Looking to grow your savings in Malaysia? Choosing a high-interest savings account can significantly boost your financial goals. Whether you’re saving for a dream vacation, your first home, or an emergency fund, the right account makes all the difference. Here’s an updated list of the top-performing high-interest savings accounts in Malaysia as of December 2024, based on interest rates and features. If you’re also looking for safer investment options, check out our guide on Best Low Risk Investments in Malaysia.

- 1. UOB One Account

- 2. Standard Chartered Privilege$aver

- 3. RHB Smart Account/-i

- 4. UOB Stash Account

- 5. Alliance SavePlus Account

- 6. OCBC 360 Account

- 7. Hong Leong Pay & Save Account

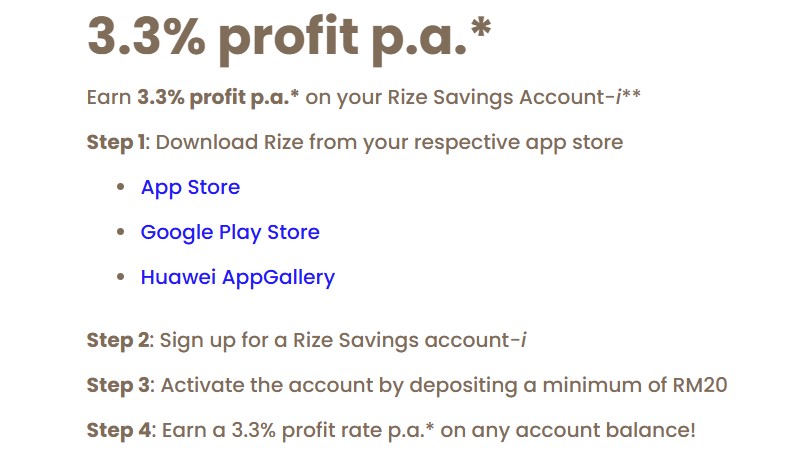

- 8. Rize Savings Account-i

- 9. MBSB Cash Rich Savings Account-i

- 10. Affin Invikta Account

- Factors to Consider When Choosing a Savings Account

- Conclusion

1. UOB One Account

- Interest Rate: Up to 6.00% p.a.

- Minimum Balance: None

- Key Features:

- Earn higher interest rates by meeting monthly requirements such as crediting your salary, paying bills, and spending with a UOB card.

- Offers flexibility with no minimum balance needed to open the account.

- Customers can access UOB’s mobile app for easy tracking of transactions and balance.

- Best For: Savvy savers who can consistently meet the monthly conditions to maximize returns.

2. Standard Chartered Privilege$aver

- Interest Rate: Up to 4.15% p.a.

- Minimum Balance: None

- Key Features:

- Attractive rates for fulfilling conditions like depositing funds, using Standard Chartered credit cards, and investing through the bank.

- Exclusive offers for Privilege$aver account holders, including investment advisory services.

- No minimum balance requirement for base interest.

- Best For: Individuals who can meet multiple conditions to earn bonus interest.

3. RHB Smart Account/-i

- Interest Rate: Up to 2.85% p.a.

- Minimum Balance: RM2,000

- Key Features:

- Additional bonuses for actions like paying bills online, spending with RHB cards, and making investments.

- Offers a combination of conventional and Islamic banking options to cater to diverse preferences.

- Convenient access through RHB Now mobile app and branch banking.

- Best For: Active users who manage regular transactions and investments with RHB.

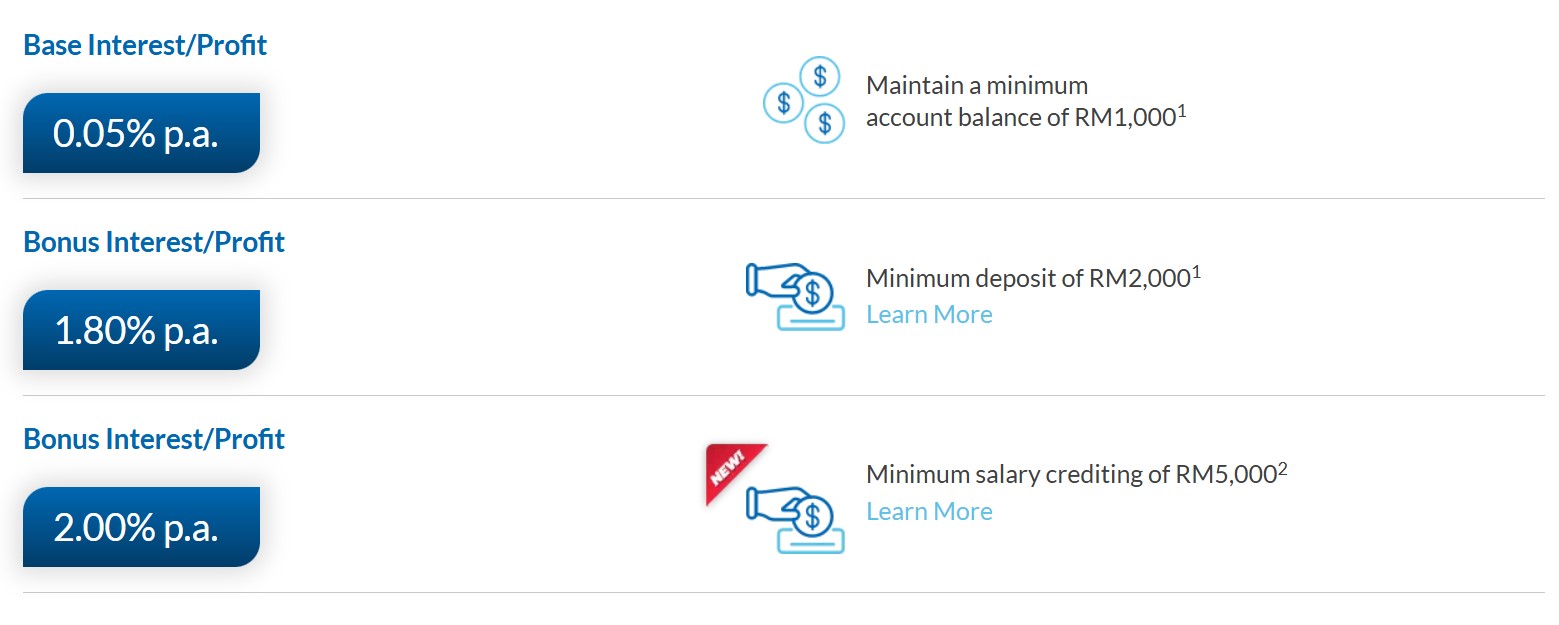

4. UOB Stash Account

- Interest Rate: Up to 3.20% p.a.

- Minimum Balance: None

- Key Features:

- Designed for savers who maintain or grow their balance monthly.

- The highest rates apply for balances between RM100,000 and RM200,000.

- Bonus interest is credited monthly for qualifying balances, encouraging consistent savings habits.

- Best For: Individuals who prefer straightforward savings with growth incentives.

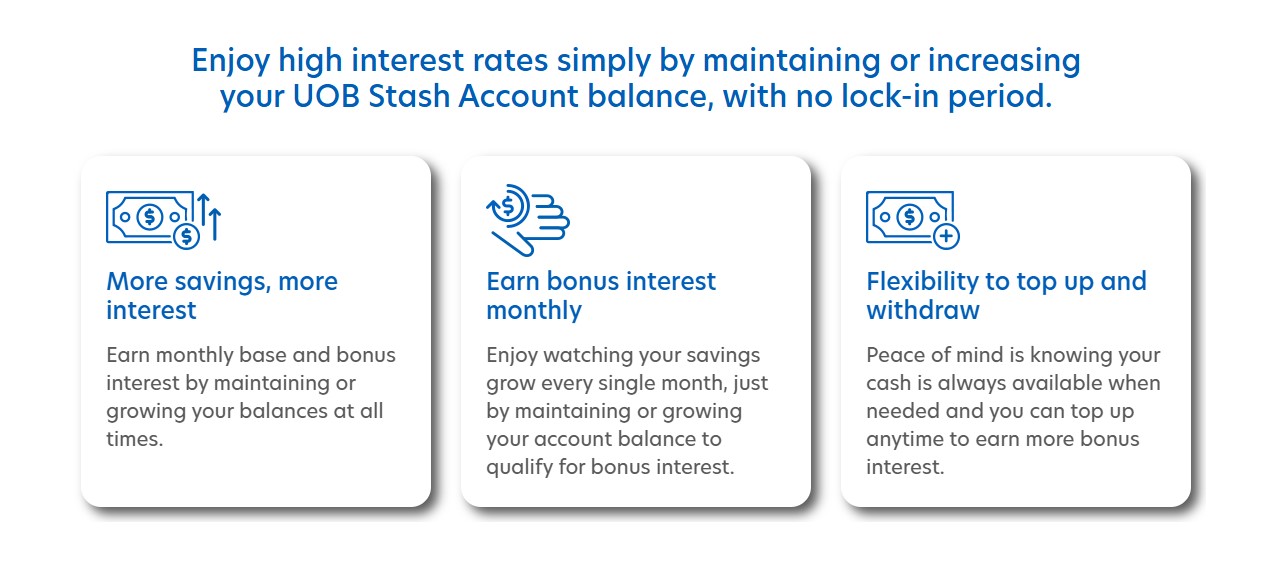

5. Alliance SavePlus Account

- Interest Rate: Up to 3.00% p.a.

- Minimum Balance: RM500,000

- Key Features:

- Simple tiered structure where maintaining a high balance unlocks better rates.

- No complex conditions or additional fees.

- Provides monthly e-statements and allows withdrawals without penalty.

- Best For: High-net-worth individuals seeking a low-maintenance savings option.

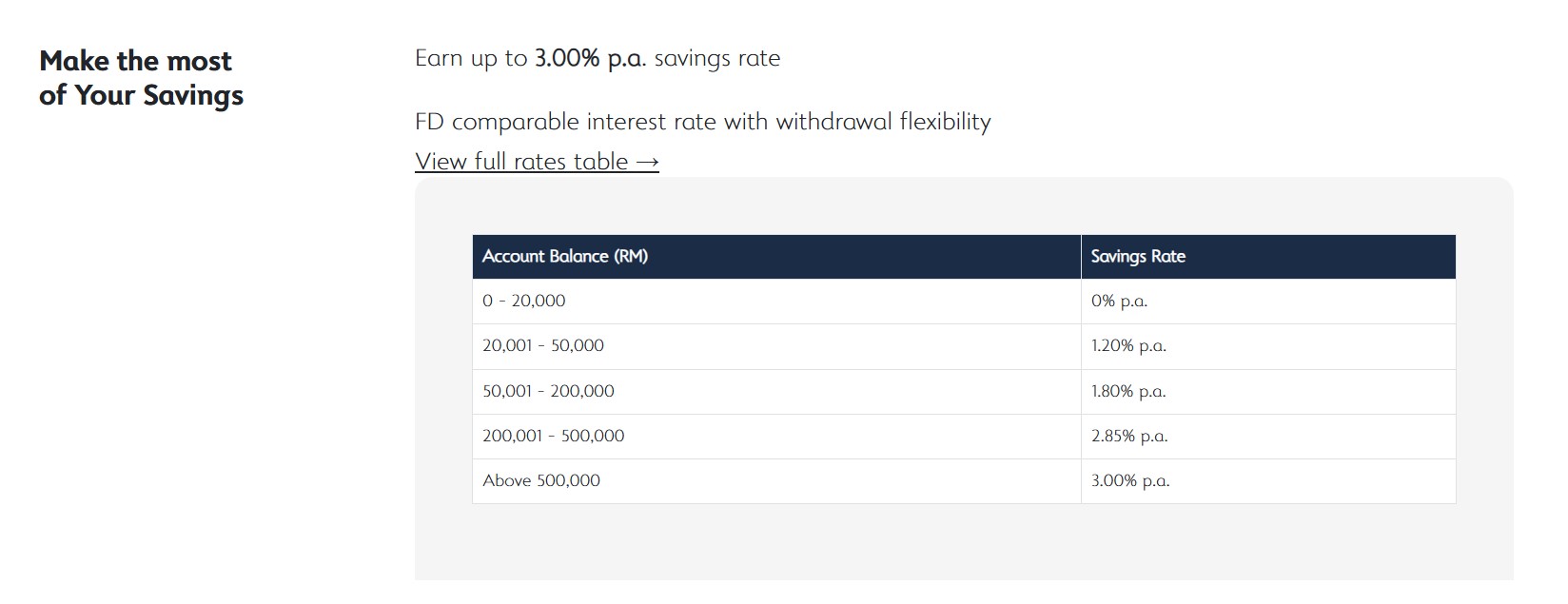

6. OCBC 360 Account

- Interest Rate: Up to 2.45% p.a.

- Minimum Balance: RM500

- Key Features:

- Offers bonus interest for salary crediting and maintaining a minimum balance.

- Provides flexibility with both online and branch banking options.

- Customers can earn additional rewards for setting up automated bill payments.

- Best For: Individuals who can maintain a minimum balance and fulfill salary crediting requirements.

7. Hong Leong Pay & Save Account

- Interest Rate: Up to 4.15% p.a.

- Minimum Balance: RM10,000

- Key Features:

- Bonus interest for meeting specific actions like monthly deposits and debit card spending.

- Free financial planning tools and alerts through Hong Leong’s online banking platform.

- Flexible access to funds with no penalties for withdrawals.

- Best For: Active users comfortable with regular transactions to maximize interest.

8. Rize Savings Account-i

- Interest Rate: Up to 3.80% p.a.

- Minimum Balance: None

- Key Features:

- Shariah-compliant account offering competitive promotional rates.

- Fully online account opening process with minimal documentation.

- Includes personal finance tips and tools through the bank’s mobile app.

- Best For: Individuals seeking an Islamic account with high promotional rates and online convenience.

9. MBSB Cash Rich Savings Account-i

- Interest Rate: Up to 1.85% p.a.

- Minimum Balance: None

- Key Features:

- Shariah-compliant option with competitive rates for Islamic banking users.

- No minimum balance requirement.

- Offers PIDM protection for deposits up to RM250,000, ensuring peace of mind.

- Best For: Individuals prioritizing Shariah-compliant savings with no balance restrictions.

10. Affin Invikta Account

- Interest Rate: Up to 1.80% p.a.

- Minimum Balance: Varies by subtype

- Key Features:

- Multiple account subtypes to suit different financial needs.

- Includes additional benefits such as preferential rates on loans and investments.

- Accessible through both online and branch banking.

- Best For: Individuals willing to explore detailed options and customize their savings approach.

Factors to Consider When Choosing a Savings Account

- Interest Rates: Understand the tiered structure and what actions are needed to achieve the highest rates.

- Minimum Balance: Select an account with requirements that match your saving capabilities.

- Bonus Conditions: Decide if you’re willing to meet specific criteria like spending with a credit card or crediting your salary.

- Fees: Watch out for charges related to withdrawals or failing to meet minimum balances.

- Accessibility: Opt for an account that offers convenient online or branch access based on your needs.

- Shariah Compliance: If you’re looking for Islamic banking options, consider accounts like RHB Smart Account/-i or UOB’s Stash Account.

Conclusion

The Malaysian savings account market offers diverse options to suit different financial goals and lifestyles. Whether you’re a high-net-worth individual or a young professional starting to save, there’s an account tailored for you. Use this guide to compare the top contenders and choose the one that best aligns with your goals. Remember to check with the banks for the latest rates and terms before opening an account.

Disclaimers:

- This list highlights popular accounts and is not exhaustive. Other options may better suit your needs.

- Information is accurate as of December 2024 but is subject to change. Always verify details directly with the banks.