Been thinking about owning a car in Singapore? Or are you curious about how much to own a car in Singapore?

I’ve had the same thought – the convenience of jumping into a car and heading wherever and whenever I want.

But then reality hits. The cost of owning a car in Singapore feels more like paying for a luxury lifestyle than a necessity.

The High Price of Convenience: Why Cars Are Expensive in Singapore

So, how much does it cost to buy a car in Singapore?

I remember thinking, “How does a car cost that much?” It’s not just the car itself because the system controls the number of vehicles on the road.

First, owning a car requires a Certificate of Entitlement (COE). The cost of the COE depends on market demand, and it only lasts ten years.

Moreover, there’s the Additional Registration Fee (ARF), a substantial percentage of the car’s open market value. Plus, you’ll pay import taxes, excise duties, and ongoing road taxes.

Remember the Electronic Road Pricing (ERP) system, too. You’re charged a fee when driving into busy areas during peak hours.

Parking? Good luck with that, too, since some spaces in the city can cost more than your lunch.

So why would anyone even consider owning a car in Singapore?

Pros of Owning a Car in Singapore

Convenience

For families, owning a car is particularly helpful when you’ve got kids in tow or a bunch of groceries. You can drive straight anywhere without waiting for buses or squeezing into an MRT during peak hours.

Freedom

Want to go for a spontaneous trip to Sentosa or explore a hawker center in the city? A car lets you go off the beaten track, which public transport may need help to reach.

But there’s the flip side…

Cons of Owning a Car in Singapore

Cost

I know people who joke that owning a car is like having a second mortgage. The upfront costs alone have a significant impact on your finances.

Moreover, you have to deal with fuel, insurance, and maintenance expenses.

Traffic During Peak Hours and ERP Charges

Have you ever driven through Orchard Road at 6 p.m.? It’s a test of patience.

You might pay for the freedom to drive, but you’re often stuck in traffic. And you need to pay for ERP fees while you’re at it.

Alternatives to Car Ownership in Singapore

I quickly started weighing the alternatives when I thought about the high cost of owning a car in Singapore.

First, you can use the public transport system, which is one of the best I’ve ever experienced. The MRT and buses are clean and reliable and can take you anywhere on the island.

Sure, they can get crowded during peak hours, but it’s hard to complain with services running frequently. Plus, it’s more affordable than owning and maintaining a car.

Ride-sharing services like Grab have also become super popular. I relied on Grab for days when I couldn’t face public transport. With carpool options like GrabShare, you get the convenience of a car ride without owning one.

Some friends opt for ride-hailing services like those from Gojek or Ryde. These services are great if you don’t want the long-term commitment or hassle of owning a car.

Need a car for specific occasions? Car rental companies and short-term options like Car Club offer a flexible, pay-as-you-drive approach.

Another option is cycling, a healthy and eco-friendly way to get around. Singapore is becoming more bike-friendly with dedicated paths, so I’ve been considering it more.

The alternatives to car ownership in Singapore are impressive. I’ve happily used public transport and ride-sharing without feeling like I’m missing out on anything.

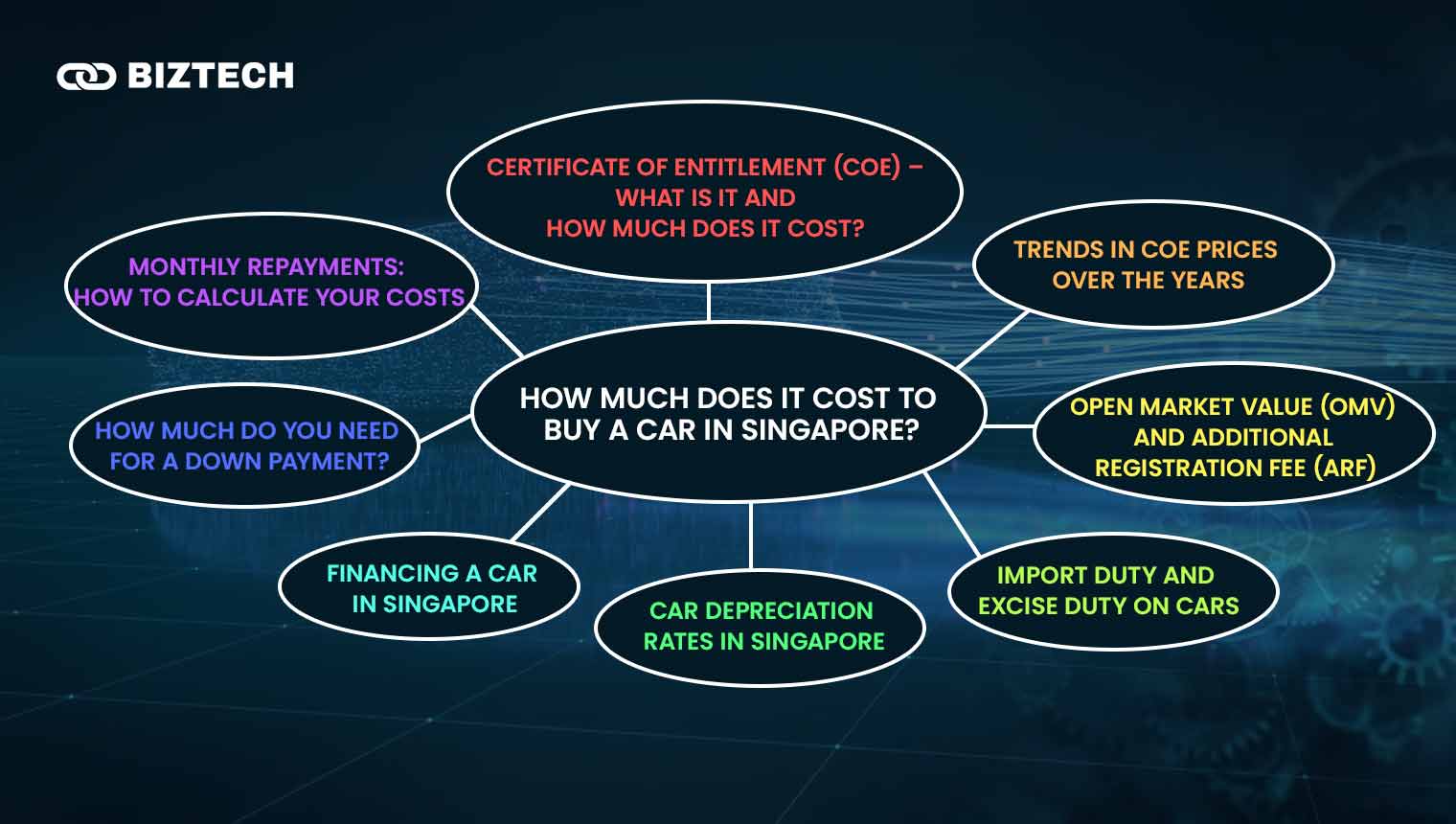

How Much Does It Cost to Buy a Car in Singapore?

I remember being overwhelmed when I first looked into the cost of buying a car in Singapore. It’s not just about picking out your dream car; you must also navigate the fees and taxes.

Initial Costs of Buying a Car

In Singapore, the bulk of the cost often comes from government-imposed fees. And it all starts with the Certificate of Entitlement (COE).

Certificate of Entitlement (COE) – What Is It and How Much Does It Cost?

When I first heard about COE, I thought, “Wait, I need to pay for the right to own a car?” Yep, that’s precisely what it is.

The government limits the number of cars on the road by controlling the number of COEs available. To get one, you have to bid in an auction, and these prices fluctuate based on demand.

For instance, COE prices can range from SGD 98,524 to SGD 113,104 (as of September 2024 – 2nd bidding). These prices depend on the vehicle category and market conditions.

Only a few cars can be registered yearly under the Vehicle Quota System (VQS). The government adjusts this number based on road capacity and environmental impact.

Five COE categories under the VQS currently determine which vehicles you’re bidding for when applying for a COE.

- Category A – This is for cars with up to 1,600 ccs engine capacity and a 97kW power output. If you’re eyeing a compact car like a Toyota Vios or Honda Jazz, this is where you’ll likely be.

- Category B – If your vehicle’s engine exceeds 1,600 ccs or has a 97kW power output, this is your category. You’ll find bigger, more powerful cars here.

- Category C – This is for commercial vehicles such as buses, trucks, and vans. This is your go-to category if you’re running a business that requires transporting goods.

- Category D – This one’s for motorcycles. It’s more affordable than other categories, but still subject to fluctuations.

- Category E – Also known as the Open Category, this one applies to all the above categories except Category D (motorcycles). You can use a Category E COE for any type of vehicle, but it’s pricier because of its versatility.

Trends in COE Prices Over the Years

COE prices have fluctuated wildly over the years. And this is where things get interesting and frustrating if you’re trying to buy a car.

The early 2000s

In the early 2000s, COE prices were relatively low compared to today. For example, the prices during December 2001 were:

- CAT A – SGD 26,998

- CAT B – SGD 28,998

- CAT C – SGD 21,000

- CAT D – SGD 509

- CAT E – SGD 28,001

This was a more affordable period for potential car owners, and demand for COEs wasn’t as intense as today’s.

2009-2011

As the global economy slowed down, Singapore’s car demand also decreased. Fewer people were willing to bid for them, leading to a decline in COE prices.

In January 2009 (2nd bidding), COE prices were:

- CAT A – SGD 2,693

- CAT B – SGD 200

- CAT C – SGD 2,900

- CAT D – SGD 900

- CAT E – SGD 3,200

However, this was short-lived. By 2011, the economy started to recover, and COE prices surged again as demand increased.

In July 2011 (2nd bidding), the prices were:

- CAT A – SGD 56,002

- CAT B – SGD 72,501

- CAT C – SGD 34,502

- CAT D – SGD 2,012

- CAT E – SGD 74,490

2013-2014

This period saw some of the highest COE prices ever recorded. This spike was mainly due to a lower supply of COEs being released and strong demand as Singaporeans’ wealth grew.

In October 2013 (1st bidding), the COE prices for different categories were:

- CAT A – SGD 85,000

- CAT B – SGD 93,500

- CAT C – SGD 76,310

- CAT D – SGD 1,961

- CAT E – SGD 93,889

Next, the prices for March 2014 (2nd bidding) were:

- CAT A – SGD 78,602

- CAT B – SGD 82,900

- CAT C – SGD 53,891

- CAT D – SGD 4,289

- CAT E – SGD 84,001

2015-2018

During these years, COE prices saw a more gradual decline. For example, the COE prices in December 2015 (2nd bidding) were:

- CAT A – SGD 54,301

- CAT B – SGD 55,001

- CAT C – SGD 46,001

- CAT D – SGD 6,600

- CAT E – SGD 57,501

And by 2018, the prices had fallen, partly due to an increased quota of COEs being released. Most 10-year COEs issued during the mid-2000s were expiring and being recycled back into the system.

In December 2018 (1st bidding), the prices were:

- CAT A – SGD 23,568

- CAT B – SGD 31,001

- CAT C – SGD 27,009

- CAT D – SGD 3,399

- CAT E – SGD 30,851

2020 (COVID-19 Impact)

COE prices remain low with lockdowns, reduced economic activity, and fewer people looking to buy cars.

In August 2020 (1st bidding), the COE prices were:

- CAT A – SGD 33,000

- CAT B – SGD 37,102

- CAT C – SGD 24,100

- CAT D – SGD 7,101

- CAT E – SGD 36,502

2021-2023

After the initial pandemic slowdown, COE prices rebounded sharply.

By late 2021, as the economy started to recover and more people wanted to buy cars, prices skyrocketed again. For example, in November 2021 (2nd bidding), the prices were:

- CAT A – SGD 55,001

- CAT B – SGD 79,601

- CAT C – SGD 43,502

- CAT D – SGD 9,381

- CAT E – SGD 86,001

By 2023, the rising prices were driven by higher demand and limited COE supply. In October 2023 (2nd bidding), the COE prices were:

- CAT A – SGD 106,000

- CAT B – SGD 150,001

- CAT C – SGD 84,790

- CAT D – SGD 11,201

- CAT E – SGD 158,004

The COE price volatility can make or break your decision to buy a car in Singapore. The price might seem just within reach in one year, and in the next, it could double.

It’s one of Singapore’s most unique and unpredictable aspects of car ownership.

Open Market Value (OMV) and Additional Registration Fee (ARF)

After the COE, you’ve got to consider the Open Market Value (OMV) and the Additional Registration Fee (ARF). And these two can add to the final cost.

The OMV is the vehicle’s value as determined by Singapore Customs, including the purchase price, shipping costs, and insurance. Regarding the ARF, it’s calculated as a percentage of the OMV, and the rate is tiered.

For example,

- For the first SGD 20,000 of the OMV, you’re charged 100% of that amount.

- For the next SGD 20,000 (SGD 20,001 – SGD 40,000), the rate jumps to 140%.

- For the next SGD 20,000 (SGD 40,001 – SGD 60,000), the ARF rate becomes 190%.

- For the next SGD 20,000 ((SGD 60,001 – SGD 80,000), expect a 250% rate.

- Anything above SGD 80,000 (SGD 80,001 and above) is taxed at a whopping 180%.

Planning to buy a Toyota Corolla Altis 1.6 Elegance with an OMV of SGD 22,741?

The ARF tiers are as follows:

- For the first SGD 20,000, the ARF rate is 100%.

- For the next SGD 2,741 (since the OMV is SGD 22,741, the remaining is SGD 2,741), the ARF rate is 140%.

ARF Calculation:

1. First SGD 20,000 at 100%:

- 100% of SGD 20,000 = SGD 20,000

2. Next SGD 2,741 at 140%:

- 140% of SGD 2,741 = SGD 3,837.40

Total ARF for Toyota Corolla Altis:

- SGD 20,000 + SGD 3,837.40 = SGD 23,837.40

So, the total ARF for the Toyota Corolla Altis 1.6 Elegance with an OMV of SGD 22,741 is SGD 23,837.40.

How about a BMW X4 XDRIVE30I MSPT ALED with an OMV of 67,196?

The ARF tiers are:

- First SGD 20,000 at 100%.

- Next SGD 20,000 (SGD 20,001 – SGD 40,000) at 140%.

- Next SGD 20,000 (SGD 40,001 – SGD 60,000) at 190%.

- Remaining SGD 7,196 (SGD 60,001 – SGD 67,196) at 250%.

ARF Calculation:

1. First SGD 20,000at 100%:

- 100% of SGD 20,000 = SGD 20,000

2. Next SGD 20,000at 140%:

- 140% of SGD 20,000 = SGD 28,000

3. Next SGD 20,000at 190%:

- 190% of SGD 20,000 = SGD 38,000

4. Remaining SGD 7,196 at 250%:

- 250% of SGD 7,196 = SGD 17,990

So, the total ARF for the BMW X4 XDRIVE30I MSPT ALED with an OMV of SGD 67,196 is SGD 103,990.

These examples show how quickly costs can rise when a car’s OMV exceeds SGD 20,000. The higher ARF rates for the following pricing tiers significantly add to the cost of owning a car in Singapore.

Import Duty and Excise Duty on Cars

Buying a car in Singapore involves several layers of taxes that can significantly inflate the final price. In addition to the COE and the ARF, you need to account for import duties and excise duties.

Import Duty is a tax on all cars brought into Singapore. It’s currently 20% of the car’s (OMV).

So, if you import a car with an OMV of SGD 30,000, you’ll pay SGD 6,000 in import duty alone.

Then, there’s the excise duty, a tax levied on goods produced or imported into Singapore. The excise duty on cars is also set at 20% of the OMV, which adds another layer of cost to your vehicle.

Combined, these taxes can significantly increase the cost of your car. If your vehicle has an OMV of SGD 50,000, you’ll pay $10,000 in import duty and $10,000 in excise duty.

When you add this to the COE and ARF, it becomes clear why cars are so expensive here.

Car Depreciation Rates in Singapore

How fast do cars depreciate in Singapore? Depreciation here is much steeper than in other countries.

Let’s say you’ve got a Toyota Corolla that you bought for SGD 100,000 and plan to sell it after 8 years for SGD 40,000. Now, the formula you’ll use to calculate your vehicle’s depreciation value is:

Annual Depreciation = (Total Cost of Vehicle – Sale Value of Vehicle) / Number of Years in Service

For your Toyota Corolla:

1. Subtract the sale value from the total cost.

- SGD 100,000 – SGD 40,000 = SGD 60,000 (this is how much value the car has lost over 8 years)

2. Divide by the number of years in service.

- SGD 60,000 / 8 years = SGD 7,500 per year

So, your car is losing SGD 7,500 in value yearly over the 8 years you own it.

Depreciation might not be something we think about daily, but it adds up. I’ve seen people try to sell their cars after just a few years, only to realize they’re getting back much less than they paid.

Financing a Car in Singapore

Getting a car loan in Singapore means following various rules. Singapore’s system is stricter, unlike some countries, where you can get a high loan-to-value (LTV) ratio.

How Much Do You Need for a Down Payment?

The Loan-to-Value (LTV) ratio determines how much you can borrow for your car purchase. The LTV ratio depends on the Open Market Value (OMV) of the car:

- If the car’s OMV is SGD 20,000 or less, you can borrow up to 70% of the car’s purchase price.

- If the OMV exceeds SGD 20,000, the maximum loan amount is capped at 60%.

You’ll need to make an upfront down payment of at least 30% to 40% of the car’s total price.

Let’s have a Corolla that costs around SGD 120,000 as an example. If the OMV is above SGD 20,000, you need to pay a 40% down payment of SGD 48,000.

Monthly Repayments: How to Calculate Your Costs

Once you’ve sorted out your down payment, the next step is to tackle your monthly repayments. This depends on several factors, including the loan amount, interest rates, and tenure.

- Loan Amount – This is the total amount you’ve borrowed after deducting the down payment. For a car that costs SGD 120,000, if you make a 40% down payment, your loan amount will be SGD 72,000.

- Interest Rates – Interest rates for car loans in Singapore typically range from 2.48% to 2.98% per annum, depending on the bank and loan terms.

- Loan Tenure – The maximum tenure for a car loan in Singapore is 7 years. A longer loan tenure means smaller monthly payments, but you’ll pay more interest over time.

If you can afford higher monthly payments, it’s often better to opt for a shorter loan tenure to save on interest.

To figure out how much your car loan will cost, you can use this simple formula:

Principal amount x Interest rate x Tenure/100 = Total interest

For example, if you borrow SGD 80,000 at a 2.5% interest rate for five years, your total interest will be SGD 10,000. Your car loan will be SGD 80,000 + SGD 10,000 = SGD 90,000.

Accordingly, your monthly repayment will be SGD 90,000 divided by 60 months = SGD 1,500.

To make this easier, many banks offer online car loan calculators. These tools are handy and can give you a quick estimate of your monthly repayments.

These repayments are calculated based on your borrowing amount, interest rate, and loan tenure. Loan calculators can help you make informed decisions before signing any car loan agreement.

There are several ways to use them effectively:

1. Start with the Loan Amount

This is where you enter the total amount you plan to borrow after your down payment. If the car costs SGD 100,000 and you have $30,000, you’ll need to borrow SGD 70,000 for the loan.

Here’s a tip: always try to put down a larger deposit. A higher down payment reduces your loan amount.

You can get lower monthly repayments and less interest in the long run.

2. Set the Loan Tenure

Next, choose your loan tenure (this is how long you plan to take to pay off the loan). You can go for a shorter period to pay off the loan faster.

The thing to remember here is:

- Longer tenures = lower monthly repayments but more interest over time.

- Shorter tenures = higher monthly payments but less interest overall.

3. Input the Interest Rate

When using the loan calculator, enter the interest rate you’ve been quoted. If you’re still shopping around for a loan, it’s better to test the calculator with different interest rates.

Even a slight change in interest can add hundreds of dollars to your repayments over the loan period.

4. Review Your Monthly Repayments

Once you’ve provided the numbers (loan amount, tenure, and interest rate), the calculator will calculate your estimated monthly repayments. This will give you a clear picture of how much you’ll need to budget each month.

A quick tip: play around with the numbers to see how different loan tenures and down payments affect your monthly repayments. If the monthly amount looks too high for comfort, you can:

- Increase your down payment or;

- Shorten your loan tenure to avoid overextending yourself.

5. Compare Loan Options

Finally, don’t just settle on the first loan offer you get. Use the loan calculator to compare different bank offers, interest rates, and terms.

You’ll quickly see how much you can save by choosing a lender with a slightly better interest rate.

Ongoing Costs of Owning a Car in Singapore

Buying a car is just the first hurdle. Once you’ve got the keys, the real adventure (and cost) of car ownership in Singapore begins.

If you don’t plan for these ongoing expenses, they can creep up on you fast.

Breakdown of Recurring Costs You’ll Face as a Car Owner

Recurring costs aren’t the kind of costs you can ignore; they’re part of the deal when owning cars in Singapore. And I’ll help you avoid that “oops, I didn’t know it would cost that much!” moment.

Road Tax and How It’s Calculated

Road tax is one of those things that catches you off guard if you’ve never owned a car before. It’s calculated based on your car’s engine capacity (measured in ccs).

And if your car has a bigger engine, you’ll pay more in road tax. It’s pretty straightforward, but the costs can pile up quickly.

As a car owner in Singapore, you must renew your vehicle’s road tax every 6 or 12 months. You can check the amount you have to pay with these formulas:

| Engine Capacity (EC) in cc for Petrol and Diesel Cars | 6-Month Road Tax |

| EC < 600 | $200 x 0.782 |

| 600 < EC < 1,000 | [SGD 200 + SGD 0.125(EC-600)] x 0.782 |

| 1,000 < EC < 1,600 | [SGD 250 + SGD 0.375(EC-1,000)] x 0.782 |

| 1,600 < EC < 3,000 | [SGD 475 + SGD 0.75(EC-1,600)] x 0.782 |

| EC > 3,000 | [SGD 1,525 + SGD 1(EC-3,000)] x 0.782 |

| Engine Capacity (EC) in cc for Petrol and Diesel Cars | 12-Month Road Tax |

| EC < 600 | SGD $400 x 0.782 |

| 600 < EC < 1,000 | [SGD 400 + SGD 0.25(EC-600)] x 0.782 |

| 1,000 < EC < 1,600 | [SGD 500 + SGD 0.75(EC-1,000)] x 0.782 |

| 1,600 < EC < 3,000 | [SGD 950 + SGD 1.5(EC-1,600)] x 0.782 |

| EC > 3,000 | [SGD 3,050 + SGD 2(EC-3,000)] x 0.782 |

| Vehicle Power Rating for Electric Cars | 12-Month Road Tax |

| PR <= 7.5 kW | SGD $200 x 0.782 |

| 7.5 kW < PR <= 30 kW | [SGD 200 + SGD 2(PR-7.5)] x 0.782 |

| 30 kW < PR <= 90 kW | [SGD 250 + SGD 3.75(PR-30)] x 0.782 |

| 90 kW < PR <= 230 kW | [SGD 475 + SGD 7.5(PR-90)] x 0.782 |

| PR > 230 kW | [SGD 1525 + SGD 10(PR-230)] x 0.782 |

For smaller sedans (up to 1,000cc), you’ll pay around SGD 391 annually. As engine capacity increases (1,001cc to 1,600cc), expect to pay about SGD 742.9.

Larger sedans with engines between 1,601cc and 2,000cc are taxed roughly SGD 1,212.1 annually.

If you own an SUV with an engine size of 1,601cc to 2,000cc, the tax will be around SGD 1,212.1 annually. SUVs with 2,001cc to 3,000cc engines can see taxes rise to approximately SGD 2,385.1.

Road tax is calculated based on electric vehicle power output. EVs between 30kW and 90kW are taxed at around SGD 371.45 per year.

More powerful EVs (90kW to 230kW) pay about SGD 1,192.55, and those over 230kW could see taxes exceeding SGD 1200.

Diesel cars older than ten years face an additional 10% to 50% surcharge, making them more expensive to own than petrol cars. Starting January 1, 2025, new diesel cars and taxis will no longer be registered. This is part of Singapore’s push to discourage diesel due to its environmental impact.

But what if you failed your road tax in time? If you miss the deadline, you’ll face a late fee and risk getting a fine of up to SGD 2,000.

Expect these fees for late road tax renewal:

| Engine Capacity (EC) in cc | Within 1 Month | 1 to 2.5 Months | More than 2.5 Months | More than 3 Months |

| EC ≤1,000 | SGD 10 | SGD 60 | SGD 80 | SGD 230 |

| 1,001 < EC < 1,600 | SGD 20 | SGD 70 | SGD 90 | SGD 240 |

| 1,601 < EC < 2,000 | SGD 30 | SGD 80 | SGD 100 | SGD 250 |

| 2,001< EC < 3,000 | SGD 40 | SGD 90 | SGD 110 | SGD 260 |

| EC ≥3,001 | SGD 50 | SGD 100 | SGD 120 | SGD 270 |

Do you own an older car?

If your car is over 10 years old, prepare for a little extra on your road tax bill. Older cars are subject to a road tax surcharge because they tend to emit more pollutants.

| Age of Vehicle | Annual Road Tax Surcharge |

| Over 10 years | 10% of Road Tax |

| Over 11 years | 20% of Road Tax |

| Over 12 years | 30% of Road Tax |

| Over 13 years | 40% of Road Tax |

| Over 14 years | 50% of Road Tax |

Car Insurance Costs for Expats and Locals

Before you can drive on the roads in Singapore, you need a valid car insurance policy. But, of course, you can navigate different options and factors that impact their premiums prior to getting one.

Different Insurance Types and Coverage Options

Third-Party Only (TPO)

This is the most basic and cheapest type of car insurance. It covers damages to other people’s property and injuries caused by your car.

However, it won’t cover damages to your vehicle.

Third-Party, Fire, and Theft (TPFT)

This option protects your car in case of fire or theft, in addition to third-party coverage. It’s a middle-ground choice for drivers wanting more peace of mind without opting for full coverage.

Comprehensive Insurance

The name says it all—this is the most complete option, covering damages to your car and others in accidents. It also covers damages due to fire, theft, and natural disasters.

It’s the go-to for most drivers, particularly if you’re driving a newer or higher-value car. While more expensive, it saves you from significant out-of-pocket costs after an accident.

Average Car Insurance Premiums in Singapore

On average, car insurance premiums in Singapore hover around SGD 2,000 annually. There’s no significant difference in the cost of car insurance for locals and expats.

Car insurance premiums are typically based on factors such as:

1. Age and Experience

Younger drivers, local or expat, are generally considered at higher risk due to their lack of experience. So, insurance companies tend to charge drivers in their 20s more.

For example, the average premium for drivers in their 20s can be around SGD 2,200. Those in their 40s might pay closer to SGD 1,600.

Tip: If you’re a new expat driver in Singapore, consider insurers that offer discounts for safe driving. You can also opt for bundle deals to help lower costs.

2. Occupation and Vehicle Usage

Your job and how often you drive can impact your premiums.

Does your job require you to be on the road frequently, like sales reps or delivery drivers? Your premiums may be higher due to the increased risk of accidents.

On the other hand, if you only drive on weekends or for leisure, you could pay less.

3. Type of Car

Your car’s make, model, and age play a significant role in determining your insurance cost. Luxury cars, SUVs, and continental cars tend to attract higher premiums because of their expensive parts and importing fees.

Brand-new cars may also have higher premiums due to the increased risk of theft and expensive replacement costs. They often have advanced features and technology that can be more expensive to repair or replace.

4. Claims History and No-Claim Discount (NCD)

If you have a good driving history with no claims, you’ll likely enjoy a lower premium. In Singapore, you can get up to 50% off your premiums if you’ve gone several years without filing a claim.

5. Gender

Men tend to pay more for car insurance than women across all age groups. The biggest price gap happens in your 20s, with guys paying about 12 more than women.

So, why do men pay more? It’s mainly because insurance companies see them as more accident-prone, making them riskier to insure.

Parking Costs: From HDB Flats to Shopping Malls

I’ve noticed that parking costs often catch new car owners off guard. After all, parking in Singapore isn’t cheap, and it varies depending on where you’re parking.

Here’s a rough breakdown:

If you live in an HDB flat, season parking for a typical car will cost around SGD 80 to SGD 110 per month.

But if you’re parking in commercial areas like shopping malls or the CBD, expect a different cost. Hourly rates can range from SGD 1 to SGD 3 per half hour, depending on the location.

You’ll also need to budget for ERP (Electronic Road Pricing) charges if you drive through toll gantries during peak hours. These fees can add up quickly, ranging from SGD 0.50 to SGD 6 per gantry.

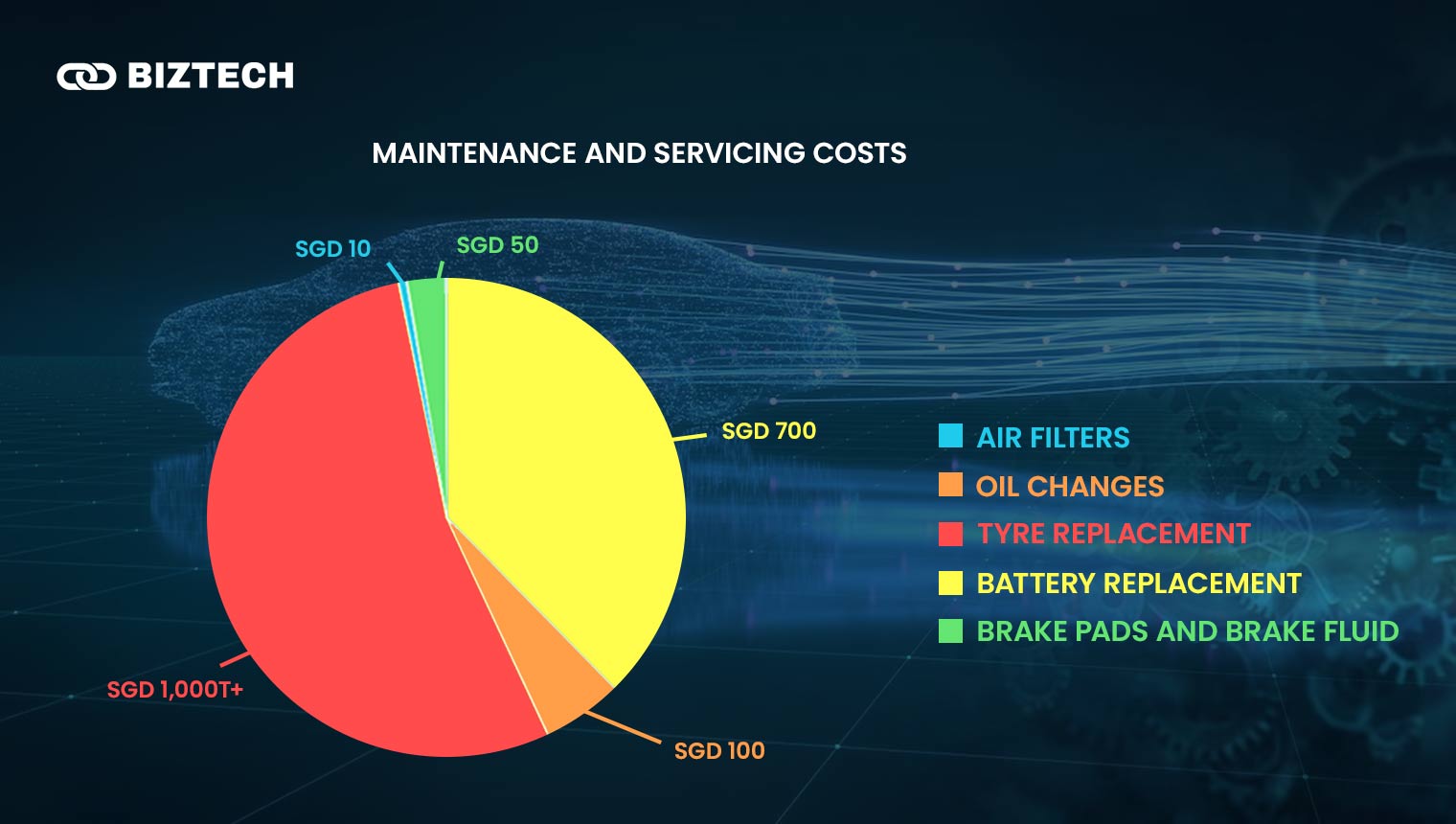

Maintenance and Servicing Costs

Owning a car in Singapore doesn’t stop at paying for fuel or insurance. You must also consider routine maintenance and servicing to keep your vehicle in good shape.

Singapore’s average car maintenance cost is around SGD 500 to SGD 800 yearly. The price depends on the car’s make and model.

And regular car servicing is recommended every 10,000 kilometers or six months.

It may feel like a lot to keep track of, but these services ensure your vehicle runs efficiently and reliably. Plus, keeping up with maintenance can prevent more costly repairs later on.

Oil Changes

You’ll spend around SGD 50 to SGD 100 for a standard oil change. The prices vary depending on the oil type, volume, and car model.

Luxury or high-performance cars requiring specialised oils can increase costs closer to S$300 or even higher.

Tyre Replacement

For a regular car, prepare SGD 400 to SGD 1,000+ for a full set of tyres. For luxury or performance vehicles, expect to pay SGD 1,200 or more for high-end brands like Pirelli or Michelin.

Brake Pads and Brake Fluid

Replacing brake pads generally costs SGD 50 onwards per piece. A full brake system check (including fluid replacement and rotor resurfacing) could range from SGD 600 to SGD 1,000.

Cars with performance or ceramic brakes can see even higher costs.

Battery Replacement

The average cost for a new battery ranges from SGD 150 to SGD 700, depending on your car’s make and model. Premium or hybrid vehicles can have much higher battery replacement costs, often over SGD 2,000.

Air Filters

Replacing your air filters every 15,000 to 30,000 kilometres is typically recommended. You can buy an air filter at a cheap price of SGD 10.

If you prefer more expensive ones, expect to pay SGD 60 to SGD 100.

Costs of Repairs for Common Car Brands in Singapore

Need to fix your car? You’ve got two main options: authorised service centres or independent workshops.

The official centres tend to charge a bit more, but they’ll use original parts and have that brand-specific expertise. Third-party garages, on the other hand, can often be cheaper but might use non-original parts.

Toyota

If you drive a Toyota, repairs are generally more affordable. The cost per visit for regular mileage servicing is between SGD 200 and SGD 800.

Honda

Honda’s repair costs start at SGD 231. However, if you encounter more serious issues, like transmission problems, the cost increases.

Subaru

If you own a Subaru, repairs through an authorised dealer workshop start at a more affordable SGD 155.

Nissan

You’ll find services starting from SGD 231, depending on the complexity.

Volkswagen and Skoda

Driving a Volkswagen or Skoda? Repair costs can start from SGD 324.

Mitsubishi, Kia, and Mercedes-Benz

If you’re driving a Mercedes-Benz, Kia, or Mitsubishi, be prepared for higher costs. Servicing at an authorised dealer workshop starts at SGD 414.

Other Unexpected Expenses to Consider

While car ownership is often seen as a symbol of freedom, the expenses go far beyond the sticker price or your monthly loan repayments. Several hidden costs sneak up on you, some of which might surprise you.

When considering car ownership, fuel, and maintenance costs probably come to mind first. But there’s a host of other expenses that can catch you off guard, from fluctuating fuel prices to the ever-present depreciation of your vehicle’s value.

Fuel Prices in Singapore

Fuel costs are one of those unavoidable expenses you can’t escape, particularly in Singapore, where prices are notably high.

Petrol

Petrol prices in Singapore fluctuate, but the cost starts at SGD 2.80 per litre on average.

If you’re driving a Toyota Corolla Altis, you may need 6.4 litres per 100 kilometres. So, if you cover about 17,500 annually in this car, you’ll spend SGD 3,136.

Diesel

Diesel tends to be slightly cheaper than petrol, typically around SGD 2.55 to SGD 2.64 per litre. But if you drive a diesel vehicle, you must also consider road tax.

Electric charging

Charging at public stations typically costs SGD 0.40 to SGD 0.55 per kWh. And if you do most of your charging at home, you’ll have slightly lower costs.

Depreciation: The True Cost of Car Ownership

Depreciation is often the biggest hidden cost of car ownership, and in Singapore, it hits harder than in most countries. Simply put, depreciation is how much value your car loses over time, and here, it’s heavily impacted by the COE.

Cars in Singapore lose value quickly, mainly due to the 10-year COE lifespan. The value of your vehicle drops sharply the moment you drive it off the dealership lot. It’s even normal for a car to lose 10% to 20% of its value in the first year alone.

No one wants to buy a car with a few years left on its COE unless they plan to renew it.

Resale Value: Can You Make Back Any Money?

The second-hand car market in Singapore operates quite differently from other countries due to a few unique factors. These factors include the COE system, high car prices, and strict government regulations.

It’s a busy market, with many car buyers choosing used vehicles over new ones to avoid the steep costs associated with buying brand-new cars, particularly high COE premiums.

If you keep your car in good condition, you can get a decent amount back. It’s always ideal to stay on top of maintenance and repairs to help retain as much value as possible.

When you eventually sell your car, your resale value will depend on a few key factors:

Age of the car

A newer car generally means less wear and tear and fewer mechanical issues. It also often has more up-to-date features, making it more appealing to buyers.

COE left

A car with several years remaining on its COE will always sell for more than one nearing its expiration. The buyer doesn’t have to worry about renewing the COE anytime soon.

Mileage

Lower mileage often signals that the car has been gently used and could last longer. In Singapore, a lower mileage car is generally considered to be in better condition because we don’t cover long distances.

How to Minimise the Cost of Owning a Car in Singapore

We’ve all heard about the high cost of car in Singapore, between the COE, road taxes, and maintenance fees. And it can seem overwhelming.

But worry not because there are ways to keep your car-related expenses manageable.

Choosing a More Affordable Car Brand

Sticking with a more affordable car brand can save you a lot of money upfront and in the long run.

Singapore’s market has plenty of reliable, budget-friendly options, which are popular with drivers because of their low maintenance costs. These cars also deliver fuel efficiency and decent resale value.

1. Honda Jazz Base 1.5 DOHC I-VTEC

Price: SGD 118,999

The Honda Jazz offers impressive fuel efficiency (up to 17.5 km/l). It also has a range of safety features like six airbags and hill start assist.

2. Suzuki Swift 1.2 Standard A

Price: SGD 134,900

The Suzuki Swift 1.2 Standard is a stylish, sporty hatchback perfect for zipping around the city. Its keyless entry and fuel efficiency (up to 24.4 km/l) make it a smart choice for daily commutes.

3. Mitsubishi Space Star 1.2

Price: SGD 113,999

With its small turning radius and impressive fuel economy (21.2 km/l), the Mitsubishi Space Star is perfect for navigating Singapore’s streets. Keyless entry and LED headlamps add convenience and safety to the package.

4. Perodua Bezza 1.3 Premium X (A)

Price: SGD 105,999

Known for its reliability and spacious 508L boot, the Perodua Bezza offers great value with features like the fuel-efficient VVT-i engine. Ideal for families or anyone looking for a practical ride.

5. Mazda 2 Hatchback 1.5 (A)

Price: SGD 156,000

Mazda’s KODO design gives the Mazda 2 a sleek, dynamic look. And its 1.5L engine delivers fuel efficiency and smooth handling.

6. Kia Stonic Mild Hybrid 1.0T EX (A)

Price: SGD 147,999

The Kia Stonic blends style with eco-friendly performance thanks to its mild hybrid engine. This car is perfect for urban adventurers, with a 0-100 km/h time of 10.4 seconds and a sleek, modern interior.

7. Mitsubishi Attrage 1.2 CVT Style (A)

Price: SGD 105,999

The Mitsubishi Attrage features a 450-litre boot, cruise control, and six airbags. Its fuel efficiency of 20.4 km/l is great for longer drives.

8. SEAT Arona 1.0 EcoTSI DSG Style (A)

Price: SGD 144,888

This compact SUV packs a punch with its 999cc engine, 400-litre boot, and impressive acceleration (0-100 km/h in 10 seconds). The SEAT Arona is a great all-rounder with features like auto headlights and a multi-zone air conditioning system.

Electric and Hybrid Vehicles: Do They Really Save Money in the Long Term?

Electric and hybrid vehicles have become increasingly popular in Singapore. This is thanks to the government’s push for greener alternatives and the incentives offered for eco-friendly cars.

But do they really save you money in the long term?

While electric vehicles like the Hyundai Kona Electric or Tesla Model 3 can have a higher upfront cost than petrol cars, they save on fuel costs. Charging an EV is significantly cheaper than filling up a petrol tank, and maintenance costs are typically lower as well.

That said, the cost of EVs in Singapore is still higher than that of petrol cars. So, you’ll need to calculate whether the savings on fuel will outweigh the initial purchase price over the years.

Hybrid vehicles like the Toyota Prius or Honda Vezel Hybrid offer a balance between petrol and electric power, which can help reduce fuel consumption.

Hybrids are often great for city drivers who spend much time in stop-start traffic. Over time, the fuel savings can add up,

However, hybrid cars tend to cost more upfront. However, they often pay for themselves in the long run, mainly if petrol prices keep rising.

Using Car Sharing and Leasing as an Alternative

If owning a car in Singapore is starting to feel a bit too costly, car-sharing and car leasing are alternatives worth considering. Both options offer flexibility and can save you money if you don’t always need a car.

Car Sharing Services

Car-sharing services allow you to rent a car only when you need it.

Don’t want to pay for COE, insurance, road taxes, and maintenance throughout the year? These services let you pay only for the time you use the car.

This is a great option for those who don’t need a car for daily commuting. It also offers a convenient way to get around occasionally, like for weekend trips or errands.

You just book a car via an app, pay by the hour or kilometre, and return it when you’re done. And it’s more cost-effective than owning a car for someone who only drives a couple of times a month.

Car Leasing Services

Leasing a car is another great alternative if you want the experience of driving a car without owning it outright.

Car leasing companies offer contracts that allow you to drive a car for 1 to 5 years. However, they also provide an option to extend or end the lease at the end of the term.

Leasing a car can be cheaper than buying one in the short term. It also typically includes servicing, insurance, and road tax, meaning you won’t have to pay unexpected repair bills.

But do you plan on keeping a car for many years? Leasing may not be the most cost-efficient in the long run, as monthly payments can add up over time.

Factors Influencing Car Prices in Singapore

So, will the car prices in Singapore rise or fall? Many potential car buyers try to make sense of the market’s future, particularly with the fluctuating prices over the years.

1. Government Policies: The COE Quotas

If you’ve ever tried to buy a car here, you’ve probably found yourself holding your breath during COE bidding rounds. The COE system plays a massive role in determining car prices.

If the government reduces COE quotas to manage congestion further, car prices will likely remain high or even increase. On the other hand, if quotas increase or stabilise, prices ease up a little. However, COE prices are unpredictable, and experts find it hard to make solid predictions.

2. Trends in Car Ownership: Will Fewer People Own Cars?

The landscape of car ownership in Singapore is undergoing a shift driven by a combination of

- High (COE) prices;

- Changing consumer behaviours;

- The government’s push towards a more sustainable transport future.

COE prices in Singapore have been on an upward trajectory, with experts predicting that this trend is likely to continue. As of late 2023, COE prices have reached:

- Almost SGD 100,000 for smaller cars (Category A)

- Over SGD 120,000 for larger and more powerful cars (Category B)

This represents a significant financial commitment for potential car buyers, making car ownership more of a luxury than a necessity.

Looking ahead, we can expect several key trends to shape the future of car ownership in Singapore:

Moderate Decline in COE Prices

Prices are unlikely to return to the lows of the past. However, an increase in COE supply from 2024 onwards should result in some relief for prospective buyers.

However, the high cost of cars in Singapore will likely remain a deterrent for many. This is particularly true in the context of Singapore’s zero-car growth policy.

Increased Acceptance of Public Transport

As public transport infrastructure improves, more Singaporeans may choose to forgo car ownership altogether.

The rise of integrated developments prioritising access to MRT stations and bus routes will make it increasingly convenient to rely on public transport.

Shift Towards EVs and Hybrids

Electric and hybrid vehicles will play a growing role in the future of car ownership.

Government incentives, technological advancements, and a greater focus on sustainability will likely drive demand for these environmentally friendly alternatives.

Continued Demand for Cars

Despite the high costs, car ownership will continue to be desirable for many Singaporeans. And this will be noticeable among families or those who value the convenience and status that comes with owning a car.

Rising household incomes and access to favourable car loan terms will ensure that demand for private cars remains strong despite high COE prices.

3. Rise of Electric Vehicles (EVs): Cheaper or More Expensive?

Another big factor to consider is the rise of EVs. The Singapore government has actively promoted EV adoption in recent years as part of its Green Plan.

Incentives like rebates on EVs and the goal to phase out internal combustion engine (ICE) vehicles by 2040 are pushing the EV market forward.

EVs could make car ownership cheaper in the long run. While an EV’s upfront cost might still be high due to COE and the current market, the running costs are generally lower.

With fewer moving parts, EVs require less maintenance. And you’ll save on fuel costs by charging your vehicle instead of filling up the tank.

Charging infrastructure is also improving, with more EV charging points being installed across the island. The government is committed to rolling out 60,000 charging points by 2030.

So as this infrastructure develops, we can expect more people to switch.

However, the question remains: Will EVs lower car prices overall? This depends on several factors.

We might see more affordable options in the EV market if:

- The government continues to offer strong incentives for EVs.

- COE quotas are adjusted to favour greener cars.

- The road tax and insurance premiums are lowered.

Comparison: Car Ownership vs. Public Transport in Singapore

With the city’s efficient MRT system, buses running like clockwork, and the increasing number of taxis and ride-hailing options, the decision isn’t always as straightforward as you might think.

Is the convenience of having your car worth the financial commitment?

Owning a car in Singapore isn’t cheap—it’s one of the most expensive places in the world.

Car Ownership Costs

Initial Purchase Price

The price of a car includes not just the vehicle itself but also the COE. Depending on the bidding market, it can cost upwards of SGD 100,000 alone.

Then there’s road tax, insurance, and maintenance costs, which add up year on year.

Petrol Costs

With petrol prices fluctuating, filling up your tank is no small expense, especially if you’re doing a lot of driving. It’s easy to underestimate how much this can add up – some drivers spend hundreds each month on fuel alone.

Parking Fees

Living in a HDB flat? Expect to pay around SGD 80 to SGD 110 monthly for a season parking ticket. That’s not counting the additional parking fees when you’re out and about, whether at shopping malls or your workplace.

Finding affordable parking in the city can be a challenge on weekends. Sometimes, you end up paying SGD 4 or more per hour.

Maintenance and Repair Fees

On average, maintaining a car in Singapore can cost upwards of SGD 500 to SGD 800 per year. For many, that’s a heavy financial burden to bear.

Public Transport Costs

On the flip side, using public transport is incredibly cost-effective. A typical MRT ride costs SGD 1.50 and SGD 2.50, depending on the distance, and buses are even cheaper. Monthly, most commuters spend less than $150 on public transport, even when factoring in the occasional taxi or Grab ride.

Pros and Cons of Each Option

Owning a Car

Pros:

- Convenience and Freedom – There’s nothing quite like the freedom of jumping into your car and going wherever you want, whenever you want. No need to check MRT schedules or wait for a bus.

- Comfort – Cars offer a private, air-conditioned space, which can be a luxury in Singapore’s tropical heat. If you’ve ever had to squeeze into a crowded MRT during rush hour, you’ll understand the appeal.

- Flexibility for Families– If you have young children or elderly family members, owning a car can be incredibly convenient for ferrying them around. This is particularly convenient during weekend trips or when visiting less accessible parts of the island.

Cons:

- High Costs – As we’ve discussed, the cost of owning a car in Singapore is substantial. Even if you can afford it, it’s hard to ignore the financial strain.

- Traffic – While public transport users avoid traffic jams, car owners often find themselves stuck during peak hours, especially on the Central Expressway (CTE) or the city centre. Despite having your own vehicle, you can still waste time in traffic.

- Environmental Impact– Cars contribute to air pollution and traffic congestion. Even if you drive an electric vehicle, it’s worth considering the environmental footprint.

Public Transport

Pros:

- Cost-Effective– Public transport is the clear winner in terms of affordability. You can easily get from one end of Singapore to another without breaking the bank.

- Environmentally Friendly – By choosing public transport, you’re contributing to a more sustainable Singapore. Public buses and the MRT system are more energy-efficient and help reduce the number of vehicles on the road.

- No Parking Worries– You never have to worry about finding a parking spot or paying hefty fees when you take the train or bus.

Cons:

- Less Flexibility– While public transport is reliable, it can’t offer the same flexibility as owning a car. If your commute involves multiple transfers or you’re carrying heavy groceries, the experience can be less than ideal.

- Crowds – If you’ve ever tried to get on the MRT during rush hour or taken a packed bus in the rain, you know how uncomfortable it can be. Sometimes, you just want a little more personal space.

The Hybrid Approach: Weekends with a Car, Weekdays on Public Transport

The hybrid approach might be the ideal solution for those who want the best of both worlds.

Some Singaporeans rely on public transport during the week for their daily commutes. But they have a car on hand for weekends or special occasions.

Taking the MRT or bus during the workweek makes sense. You avoid the hassle of parking, don’t have to worry about traffic and save a significant amount on petrol.

Then, come the weekend, having a car allows you to explore parts of Singapore less accessible by public transport.

Making the Decision: Is Car Ownership Right for You?

The right choice depends on your lifestyle, financial situation, and how much you value the convenience of private transport.

That said, car ownership offers convenience that public transport simply can’t match.

Public transport remains a highly viable, cheaper alternative for those who live in more central areas or are well-connected by MRT and bus routes.

Another hybrid option is renting or leasing a car for weekends or holidays while relying on public transport during weekdays. This way, you enjoy the cost savings of public transport with the freedom and flexibility of a car when you need it most.

The decision to buy a car in Singapore is complex. It involves balancing financial costs with lifestyle needs.

And for many, public transport or ride-sharing apps may provide enough flexibility at a fraction of the cost.

But do you value the freedom of having your own vehicle and are prepared for the high cost of car in Singapore? Car ownership is still an appealing, though expensive, option in this unique city-state.