Table of Contents

Understanding Islamic Credit Cards: Your Guide to Shariah-compliant Financing

Looking for a credit card that aligns with your Islamic values? Enter the world of Islamic credit cards, financial products that comply with Shariah law and cater to Muslim consumers seeking ethical and faith-based solutions.

What are Islamic credit cards?

Unlike traditional cards, Islamic credit cards function without charging or paying interest (riba), a key principle in Shariah law. Instead, they operate under alternative financing models like profit-sharing (mudarabah) or cost-plus-markup (murabaha), ensuring ethical and transparent transactions.

Ready to explore Islamic credit cards? Research available options, compare features, and consult with your local Islamic financial institution to find the perfect card for your needs. Remember, informed decisions lead to empowered financial choices aligned with your values.

Top Islamic Credit Card in Malaysia

Here is a comparison table highlighting the features, benefits, and drawbacks of the top Islamic credit card in Malaysia

| Credit Card | Features | Benefits | Drawbacks |

|

HSBC Amanah MPower Visa Platinum Credit Card-i |

– Cashback | – Up to 8% Cashback on eWallet, Petrol & Grocery Spend

– 0.2% Cashback on Other spend – 1% contribution on Charity spend – e-Commerce Purchase Protection (coverage up to USD200) |

– 8% Cashback requires total monthly spend of RM2,000 and above

– Cashback capped at RM15 per category per month |

|

BSN Platinum MasterCard Credit Card-i |

– Rewards points system

– Travel Takaful provided |

– Earn 2X points for every RM1 on global spending

– Earn 2X points for every RM1 on local dining, golf and travel expenses – Earn 1X points for every RM1 on local retail spending – Exchanges the gifts with your points – Up to RM300,000 travel Takaful protection – Free for life for annual fee |

– Annual income must meet at least RM48,000

– Reward Point system may not attractive compare to cashback |

|

Maybank Islamic Ikhwan American Express Platinum Card-i |

– Cashback

– Reward points system – Free annual fee |

– Enjoy up to 8% cashback on online spending

– Earn 3X points for every RM1 on selected eco-friendly merchants – Earn 2X points for every RM1 on local spending – Earn 1X points for every RM1 on petrol, government utilities, education, and Takaful – No Annual Fee |

– Higher income requirement

– The higher rewards category limited on selected eco-friendly merchants only |

|

Public Islamic Bank MasterCard Gold Credit Card-i |

– Cashback

– 0% balance transfer plan |

– Enjoy up to 2% cashback on grocery spending

– 0.1% of total dining spending will donated to Yayasan Waqaf – Enjoy 0 management fee and 6-months instalment plan |

– Narrow cashback category

– Low cashback rate – RM150 for annual fee |

|

Bank Islam Platinum Visa Credit Card-i |

– Rewards points system

– Takaful Travel Protection |

– Earn 1X TruPoints for every RM1 when local and global spending

– Enjoy Takaful travel coverage of up to RM1 million – Complimentary RM100,000 Takaful Protection on outstanding balances and RM1,000 on funeral expenses. |

– Expensive annual fee

– High annual income requirement – Reward points system not attractive compare to other |

|

CIMB Petronas Platinum-i Credit Card |

– Cashback

– Travel Protection – No Annual Payments |

– Up to 7% cashback at Petronas with Setel Transactions

– Up to 5% cashback when spending in Petronas with physical card – Unlimited cashback for all category – Waived for life on annual fee |

– Limitation for 7% cashback, only accepte for Setel transactions.

– Low as 0.2% unlimited cashback for all categories. – Cashback rate cap at RM30 per month – Spending limit required |

|

RHB World MasterCard Credit Card-i |

– Cashback

– Free access to Plaza Premium Lounges – Golf Privileges – Free Annual Fee |

– Enjoy up to 6% cashback on petrol, dining, and travel spending

– Enjoy 5X complimentary access to Plaza Premium Lounges – Enjoy 25% discounts for accompanying guests to Plaza Premium Lounges – Golf privileges in Selangor, Malaysia – Free annual fee for life |

– High annual income requirement

– Local spending cashback cap only RM30 per month – High monthly spending to gain high cashback rate |

|

AmBank Islamic Visa Infinite |

– Numerous Reward

– No Annual Payments – Travel Takaful Coverage – Islamic |

– 5X AmBonus Points for every RM1 on overseas spending

– 1X AmBonus Points for every RM1 on local spending – 5X Plaza Premium Lounge Access – Club Marriott Malaysia Privileges – 1 FOR 1 Dining Deals at Shangri-La Malaysia – Golf Privileges – Up to RM2 million Travel Takaful Coverage |

– Higher minimum income requirement

– Higher points needed for reward redemption. |

|

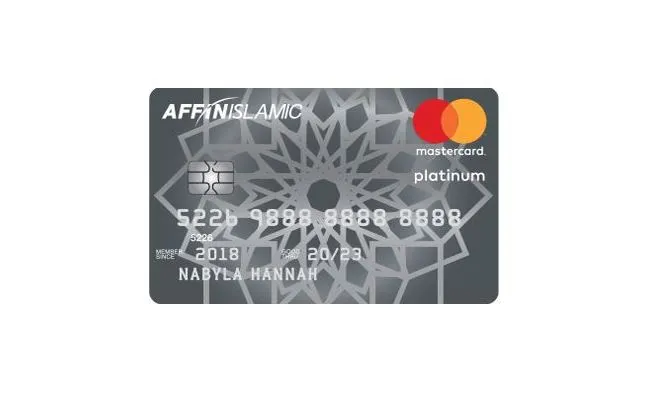

AFFIN Islamic Platinum Mastercard |

– Reward points system

– Free access to Plaza Premium Lounges – Free Annual Fee |

– Earn 1X AFFIN Reward points for every RM1 on dining, groceries, online and local retail spending

– Enjoy 2X complimentary access to Plaza Premium Lounges – Enjoy 25% discounts for accompanying guest to Plaza Premium Lounge Access – Spending and donating contribute to selected charity organization. – Free annual fee for life |

– Reward system not attractive compared to others

– Only 2x complimentary access to Plaza Premium Lounges |

|

Bank Rakyat Platinum Explorer Credit Card-i |

– Cashback

– Reward point system – Free access to Plaza Premium Lounges – Travel Takaful Coverage – Free Annual Fee |

– Enjoy 5% cashback for airline tickets and hotel bookings

– Earn 1X Rakyat Reward Point for every RM10 on all retail spending – Enjoy 3X access to Plaza Premium Lounges in Malaysia – Enjoy travel Takaful protection up to RM300,000 – Free annual fee for life |

– Only cashback on airlines and hotel bookings

– High requirement to earn the reward points – Higher annual income required |

How does a Malaysian Islamic credit card work?

Malaysians who want to take advantage of credit card convenience while adhering to Islamic financial principles have access to Islamic credit card, also known as credit card-i in that country. These cards are made to be Shariah-compliant, offering a different option from traditional credit cards while ensuring that Islamic finance principles are followed.

An overview of how a Malaysian Islamic credit card functions is provided below:

- Shariah Compliance: Islamic credit card must adhere to Shariah and be devoid of practices that Muslims consider to be forbidden. The ban of gharar (overcharging) and riba (interest) distinguishes Islamic credit card from traditional credit cards as their key differences. Compound charges are not used on Islamic credit card since Shariah law forbids overcharging.

- Filtering System for Permissible Transactions: Islamic credit card have filters built in to make sure they can only be used for halal (allowed) transactions. This means that no purchases of alcohol, gambling, or other items that are prohibited by Islam may be made using the card. The card issuer will refuse the transaction if the card is used for such things.

- No Interest (Riba): Islamic credit card carefully avoid any interest fees since interest (riba), which is against Shariah law, is not allowed. Instead, Islamic banks charge a “profit charge” for their services in order to supply these cards. Only when an unpaid balance remains after the grace period does this fee become effective.

- Different Features and Benefits: In terms of daily usage, Islamic credit card are identical to traditional credit cards. They might, however, offer slightly different features and advantages. As an illustration, Islamic credit card may provide takaful coverage (Islamic insurance), early repayment discounts, and the choice to make zakat contributions.

It’s vital to remember that Muslims are not the only ones who can use Islamic credit card. Islamic credit card are an option for non-Muslims who prefer the idea of Islamic banking over traditional credit cards.

Advantages of Islamic Credit Card

In addition to meeting their unique religious requirements, Islamic credit card also provide benefits for users’ protection and ethical banking practices. The following are the main benefits of Islamic credit card:

1. Ethical banking principles

Islamic credit card follow Shariah regulations, which encourage moral and prudent financial behaviour. These values forbid engaging in haram economic deals as well as engaging in riba (interest) and gharar (uncertainty). Individuals can support a more moral banking system and ensure that their financial activities are in line with their religious convictions by using an Islamic credit card.

2. Catering to specific religious needs

Islamic credit card offer benefits for consumer protection that put the welfare of cardholders first. For instance:

- Filtering System: Islamic credit card have a filtration system built in to make sure that only halal (permissible) transactions are allowed. This feature stops the card from being used to make purchases related to gambling, drinking, or other activities that Islam considers to be forbidden. Such transactions will be rejected by the card issuer, giving cardholders peace of mind and preventing their money from being used for illegal purposes.

- Transparent Liability: Islamic credit card come with a built-in filtration system to ensure that only halal (permissible) transactions can be made. With the help of this feature, the card can no longer be used to make purchases connected to drinking, gambling, or other prohibited behaviours in Islam. The card issuer will refuse such transactions, providing cardholders with peace of mind and preventing the misuse of their money.

- Early Repayment Rebates: Some Islamic credit card offer early payback discounts to encourage customers to pay off their unpaid bills as soon as possible. These rebates offer financial advantages and promote prudent credit usage.

3. Consumer protection benefits

Islamic credit card are created expressly to meet the demands of Malaysian Muslims who practise their religion. These cards guarantee adherence to Shariah guidelines while offering a practical and accessible financial tool. Islamic credit card do not include interest (riba) charges, which are forbidden by Islamic law, therefore Muslim cardholders can access credit facilities without jeopardising their faith.

Additionally, Islamic credit card include advantages including cashback, rewards, airmiles, and other features found on regular credit cards. These extra benefits give cardholders a financial edge while upholding their dedication to moral banking.

In order to maintain adherence to Shariah principles and consumer safety, Islamic banking, including Islamic credit card, is strictly regulated in Malaysia. In order to ensure that Islamic financial products correspond to Islamic law, shariah boards made up of qualified Islamic scholars are essential in analysing and offering comments on them.

Malaysian customers can take advantage of credit card benefits while upholding their moral values and supporting ethical banking practises by using Islamic credit card.

**Looking for the most ethical and rewarding credit card options? Discover the best credit cards in Malaysia on our informative page.