Calculate Your Loan Repayment Instantly

- Calculate Your Loan Repayment Instantly

- Fast Approval Personal Loans In Malaysia

- Definition of Fast Approval Personal Loans

- Working Mechanism of Fast Approval Loan

- Importance of Fast Approval Personal Loan in Financial Emergencies

- Are there banks that offer fast loan approval?

- Banks Offering Fast Loan Approval in Malaysia

- Non-Banks Offering Fast Loan Approval

- What is the Approval Process for Fast Loans?

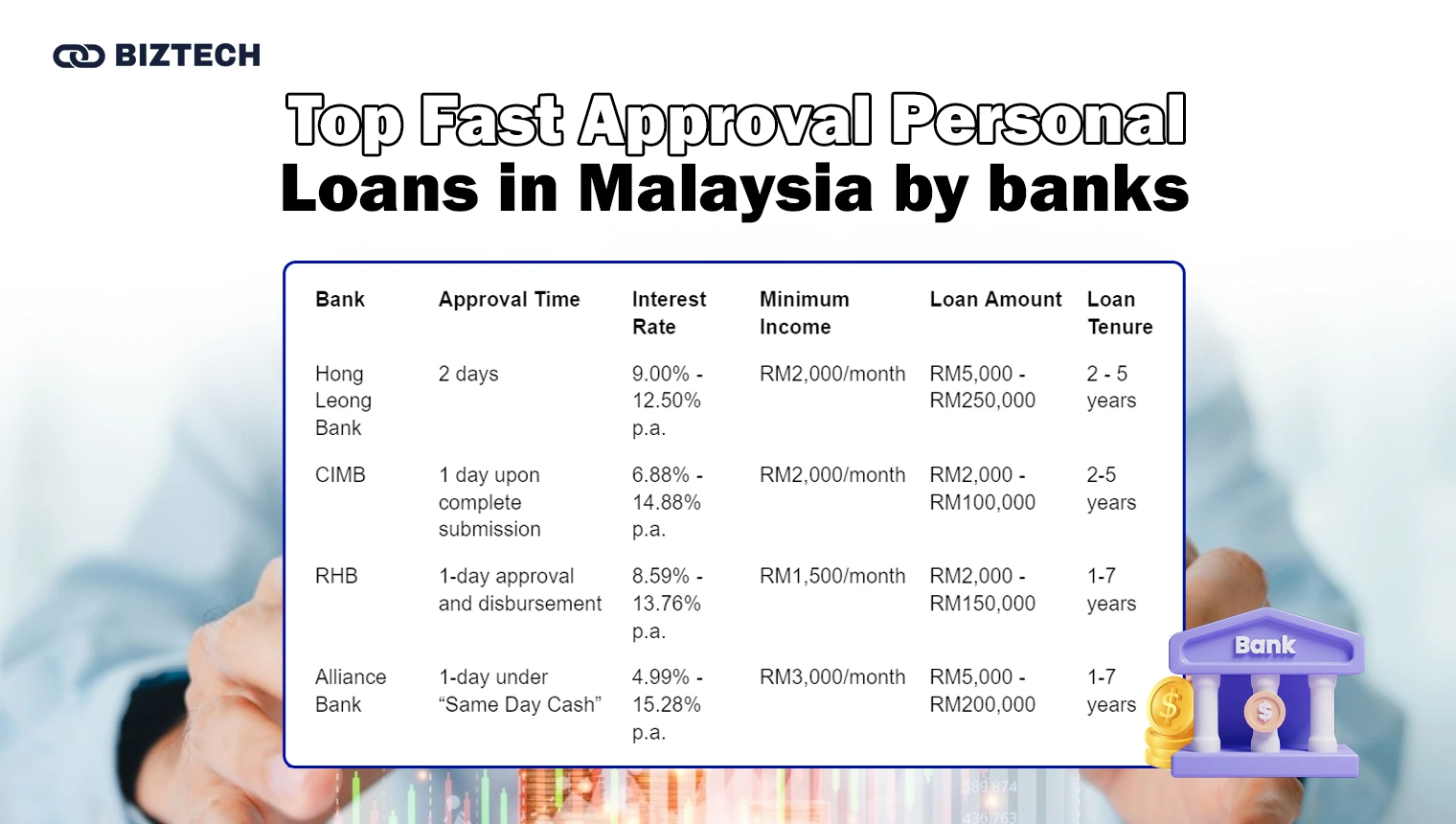

- Top Fast Approval Personal Loans in Malaysia for 2025

- 1. Hong Leong Bank

- 2. CIMB Bank

- 3. RHB Bank

- 4. Alliance Bank

- Top Fast Approval Personal Loan in Malaysia by non-banks

- 1. Icon Venture Capital

- 2. Emicro

- 3. Yayasan Ihsan Rakyat

- 4. JCL

- 5. instaDuit

- Applying for Fast Approval Personal Loan in Malaysia

- Preparing for the Loan Application Process (What to prepare for fast loan approval?

- Step-by-step Guide to Fast Approval Loan Application

- Tips to Enhance Approval Chances

- Conclusion

- Frequently Asked Questions

Fast Approval Personal Loans In Malaysia

Fast approval personal loans are financial products provided by banks and non-banking organisations in Malaysia that are intended to give borrowers access to funds rapidly. These fast loans are designed to satisfy consumers’ urgent financial needs, making them a vital resource for anyone facing a financial emergency.

Definition of Fast Approval Personal Loans

Fast approval personal loan, often known as fast loan, are loans where the application process, approval, and disbursement of funds happen within a short timeframe, typically within 24 to 48 hours. Compared to traditional loans, which can take several days or even weeks to approve, this speed is substantially quicker. Fast approval personal loan are the best option for emergency scenarios as they cater to customers who require immediate financial aid.

Working Mechanism of Fast Approval Loan

In terms of their fundamental operation, fast approval loan function similarly to conventional personal loans. Once a borrower submits an application for a fast loan, the lending company evaluates it based on things including the borrower’s credit history, income level, work situation, and other financial obligations. Fast loan approval, in contrast to conventional loans, utilise streamlined procedures to shorten the approval time.

Notably, the fast approval loan process doesn’t affect the crucial criteria taken into account for fast loan approval. Based on the borrower’s creditworthiness and capacity to repay the loan, the loan’s size, interest rate, and period are chosen.

Banks including Alliance Bank, Hong Leong Bank, CIMB, RHB, and CIMB offer fast approval personal loan in Malaysia, as do non-banking finance institutions like Icon Venture Capital and Emicro. Their approval times can be as quick as one to two days, which is far quicker than the typical turnaround time for traditional loans, which is three to five working days.

Importance of Fast Approval Personal Loan in Financial Emergencies

In times of financial crisis, fast approval personal loan are essential. Waiting for a protracted approval procedure from traditional loans can add stress and possibly make the situation worse when unanticipated expenses, such as medical bills, auto repairs, or essential home upkeep, arise.

Fast approval personal loan offer an immediate resolution to these problems. They help borrowers efficiently handle their situations by ensuring that they receive the necessary funds as soon as possible thanks to their speedy approval and payout timelines. Additionally, the ease of online applications increases the availability of these fast loan by enabling borrowers to apply and receive the money without ever leaving their homes.

Are there banks that offer fast loan approval?

Any moment, and frequently without prior notice, a financial emergency could occur. When you don’t have a reserve fund built up, this might be a stressful period. Fast approval personal loan have become more popular as a result of the demand for immediate financial support, and many Malaysian banks and financial institutions have shortened the process. These organisations have altered their systems to offer fast loans, including fast approval personal loan, since they recognise that standard fast loan approval processing periods may not always fulfil borrower demands.

Banks Offering Fast Loan Approval in Malaysia

In Malaysia, there are roughly fifteen banks that provide fast approval personal loan. Some of the well-known institutions that provide fast loan approval in Malaysia include CIMB, Hong Leong Bank, RHB, and Alliance Bank. Each bank has a different loan size, loan tenure, minimum income criteria, approval time, and interest rate.

For instance, CIMB has a 1-day approval time after a complete submission, and Hong Leong Bank offers fast approval personal loan with a 2-day approval period. Depending on the financial institution, approval dates may vary, but generally speaking, you may anticipate having a fast approval personal loan granted between one to three days.

Non-Banks Offering Fast Loan Approval

In addition to conventional banks, a number of non-banking organisations in Malaysia provide fast approval personal loan Malaysia. These consist of financial institutions, cooperatives, peer-to-peer lending platforms, and moneylenders. Although there is a chance that these non-banks will approve your fast loan, you should proceed with caution. Always confirm the legitimacy of the business using MyData SSM.

Fast approval personal loan are offered by non-banks like Icon Venture Capital and Emicro, with approval times of just one day. Compared to bank loans, the loan amounts, interest rates, and tenure might vary greatly.

What is the Approval Process for Fast Loans?

Usually, the fast loan approval process is shortened and made simpler. You’ll need to complete an application form and provide the required documentation after selecting a lender. The necessary paperwork for a fast approval personal loan often consists of income documentation, employment confirmation, and credit history.

The bank or non-bank entity will determine your loan eligibility after receiving your application. If accepted, the fast loan is typically dispersed swiftly, sometimes in only a few hours. It’s important to remember that even though these fast loans are completed rapidly, credit checks and verification procedures are still involved.

Fast approval personal loan have become an essential service for many Malaysians facing financial emergencies or sudden large expenses. Whether you approach a traditional bank or a non-bank institution, fast loan approval offers a convenient and timely solution to your financial needs.

Top Fast Approval Personal Loans in Malaysia for 2025

When financial emergencies strike, having access to a fast approval personal loan can make all the difference. Many banks in Malaysia now offer quick and efficient personal loans to meet urgent needs. Here’s an updated guide to the best fast approval personal loans in Malaysia, reflecting the latest rates, terms, and features for 2025.

| Bank | Approval Time | Interest Rate (% p.a.) | Minimum Income | Loan Amount | Loan Tenure |

| Hong Leong Bank | 2 days | 9.00% – 12.50% | RM2,000/month | RM5,000 – RM250,000 | 2 – 5 years |

| CIMB | 1 day upon submission | 6.88% – 14.88% | RM2,000/month | RM2,000 – RM100,000 | 2 – 5 years |

| RHB | 24 hours | 8.59% – 13.76% | RM1,500/month | RM2,000 – RM150,000 | 1 – 7 years |

| Alliance Bank | Same Day Approval | 4.99% – 15.28% | RM3,000/month | RM5,000 – RM200,000 | 1 – 7 years |

1. Hong Leong Bank

Hong Leong Bank offers fast approval personal loans with competitive rates. With a quick application process, it’s ideal for those needing funds urgently.

Loan Calculator Example:

- Borrow: RM10,000

- Monthly Income: RM5,000

- Tenure: 2 years

- Interest Rate: 9% p.a.

- Monthly Repayment: RM491.67

Fees & Charges:

- Interest Rate: 9.00% – 12.50% p.a. (depending on tenure and amount)

- Processing Fee: None

- Stamp Duty: 0.5% of loan amount

- Early Termination Fee: No charges if 3 months’ prior written notice is given

- Late Penalty Fee: 1% of outstanding amount

Eligibility:

- Minimum income: RM2,000/month

- Age: 21 – 60 years old

- Open to salaried employees and self-employed individuals

Documents Required:

- Copy of IC (front and back)

- Latest 3-month salary slips or 6-month bank statements for variable income

- EPF or tax documents for self-employed individuals

2. CIMB Bank

CIMB offers fast loan approval within one working day upon complete submission. Its competitive rates make it a great choice for urgent financial needs.

Loan Calculator Example:

- Borrow: RM10,000

- Monthly Income: RM5,000

- Tenure: 2 years

- Interest Rate: 6.88% p.a.

- Monthly Repayment: RM474

Fees & Charges:

- Interest Rate: 6.88% – 14.88% p.a.

- Processing Fee: None

- Stamp Duty: None

- Late Penalty Fee: 1% of outstanding amount per annum

Eligibility:

- Minimum income: RM2,000/month

- Age: 21 – 58 years old

- Open to salaried employees and self-employed individuals

Documents Required:

- Latest 1-month or 3-month salary slips

- EPF statement (minimum 6 months contribution)

- For self-employed: Business registration documents and 6-month company bank statements

3. RHB Bank

RHB Bank’s fast approval personal loans come with flexible tenures and competitive rates tailored to different income levels.

Loan Calculator Example:

- Borrow: RM10,000

- Monthly Income: RM5,000

- Tenure: 2 years

- Interest Rate: 13.76% p.a.

- Monthly Repayment: RM531.33

Fees & Charges:

- Interest Rate: 8.59% – 13.76% p.a.

- Processing Fee: None

- Stamp Duty: 0.5% of loan amount

- Early Termination Fee: RM100 or 1% of remaining amount, whichever is higher (lock-in period: 6 months)

- Late Penalty Fee: 1% of outstanding amount

Eligibility:

- Minimum income: RM1,500/month

- Age: 21 – 55 years old

- Open to salaried employees and self-employed individuals

Documents Required:

- Copy of IC

- Latest 3-month salary slips or 12-month EPF statement

- For self-employed: Business registration documents and tax receipts

4. Alliance Bank

Alliance Bank’s “Same Day Approval” feature makes it a standout choice for borrowers seeking quick disbursement.

Loan Calculator Example:

- Borrow: RM10,000

- Monthly Income: RM5,000

- Tenure: 2 years

- Interest Rate: 5.99% p.a.

- Monthly Repayment: RM466.58

Fees & Charges:

- Interest Rate: 4.99% – 15.28% p.a.

- Processing Fee: None

- Stamp Duty: 0.5% of loan amount

- Early Termination Fee: None

- Late Penalty Fee: 1% of outstanding amount

Eligibility:

- Minimum income: RM3,000/month

- Age: 21 – 60 years old

- Open to salaried employees and self-employed individuals

Documents Required:

- Latest 3-month salary slips or bank statements

- For self-employed: Business registration certificate and income tax documents

Top Fast Approval Personal Loan in Malaysia by non-banks

In Malaysia, looking for immediate financial solutions? Fast approval personal loan are your greatest option, especially if you require fast cash for urgent personal or company expenses. A fast approval loan is processed more quickly than a traditional loan, usually in a day or two, depending on the financial institution you choose. Here is a list of Malaysia’s best non-bank lenders for personal loans with quick approvals.

| Financial Lender | Approval Time | Interest Rate | Minimum Income |

| Icon Venture Capital | 1-day | 18% p.a. | RM3,000 / month |

| Emicro | 1-day | 18% p.a. | RM1,500 / month |

| Yayasan Ihsan Rakyat | 1-day | 5.99% – 9.99% p.a. | RM1,500 / month |

| JCL | 3-day | 18% – 20% p.a. | RM1,000 / month |

| instaDuit | 1-day | 18% p.a. | RM1,500 / month |

Note: The institutions’ names are not mentioned in the reference sources. Ensure to check the credibility of the non-bank institutions before applying for a fast approval loan in Malaysia.

Fast approval personal loan are excellent solutions to meet immediate financial needs. However, it’s crucial to understand the loan terms and conditions before applying. Consulting a financial advisor can be a wise move to make an informed decision.

1. Icon Venture Capital

For example about the loan calculator:

Borrow: RM10,000

Monthly Income is: RM5000

Tenure: 2 years

According to the interest rate is 18% p.a. The monthly repayment will be RM566.67.

Interest Rates

| Amount that borrow | Loan period | Your income | Interet rate |

| RM5,000 – RM100,000 | 12 to 60 months | Min. RM36,000 | 18% p.a. |

Fees & Charges

- Interest rate / APR – As low as 18% p.a, depending on loan amount and period.

- Processing Fee – None

- Stamp Duty – None

- Early Termination Fee – 6-months interest will be charged

- Late Penalty Fee – 8% from current outstanding amount.

Requirements

- Minimum Annual Income – RM36,000

- Minimum Age – 18 to 60 years old

- Who Can Apply – Malaysians, Individuals residing in Klang Valley only, Salaried employee, Self-employed

Document Requirements

- Application form

- Copy of your IC (both sides)

- Latest 3 months salary slips/pay slips

- Latest 3 months bank statements

- Latest EPF or Tax Declaration Form (BE Form)

- Utility bill: electricity, water, etc

- Address Confirmation (example below): Phone/Internet Bill, Mail from Banks, Tenancy Agreement

More Information

This high-margin personal loan is offered by Icon Venture Capital Sdn Bhd (Company No. 1246743-K), a licensed company under the Moneylenders Act 1951.

2. Emicro

Interest Rates

| Amount that borrow | Loan period | Your income | Interet rate |

| RM500 – RM1,000 | 1 to 3 months | Min. RM18,000 | 18% p.a. |

| RM1,001 – RM3,000 | 1 to 6 months | Min. RM24,000 | 18% p.a. |

| RM3,001 – RM5,000 | 1 to 12 months | Min. RM36,000 | 18% p.a. |

| RM5,001 – RM10,000 | 1 to 24 months | Min. RM48,000 | 18% p.a. |

Fees & Charges

- Interest rate / APR – As low as 18% p.a, depending on loan amount and period.

- Processing Fee – RM60, maximum is RM400, depending on the loan amount

- Stamp Duty – Included in the Processing Fee

- Early Termination Fee – None

- Late Penalty Fee – RM25 or 8% from current outstanding amount.

Requirements

- Minimum Annual Income – RM18,000

- Minimum Age – 18 to 50 years old

- Who Can Apply – Malaysians, Salaried employee, Self-employed

Document Requirements

- Copy of your IC (both sides)

- Your selfie, holding MyKad (to avoid identity Fraud)

- Latest salary slip or EPF Statement

- Utility bill: electricity, water, etc

More Information

Emicro Services Sdn Bhd is a licensed company under the Ministry of Housing and Local Government (KPKT) that provides a fast microloan to Malaysians only.

Apply for this loan online to get approved and your money banked into your account in as fast as 6 hours. It is recommended to use CIMB Bank as your designated account for fast deposit.

If you apply anytime outside of working hours, you will receive your personal loan the next working day.

Emicro will Not approve personal loan applications from:

- Government employee (PDRM Police/ Security/ Bomba/Army/Prison Officer)

- Chief

- Factory operator/storekeeper

- Sales promoter

- Self-employed

- Driver (Grab, truck or lorry) and

- Commission-based employee.

3. Yayasan Ihsan Rakyat

For example about the loan calculator:

Borrow: RM10,000

Monthly Income is: RM5000

Tenure: 2 years

According to the interest rate is 5.99% p.a. The monthly repayment will be RM466.58.

Interest Rates

| Amount that borrow | Loan period | Your income | Interet rate |

| RM2,500 – RM250,000 | 12 to 120 months | Min. RM18,000 | 5.99% p.a. – 9.99% p.a |

Fees & Charges

- Interest rate / APR – As low as 5.99% p.a, depending on financing amount and period.

- Processing Fee – None

- Stamp Duty – 0.5% of the whole amount

- Early Termination Fee – RM100

- Late Penalty Fee – 1% from current outstanding amount.

Requirements

- Minimum Annual Income – RM18,000

- Minimum Age – 20 to 58 years old

- Who Can Apply – Malaysians, Government employee

Document Requirements

Certified True Copy Required:

- 1 photocopy MyKad / PDRM Identification Card

- Recent 3 months’ payslips

Certified True Copy Not Required:

- Latest bank statement (salary account / local savings account / current account to receive financing)

- Employment verification letter

- Option letter (if applicable)

- Transfer letter / secondment letter (if applicable)

- Settlement statement (if applicable)

More Information

YIR established in 2012 is a foundation incorporated under the Companies Act 2016 with a company registration number 201201017719 (1003231-A). And YIR is not part of the co-operative society under the Co-operative Societies Act 1993.

Who can apply for Yayasan Ihsan Rakyat Personal Financing-i?

First of all, this fixed rate Islamic personal financing is open to all civil servants of the Malaysian government for the following employers only:

- Accountant General

- Polis Diraja Malaysia (PDRM)

- Universiti Putra Malaysia (UPM)

- Universiti Teknologi MARA (UiTM)

You are also required to meet the minimum eligibility criteria such as follows:

- A Malaysian citizen

- Aged between 20 – 50 years old (Maximum age for PDRM customers is 55 years old)

- Minimum gross monthly income of RM1,500 per month

- Have a permanent job with at least 6 months of service

- Not a bankrupt person or in bankruptcy process

- Pass YIR’s credit assessment

4. JCL

For example about the loan calculator:

Borrow: RM10,000

Monthly Income is: RM5000

Tenure: 2 years

According to the interest rate is 18% p.a. The monthly repayment will be RM566.67.

Interest Rates

| Amount that borrow | Loan period | Your income | Interet rate |

| RM1,000 – RM50,000 | 6 to 60 months | Min. RM12,000 | 18% p.a. – 20% p.a. |

Fees & Charges

- Interest rate / APR – As low as 18% p.a, depending on financing amount and period.

- Processing Fee – RM50

- Stamp Duty – None

- Early Termination Fee – None

- Late Penalty Fee – 1% Ta’widh (Compensation) and 7% Gharamah (Penalty) per annum will be imposed upon the amount due

Requirements

- Minimum Annual Income – RM12,000

- Minimum Age – 18 to 60 years old

- Who Can Apply – Malaysians, Individuals residing in Klang Valley, Penang, Johor, Ipoh, Kedah and Kelantan only, Salaried employee, Self-employed, Commission earner

Document Requirements

Salaried employee:

- Copy of IC (both sides)

- Latest 3-months payslips

- Latest 3-months bank statement

- Latest utility bill (Electricity/Water)

Self-employed:

- Copy of IC (both sides)

- Latest SSM

- Latest 6-months company bank statement

- Latest 3-months personal bank statement

- Latest utility bill (Electricity/Water)

More Information

The JCL i-Fund Personal Financing is an unsecured Islamic personal loan from a licensed credit leasing company called JCL Credit Leasing.

The approval loan amount can get as fast as three working days.

5. instaDuit

For example about the loan calculator:

Borrow: RM10,000

Monthly Income is: RM5000

Tenure: 2 years

According to the interest rate is 18% p.a. The monthly repayment will be RM566.67.

Interest Rates

| Amount that borrow | Loan period | Your income | Interet rate |

| RM1,000 – RM10,000 | 12 to 48 months | Min. RM18,000 | 18% p.a. |

Fees & Charges

- Interest rate / APR – As low as 18% p.a, depending on loan amount and period.

- Processing Fee – As per Loan Agreement

- Stamp Duty – 0.5% of the whole amount

- Early Termination Fee – This fee shall be imposed on you as per the Loan Agreement with instaDuit

- Late Penalty Fee – 8% from current outstanding amount

Requirements

- Minimum Annual Income – RM18,000

- Minimum Age – 21 to 55 years old

- Who Can Apply – Malaysians, Salaried employee, Minimum salary of RM1,500, Working in Kuala Lumpur, Selangor and Putrajaya, Not declared bankrupt, Not under AKPK’s debt management program

Document Requirements

Below are some of the things you should prepare beforehand to ensure a smooth application journey.

- A photo/selfie of yourself (to ensure you are who you say you are)

- Your IC (front and back)

- Your latest 3 months’ salary slips

- A picture of your office (as proof of your income and employment)

- Latest EPF statement

- Latest 3 months’ bank statement

To apply the quick loan, these documents is required:

- Copy of your IC (front and back)

- Latest 3 months’ salary slips

- Latest 3 months’ bank statement of your salary crediting account

- Latest EPF statement

- Utility bill (electricity bill, water bill etc)

More Information

Offered by BB Capital Sdn Bhd, instaDuit is a licensed loan provider registered under the Ministry of Local Government Development of Malaysia or better known as KPKT with a registration number of WL6540/10/01-4/151122.

Applying for Fast Approval Personal Loan in Malaysia

When time is of the importance, navigating the personal loan application procedure can be challenging. However, a number of Malaysian banks and non-banking institutions offer fast approval personal loan that can be completed in a matter of hours or days. The key is proper planning and comprehension of the procedures to be taken in order to guarantee a fast and easy process.

Preparing for the Loan Application Process (What to prepare for fast loan approval?

Make sure you fulfil the minimum monthly income requirements established by different banks in order to improve your chances of a fast loan approval. This can cost anything from RM1,000 to RM5,000, depending on the bank.

Next, gather all the paperwork required for a personal loan application with a fast loan approval. These could include things like your ID, financial documents, and evidence of income. When applying, having these on hand might hasten the approval procedure.

| Salaried Employee | Self-Employed |

|

|

Step-by-step Guide to Fast Approval Loan Application

- Research: Start by contrasting the many loan choices Malaysia has to offer. Sites like RinggitPlus and CompareHero can provide you a thorough overview of the conditions and interest rates that various banks are willing to offer.

- Application: Fill out the application after deciding on a reliable lender. This might be done at a physical location or on the lender’s website.

- Document Submission: According to the lender’s instructions, submit all necessary documentation.

- Approval and Disbursement: The loan money will be paid to your account after your application is approved. Depending on the lender, this process could take anywhere from 30 minutes to a week.

Tips to Enhance Approval Chances

1. Maintain a DSR level between 30% to 40%

DSR is determined as a percentage by dividing your total monthly debt payments by your net monthly income. The result is then multiplied by 100. This is how banks determine your capacity to repay the loan.The general formula to calculate DSR is:

DSR = (Total monthly commitments / Net income) * 100

Let’s consider an example where an individual wants to maintain a DSR between 30% and 40%. This range implies that the person’s total monthly debt obligations should not exceed 30% to 40% of their net monthly income.

Assume the person has a monthly net income (after statutory deductions like EPF, SOCSO, taxes) of RM 7,000. Let’s assume their current monthly commitments (existing loans) total to RM 1,500.

To maintain a DSR between 30% and 40%, the total monthly commitments including any new loan should be between RM 2,100 (30% of RM 7,000) and RM 2,800 (40% of RM 7,000).

Therefore, if the person is considering applying for a new loan, they should ensure that the monthly repayments on this new loan, when added to their current commitments of RM 1,500, do not exceed RM 2,800 and are no less than RM 2,100.

For instance, if the monthly repayment for the new loan is RM 1,000, the total monthly commitment would be RM 2,500 (RM 1,500 current commitments + RM 1,000 new loan). The DSR would then be (RM 2,500 / RM 7,000) * 100 = 35.71%, which falls within the 30-40% DSR target.

2. Always pay on time and in the full amount

Your chances of getting a loan are increased if you can demonstrate a history of making on-time payments on your credit obligations.

3. If you have a bad credit score, improve it

An indication of your creditworthiness is your credit score. If it’s low, think about improving it by paying off past-due debts and making sure future invoices are paid on time.

4. Reduce your loan commitments, if can, consolidate them

High previous loan obligations may have an impact on your DSR and lessen your chances of acceptance. To reduce your obligations, consolidate them if you can or pay off lesser ones.

5. Create a credit history, for beginners only

If you’re just starting out and have no credit history, think about getting a small loan or credit card and making sure you pay the balance back on time. Your credit history will be developed as a result, which is necessary for fast loan approval.

Conclusion

In conclusion, prudent borrowing is essential for maintaining financial stability, especially for business owners seeking to spur long-term revenue growth. Understanding one’s financial condition, company requirements, and having a responsible attitude towards financial management are at the core of responsible borrowing.

The cornerstones of responsible borrowing include clear justifications for borrowing, a thorough self-evaluation of repayment capacity, a thorough awareness of the costs and dangers of borrowing, and examination of other possibilities. In order to increase borrowing prospects and guarantee affordable payback conditions, it is equally crucial to keep a strong credit history and have a realistic repayment plan.

To promote flexibility and trust, communication with lenders must be open and honest. Entrepreneurs should let lenders know if their company’s financial situation changes or if there are any difficulties that could affect fast loan repayment.

In conclusion, responsible borrowing entails more than just getting money; it also entails making wise choices, using borrowed money properly, and handling repayments well. Individuals and companies can manage their debt, reduce their financial risks, and prepare the way for long-term financial success by engaging in responsible borrowing.

Frequently Asked Questions