Calculate Your Loan Repayment Instantly

- Calculate Your Loan Repayment Instantly

- Understanding Housing Loan Malaysia

- Recent Trends in Malaysia’s Housing Loan Market

- What you should know about home loans in Malaysia

- Types of Housing Loan Malaysia

- Factors to Consider When Choosing a Housing Loan

- Detailed Review of Top Housing Loan Providers in Malaysia

- 1. Bank Negara Malaysia: Premier Choice for Stability

- 2. CIMB Group: Comprehensive Banking Solutions

- 3. Maybank: Traditional Yet Reliable

- 4. Public Bank Berhad: Customer-Centric Approach

- Best Housing Loans for First-time Buyers

- Best Housing Loans for Investment Properties

- Best Housing Loans for Refinancing

- Best Islamic Housing Loans

- How Do You Increase Your Chances Of Getting Approved For A Home Loan?

- 1. Check your credit score

- 2. Calculate your debt-service-ratio (DSR)

- 3. Prove stability in your employment background

- What Documents Do I Need To Apply For A Home Loan?

- Summary and Conclusion

- Frequently Asked Questions (FAQs)

This introduction will discuss the essential elements of comprehending Malaysian home loans and the current trends affecting the local housing loan Malaysia market in 2023.

Understanding Housing Loan Malaysia

Many Malaysians use housing loans to finance their investment when buying a home. A housing loan, usually a home loan or mortgage, is a financial product that banks and other financial organisations provide to help people purchase homes. These loans give borrowers the money they need to buy the homes they want and offer adjustable repayment periods to fit their budgets.

Borrowers in Malaysia often need to meet certain eligibility requirements to obtain a housing loan. These requirements might include being employed, having a steady income, and satisfying the minimum age and credit requirements imposed by the lenders. The housing loan Malaysia amount granted is determined by several variables, including the borrower’s income, creditworthiness, and property valuation. Borrowers must also consider other important factors, including the housing loan length, housing loan interest rates, and associated costs.

Recent Trends in Malaysia’s Housing Loan Market

Several notable trends in housing loan Malaysia sector in 2023 have influenced how prospective homeowners can borrow money. The availability of low-interest housing loans is one noticeable development. Financial institutions have created competitive low-interest housing loans to entice borrowers as the demand for affordable housing keeps rising. People now have more opportunities to obtain house loans with advantageous terms, allowing them to manage their money better.

Further development in Malaysia’s housing loan Malaysia sector is a stronger focus on digital accessibility and convenience. The procedure of applying for a loan has been simplified thanks to the development of online and mobile platforms by banks and other financial organisations. Borrowers can readily access house loan calculator through various digital channels, compare housing loan Malaysia interest rates, and submit their applications comfortably from the convenience of their homes.

Furthermore, Malaysian homeowners are becoming increasingly familiar with the idea of refinancing. Borrowers can refinance their old mortgages to replace them with new ones with better interest rates and repayment terms. This pattern has allowed borrowers to lighten their financial load and exploit opportune market circumstances to maximise their loan commitments.

What you should know about home loans in Malaysia

Due to the numerous terms you’d need to be aware of, and the processes it takes from making an offer to purchasing up to receiving the keys in your hands, buying and owning a home is typically difficult and occasionally daunting for first-time home purchasers.

Therefore, here are a few things to know to help you better grasp this procedure before applying for a mortgage.

Types of Housing Loan Malaysia

Understanding the many housing loan Malaysia options available to consumers is crucial when considering a home loan in Malaysia. Here are the three most typical forms of mortgages in Malaysia:

- Term Loan: The most fundamental kind of mortgage is a term loan. It has a set repayment schedule, with a regular monthly payment over the course of the loan. Those who like predictable monthly instalments should choose this form of credit.

- Semi-Flexi Loan: Borrowers have some flexibility with semi-flexi loans. It enables you to make additional payments to lower the loan principal and interest payments. The increased payments, however, cannot be withdrawn. This loan is excellent for people wanting to speed up repayment while retaining flexibility.

- Flexi Loan: Borrowers have the most freedom with flex loans. You can use it to reduce the loan principal and interest payments by depositing extra money into a linked current account. Additionally, you can withdraw extra money as needed. Individuals with variable income or occasionally needing additional funds might benefit from this loan.

Understanding the different types of housing loan Malaysia will help you choose the one that aligns with your financial goals and preferences.

Factors to Consider When Choosing a Housing Loan

To choose a housing loan Malaysia wisely, it is important to consider the following factors:

- Interest Rates: Interest rates from various banks and financial institutions should be compared. Over the course of the loan, a low-interest housing loans can result in significant financial savings for you. Consider whether you want a set or variable interest rate that changes depending on the market.

- Loan Tenure: It is important to compare low-interest housing loans offered by different banks and financial institutions. A reduced housing loan interest rate can help you save a lot of money over the course of the loan. Consider whether you want a fixed interest rate or one fluctuating in response to the market.

- Repayment Flexibility: It’s crucial to compare the low-interest housing loans that various banks and financial organisations provide. You can save a lot of money over the course of low-interest housing loans. Consider whether you want a set interest rate or one that varies depending on the market.

- Fees and Charges: It’s critical to compare the low-interest housing loans offered by different banks and financial institutions. With low-interest housing loans, you can save a lot of money over the life of the housing loan Malaysia. Consider whether you want a fixed interest rate or one that changes with the market.

Considering these aspects, you can choose a house loan that best meets your financial needs and long-term goals.

Detailed Review of Top Housing Loan Providers in Malaysia

1. Bank Negara Malaysia: Premier Choice for Stability

In Malaysia, Bank Negara Malaysia is often regarded as a cornerstone of financial stability, offering a variety of housing loan options designed to meet the diverse needs of Malaysian borrowers. Their focus on fostering homeownership and ensuring financial accessibility makes them a reliable choice.

Types of Housing Loans Offered

- Term Loan: Provides fixed repayment terms with predictable monthly installments, making it easier for borrowers to manage finances.

- Flexi Loan: Offers flexibility to make additional payments, which can reduce the loan principal and lower interest costs over time.

Interest Rates & Payment Terms

To illustrate, let’s consider an example:

- Loan Amount: RM500,000

- Loan Tenure: 30 years (360 months)

- Interest Rate: 3.50% p.a.

Calculation:

- Monthly Interest Rate: 3.50% / 12 = 0.29%

- Monthly Installment: (500,000 * 0.29%) / (1 – (1 + 0.29%)^(-360))

- Total Repayment: Monthly Installment * Loan Tenure

This example highlights the affordability and competitive rates offered, though actual figures may vary based on creditworthiness and loan eligibility.

Customer Service Evaluation

Bank Negara Malaysia prioritizes a customer-centric approach with dedicated support teams available through in-person, phone, and digital channels. Their online platforms allow borrowers to manage loans, track repayments, and access financial tools conveniently. With its emphasis on accessibility and support, Bank Negara Malaysia stands as a top choice for housing loans.

2. CIMB Group: Comprehensive Banking Solutions

CIMB Group, a leading Malaysian financial institution, provides a range of housing loan products designed for different borrower needs. Their commitment to innovation and customer satisfaction makes them a popular choice.

Types of Housing Loans Offered

- Term Loan: Fixed monthly payments ensure stability.

- Flexi Loan: Allows borrowers to make prepayments to reduce interest costs, with the flexibility to withdraw excess payments if needed.

Interest Rates & Payment Terms

Example scenario:

- Loan Amount: RM500,000

- Loan Tenure: 20 years (240 months)

- Interest Rate: 4.00% p.a.

Calculation:

- Monthly Interest Rate: 4.00% / 12 = 0.33%

- Monthly Installment: (500,000 * 0.33%) / (1 – (1 + 0.33%)^(-240))

- Total Repayment: Monthly Installment * Loan Tenure

Customer Service Evaluation

CIMB is known for its streamlined processes and responsive customer service teams. Borrowers can access robust digital platforms for managing accounts and payments. With a focus on transparency and customer convenience, CIMB remains a dependable option for housing loans.

3. Maybank: Traditional Yet Reliable

In Malaysia, Maybank is a well-established financial institution with a reputation for providing dependable housing loan solutions. Their widespread presence and customer-focused approach make them a trustworthy option.

Types of Housing Loans Offered

- Term Loan: Offers fixed repayment terms for stability.

- Flexi Loan: Enables borrowers to reduce their loan principal through additional payments, offering greater control.

Interest Rates & Payment Terms

Example scenario:

- Loan Amount: RM500,000

- Loan Tenure: 30 years (360 months)

- Interest Rate: 3.50% p.a.

Calculation:

- Monthly Interest Rate: 3.50% / 12 = 0.29%

- Monthly Installment: (500,000 * 0.29%) / (1 – (1 + 0.29%)^(-360))

- Total Repayment: Monthly Installment * Loan Tenure

Customer Service Evaluation

Maybank excels in providing a seamless housing loan application process. Their digital tools, including mobile apps, allow borrowers to manage repayments and access loan-related information easily. Maybank’s dedication to service quality cements its reputation as a reliable choice.

4. Public Bank Berhad: Customer-Centric Approach

Public Bank Berhad is renowned for its focus on customer satisfaction, offering a variety of housing loan options tailored to meet diverse needs.

Types of Housing Loans Offered

- Conventional Term Loan: Provides fixed monthly payments for a set period.

- Flexi Loan: Offers flexibility to make additional payments, reducing interest and principal.

Interest Rates & Payment Terms

Example scenario:

- Loan Amount: RM500,000

- Loan Tenure: 30 years (360 months)

- Interest Rate: 3.50% p.a.

Calculation:

- Monthly Interest Rate: 3.50% / 12 = 0.29%

- Monthly Installment: (500,000 * 0.29%) / (1 – (1 + 0.29%)^(-360))

- Total Repayment: Monthly Installment * Loan Tenure

Customer Service Evaluation

Public Bank emphasizes accessibility and service quality. Their mobile apps and online platforms provide real-time loan management tools, while dedicated support teams ensure a smooth borrowing experience.

Best Housing Loans for First-time Buyers

In Malaysia, selecting the right house loan is essential for first-time buyers. Here are some of the top mortgage products designed with first-time buyers in mind:

- Maybank First Home Scheme: First-time buyers can apply for a special housing loan Malaysia programme Maybank offers. First-time buyers can realise their dream of homeownership with the support of Maybank, which offers several advantages, including reasonable housing loan interest rates and flexible financing alternatives.

- CIMB Skim Rumah Pertamaku: The Skim Rumah Pertamaku (My First Home Scheme) programme from CIMB Bank offers first-time homebuyers appealing financing alternatives and other advantages. This programme offers reduced interest rates and greater funding margins to increase first-time homebuyers’ access to housing affordability.

- RHB Easy Homeownership Campaign: The Easy Homeownership Campaign from RHB Bank is intended to help first-time homebuyers get into their ideal homes. To help first-time buyers lessen the financial burden of house ownership, this programme offers competitive housing loan interest rates, flexible financing alternatives, and special incentives.

Best Housing Loans for Investment Properties

Choosing the appropriate housing loan in Malaysia is crucial for people interested in investing in real estate. The following are some of Malaysia’s top home loan choices for investment properties:

- UOB Property Loan: A property loan designed for investment purposes is available from UOB Bank. This loan is a popular alternative for investors wishing to increase the size of their real estate portfolio since it offers competitive housing loan interest rates and flexible repayment options.

- Alliance Bank My Home Investment Loan: Alliance Bank offers a specific housing loan Malaysia for investment properties. This loan accommodates the particular requirements of real estate investors and has attractive housing loan interest rates and specialised financing options.

- Hong Leong Bank Flexi Property Financing: Hong Leong Bank provides a flexible financing option for investment properties. Investors can benefit from this loan’s reasonable housing loan interest rates, practical payback terms, and flexibility to deduct additional loan installments.

Best Housing Loans for Refinancing

Borrowers may benefit financially or reduce their interest costs by refinancing their mortgage. The following are some of Malaysia’s top refinancing options for housing loans Malaysia:

- Public Bank Flexi Home Financing-i: With the flexible home financing option provided by Public Bank, customers can cut their interest payments and loan terms. This refinancing option offers competitive housing loan interest rates, as well as the freedom to make additional payments and remove surplus funds as needed.

- RHB Smart Move Home Financing: For consumers wishing to refinance their current mortgage, RHB Bank offers Smart Move Home Financing. The convenience of online application and approval, affordable housing loan interest rates, and flexible repayment options are all features of this housing loan.

- Alliance Bank CashVantage Home Loan: The CashVantage Home Loan from Alliance Bank offers refinancing choices with competitive housing loan interest rates and the chance to access the equity in the property for cash. Borrowers who want to combine their debts or access more funds for other uses might apply for this housing loan.

Best Islamic Housing Loans

Several banks in Malaysia provide Shariah-compliant housing loans Malaysia for people looking for Islamic financing choices. Some of the top Islamic mortgages on the market are listed below:

- Bank Islam Home Financing-i: Based on the principle of Murabahah (cost plus profit), Bank Islam’s Home Financing-i offers attractive profit rates. The flexible repayment periods and financing alternatives offered by this housing loan that complies with Shariah are designed to meet the various needs of homebuyers.

- Maybank Islamic Home Financing-i: Home finance alternatives that are consistent with Shariah and Musharakah Mutanaqisah (Diminishing Partnership) are offered by Maybank Islamic. This housing loan is appropriate for Islamic financing because of its affordable profit rates and flexible repayment terms.

- RHB Islamic Bank Home Loan: Home Loan-i, a Shariah-compliant financing option that upholds the concepts of Bai Bithaman Ajil (Deferred Payment Sale), is provided by RHB Islamic Bank. Homebuyers looking for alternatives to conventional Islamic financing can use this housing loan’s competitive profit rates and flexible repayment choices.

How Do You Increase Your Chances Of Getting Approved For A Home Loan?

Applying for a house loan can be challenging for first-time homebuyers, especially if they lack trustworthy resources. A house loan eligibility question may also be on your mind.

Here are some tips on improving your chances of getting your house loan approved by the bank now that you are armed with the above fundamental knowledge regarding home loans.

1. Check your credit score

Your credit score is one of the most important variables lenders consider when approving a mortgage. Your credit score is a reflection of your creditworthiness and a prediction of your propensity to make timely debt payments. Examining and raising your credit score to maximise your chances of being approved for a home loan in Malaysia is crucial. What you can do is:

- Review Your Credit Report: Get a copy from companies that provide credit reports, such as Credit Bureau Malaysia or CTOS. Examine your report for any mistakes or inconsistencies and, if found, report them for rectification.

- Pay Your Bills on Time: Make sure to pay all your bills on time, including utility bills, credit card bills, and loan repayments. Late payments may impact your credit score.

- Reduce Your Debt: Pay off or as much down your current debts as possible. A high debt load may reflect financial difficulty and harm your credit score. Avoid taking on additional debt and concentrate on paying off existing obligations.

- Maintain a Healthy Credit Utilization Ratio: Keep your credit utilisation ratio, the percentage of your total available credit that you currently use, below 30%. A lower credit utilisation ratio indicates reliable credit management.

- Avoid Multiple Loan Applications: You should try to avoid applying for too many loans simultaneously. Multiple applications may reduce your credit score and raise questions about your creditworthiness.

You increase your reputation as a borrower and your chances of being approved for a home loan by having a strong credit score.

2. Calculate your debt-service-ratio (DSR)

Your Debt-Service-Ratio (DSR) is an additional essential consideration in the loan approval procedure. DSR is the percentage of your monthly income used to pay off obligations, such as the possible mortgage. Calculate your DSR and maintain within a favourable range to improve your loan acceptance chances. This is how:

- Determine Your Monthly Income: Determine your total monthly income, taking into account your pay, benefits, and other revenue sources.

- Calculate Your Monthly Debt Obligations: Adding together your pay, benefits, and other income streams, calculate your monthly take-home pay.

- Assess Your DSR: To calculate your DSR as a percentage, divide your monthly debt payments by your monthly income and multiply by 100. Lenders often like a DSR below 60% to ensure you have enough money to repay your loan.

Divide your monthly debt payments by your monthly income and multiply the result by 100 to get your DSR as a percentage. To ensure that you have adequate money to repay your housing loan, lenders frequently want a DSR below 60%.

3. Prove stability in your employment background

Employment stability is important to lenders since it shows a reliable source of revenue for housing loan repayments. Show proof of solid employment history to increase your chances of getting a house loan approved. What you can do is:

- Maintain Job Stability: Aim to have a stable employment history with few job alterations. Borrowers who have worked at the same company for at least two years are frequently preferred by lenders.

- Prepare Employment Documents: Obtain the pay stubs, job contracts, and offer letters required to prove your income stability.

- Show Proof of Income: Provide bank statements and income tax returns to demonstrate a consistent and sufficient income flow.

Lenders will have more faith in you if you demonstrate stability and consistency in your employment history, increasing your chances of getting a home loan.

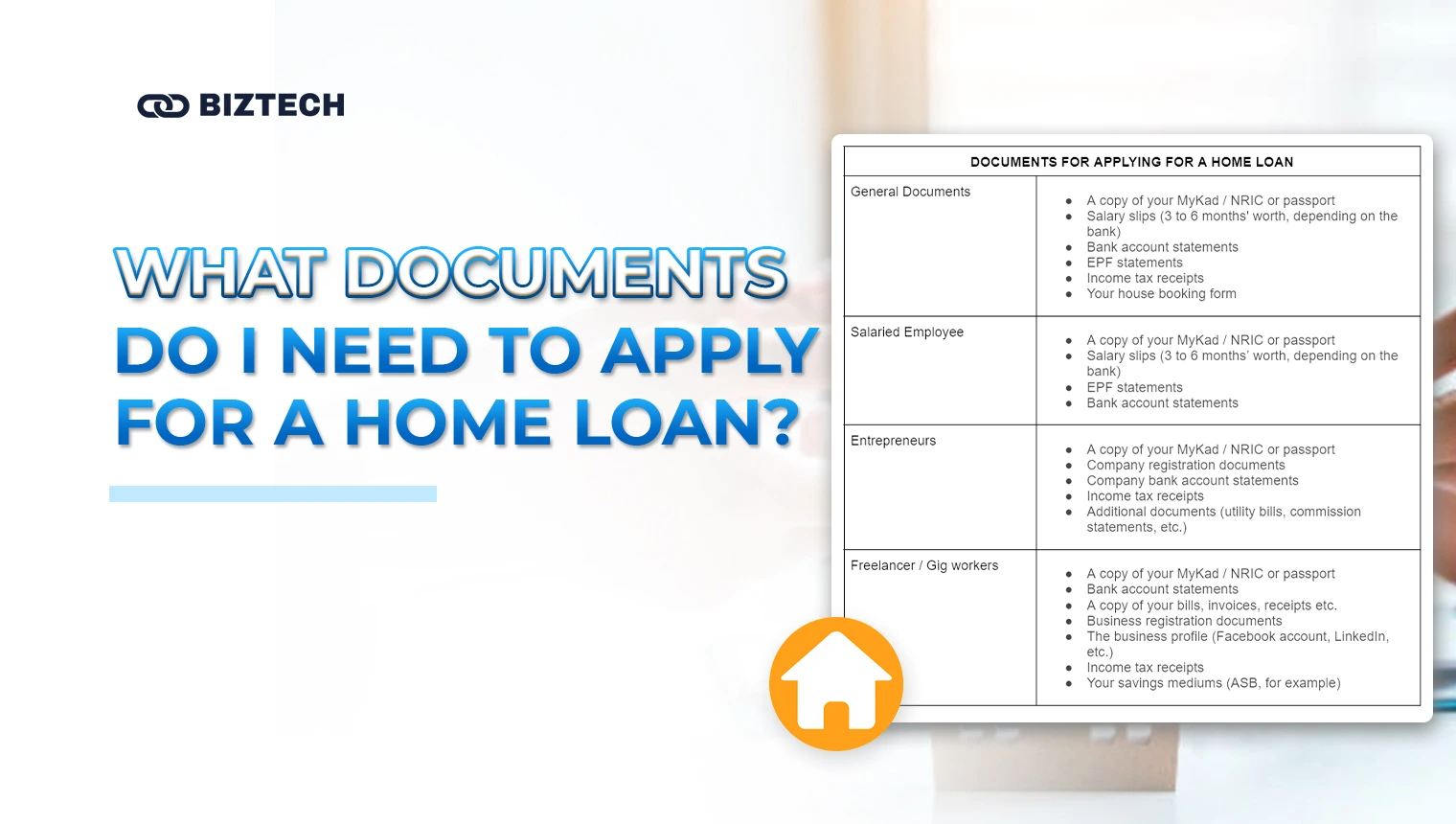

What Documents Do I Need To Apply For A Home Loan?

Are you prepared to start your online application for a mortgage? Have the following documents available for most banks to process your application so the procedure goes more smoothly.

Additionally, you can send any additional papers you may have, such as fixed deposit certificates, Amanah Saham Berhad (ASB) certificates, Tabung Haji account statements, bonds, etc. These could be helpful since they could raise your chances of approving your housing loan.

| DOCUMENTS FOR APPLYING FOR A HOME LOAN | ||

| General Documents |

|

|

| Salaried Employee |

|

|

| Entrepreneurs |

|

|

| Freelancer / Gig workers |

|

|

Summary and Conclusion

In conclusion, Malaysians must make a critical choice when selecting a house loan. In addition to Bank Negara Malaysia, CIMB Group, Public Bank Berhad, RHB Bank, Hong Leong Bank, AIA Home Loan, UOB Home Loan, Alliance Islamic Bank, Bank of China Malaysia, and many others, we have thoroughly examined the top housing loan Malaysia providers. For varied purposes, each bank offers a range of housing loans, including those for first-time buyers, investment properties, refinancing, and Islamic finance.

Malaysians should consider details like housing loan interest rates, payment schedules, customer service ratings, and the precise kinds of housing loans each bank offers to make an informed choice. To learn more, conduct in-depth research, weigh your options, and consult websites like RinggitPlus, Trusted Malaysia, and Loanstreet.

Ultimately, Malaysians should carefully consider their financial capabilities, long-term aspirations, and payback capacities before selecting a bank loan. Before making a final choice, getting professional advice and speaking with the banks directly to understand the terms and conditions is advisable. By making an informed decision, Malaysians can find low-interest housing loans for their circumstances and open the door to a smooth and successful road towards homeownership.

Read more: Best Fast Approval Personal Loans in Malaysia