Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Raydium (RAY) native token, a Solana-based decentralized exchange (DEX) and automated market maker (AMM) platform, saw a drastic drop in price following news that meme coin launchpad platform Pump.fun was testing their own AMM feature. This decline sparked concern among investors and traders in the Solana ecosystem.

Based on CoinMarketCap data on Monday (2/24/2025) afternoon, the price of the RAY token was recorded to have dropped from US$4.2 to US$2.29 in just a few hours. The decline of more than 35% in the last 24 hours caused RAY’s market capitalization to fall to US$704 million. At the time of writing, RAY was trading at US$2.42, according to the latest market reports.

Market Reaction to Pump.fun’s Move

Pump.fun, known as a meme coin launch platform with a Bonding Curve model, has relied on Raydium to provide AMM liquidity for tokens that have reached a market capitalization of US$69,000. However, the latest on-chain data reveals that Pump.fun is developing its own AMM platform. This allows meme coin trading to be done directly on their protocol, without relying on Raydium.

Also Read: What is Pump.Fun? Understanding the Concept, How it Works, and Why It So Hype

EXCLUSIVE : @pumpdotfun is working on their own AMM liquidity pools, which is currently being tested on https://t.co/nuir86gnkl

It seems they are planning to have pump tokens graduate to their own pools instead of Raydium so they can either extract more fees on Solana or have… pic.twitter.com/svmWfl6Rlt

— trenchdiver (@trenchdiver101) February 24, 2025

This news was first revealed by user X @trenchdiver101, who also shared a link to the Pump.fun website to access the latest AMM feature.

This move is considered to be able to divert trading volume and transaction costs from Raydium to Pump.fun. Pump.fun’s latest user interface even offers the ability for users to add liquidity to any SPL token, strengthening its position in the market.

Data from Dune Analytics shows that Pump.fun has earned more than US$577 million since its launch, with daily revenues reaching US$1.5 million. This success adds competitive pressure to Raydium.

Technical Analysis of Raydium Price

Technically, the daily RAY chart shows a right-angled ascending broadening pattern that has been broken down. After news of AMM Pump.fun surfaced, the token fell below the key support level of US$4.20, losing more than 27% of its market value.

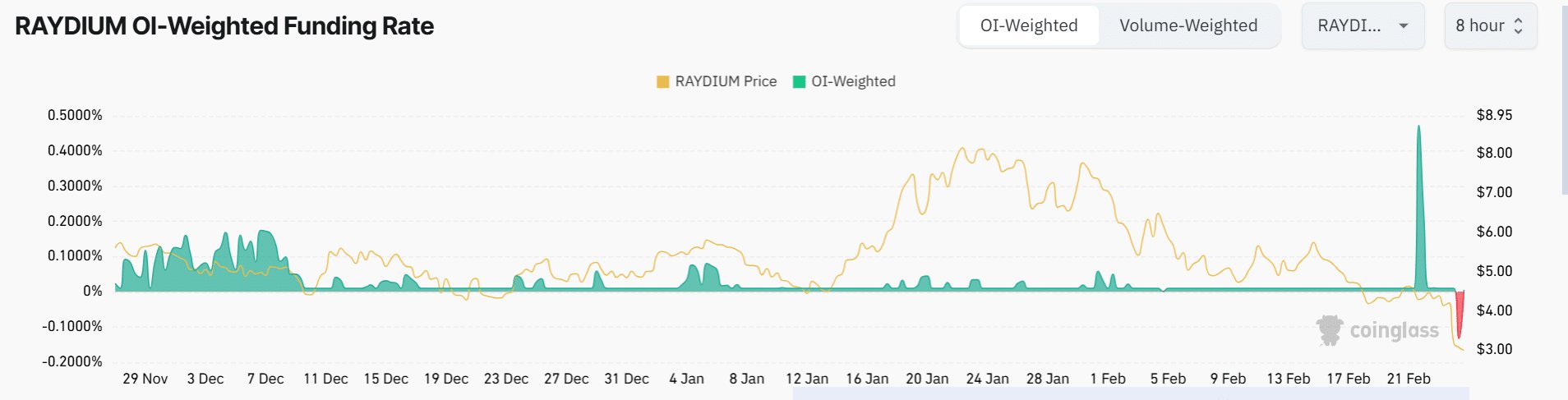

Source: Coinglass

The on-chain metrics also reflect significant market pressure. Although RAY’s trading volume has surged 65.74% in the last 24 hours, Raydium’s Total Value Locked (TVL) has steadily declined in the last 72 hours, reaching US$1.213 billion, according to DefiLlama. The Relative Strength Index (RSI) is at 26 and the MACD (12.26) at -0.6569, indicating oversold conditions and strong bearish momentum. Meanwhile, Open Interest is down 33.85% and the Funding Rate has turned negative for the first time in months, as reported by Coinglass.

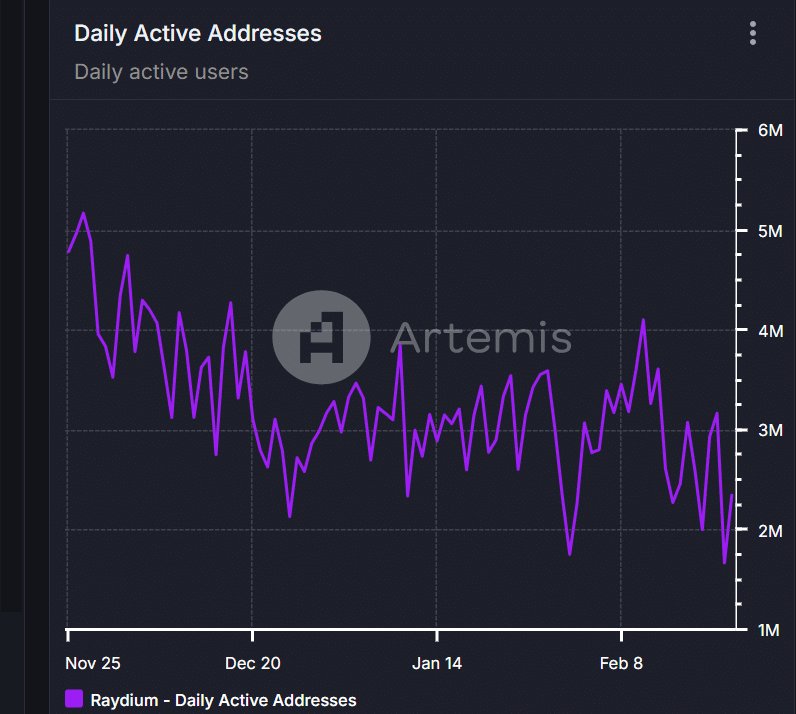

Source: Artemis

The surge in active addresses on the network also indicates massive panic selling by investors, triggered by recent market news, according to Artemis data.

Market Sentiment: FUD or Real Threat?

Current market sentiment appears to be dominated by Fear, Uncertainty, Doubt (FUD). Raydium’s Long-Short Ratio is at 0.93, indicating slightly more sellers than buyers. Short-, medium-, and long-term moving averages also provide a strong “Sell” signal.

If buyers are able to maintain the US$2.70 level with solid volume, there is an opportunity for RAY to reverse the trend towards the key US$3.50-US$4.00 zone. However, if the dominance of sellers continues, the price of RAY has the potential to plummet further to US$2.20.

The development of the AMM Pump.fun feature and its impact on Raydium continue to be in the spotlight among the crypto community. Market participants are now awaiting Raydium’s strategic moves to face the increasingly fierce competition in the Solana ecosystem.