Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

On February 21, 2025, Bybit, one of the world’s largest crypto exchanges, was hacked in what was recorded as the biggest theft in the crypto industry’s history. Hackers managed to make off with around 1.4 billion US dollars in the form of Ethereum (ETH) from Bybit’s cold wallet.

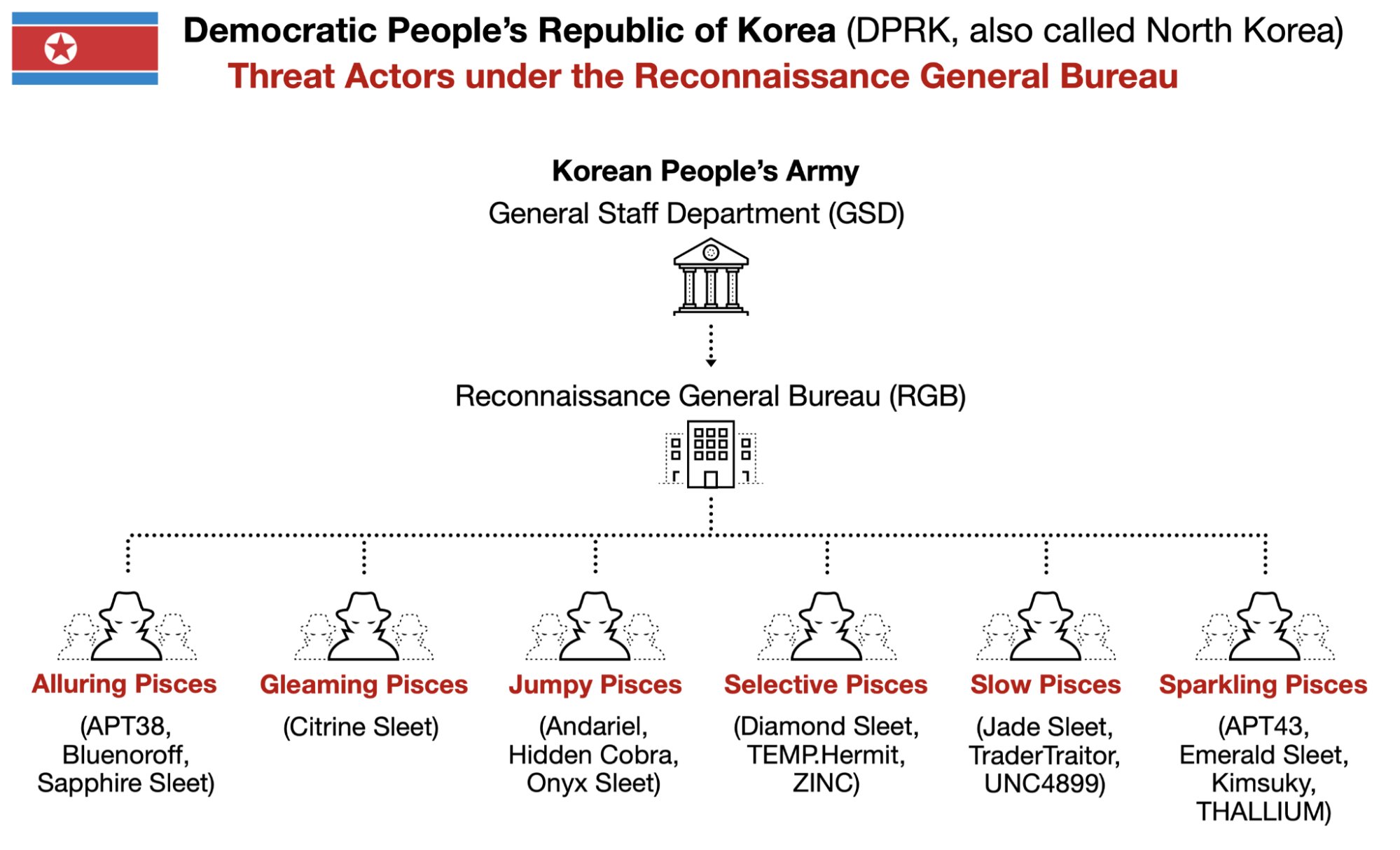

The perpetrator behind this attack is believed to be the Lazarus Group, a North Korean hacker group famous for major attacks in the crypto world.

This incident raises a big question: will the crypto market enter a bear market phase, as happened after the FTX collapse in 2022?

What Happened to Bybit?

Source: the trail of bits

The Bybit hack involved sophisticated social engineering techniques targeting its multisig cold wallet system. Hackers manipulated one of the signers by creating a malicious contract that changed the smart contract implementation address.

As a result, they managed to take control of the wallet and transfer funds to an address they controlled without the auditor’s or other signers’ knowledge.

A total of 401,346 ETH were stolen, making this the most significant theft in crypto history, beating the previous record of the 1 billion US dollar robbery of the Central Bank of Iraq in 2003.

Despite the heavy loss, Bybit survived. CEO Ben Zhou appeared live on stream an hour after the incident, confirming that Bybit was still solvent and all client assets were 1:1 guaranteed.

Data from Arkham Intelligence shows that Bybit’s reserves reached 19.5 billion US dollars when the incident occurred. To overcome the losses, Bybit obtained a bridge loan from Binance, Bitget, and MEXC to maintain liquidity.

Despite network congestion, more than 350,000 withdrawal requests have been processed to date.

Bybit vs FTX: Two Different Cases

Many have compared the Bybit incident to the FTX collapse in November 2022, which triggered a prolonged bear market. However, there are fundamental differences between the two.

FTX collapsed because it had been insolvent for a long time and did not have sufficient reserves to cover massive withdrawals. When the bank run happened, FTX had no industry support, and Sam Bankman-Fried, its founder, was eventually arrested on fraud charges.

Bybit, on the other hand, was hacked and did not collapse due to mismanagement.

Bybit’s reserves proved strong, and industry support from big players like Binance showed rarely seen solidarity.

Bybit also pioneered transparency, implementing proof-of-reserve with post-FTX Merkle Tree technology and opening up a real-time futures liquidation API. This proves that Bybit is better prepared to face the crisis than FTX.

Is a Bear Market in Sight?

Post-FTX, the bear market was triggered by a combination of macro and internal factors.

In 2022, the US Federal Reserve (Fed) raised interest rates from almost 0% to 3.5%, sucking liquidity out of the market. This coincides with the 4-year crypto cycle, which puts 2022 as a bearish year.

When FTX collapsed, market confidence plummeted, exacerbating the decline.

The current context is different. In 2025, the Fed shows no sign of aggressively raising interest rates, and the market is in the third year of a bullish cycle.

The Bybit incident did cause a temporary correction—users sold assets to withdraw to stablecoins or closed derivative positions—but the market quickly stabilized thanks to Bybit’s solvency and industry support.

With Bitcoin still hovering around $94,000-100,000 in February 2025, there is no strong indication of a bear market soon.

Bybit chose a bridge loan instead of buying ETH on the open market. This decision was wise because the pressure to buy 1.4 billion US dollars could trigger a surge in the price of ETH, increasing losses to 2 billion US dollars or more.

With the loan, Bybit covers the temporary loss and pays gradually through OTC (over-the-counter), avoiding supply shock.

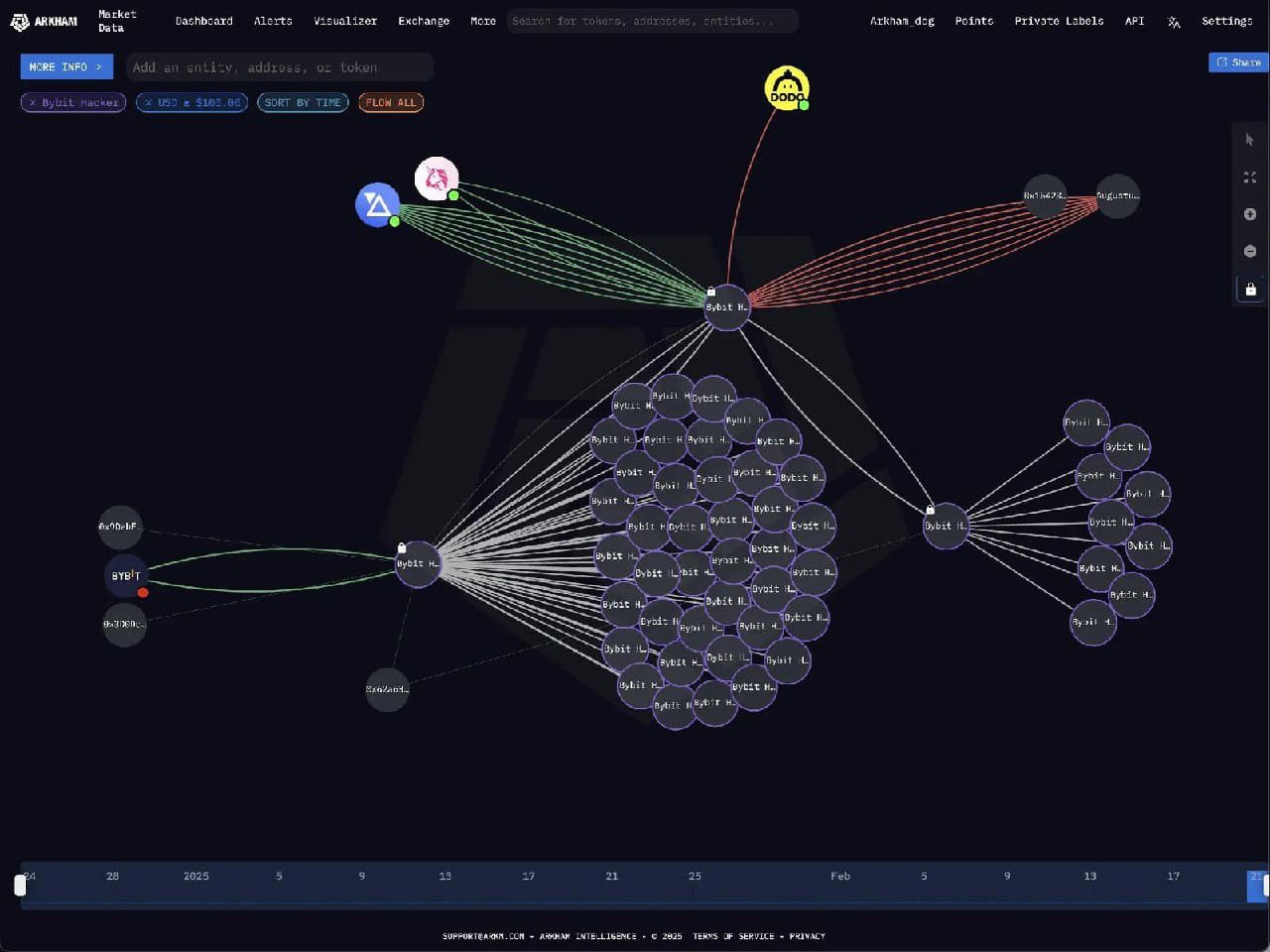

Meanwhile, hackers face significant difficulties. Although funds are laundered through various wallets, the transparent blockchain makes tracking easier.

Several parties have frozen the addresses that store the stolen proceeds, and the volume of 1.4 billion US dollars is too large to be sold undetected.

Even compared to ETFs or Vitalik Buterin, this hacker is now one of the largest ETH owners, but it has assets that are difficult to liquidate.

Long-Term Impact

This incident highlights the vulnerability of exchanges to sophisticated attacks like the one carried out by the Lazarus Group. Massive industry support—something that has never happened before—strengthens the belief that Bybit will recover.

Industry leaders like Grace from Bitget stated that 1.5 billion US dollars is just Bybit’s annual profit, showing their financial capacity. If Pantera Capital can quickly pay a fine of 4.4 billion US dollars, Bybit will likely cover this loss.

However, this incident has prompted a discussion about security. Self-custody with hardware wallets is becoming an increasingly relevant option to reduce exchange risk.

Diversifying assets across multiple platforms can spread the risk for those who continue to use exchanges. Bybit has passed this stress test, but the threat from groups like Lazarus remains real, pushing the industry to raise security standards.

Conclusion

The Bybit hack was a big blow, but it’s not the end. Unlike FTX, Bybit has shown financial resilience and strong industry support.

The market may experience a temporary correction, but a bear market does not appear imminent based on current macro and cyclical conditions.

For users, this is a reminder to manage assets wisely through self-custody or diversification.

The crypto industry is moving forward, and Bybit is set to remain a key player despite being tested by the biggest theft ever.