Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The cryptocurrency market is going through another unpleasant correction. Bitcoin has dropped below $86,000, Ethereum is having trouble staying over $3,400, and the whole market capitalization has dropped by more than $600 billion in just a few weeks. For people who got on the train at the exuberant highs of early 2025, when Bitcoin was worth $126,000, the infinite sea of red candles feels like the end of the world.

But history tells a totally different narrative. After every big bear market, like the ones in 2014, 2018, and 2022, there have been huge new highs. It’s almost never happenstance that makes someone affluent or leaves them damaged; it’s preparation, dedication, and thinking. This is a calm, step-by-step guide to not just getting through the current downturn, but also getting ready to make a lot of money when things turn around.

Knowing What Winter Season Are Like

A bear market in crypto or what we call “winter season” is just a long time when prices go down and people feel bad about it. These phases happen because of a mix of big economic shocks, uncertainty about regulations, too many liquidations, or just the natural tiredness that comes after a parabolic bull run. The speed and depth of the drops—70–90%—are what make them feel like the end of the world. The bear market from 2018 to 2019 lasted 364 days and took 84% off of Bitcoin’s peak.

The bear in 2022 took 77% off the top. At the time, they both seemed like they would never finish, but they both led to the next multi-year uptrend. The first step to not becoming too emotionally involved is to accept that this asset class is very volatile. The market is not “broken”; it is acting just like it always has.

1. The real battle is learning to control your emotions

Panic selling, not the price action itself, is the biggest thing that destroys wealth in down markets. When portfolios lose 50% or more of their value in a few weeks, the brain’s fight-or-flight response comes in, making investors sell at a huge loss right before the bottom. Institutions and experienced investors know that unrealized losses are just losses on paper. Selling makes the damage permanent and takes away any hope of becoming part of the healing. The answer is simple but not easy: stay away from the charts. Cut back on your screen time, turn off price alerts, and remind yourself every day of the long-term thesis that got you into crypto in the first place. Michael Saylor, Paul Tudor Jones, and the endowments that bought Bitcoin in 2022 didn’t care since they were looking at years, not days.

2. How to Make Your Downtime an Educational Superpower

Bear markets are the best way to get a world-class financial education for the least amount of money. When prices are low and the hype is low, the signal-to-noise ratio goes up a lot.

Now is the best time to really get into the projects you own. Read whitepapers, look at on-chain data on sites like Glassnode, Dune Analytics, or Nansen, and follow analysts who care more about the fundamentals than the price.

You can be sure that no amount of red candles will break your faith if you know things like active addresses, transaction traffic, hash rate (for Bitcoin), or total value locked (for layer-1s and DeFi).

People that buy without fear at capitulation points are almost typically the ones who used the bear market to learn a lot while everyone else was giving up.

3. Rebuilding a Strong Portfolio

A bear market shows off weak hands and weak assets. Use this time to cut out speculative positions like meme coins, micro-cap tokens, and initiatives that don’t have much real-world traction. Instead, put your money into battle-tested leaders. Any serious portfolio should have Bitcoin and Ethereum as its main parts. For conservative investors, this is usually 60–80% of the total. You can give the rest of the money to well-known layer-1s with a lot of developer activity (such Solana, Avalanche, and Sui) or to proven DeFi blue-chips. One of the best tools for retail investors is still dollar-cost averaging. Automating tiny, regular transactions takes the emotion out of it and makes sure you get more coins at cheaper average pricing. Backtests from the past demonstrate that continuous DCA during the bad markets of 2018 and 2022 led to returns of more than 400% by the next cycle peak.

4. Keeping Dry Powder and Making Safe Money

Keeping a decent amount of cash or stablecoins on hand is one of the best things you can do during a long slump. Having 20–40% of your money in regulated stablecoins like USDC or USDT (with audited reserves) or newer institutional choices like PayPal USD serves several functions. First, it protects your money while everything else is going down.

Second, many centralized and decentralized platforms pay 4–12% interest on stablecoin deposits each year, which is much better than what most regular savings accounts pay. Third, and most importantly, it offers you quick buying power when people are really scared and high-conviction assets are on sale for a lot less than they are worth. Stablecoins are like bullets: the individual who can calmly put money to work at the bottom nearly always does better than the person who sold everything months before.

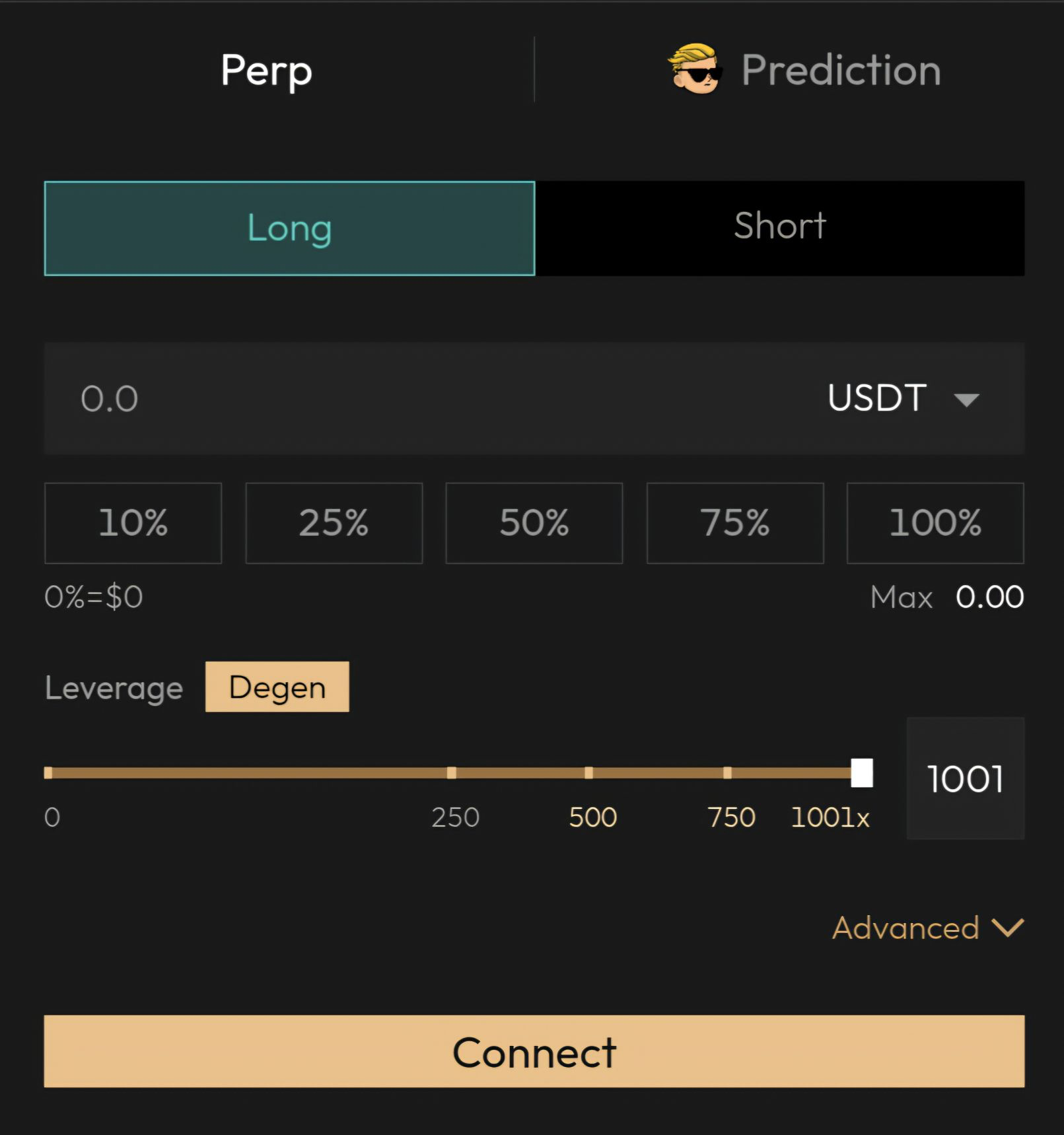

5. Not using leverage until you know how

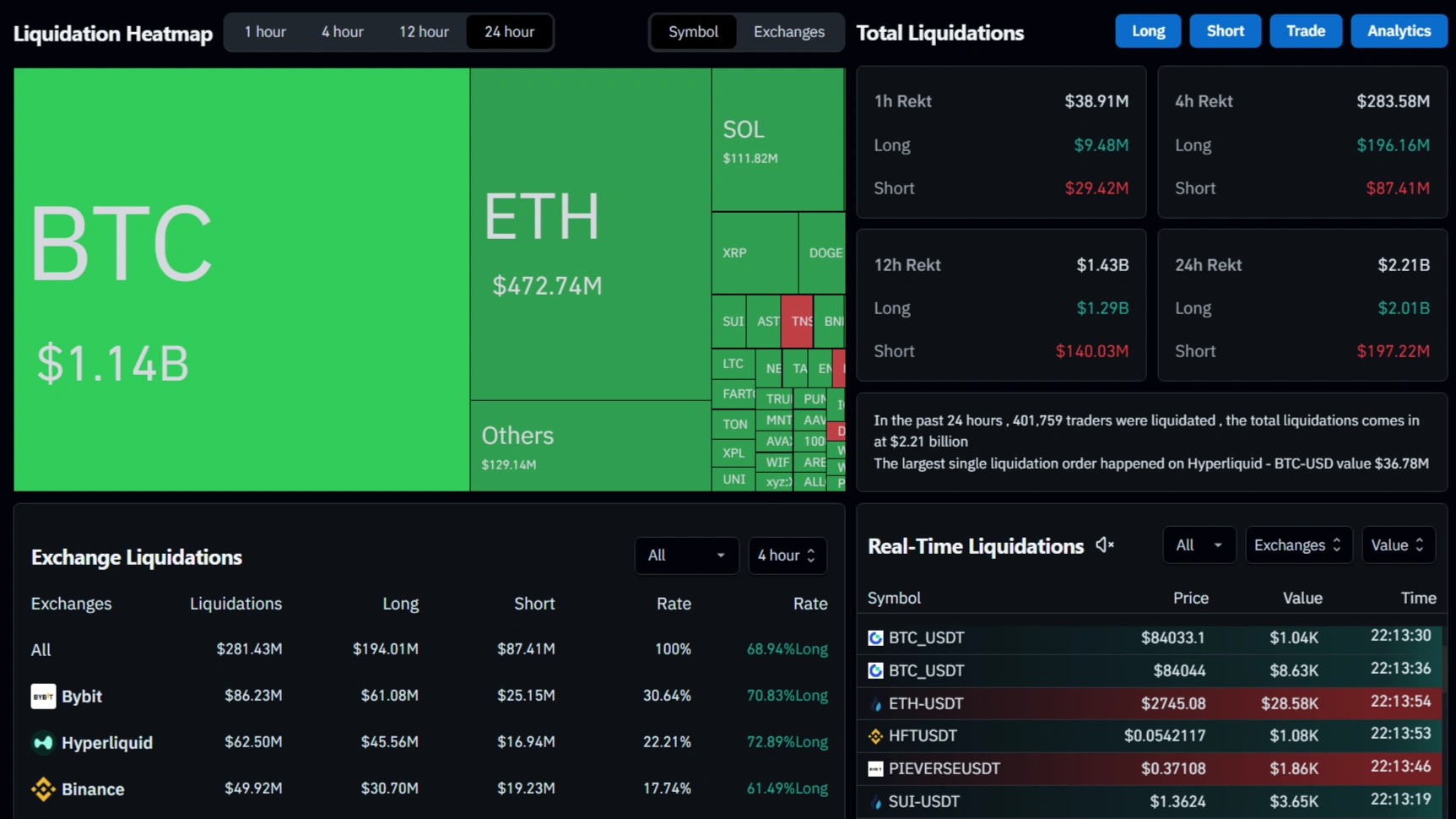

Using leverage is the quickest method to turn a small loss into a huge one that changes your life. In bear markets that are very volatile, a single 5–10% move against a 10–20x investment might cause liquidation and wipe out months or years of gains. In the last 30 days, more than $8 billion in leveraged positions have been closed. If you don’t have years of expertise and rock-solid risk management, don’t use leverage at all. Owning the physical asset, or “spot holding,” stops forced sales and lets time work in your advantage. In the history of crypto, the people who have held on to their coins the longest have nearly always avoided using too much leverage while the market is down.

6. Learning from the past

Every bear market has made a new group of crypto billionaires. They didn’t catch the bottom exactly, but they did buy good assets at prices that now appear ridiculously low. People who bought Bitcoin for $4,000 in 2019 or $16,000 in 2022 are now seeing rewards that will change their lives. When social media is full of doom, it helps to stay connected to smart people through podcasts, research reports, or on-chain analysts. During these times, communities that are more focused on education than price speculation become very important.

7. The Mental Change That Changes Everything

In the end, getting through a bear market is more about your mindset than about complicated plans. Volatility is what you have to pay to get the asymmetric upside that crypto delivers.

The same market that can slash your wealth in half can also make it ten times bigger in the next cycle. People that see bear markets as long-term sales instead than disasters are the ones who build up their riches over decades. The pain you’re feeling right now won’t last forever; the regret of selling low will. Stay disciplined, keep studying, safeguard your money, and remember that every great bull market in history was built on the ashes of the bear that came before it. Your fear right now is setting for the next parabolic move.

At this time, when the weak hands are being shaken out, you’ve entered one of the most unbalanced asset classes in history. Be smart about where you stand, be patient, and the benefits will come. We’ll see you on the other side, where you’ll be stronger, smarter, and a lot richer.