Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

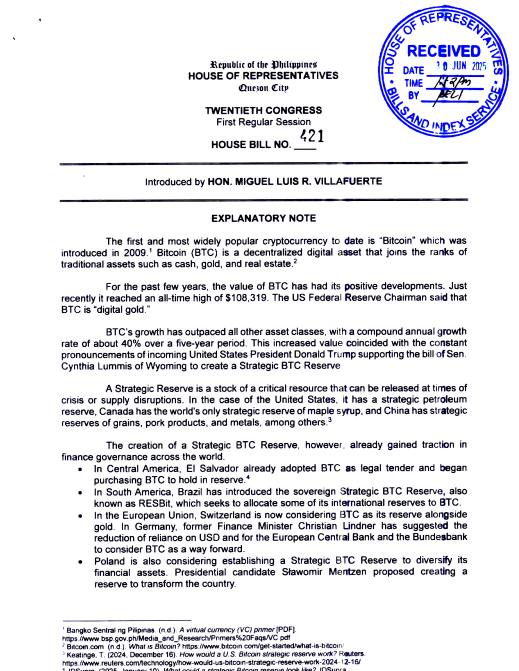

The Philippine House of Representatives has officially accepted House Bill No. 421, better known as the Strategic Bitcoin Reserve Act. This is a big deal.

The bill, which was sponsored by Congressman Miguel Luis “Migz” Villafuerte, the Chairman of the House Committee on Information and Communications Technology, intends to make Bitcoin a strategic financial asset by adding it to the country’s foreign exchange reserves.

The proposed law says that the Bangko Sentral ng Pilipinas (BSP), which is the country’s central bank, must buy 2,000 BTC every year for the next five years. This will build up a reserve of 10,000 BTC. Cold storage will be used to keep these assets safe, and they will be spread out geographically to lower security risks.

The bill says that the Bitcoin that has been collected can’t be sold or moved for at least 20 years, unless it’s needed to pay off government debt.

The way this law lets people get their assets back is one of its most important parts. BSP has to send an official report to Congress a year before the end of the 20-year lockup term.

Congress would then decide whether to extend the holding period or start releasing the reserves. If Bitcoin is released, a maximum of 10% of the reserve can be sold every two years.

Villafuerte said in a written statement, “This step is meant to diversify the country’s reserves and protect the economy from relying too much on traditional assets like gold and the U.S. dollar.”

Philippines Wants to Be the First Country in Asia to Have Bitcoin Reserves

The Philippines’ national debt is rising, which is why this bill was introduced. Villafuerte sees Bitcoin as a “digital gold” that might help the country’s economy stay stable over the long run and keep its reserves safe from global financial instability.

If the measure passes, the Philippines will be the first Asian country to make it illegal to use Bitcoin in its national foreign exchange reserves.

This might make the Philippines a leader in the area when it comes to using digital assets as a financial tool for the government, along with a rising number of other countries who are trying out Bitcoin as a reserve asset.

For example, El Salvador was the first country to make Bitcoin legal tender and has added it to its national reserves. Brazil, Switzerland, and Poland are also interested in adding Bitcoin to their financial systems.

The U.S. and China are also having local debates and projects around cryptocurrency.

The law’s limit on releases, along with the 20-year lockup period, is meant to protect against short-term market manipulation.

In this system, Bitcoin reserves are supposed to be long-term strategic assets instead than things to trade on the market.

The process of making laws and how the public reacts

The Philippine Congress is still talking about House Bill 421 at this time. The legislative procedure is likely to include detailed studies of the financial effects, storage methods, and the threats of Bitcoin’s price changes.

People in both the traditional financial sector and the domestic cryptocurrency community have reacted to this measure as a daring move that might start bigger discussions in the area about the role of digital assets in national economies. Some financial experts have praised the concept of diversifying reserves beyond traditional assets, while others have voiced worries about the risks that come with Bitcoin’s well-known volatility.

Some people say that Bitcoin’s price is too unstable, which might make national reserves less stable, especially when the economy is shaky. But supporters see Bitcoin as a way to protect against inflation and currency devaluation, which can help keep a country’s economy safe in the long run.

One financial analyst said, “The Philippine government is looking for new ways to cut down on its reliance on reserves that are based on the U.S. dollar.” “Bitcoin is a non-correlated asset that could help stabilize the country’s reserves in the long run, especially as the global financial landscape changes.”

A Step Toward Modernizing Finances

If the measure passes, the Philippines will start building up its Bitcoin reserve in the next fiscal year. The BSP will be in charge of the acquisition process, and Congress will keep an eye on it to make sure the reserves are safe and open.

This law is not just an experiment; it is a real effort to lessen the country’s dependence on U.S. dollar-denominated reserves, which have long been the foundation of the world’s financial institutions. The Philippines would be embracing financial modernization and putting itself in a position to be a forward-thinking player in the global economy by adding Bitcoin to the mix.

If this measure passes, it might change the way people talk about digital currencies in the US and set an example for other countries that want to do the same thing. It would show that the Philippines is not just adjusting to the rise of cryptocurrencies, but also actively looking for ways to use blockchain technology to boost its economy.

Read also: Trump asks Congress to set up a Bitcoin reserve for the U.S. What does the signal mean?

A Key Point in the Philippines’ Monetary Policy

The Strategic Bitcoin Reserve Act could be a turning point in the development of the Philippine economy as the world leans more and more toward digital financial solutions. The choice to add Bitcoin to the country’s official reserves is a sign of intent that puts the Philippines at the forefront of digital financial innovation.

This change in policy might have big effects on the country’s economy and its place in the world. If the Philippines adopted Bitcoin in such a big scale, it would signal that it is ready to embrace the future of money. This might draw attention and investment from around the world to its cryptocurrency ecosystem.

Everyone will be watching the Philippine Congress as the legislation process moves along. The world is watching intently to see if this daring plan will pass, which would make the Philippines the first country to use digital currencies in its national financial institutions. No matter what happens with the law, one thing is clear: this proposal is a key moment in the continuing worldwide discussion about how cryptocurrencies fit into conventional finance.