In Malaysia, Islamic credit cards have grown in popularity as a way to manage finances that is in line with Islamic values. To help people handle their money in a way that complies with Shariah law, these cards offer an alternative to regular credit cards. Islamic credit cards are complex, but this article will explain what they are, how they work, and how to pick the best one for you.

- Top Islamic Credit Cards in Malaysia

- 1. Maybank Islamic Ikhwan Mastercard Platinum Credit Card-i

- 2. HSBC Amanah MPower Platinum Credit Card-i

- 3. RHB Rewards Credit Card-i

- 4. Public Bank Petron Visa Gold

- Comparing Islamic Credit Cards: Features and Benefits

- Choosing the Right Card for Your Needs

- What Are Islamic Credit Cards?

- How Do Islamic Credit Cards Work?

- Benefits of Using an Islamic Credit Card

- Conclusion: Finding the Right Islamic Credit Card for Your Lifestyle

- Frequently Asked Questions

Top Islamic Credit Cards in Malaysia

1. Maybank Islamic Ikhwan Mastercard Platinum Credit Card-i

Key Features: Offers 5% cashback on petrol and groceries on weekends, capped at RM50 per month. No annual fee for the first year.

Who Is It Best For?

It is ideal for frequent shoppers who want to earn rewards on everyday purchases while enjoying cashback benefits.

2. HSBC Amanah MPower Platinum Credit Card-i

Key Features: Up to 8% cashback on petrol purchases at participating stations and 2x TreatsPoints on overseas spending.

Who Is It Best For?

Suitable for frequent travellers and those who regularly fill up at designated petrol stations.

3. RHB Rewards Credit Card-i

Key Features: Earn up to 5% cashback on all retail spending and additional rewards for halal transactions.

Who Is It Best For?

Great for consumers looking for flexibility across various spending categories while adhering to halal guidelines.

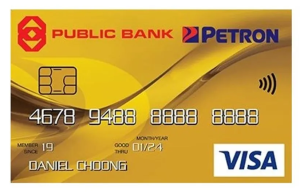

4. Public Bank Petron Visa Gold

Key Features: Cashback rates from 0.5% up to 5% on petrol purchases at Petron stations.

Who Is It Best For?

Perfect for loyal Petron customers seeking consistent rewards on their fuel expenses.

Comparing Islamic Credit Cards: Features and Benefits

| Credit Card | Cashback Rate | Annual Fee | Minimum Income | Ideal For |

| Maybank Islamic Ikhwan Mastercard | 5% (capped RM50) | Free (1st year) | RM30,000 | Frequent shoppers |

| HSBC Amanah MPower Platinum | Up to 8% | RM200 | RM60,000 | Frequent travellers |

| RHB Rewards Credit Card-i | Up to 5% | RM60 | RM36,000 | Flexible spenders |

| Public Bank Petron Visa Gold | Up to 5% | RM98 | RM24,000 | Petron loyalists |

Choosing the Right Card for Your Needs

When selecting an Islamic credit card, consider your spending habits and lifestyle:

Frequent Travellers: If you travel often, opt for a card like the HSBC Amanah MPower Platinum that offers enhanced rewards for overseas spending.

Everyday Shoppers: The Maybank Islamic Ikhwan Mastercard is ideal for those who frequently shop for groceries and fuel.

Petrol Users: The Public Bank Petron Visa Gold provides excellent cashback opportunities if you primarily refuel at Petron stations.

What Are Islamic Credit Cards?

Islamic credit cards are a kind of credit card that adheres to Islamic law, often known as Shariah. Islamic credit cards, in contrast to their conventional counterparts, function through a profit-sharing arrangement rather than charging interest (riba). Credit card users will not be charged interest on their outstanding balances, but rather a profit rate or fee. To further guarantee that users are engaging in ethical spending, these cards limit transactions to just halal (permissible) products.

How Do Islamic Credit Cards Work?

Islamic credit cards function similarly to traditional credit cards but with key differences:

- No Interest Charges: If you do not pay off your balance in full by the due date, you will not incur interest charges. Instead, a profit rate is applied to the remaining balance.

- Ujrah Fee: This is a service fee charged for the benefits and services provided by the card issuer, replacing conventional interest fees.

- Halal Transactions: Purchases made using an Islamic credit card must adhere to Shariah principles, typically excluding any goods or services deemed haram (forbidden).

These features make Islamic credit cards appealing to Muslims and non-Muslims who prefer ethical banking practices.

Benefits of Using an Islamic Credit Card

Utilizing an Islamic credit card offers numerous advantages:

- Shariah Compliance: Ensures that your financial activities align with Islamic teachings.

- Flexible Payment Options: Users can manage their payments without the burden of interest.

- Rewards and Cashback: Many Islamic credit cards provide cashback or reward points for every purchase, similar to conventional cards.

- Financial Transparency: Clear terms and conditions regarding fees and charges promote better financial management.

Conclusion: Finding the Right Islamic Credit Card for Your Lifestyle

Credit cards that adhere to Islamic principles provide an option for people who are looking for a different kind of financial instrument. With so many choices, it’s important to evaluate your spending patterns and pick a credit card that works for you in Malaysia. Managing your money responsibly while reaping the benefits of savings and incentives is possible with these Shariah-compliant solutions.

**Looking for the most ethical and rewarding credit card options? Our informative page will help you discover the best credit cards in Malaysia.