Both BlackRock and Blackstone stand as titans in the world of asset management, headquartered in New York City.

These financial giants provide a comprehensive range of services encompassing bonds, stock acquisitions, and a myriad of other financial instruments.

In this article, let’s delve into discovering the differences between these two giants, shedding light on their services, company structure, products, and services that they offer. Whether you are a seasoned investor looking to diversify your portfolio or an aspiring financial enthusiast, understanding the nuances of BlackRock and Blackstone is a captivating journey that offers.

Let’s find out the differences between BlackRock vs Blackstone:

Table of Contents

BlackRock

BlackRock

BlackRock, famously known as the global leader in asset management, specializes in passive investments such as fixed-income and corporate risk management.

It has operations in over 30 countries, and a client service spanning over to more than 100 nations.

BlackRock has garnered a good reputation similarly to being a global investment dominance, holding significant stakes in companies such as Apple, Microsoft, P&G, Amazon and even Pfizer.

Strengths:

- Long-term vision: The company focuses on an asset’s long-term growth potential focusing on the potential for clients to increase profits through compounding returns.

- User-centric approach: BlackRock streamlines the investment process making more user-friendly and simplify the complexities of investing.

- Accessibility for investors: BlackRock works with institutional and individual investors, allowing for a wide range of investors to invest in.

- Diverse investment products as Index Fund Pioneers: A comprehensive spectrum of investment opportunities, spanning from stock portfolios, ETFs, mutual funds and various other investment vehicles. The diversification reduces the overall risk exposure for both private and public investors.

Weaknesses:

- Limited focus on alternative investments: Focusing mainly on traditional investment strategies only, for example, stocks, funds and bonds. However, BlackRock has a specific division, BlackRock Alternative Investors (BAI), covers private investments which works exclusively with institutional investors.

Blackstone

What does Blackstone do? The Blackstone Group, an investment powerhouse, primarily manages assets concentrated in the United States, where it originated, and Europe. While its global footprint may not rival that of BlackRock, it proudly holds the distinction of being the largest private equity firm worldwide.

Blackstone distinguishes itself through its prominent involvement in the realm of private equity investments, often making headlines for its bold and at times, controversial maneuvers.

Initially established with the primary objective of acquiring and merging companies, Blackstone has evolved over time to diversify its portfolio, positioning itself as a versatile alternative investment bank. Its operations now encompass a wide spectrum of financial activities, including the management of distressed companies, debt investments, real estate management, and, of course, equity investment.

Strengths:

- Expert in alternative investments: The firm assists instituitional investors find private opportunities that are not offered in the stock market.

- Hands-on-management: The company advise about operational efficiency to organisational structure. Thus, providing direct hand on its investment’s profitability.

- Global footprint: With the glarious name of BlackStone, the company has a strong presence in the global financial scene and you would be able to find any alternative investments globally.

Weaknesses:

- Low liquidity: The assets are not liquid as BlackStone invests in alternative investments that do not trade publicly. Due to this reason, investors may not have the chances to capitalise on other investment opportunities that would arise.

- High capital needed: Most of the clients have to fund high-risk and high reward investments which require a lot of capital.

- Limited investments for retail investors: BlackStone only focuses on high net-worth individuals and institutional investors.

Differences between Blackstone vs BlackRock

1. Company Structure

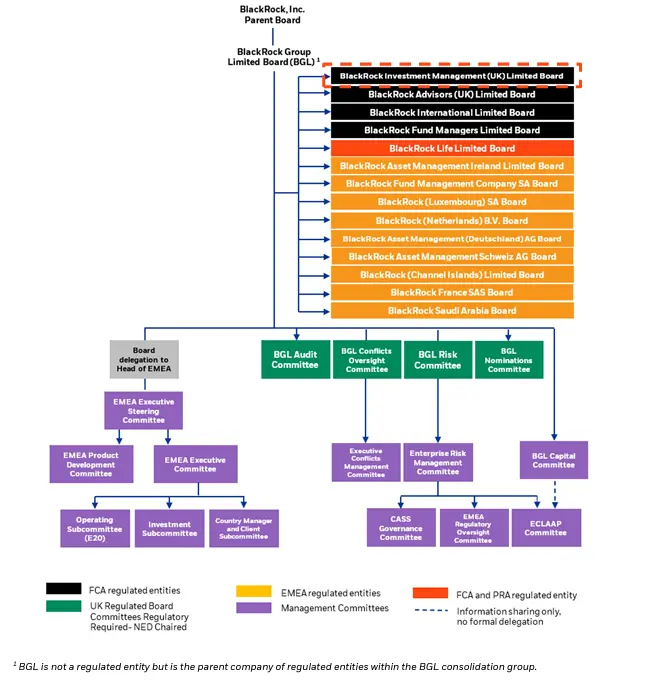

To kick things off, let’s take a simple and straightforward dive into the organizational framework of BlackRock.

Take a look at the governance structure of BlackRock group and its regulated subsidiaries:

Photo credit: BlackRock.com

Blackstone:

With Blackstone Inc. as the main parent company, there are four subsidiaries under it:

- Blackstone Partners L.L.C

- Blackstone Group Management L.L.C

- The Vanguard Group, Inc.

- BlackRock, Inc.

Now, I will share with you some of the companies listed under Blackstone’s four main business segments (these segments are not legal entities):

1. Credit and insurance

– Blackstone Credit

– Blackstone Private Credit Fund

– Blackstone Secured Lending Fund2

2. Private Equity

– Blackstone Capital Markets

– Blackstone Core Equity Partners

– Blackstone Total Alternatives Solution

– Blackstone Growth

3. Real estate

– REITs

– Core+

– Blackstone Property Partners

– Blackstone European Property Income

4. Hedge fund solutions

– Blackstone Alternative Asset Management

2. Core Business Models

BlackRock’s Focus on Passive Investment

BlackRock has established its presence as a pioneer in the past investment area – the index fund industry by popularizing exchange-traded funds (ETFs) that cover various asset classes.

Blackstone’s Private Equity Operations

BlackStone is the leader in the private equity sector, with a strong specialization in acquiring and managing companies privately. The main focus is to generate higher risk-adjusted returns for investors by determining assets that are undervalued and employ active management strategies to enhance their value.

Key Differences between BlackRock and Blackstone in Investment Approach

1. Investment Sector Strategies BlackRock vs.Blackstone

BlackStone has a notable specialization in real estate investments that leverages on its expertise to determine great investment opportunities in real estates that could be ranging from residential developments to commercial properties.

BlackRock places a strong emphasis on technology and innovation, focusing on using technological solutions to improve efficiency and provide data-driven insights as part of its investment strategies.

2. Social Impact of BlackRock vs.Blackstone

BlackRock engages in socially responsible investments and pays strong attention to Environmental, Social and Governance (ESG) factors to deliver strong results for clients.

BlackStone commits to philanthropy and social impact investing strategies as well with a strong active participation in initiatives to promote positive changes in the investments. These include addressing societal challenges to create long-term sustainable solutions.

3. Financial Showdown: BlackRock vs Blackstone

BlackRock:

Revenue Streams

- Mainly from fees charged for asset management services.

- Fees include from managing various types of investment funds, such as mutual funds, ETFs and institutional accounts

- Revenue through risk management and technology solutions provided to clients

- A significant presence in iShares ETF business also contributes to its revenue

Recent Financial Highlights

- As of September 2023, the asset under management (AUM) is $1 Trillion.

- In the quarter ending June 30, 2023, BlackRock revenue was $4.463 billion, marking a 1.39% decrease compared to the same period in the previous year.

- Over the 12 months with the year ending on June 30, 2023, BlackRock revenue in total was $17.354 billion, indicating a year-over-year decline of 10.46%.

- The annual revenue for 2022 amounted to $17.873 billion, that is a 7.75% decrease compared to its revenue in 2021.

Risk and Volatility Factors

- Market downturns, market volatility and economic conditions lead to lower AUM and fee income.

- BlackRock’s reliance on ETFs and index funds increase the competition and fee compression in the passive investment world.

- Any increase in regulatory changes or heightened scrutiny on the asset management industry can pose potential risks.

Blackstone:

Revenue Streams

- Revenue is generated from fees in managing private equities, real estates and hedge funds.

- There is also a performance fee based on the investment funds’ performance.

- With its significant real estate investment, BlackStone earns income from rental properties and property appreciation.

Recent Financial Highlights

- In the quarter ending June 2023, Blackstone reported revenue of $2.815 billion, marking an impressive year-over-year surge of 347.33%.

- However, over the twelve months ending on June 30, 2023, Blackstone’s total revenue amounted to $6.959 billion, signifying a substantial year-over-year decrease of 60.78%.

Risk and Volatility Factors

- The financial performance of BlackRock is affected by market cycles and the performance in various investment funds, particularly in real estate and private equity.

- Economic downturn causes impact on the real estate asset valuation and the chances of making a profitable exit.

- Changes in investor sentiments and regulatory changes can alter the alternative investments too.

4. BlackRock vs Blackstone in Products and Services

BlackRock:

- Asset management services including mutual funds, ETFs, Institutional accounts.

- Risk management solutions: BlackRock offers risk management services and tools to mitigate risks involved in investments.

- Technology solutions: BlackRock’s most iconic technology solution, Aladdin, is an investment management platform used by institutional investors and financial institutions.

- Sustainable Investing: The company is known to focus on sustainable investing, and pay strong attention to ESG factors.

BlackStone:

- Real Estate: Blackstone has a real estate division that invests in various real estate assets, such as commercial, residential, and industrial properties.

- Financial Advisory: Blackstone offers financial advisory services, including mergers and acquisitions (M&A) advisory and strategic consulting.

- Private Equity: Blackstone acquires and manages private companies to enhance their value and generate returns for investors.

- Life Sciences: A division called Blackstone Life Science (BXLS) focused on life sciences investments, including pharmaceuticals, biotechnology, and healthcare services.

5. Management and Leadership between BlackRock vs.Blackstone

Let us take a look into differences between BlackRock and Blackstone in leadership structure and management approaches:

BlackRock:

The hierarchy structure starts with the Global Executive Committee (GEC) as the top decision-making team at BlackRock and on top of it is the Chairman and Chief Executive Officer, Larry Fink, and Rob Kapita who serves as the President.

The other positions on the GEC team (headquartered at New York) include:

- Deputy Chief Financial Officer

- Chief Operating Officer Global Head of BlackRock Solutions

- Global Head of Human Resources

- Vice Chairman

- Chief Investment Officer of ETF and Index Investments

- Chief Legal Officer

- Head of BlackRock Global Markets

- Global Head of the Aladdin Business

- Global Head of iShares and Index Investments

- Chief Investment Officer of Global Fixed Income

- Global Head of BlackRock Systematic

- Chief Financial Officer

- Global Head of Corporate Strategy

- Global Head of Technology and Operations

- Head of the Global Client Business

- Head of Europe, Middle East, and Africa

- Global Head of BlackRock Alternatives

- Chief Risk Officer Head of the Risk and Quantitative Analysis

- Head of External Affairs

- Head of Great China

Following this consists of the Board of Directors with seasoned experiences in the financial industry. There comes the leadership team after, which provides guidance on corporate strategy and business analysis, including ensuring effective communication with external stakeholders.

The last on the hierarchy is the CEO and a small Executive team.

Blackstone:

Stephen Schwarzman is the Chairman, Co-Founder and CEO of Blackstone with many senior executives foreseeing different aspects of the company.

A few senior executives under Stephen Schwarzman are:

- Tony James, Executive Vice Chairman

- Jonathan Gray, President & COO

- Michael Chae, Chief Finance Officer

- Christine Anderson, Global Head of Corporate Affairs

- Joseph Barratta, Global Head of Private Equity

6. Market Reach and Global Impact Blackstone vs BlackRock:

BlackRock has a sizable market presence with offices around the Americas, Europe, Asia-Pacific, and other regions. The company has over 16,000 colleagues working in 38 countries at 89 offices.

On the other hand, Blackstone is well-represented in major financial markets with 26 offices across North America, Europe, Asia, and other continents, with over 4695 employees as of December 2022.

7. Future Prospects

Growth Strategies for BlackRock

BlackRock has funds focusing on growth strategy using multi-asset growth strategy.

What is a multi-asset growth strategy? It is suitable for long-term investors who seek long-term capital appreciation at a lower level of volatility than stocks.

Here are some funds that BlackRock manages:

1. Sustainable Balanced Fund

This fund allocates investments across debt, equity and convertible securities, harnessing both traditional financial metrics and ESG to identify opportunities for generating alpha and effectively managing risk.

2. 80/20 Target Allocation Fund

Investors can use this fund to attain a more diversified and balanced investment portfolio as this fund diversifies across a mix of active and passive strategies which encompasses stocks and bonds through a selection of underlying mutual funds.

3. 60/40 Target Allocation Fund

This fund offers investors a balanced and broad exposure to various asset classes, regions, and securities.

Growth Strategies for Blackstone

The company expects that by providing investors with the highest possible returns, its key strategy will continue to fuel growth.

The company plans to attract larger investments focused on these key strategies. For instance, the business recently hit a major milestone when it closed record-breaking secondary private equity funds, bringing in more than $25 billion.

The COO, John Gray highlighted insurance companies as another significant growth driver. Blackstone has partnered with four insurance clients and anticipates the platform’s growth.

It recently formed a strategic partnership with Resolution Life and contributed $500 million to help Resolution achieve its objective of raising $3 billion in new equity capital. Initially, Blackstone will oversee up to $25 billion of Resolution’s private assets, with expectations for this figure to exceed $60 billion in the coming six years.

Emerging Challenges and Opportunities

In the 2023 midyear investment outlook, although there are differences between BlackRock and Blackstone, it seems that the investment approach has evolved and there have been 3 key investment themes to navigate through this changing economic landscape.

Let’s take a look:

- Holding tight: Central banks maintain tight monetary policies due to the supply constraints and inflationary pressure. The investment expertise foresees that a broad asset class returns may be challenging, thus marking a departure from the previous decades of steady growth.

- Harnessing mega forces: Some structural changes such as Artificial Intelligence (AI), geopolitical shifts in globalization, population that is aging, the shifts to a low-carbon economy as well as a dynamic financial system are mega forces. To fully identify investment opportunities, it is important to identify sectors and companies taking into factors as mentioned above.

- Pivoting to new opportunities: the market volatility has exacerbated and led to a divergence of securities performance. To capitalize on this, investment experts can adopt a more granular approach by focusing on areas where the macro view is reflected in pricing.

Overview of BlackRock vs Blackstone:

Is BlackRock a good investment? Or Blackstone is more favourable?

Well, too much information can be overwhelming. Take a look at the overview below provides a snapshot of the key differences and some notable similarities between BlackRock and Blackstone, to help you grasp their characteristics at a glance.

| Aspect | BlackRock | Blackstone |

| Core Business Model | Asset management | Private equity and Alternative investments |

| Fund Strategy | Passive investment | Focus on asset enhancement and acquisitions |

| Investment Vehicles | Stocks, bonds, ETFs | Private equity, real estate, advisory |

| Global Presence | worldwide | Globally with a focus on alternatives |

| Investor Base | Instituitionals and individual investors | High net-worth individuals and institutions |

| AUM | $9 Trillion | $1 Trillion |

Conclusion

While there are differences between BlackRock and Blackstone, it illuminates the captivating dynamics of two financial giants with each offering a unique niche in the investment realm.

Comparative Advantages and Disadvantages

BlackRock is becoming a giant in asset management, offering unparalleled scale and stability with its range of passive investment products. Its global reach and well diverse products make it the first choice for many investors. One concern is that its sheer size has raised concerns about potential conflicts of interest.

However, Blackstone excels in private equity and alternative investments, leveraging its expertise in strategic acquisitions and advisory. Despite the higher risks associated with its specialisation, the huge profit potential of this niche remains undeniable.

Investor Insights

Investors should carefully consider their risk tolerance and investment objectives.

If you are an investor who is looking for stability and wants to diversify your portfolio through traditional investing, BlackRock may be a top choice, while Blackstone appeals to those willing to take calculated risks for potentially rich returns.

My Final Thoughts

BlackRock and Blackstone both occupy important positions in vast financial networks and shape the investment landscape.

The choice between them ultimately comes down to personal preference and goals as an investor. Whether you choose BlackRock’s proven stability or the allure of Blackstone’s alternative investments, one thing is for sure: The financial world is a richer place for these two giants.

The financial landscape is ever-changing and evolving. The competition and collaboration between BlackRock and Blackstone continue to redefine the contours of the investment world, offering investors with a fascinating journey full of opportunities and wide-array of choices.