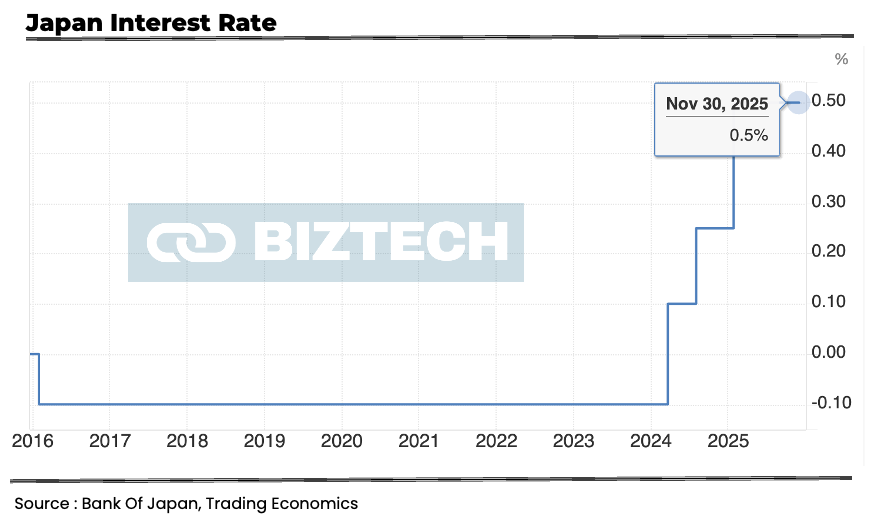

Japan’s protracted fight against deflation resulted to very loose monetary policy: interest rates stayed close to zero for more than 20 years, making the yen the cheapest currency in the world for borrowing.

Depending on whether leverage is included, estimates put the entire value of the carry trade at $3 trillion to $20 trillion. This rush of cheap money made it possible for people all across the world to take risks, from buying bonds in emerging markets to tech stocks and Bitcoin. When rates were almost free, investors looked for yield wherever, which made it possible for crypto to have a bull run from 2020 to 2021.

When Japanese rates go up or the yen gets stronger, the transaction becomes less appealing. When borrowing costs go up, profits go down, and when the yen goes up, it makes it harder to pay back loans in local currency.

This makes “unwinding” necessary: selling foreign assets to pay back yen debts, which makes people feel less risky and puts pressure on markets to sell.

The BOJ’s Policy Change Ends The Time of Cheap Yen

The BOJ started to normalize in 2024 after 17 years of rates that were either negative or zero. In March, rates went from negative to 0.0%–0.1%. In July, they went up to 0.25%, and in January 2025, they went up to 0.5%.

Governor Kazuo Ueda’s December signals, which focused on wage growth and inflation prospects, led markets to believe there was an 85% possibility of a 25 basis point raise at the December 18–19 meeting, possibly to 0.75%.

Ueda’s address in Nagoya at the end of November focused on keeping an eye on wage talks and global threats, but he also said that the circumstances for rate hikes were coming together. The yen got stronger versus the dollar, as Japanese 10-year rates reached 1.85%, the highest level since 2008. This path could make the carry trade less useful: Borrowing at 0.5% or more lowers spreads, especially if U.S. rates are falling (Fed cuts are projected in 2026).

Japan’s economy makes things more difficult. Weak exports, stagnant consumption, and enormous debt ($12 trillion, 250% of GDP) make rises riskier and could make the slump worse. But inflation that stays above 2% and a weak yen require action.

What Happens to Bitcoin When the Carry Trade Unwinds

Because Bitcoin is sensitive to liquidity, it is a prime target for carry trade reversals. Japanese investors and hedge funds sell dollar assets, including crypto, to pay back yen debts when they unwind. This puts a lot of pressure on:

- Direct selling: When leveraged bets in BTC futures get margin calls, the price drops even more.

- Risk-off sentiment: The strength of the yen shows that people around the world are being careful, which stops speculative flows.

- Dollar dynamics: The weaker carry lowers demand for USD, but the initial unwinds make the yen stronger, which puts pressure on BTC/USD.

There have been many similar events in the past. For example, the sudden jump in July 2024 caused Bitcoin to drop 26% to $50,000, with $1.7 billion in liquidations. August 2024 was just as unstable, and in December 2025, $656 million was lost when BTC touched $85,500. There were more than 217,000 traders who sold, largely longs.

The transmission goes deeper: Japan has $1.1 trillion in U.S. Treasuries, and repatriation raises yields, making conditions around the world tighter. Bitcoin generally leads risk-off waves since it has a high beta (3–5 times the moves of stocks).

Short-Term Pain, Possible Long-Term Opportunities

In the short term, BOJ tightening could lead to increased volatility. If the market unwinds quickly, a December rate hike might cause another 10–20% decrease in BTC, especially since there isn’t much money available around the holidays. Altcoins like ETH, SOL, and XRP, which fell 3–6% in early December, are in even more misery.

But not all of the news is bad. The pressure from carry trades usually doesn’t last long: Once positions unwind, selling stops. The Fed might lower rates by 75 to 100 basis points in 2026, which might flood the USD market with cash, making the yen effects seem small and starting risk-on flows again. The story of Bitcoin’s scarcity gets stronger when fiat currencies lose value, making it a good hedge if Japan’s financial problems get worse.

JPMorgan and other analysts say that unwinds are “largely priced in,” and that yen positioning is already positive. A controlled rise might limit the damage, letting BTC rise back to $100,000 or more if the Fed eases up.

Conclusion

The yen carry trade’s possible unwind, which was hinted to by the BOJ in December, explains why Bitcoin fell from $92,000 in early December. This shows that macro is more important than crypto. Japan is getting back to normal after decades of cheap money. There may be short-term turbulence, but Fed pivots could help. For investors, this is a reminder that crypto needs liquidity to grow, so keep a careful eye on central banks. This dip might not last long; history teaches that bears come before bulls.