Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Stablecoins are cementing their role as a powerhouse in the digital finance ecosystem. According to fresh insights from The State of Stablecoins 2025: Supply, Adoption & Market Trends, a report by Dune and Artemis, the transaction volume of these digital currencies has soared to $35 trillion annually as of February 2025—more than double the $15.7 trillion processed by Visa throughout 2024.

Stablecoin Volume Reaches $35 Trillion Milestone

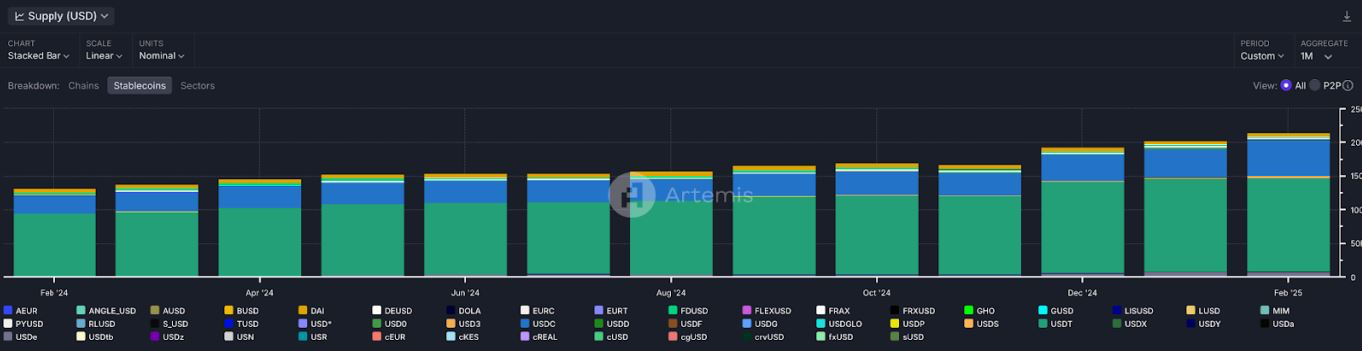

The report highlights the meteoric rise of stablecoins, fiat-pegged cryptocurrencies that have seen their total supply surge by over 63% year-over-year. From $138 billion in February 2024, the supply ballooned to $225 billion by February 2025, reflecting robust growth in adoption and utility.

“Stablecoins witnessed remarkable expansion in 2024, with their total supply climbing 63% in just one year,” the report states, underscoring the asset class’s growing footprint in global finance.

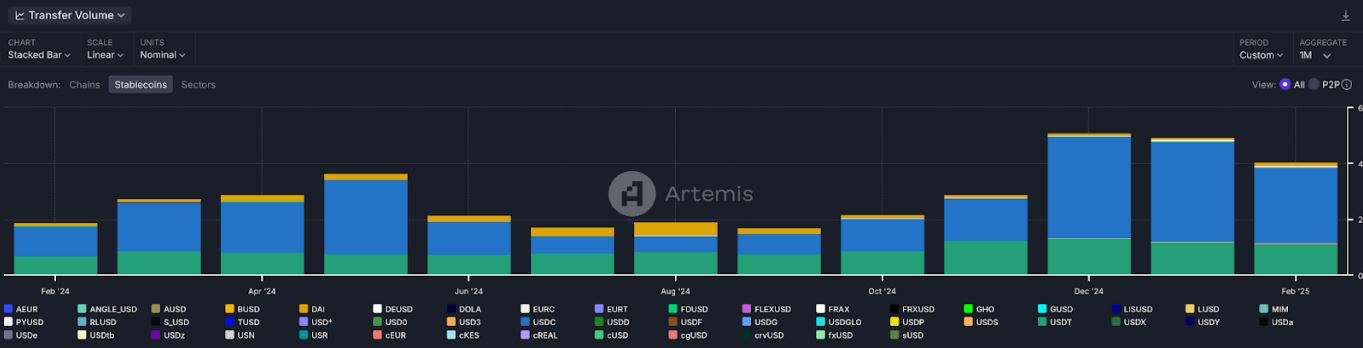

Beyond supply growth, transaction volume has been the real headline. Clocking in at $35 trillion over the past year, stablecoin activity has dwarfed Visa’s annual throughput, signaling a seismic shift in how value moves across borders and blockchains.

A Backbone of Digital Finance

Stablecoins have evolved into a critical bridge between traditional finance (TradFi) and the crypto universe, fueling everything from cross-border payments to decentralized finance (DeFi) applications. The report also notes a 53% spike in active addresses, jumping from 19.6 million in February 2024 to 30 million a year later, a clear sign of widening adoption.

While their market cap remains below the U.S. M1 money supply of $18.4 trillion, the sheer volume of stablecoin transactions underscores their outsized influence in the financial landscape.

USDT and USDC Lead with Divergent Playbooks

The stablecoin market remains dominated by two heavyweights: Tether’s USDT and Circle’s USDC, though their strategies diverge.

USDT, boasting a market cap of $146 billion, continues to reign supreme in peer-to-peer (P2P) transactions and remittances, particularly on the TRON network. Yet, its market share dipped from 69% to 64% over the year. Meanwhile, USDC has staged an impressive comeback, doubling its market cap from $28.5 billion to $56 billion, capturing 24.5% of the stablecoin pie.

“USDC’s growth stems from its regulatory alignment in regions like Europe and the Middle East, including MiCA compliance in the EU and DIFC approval in Dubai,” the report explains. Circle’s strategic tie-ups with payment giants like MoneyGram and Stripe have further turbocharged its global reach.

USDT, by contrast, retains its edge in emerging markets, serving as a go-to alternative to legacy financial systems for remittances and everyday transactions.

Hurdles on the Horizon

Despite outstripping Visa, stablecoins face headwinds. Regulatory scrutiny remains a persistent challenge, with authorities pressing for greater transparency around reserves and adherence to international financial norms. The report notes that 91% of stablecoin supply is now backed by fiat collateral—cash and bonds—up slightly from 90% last year, reinforcing trust in the traditional pegged model.

Conversely, crypto-backed and algorithmic stablecoins continue to lose ground, a fallout from high-profile collapses that eroded confidence in uncollateralized designs.

Competition is also heating up. Yield-bearing stablecoins like Ethena’s USDe and Sky Ecosystem’s USDS are gaining traction, particularly in DeFi, as they entice investors with returns—a trend that could reshape market dynamics.

The Road Ahead

Stablecoins stand at a crossroads. Their future hinges on striking a balance between technological innovation and regulatory clarity. As transaction volumes soar and adoption deepens, maintaining user trust and stability will be paramount to sustaining this crypto juggernaut’s momentum.