Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The cryptocurrency market is in a big slump, with Bitcoin (BTC) down to about $103,000 as tensions rise in the Middle East. According to CoinGlass, the steep drop has caused a lot of liquidations, taking $1.16 billion out of the crypto derivatives market.

Bitcoin and Altcoins Drop

As of the morning of June 13, 2025, CoinMarketCap said that Bitcoin’s price was still going down. It fell from $108,500 to a daily low of $102,822, which was the lowest figure since early June. BTC went back up to almost $103,500 for a short time, although it still dropped by 4% in the last 24 hours.

Things weren’t going well for just Bitcoin. Other big coins lost significantly more money. Ether (ETH) dropped more than 10%, from $2,700 to $2,400. XRP and Solana (SOL) both lost a lot of value during this time, dropping 6% and 11%, respectively.

Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) are some of the most popular meme currencies, and they lost even more, between 10% and 14%.

The worldwide market capitalization of all cryptocurrencies fell by 6% in just 24 hours, to $3.21 trillion. This affected the whole crypto market as well. This big drop shows how scared people are and how much they are selling because of the upheaval in the world.

Huge Sell-Offs in the Derivatives Market

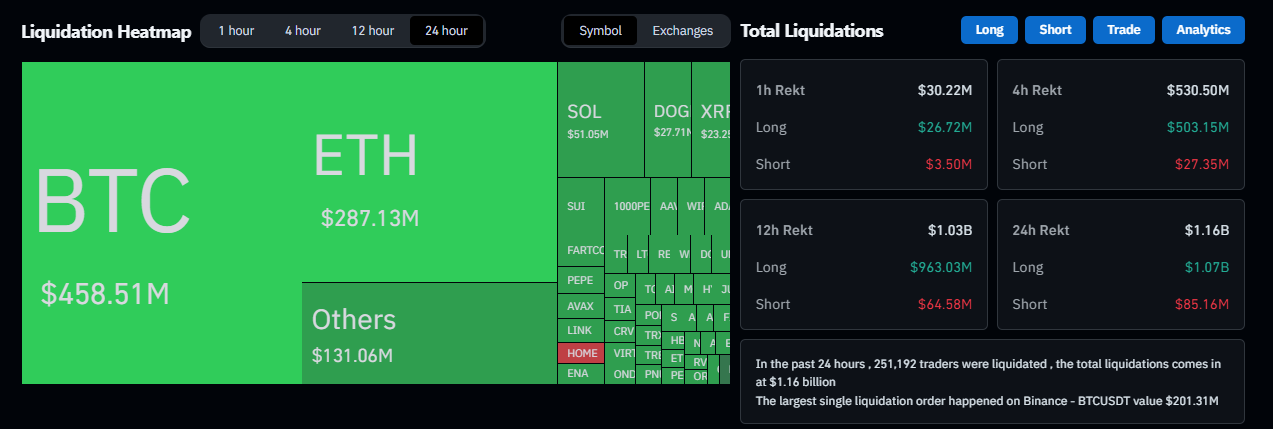

The crypto derivatives market took the worst hit, with CoinGlass stating that $1.16 billion worth of trades were canceled in the last 24 hours. Traders who were betting that Bitcoin’s price will go up and had long bets lost the most money, $1.07 billion.

Bitcoin saw the most long holdings wiped out, with $451 million worth of them gone. Ether came in second, with $247 million worth of long positions gone.

The size of these liquidations shows how risky and leveraged the crypto derivatives market is, where unexpected price changes can cause a chain reaction of liquidations. Traders who thought the market would go up were surprised by the sudden change, which cost them a lot of money.

Market Volatility Caused by Geopolitical Tensions

Axios, citing unidentified sources, was the first to claim that an Israeli military activity in Iranian airspace was the reason for the market turmoil. Al-Jazeera later confirmed that there were explosions in Tehran, Iran’s capital. This made people even more worried of a wider confrontation in the area.

The Israeli military said that the attacks hit military installations near Tehran and Tabriz. They called the operation a “pre-emptive response” to rising threats from Iran.

Israeli Prime Minister Benjamin Netanyahu called Iran’s plans to build nuclear weapons a “real and immediate danger” at a press conference.

He made it clear that Israel’s military reaction would continue for as long as it took to get rid of the perceived threat. The statement, which was shared a lot on sites like X, made people around the world even more worried about the region’s stability.

A report from the International Atomic Energy Agency (IAEA) added gasoline to the fire by saying that Iran had started enriching uranium again above the limitations that had been set before.

This was the first time in twenty years that Iran has broken international agreements in such a big way. This made people even more worried about a possible nuclear escalation, which made financial markets, including cryptocurrency, even more unstable.

More effects on the crypto market

The crypto market has always been sensitive to geopolitical events, but the size of this reaction shows how easily it may be shaken by outside events. Bitcoin, which is sometimes called a “safe haven” asset like gold, has had a hard time keeping its value when the world is uncertain.

The big drop in BTC and other cryptocurrencies shows that investors are migrating away from riskier assets, like digital currencies, and into safer ones, like bonds or gold.

The meme currency sector, which is notorious for being quite unstable, was hit the worst. Dogecoin, Shiba Inu, and Pepe, which typically depend on social media buzz and speculative trading, all fell by double digits.

This shows that regular investors are losing faith in the market as a whole. The big losses in these assets show that speculative excitement, which has fueled a lot of their recent expansion, may suddenly fade away when macroeconomic or geopolitical headwinds arise.

What Should Crypto Investors Do Next?

The present drop in the market makes people wonder what will happen to cryptocurrencies in the medium future.

Bitcoin momentarily rose near $103,500, but the 4% daily loss and persistent geopolitical uncertainty signal that the price may continue to change. Investors are paying close attention to what’s happening in the Middle East since any more escalation might make the sell-off worse.

Analysts say that a few important things could affect the direction of the market. First, it will be very important to settle the disagreements between Israel and Iran. A de-escalation could boost some people’s faith, which could help prices stay stable. But if the confrontation goes on for a long time or Iran breaks other international nuclear accords, the downturn might get worse.

The way the crypto market reacts to macroeconomic factors, such major central banks’ decisions about interest rates or changes in investor sentiment toward risk assets, will also be very important. Traders should be careful for now, especially in the derivatives market, where excessive leverage makes both gains and losses bigger.

What we learned from the crash

The $1.16 billion liquidation incident is a clear reminder of how risky the crypto market can be, especially for people who trade with leverage.

The fact that long position liquidations are so common shows how risky it is to make wagers that are too optimistic when things are uncertain.

Investors might need to rethink how they manage risk, such as by lowering their leverage and spreading their investments across different types of assets to lessen the effects of rapid market shocks.

Also, the way the crypto market reacts to geopolitical events shows how tied it is to global financial networks. Cryptocurrencies run on decentralized networks, but they are not immune to changes in the economy and politics.

As the market matures, it may become more closely linked to existing financial markets, which goes against the idea that crypto is a completely separate type of asset.

Conclusion

Everyone is watching the Middle East and the possibility of more geopolitical changes while the crypto market goes through this rough patch.

The $1.16 billion liquidation event and the 6% reduction in worldwide market capitalization have made investors less sure of themselves, but they also offer chances for those who are ready to ride out the storm.

Bitcoin and other cryptocurrencies may be able to get back on their feet if geopolitical stability, market sentiment, and larger economic trends all work together.

For the time being, the crypto community is left to deal with the effects of this unanticipated crisis, as traders and investors get ready for what might be a long period of instability. In the fast-paced world of cryptocurrency, being flexible and careful is still important.