Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

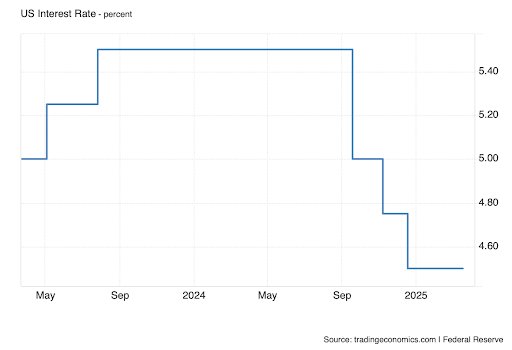

The Federal Reserve opted to keep interest rates unchanged on Wednesday, reflecting a cautious approach as policymakers assess the effects of President Donald Trump’s bold economic initiatives.

This decision emerged from the Fed’s two-day monetary policy meeting, signaling that officials are seeking clearer signs of whether inflation will stabilize near their 2% goal or if economic growth will falter beyond current projections.

The Fed’s benchmark rate remains within the 4.25% to 4.5% range. Despite holding steady, officials anticipate implementing two rate reductions later this year, consistent with their latest economic outlook released Wednesday.

This pause allows the Fed to monitor the unfolding impact of Trump’s policies, including significant tariffs, widespread deportations, and reductions in federal employment.

In their official statement, Fed leaders noted an elevated level of uncertainty, much of it tied to Trump’s unconventional economic strategies.

Recent remarks from Fed officials indicate their readiness to adjust rates—upward or downward—based on forthcoming economic data.

Economic Growth Forecasts Downgraded as Trump’s Tariffs Take Hold

Federal Reserve projections released Wednesday reveal a gloomier outlook for U.S. economic growth, largely attributed to Trump’s return to office and his tariff-heavy agenda.

Officials now predict an annual GDP growth rate of 1.7%, down from the 2.1% forecasted in December—a drop of nearly 20%. This revision reflects the toll of escalating tariffs, which have dampened consumer and business confidence.

Consumer spending, a key driver representing over two-thirds of U.S. GDP, has also shown weakness, growing last month but falling short of expectations after a January decline.

Meanwhile, the Atlanta Fed’s real-time GDP tracker suggests an even bleaker picture, hinting at a potential first-quarter contraction.

Stocks Rise as Fed Signals Two Rate Cuts for 2025

Source: Yahoo.finance

U.S. stock markets responded positively Wednesday following the Fed’s announcement to maintain current rates.

The Dow climbed 230 points, a 0.56% increase, while the S&P 500 and Nasdaq Composite gained 0.8% and 1.2%, respectively.

These gains held firm despite a midday dip ahead of the Fed’s decision, aligning with investor expectations of a steady rate policy.

The Fed raised its year-end inflation forecast to 2.8% from 2.5%, acknowledging that price pressures remain “somewhat elevated.”

Uncertainty surrounding Trump’s economic moves—such as tariffs that could fuel inflation and slow growth, alongside immigration restrictions and federal job cuts—continues to loom large.

However, potential growth boosts from deregulation and tax cut extensions add complexity to the economic forecast.

Fed Adjusts Quantitative Tightening Pace to Support Economy

Beyond holding rates steady, the Fed announced a tweak to its quantitative tightening (QT) strategy, which involves selling off Treasury bonds to temper inflation. Starting in April, the monthly sales will drop from $25 billion to $5 billion.

This slowdown aims to ease bond yields, potentially encouraging business investment and consumer borrowing. With inflation cooling but still above the 2% target, and economic growth stabilizing, the Fed signaled confidence in this measured adjustment.

Rising Inflation and Unemployment Cloud the Horizon

The Fed’s latest projections paint a challenging picture: inflation is expected to reach 2.7% by year-end, up from 2.5%, while unemployment could climb to 4.4% from the current 4.1%.

These shifts, compared to December’s forecasts, suggest a tricky balancing act ahead. Though reminiscent of stagflation—a mix of stagnant growth and rising prices—Fed Chair Jerome Powell has dismissed such comparisons, noting that current conditions fall far short of the severe stagflation seen in the 1970s.

Trump’s Tariffs Complicate Fed’s Dual Mandate

President Trump’s tariff policies are proving a thorn in the Fed’s side, driving up costs while stifling growth—counter to the central bank’s goals of low inflation and robust employment.

Fed Chair Jerome Powell highlighted this tension during a Wednesday press conference, pointing to tariffs as a key factor behind the revised economic projections.

Analysts, including Fitch Ratings’ Brian Coulton, warn that these trade barriers could delay rate cuts as the Fed navigates heightened price pressures and their ripple effects on U.S. firms and consumers.

Powell Addresses Recession Risks, Remains Optimistic

While acknowledging a slightly elevated risk of recession, Powell sought to calm concerns during Wednesday’s press conference. He estimated a baseline recession probability of about 25%, in line with historical norms, and stressed that current risks remain moderate, though higher than a few months ago.

External forecasts, such as JPMorgan’s 40% recession odds tied to Trump’s policies, reflect growing unease, but Powell emphasized that the Fed’s focus remains on data-driven responses rather than speculative downturns.

Fed Drops Familiar Phrase, Signals Policy Evolution

In a subtle shift, the Fed omitted its long-standing statement that risks to employment and inflation goals are “roughly in balance.”

Powell downplayed the change, describing it as a natural retirement of outdated language rather than a hint at new priorities.

This adjustment underscores the Fed’s transition from aggressive rate hikes to a more stable, responsive stance as it grapples with an unpredictable economic landscape.