Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

On Friday, November 21, 2025, the cryptocurrency market took a severe knock. Bitcoin fell below $86,000 as a lot of people sold because the U.S. job market was sending mixed signals. This drop not only added to the asset’s weekly losses, but it also showed how sensitive digital currencies are to macroeconomic signals, especially those that affect Federal Reserve policy choices. As investors go over the most recent data, the question remains: is this dip a chance to buy, or is it the start of a bigger correction in a year when Bitcoin has already risen more than 120%?

This week, Bitcoin’s price has been very unstable, which shows how uncertain people are about what the Fed will do next. According to CoinMarketCap statistics, the leading cryptocurrency recently traded at $85,702.08, down 6.8% on the day after hitting an intraday low of about $85,417.6. This drop means that Bitcoin will lose 8% of its value this week, which takes away some of the gains it made when it was going up to all-time highs around $126,000. The rest of the market also felt the pinch. Ethereum fell 5.2% to $3,450 while Solana fell 7.1% to $138. The overall market cap of all cryptocurrencies fell 4.3% to $3.78 trillion.

Clouds Over US Jobs Data What the Fed thinks

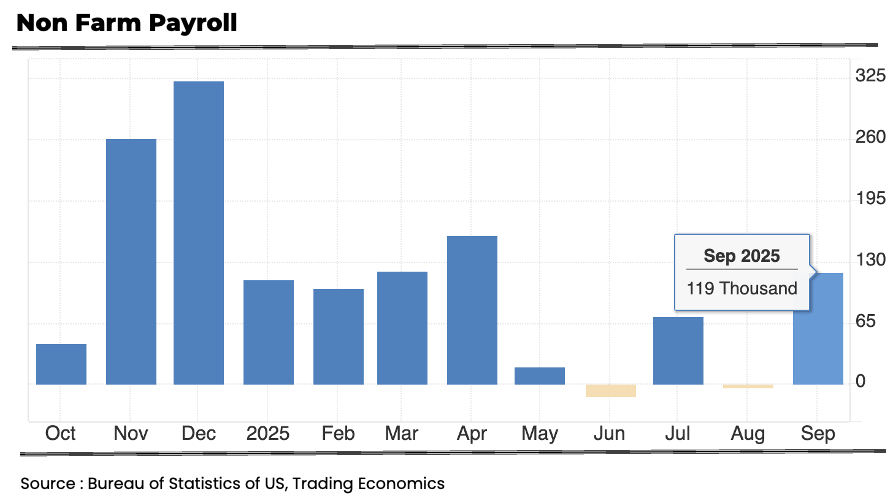

The delayed September non-farm payrolls (NFP) report that came out on Thursday was the reason for the sell-off. It showed a mixed image of the U.S. economy. The number of jobs added was just 119,000, which is less than the 150,000 that was expected. The unemployment rate also went up from 4.2% to 4.4%, which means that the job market is getting worse. Wage growth stayed at 0.3% a month, but changes to previous months made things less clear, so investors weren’t sure if the data supported substantial rate cuts.

This report, which was delayed because of the government shutdown, did not help settle arguments over the Fed’s direction. According to the CME FedWatch Tool, rate futures currently show a 75% chance of a 25-basis-point decrease at the December meeting, down from 90% before the news.

There is still uncertainty because of worries about inflation (core PCE is at 2.6%) and the data blackout caused by the shutdown, which could push out the October NFP until mid-November. Jason Pride of Glenmede said, “The Fed is in a tough spot—jobs are getting weaker, but inflation isn’t dead.” Risky investments like cryptocurrencies are still at risk of changes in mood without firmer signs.

A Downturn in Strategy’s Focus

The bigger sell-off has brought attention to companies that have a lot of Bitcoin, such Strategy Inc. (NASDAQ: MSTR), whose shares fell at 52-week lows at $177.14, down 55% in six months. JPMorgan analysts say that Strategy might be kicked out of MSCI benchmarks by January 15, 2026, if its crypto-heavy balance sheet makes it ineligible. This could lead to $5-10 billion in passive withdrawals. Bitcoin is getting closer to Strategy’s break-even point of $74,430, which puts further pressure on the company. However, CEO Michael Saylor remains defiant: “We’re in it for the long haul; volatility is the cost of belief.”

Markets Get Ready for More Uncertainty

Even if things look bad, some people perceive good things: Cooling inflation (CPI at 3.0%) keeps prospects for rate cuts alive. Trump’s tariff increases, while disruptive, could support Bitcoin’s “digital gold” story in the face of anxieties about fiat debasement. But the dip in consumer sentiment to 53.6 (University of Michigan) and the data gaps caused by the shutdown make things even worse. Dan Ives of Wedbush said, “This could be a dip to buy, but wait for the Fed to be clear.”

For crypto traders, the event shows how dangerous leverage may be: The tariff crash in October cost $19 billion. Bitcoin is testing support at $85,000. If it breaks below there, it could go down to $80,000, but bulls are looking for resistance at $90,000 to bounce back. Wall Street’s best picks, like those from Goldman Sachs, tend to use a mix of methods when things are unstable.

Conclusion

Bitcoin’s drop below $86,000 on mixed jobs data shows that the economy is still shaky, but the slump may not last long because the Fed is still cutting rates and institutional inflows are strong. As the shutdown’s effects linger, the markets are waiting for more information. Get ready to be strong in unpredictable times.